Tax Resource And Help Center

Welcome to The College Investor Tax Help Center. We know that taxes can be challenge. There are a lot of "rules" to follow, there are a lot of software options, and there are a lot of scams to avoid.

That's why we put this tax center together - to put our best tax content in one single place. Whether you're getting ready to prepare your tax return, or are waiting on your tax refund, here is what you need to know about taxes.

From picking the best tax software, to getting prepared to file your return, to dealing with any potential problems after the fact, here's everything you need to know to make your tax filing easy!

Key Things To Know About Your Tax Return

Here are some of our key resources for filing your taxes, as well as our list of the best tax software. Remember, the best tax software varies by situation - there is no "one-size-fits-all" approach.

Top Rated Tax Software

Here's our top tax software options for the 2022 - 2023 tax season.

Guides And Tools

Compare All Tax Products

We review as much of the tax software products as we can find on the marketplace. Here's a list of all our tax reviews this season.

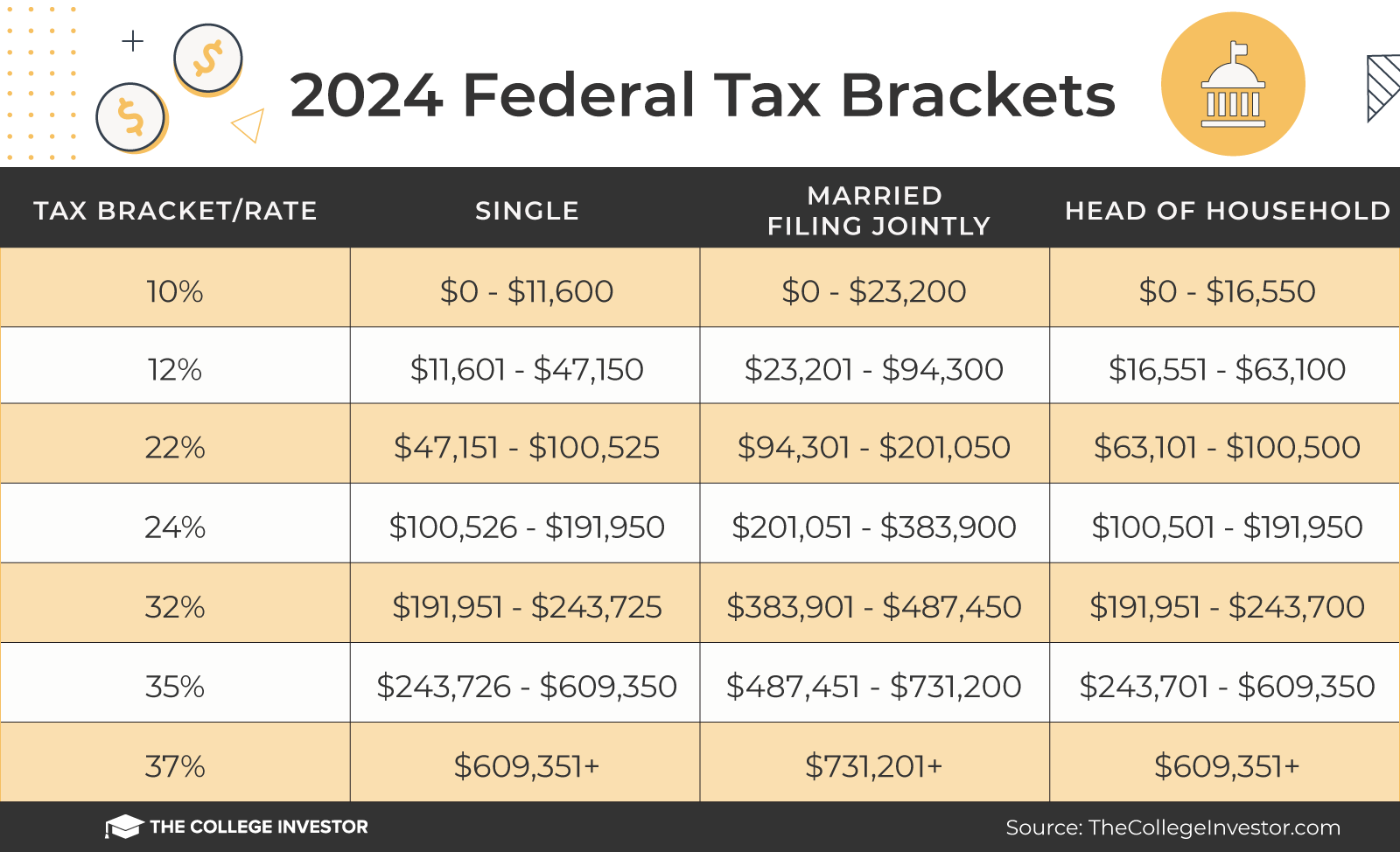

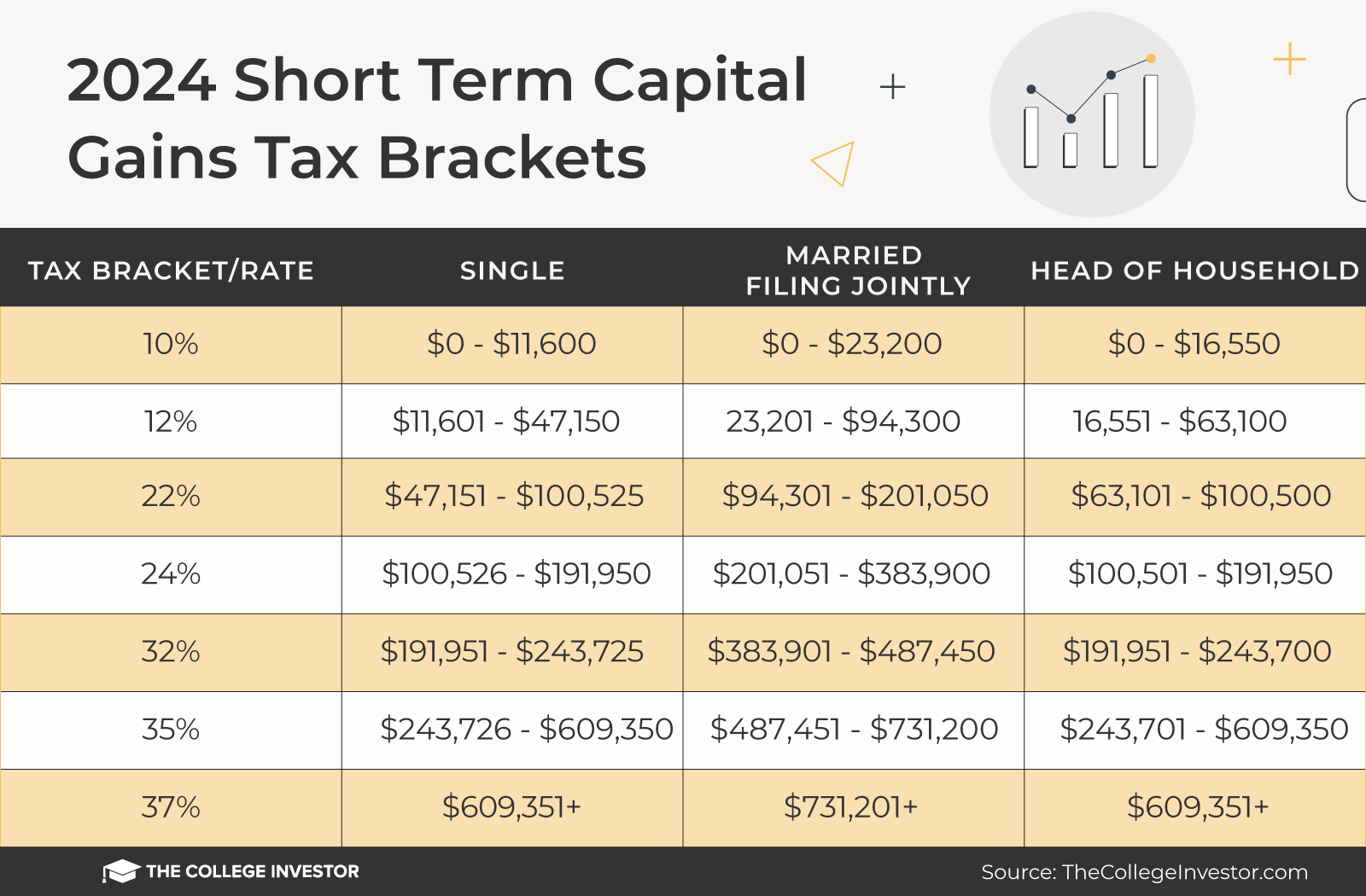

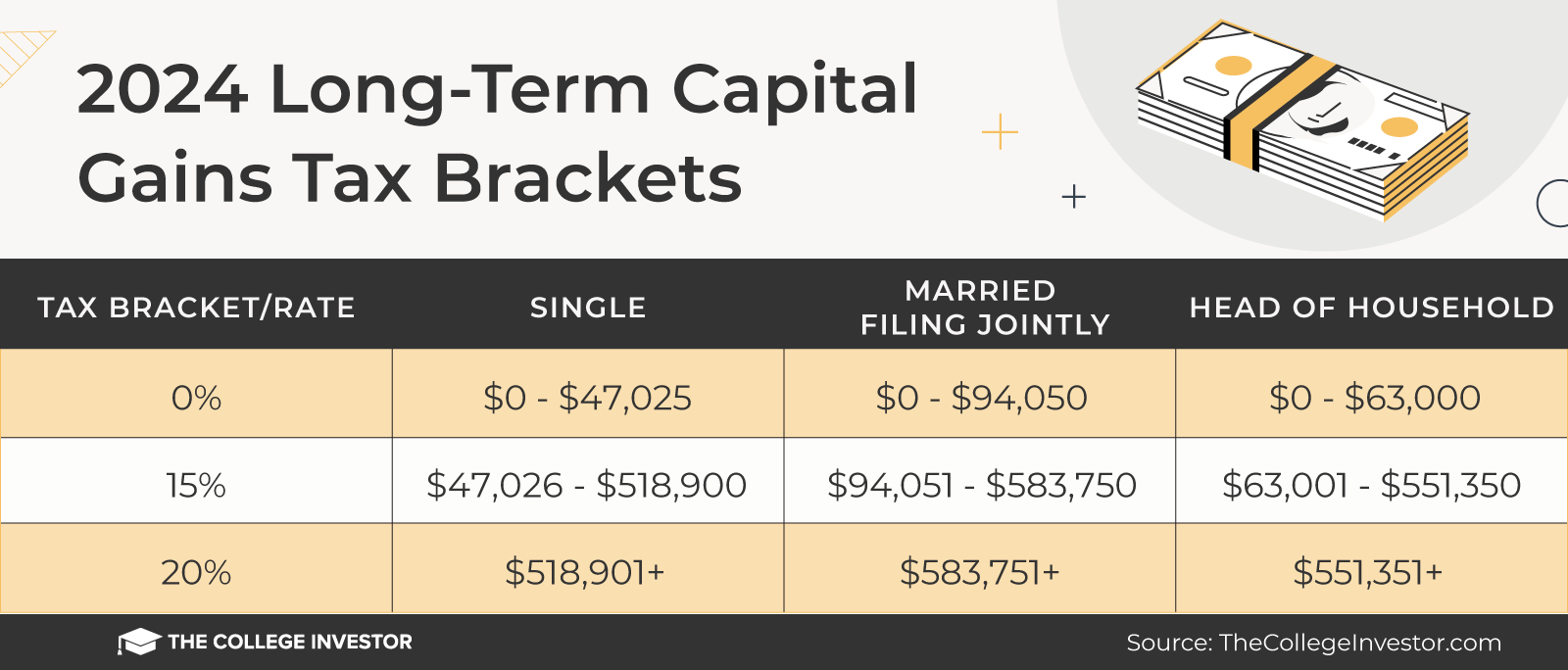

Tax Brackets

Here are the tax brackets for 2024 tax years. You can find the tax brackets here.

Don't forget to spend a few minutes to understand how effective tax rates work. A lot of people don't know what they really pay in taxes.

Read All Our Tax Articles

Page [tcb_pagination_current_page] of [tcb_pagination_total_pages]

Tax Terms And Definitions

Learn more about what these tax terms mean, from A to Z:

A

B

C

D

E

- Earned Income Tax Credit (EITC)

- Education Credits

- Effective Tax Rates

- Employer Identification Number (EIN)

- Estate Tax

- Estimated Taxes

- Exemption

F

- FICA

- Filing Deadline

- Filing Status

- Foreign Tax Credit

- Form 1040

- Form 1099-C

- Form 1099-NEC

- Form 5500-EZ

- Form 8949

- From W-2

- Form W-4

- Fringe Benefits

G

- Gift Tax

- Gross Income

H

- H&R Block

- Home Office Deduction

I

- Inheritance Tax

- Injured Spouse

- Installment Agreement

- Internal Revenue Service (IRS)

- Itemized Deductions

K

M

- Marginal Tax Rate

- Medicare Tax

N

- Non-Profit Organizations

O

- Offshore Accounts

P

- Payroll Tax

- Penalty Charges

- Personal Exemption

- Property Tax

Q

- Qualified Business Income Deduction (QBI)

R

- Refund

- Refundable Tax Credits

S

- Sales Tax

- SALT Deduction (State and Local Taxes)

- Schedule A

- Schedule C

- Schedule D

- Schedule E

- Schedule K-1

- Schedule SE

- Self-Employment Tax

- Standard Deduction

- State Income Tax

T

- Taxable Income

- Tax Allowance

- Tax Base

- Tax Bracket

- Tax Court

- Tax Credit

- Tax Deduction

- Tax Evasion

- Tax Exemption

- Tax Fraud

- Tax Haven

- Tax Identification Number (TIN)

- Tax Incentive

- Tax Liability

- Tax Lien

- Tax Offset

- Tax Planning

- Tax Rate

- Tax Return

- Tax Shelter

- Taxable Event

- TurboTax

U

- Underpayment Penalty

- Unearned Income

V

- Value-Added Tax (VAT)

W

- Wage Garnishment

- Wealth Tax

- Withholding

Editor: Clint Proctor Reviewed by: Chris Muller