For 2024, TaxHawk offers free federal filing for all users and low-cost state filing. If you don’t qualify for free tiers with other tax software companies, you may find TaxHawk offers better prices. While most filers have to pay for state tax returns, the price for TaxHawk is still much cheaper than many “free versions” elsewhere.

However, the company doesn’t offer 1099 imports, a major drawback. Depending on the complexity of your taxes, no option to import tax PDFs or spreadsheets with investment data could be a deal breaker.

In this TaxHawk review, we examine the ins and outs of TaxHawk's software and break down when it makes sense for bargain hunters to use TaxHawk and when to look elsewhere. If you’re shopping around, check out how TaxHawk ranks on our list of the best tax software.

TaxHawk Details | |

|---|---|

Product Name | TaxHawk |

Federal Price | Starts at $0 |

State Price | $14.99 per state |

Deluxe Support - Technical Support | $7.99 |

Pro Support - Tax Support | $44.99 |

Promotions | None |

TaxHawk - Is It Really Free?

With $0 and the word “Free” on the front page, you may expect TaxHawk to be available for free. That’s true for a limited number of filers who live in a state not requiring a state income tax return. TaxHawk offers free federal tax filing, but state tax returns cost $14.99 per state. You’ll pay more if you pick any optional upgrades.

While TaxHawk isn’t 100% free for anyone who requires a state tax return, it’s still an excellent value. For 2023 taxes (filed in 2024), it's a top software for value seekers who don't qualify for free filing elsewhere. Small business owners and side hustlers might find a much lower price for the same final tax results you would get with any tax software. It’s fairly easy to use, and the optional upgrades are competitively priced.

What's New For 2024?

TaxHawk was updated in 2024 for changes in the tax code, notably new tax brackets and limits for various deductions and credits. The filing experience is moderately improved from last year, a continuation of improvements from 2023.

The most significant upgrade is the option to upload and import W-2 forms from your employer. While 1099s are still unsupported, adding some PDF upload support is a good step forward.

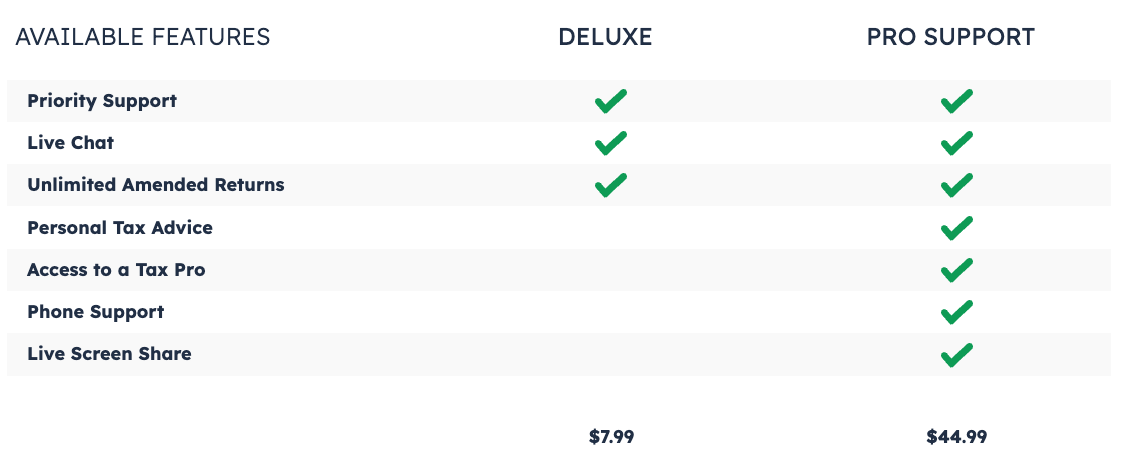

Prices are a little higher this year, but the Deluxe Support option for $7.99 and Pro Support for $44.99 remain competitively priced and much less than you would pay for similar products from industry leaders TurboTax and H&R Block.

Deluxe Support includes unlimited amendments to your tax return and live chat support for software questions. Pro Support includes phone or chat support with a licensed tax professional who can offer personalized tax advice.

TaxHawk consistently lands on our list of the Best Tax Software thanks to its overall good user experience and low pricing for a quality tax product. Even with all of the add-ins, filers are unlikely to pay more than $60 ($44.99 Pro Support + $14.99 State Tax). That’s a good price for tax prep and phone support from a tax pro.

If you’re not sold on TaxHawk or want to learn more about how it compares, see all the best tax software options here.

Does TaxHawk Online Make Tax Filing Easy In 2024?

TaxHawk is fairly easy to use but not the easiest tax software available. It stacks up well when comparing features to other value-priced tax software but falls short of more expensive TurboTax and H&R Block.

TaxHawk’s question-and-answer formatting, bookmarks, and quick navigation make the software intuitive. The software also includes section summaries to help users check whether they’ve made any errors.

The main TaxHawk drawback is a lack of import features. Premium-priced tax software packages typically allow users to upload 1099 PDFs, and the software fills in the necessary information. With TurboTax, you can directly download tax data from bank and investment websites.

You must manually type your information into TaxHawk. In some scenarios, filers spend a lot of time hand-keying information in the software. Active investors are likely better off elsewhere due to the manual time commitment and the potential for typos.

TaxHawk Features

Given the low price, TaxHawk is pleasantly high quality and easy to use. Thoughtful features like bookmarks, navigation bars, and section summaries make the software better than many middle and low-priced competitors. It has much more to like than dislike.

Q&A Plus Menu Guidance

TaxHawk uses a blend of questions and answers and quick navigation menus to guide users through the tax filing experience. The Q&A portion focuses on the most common questions. Users with more unique circumstances, including rental properties or other business income, can select their tax needs from a menu.

TaxHawk offers Q&A style navigation in each section to help users accurately file their returns.

Simple, Low-Cost Pricing

Federal tax filing is free for all users in all supported situations. State filing costs $14.99 per state. You can file for free if you live in a state with no required tax return.

If you live and work across state lines or need to file multiple state returns for any other reason, you’ll likely find significant savings compared to the biggest names in tax prep. Users have a few upgrade options, but those upgrades aren’t required and come reasonably priced.

Section Summaries

TaxHawk automatically shows a section summary where users can review the information they’ve entered before moving to another section. A “fat finger” error, such as adding one too many zeros, is easy to catch and correct when you see all the numbers on the same page.

Deluxe Support Add-On

TaxHawk’s Deluxe upgrade enables users to access live chat support for questions about using TaxHawk for just $7.99. Deluxe also includes a front-of-the-line priority support option and unlimited amended returns if you make a mistake on your taxes.

Pro Support Add-On

For $44.99, tax filers can add on Pro Support. Users can ask questions and receive personalized tax advice from a CPA or enrolled agents. Users will work with these tax pros via chat or phone, with screen sharing supported.

TaxHawk Drawbacks

Despite the general usability, TaxHawk isn’t perfect and falls short in key areas.

Can't Import Most Forms

TaxHawk doesn’t allow users to import 1099 forms. This means tax filers must hand-type the information. It’s easy to make a mistake while transcribing these forms.

Other leading filing services, including H&R Block, TurboTax, and TaxAct, offer importing tax form PDFs in a few clicks.

While you can't import most forms into TaxHawk, you can import prior-year tax returns from some software companies. This helps you compare year-over-year results to spot significant anomalies or changes to your income or tax situation.

No Free State Filing

State filing costs $14.99 for all users. Several companies, including TurboTax, TaxSlayer, and H&R Block, have free state and federal filing for some users. However, this is a decent cost compared to the regular price from TurboTax, H&R Block, and others.

TaxHawk Pricing And Plans

All filers pay the same base rate for TaxHawk software. That base rate is $0 for federal filing and $14.99 per state. The Deluxe and Pro Support levels unlock new levels of support, but the software remains unchanged.

Plan | Free (Federal Only) | Deluxe | Pro Support |

|---|---|---|---|

Best For | All filers | Priority technical support | Advice from tax professionals |

Federal Cost | $0 | $7.99 | $44.99 |

State Cost | $14.99 per state | $14.99 per state | $14.99 per state |

Total Cost | $14.99 | $21.98 | $59.98 |

How Does TaxHawk Compare?

TaxHawk is a value-priced software, and it is ideal for anyone who cannot qualify for free filing elsewhere and has only a small stack of tax forms. If you want the easiest experience, consider TurboTax or H&R Block.

For bargain-priced tax software, we’ve compared it to two other low-priced leaders, TaxAct and TaxSlayer, to help you pick the best tax software for your unique needs. TaxHawk is slightly more challenging to use than TaxSlayer, but it still offers a lot of functionality at very reasonable prices.

Header | |||

|---|---|---|---|

Rating | |||

Stimulus Credit | Free | Free+ | Free+ |

Unemployment Income (1099-G) | Free | Classic+ | Deluxe+ |

Student Loan Interest | Free | Free+ | Deluxe+ |

Import Last Year's Taxes | Free | Free+ | Free+ |

Snap A Pic of W-2 | Not Available | Not Available | Free+ |

Multiple States | $14.99 per state | Classic+ | Not advertised |

Multiple W-2s | Free | Free+ | Free+ |

Earned Income Tax Credit | Free | Free+ | Free+ |

Child Tax Credit | Free | Classic+ | Free+ |

Dependent Care Deductions | Free | Classic+ | Deluxe+ |

HSAs | Free | Classic+ | Deluxe+ |

Retirement Contributions | Free | Free+ | Free+ |

Retirement Income (SS, Pension, etc.) | Free | Free+ | Free+ |

Interest Income | Free | Classic+ | Deluxe+ |

Itemize Deductions | Free | Classic+ | Deluxe+ |

Dividend Income | Free | Classic+ | Deluxe+ |

Capital Gains | Free | Classic+ | Premier+ |

Rental Income | Free | Classic+ | Premier+ |

Self-Employment Income | Free | Classic+ | Self-Employed |

Audit Support | Deluxe+ | Premium+ | Not Offered |

Support From Tax Pros | Pro Support | Premium+ | Xpert Help Upgrade |

Small Business Owner (over $5k in expenses) | Free | Classic+ | Self-Employed |

Free Tier Price | $0 Fed & | $0 Fed & | $0 Fed & |

Deluxe Tier Price | $7.99 Fed | $37.95 Fed | $49.95 Fed & |

Premium Tier Price | There's technically no Premium tier, but users can add Pro Support for $44.99 | $57.95 Fed | $69.95 Fed |

Self-Employed Tier Price | N/A (Users can report self-employment income on the Free and Deluxe Tiers) | $67.95 Fed | $99.95 Fed |

Cell |

How Do I Contact TaxHawk Support?

For basic software-related questions, you can send a message (inside your account) or email to TaxHawk's general customer service team. The company's main customer support email address is support@support.taxhawk.com.

If you pay for Deluxe ($7.99), the messages you send will be prioritized. You'll also get access to the Audit Assist center. With the Pro Support add-on ($44.99), you'll get live chat and phone support from professional tax preparers.

Is It Safe And Secure?

TaxHawk boasts several major security credentials that prove it meets security standards. The company hasn’t suffered a security breach and protects users by requiring multi-factor authentication and strong passwords.

Users should feel confident when using TaxHawk in 2024. To keep your personal information and tax data safe, using a unique password on every website and following other online security best practices is important.

After all, if your password is compromised on another site and you use the same email address and password combination at TaxHawk, it’s much easier to get into your account.

Why Should You Trust Us?

The College Investor team spent years reviewing all of the top tax filing options, and our team has personal experience with the majority of tax software tools. I personally have been the lead tax software reviewer since 2022, and have compared most of the major companies on the marketplace.

Our editor-in-chief Robert Farrington has been trying and testing tax software tools since 2011, and has tested and tried almost every tax filing product. Furthermore, our team has created reviews and video walk-throughs of all of the major tax preparation companies which you can find on our YouTube channel.

We’re tax DIYers and want a good deal, just like you. We work hard to offer informed and honest opinions on every product we test.

How Was This Product Tested?

In our original tests, we went through TaxHawk and completed a real-life tax return that included W2 income, self-employment income, rental property income, and investment income. We tried to enter every piece of data and use every feature available. We then compared the result to all the other products we've tested, as well as a tax return prepared by a tax professional.

This year, we went back through and re-checked all the features we originally tested, as well as any new features. We also validated the pricing options.

Is It Worth It?

TaxHawk’s combination of features and pricing makes it a strong contender for anyone’s tax needs. The software is a decent choice for bargain seekers, but recent upgrades make it better than ever.

However, TaxHawk doesn’t support 1099 imports. This makes it a tough choice for users with many forms or active investment trading data to enter.

It’s still recommended for bargain hunters who can’t qualify for free filing and business owners looking for a lower-cost filing option. Many side hustlers, rental property owners, and multi-state filers will see significant value in TaxHawk.

TaxHawk FAQs

Here are some of the most common questions about TaxHawk.

Can TaxHawk Online help me file my crypto investments?

TaxHawk supports cryptocurrency trades, but users need to hand-key all their information. Users who sold one or two positions may do well with TaxHawk. Those with a dozen or more trades may need to use dedicated cryptocurrency tax software and upload the results to more powerful software like H&R Block or TurboTax to complete their taxes.

Can TaxHawk help me with state filing in multiple states?

Yes, TaxHawk allows users to file taxes in multiple states. Before starting the process, make sure TaxHawk supports both states through its supported forms. State filing costs $14.99 per state.

Is TaxHawk really free?

TaxHawk has a free federal pricing tier. However, you'll have to pay for a state tax return at every price level. Other add-on features (optional) are available for an additional fee.

Are TaxHawk, FreeTaxUSA, and 1040Express owned by the same company?

Yes. TaxHawk Inc. owns TaxHawk, FreeTaxUSA, and 1040Express. Each software has a slightly different branding, but the software is more or less the same under the hood. Users can even transfer accounts from one software to the next.

TaxHawk Features

Federal Cost | Free |

State Cost | $14.99 per state |

Basic Customer Support | Free |

Audit Support | Included with Deluxe ($7.99) |

Pro Support | $44.99 |

Printable Tax Return | Yes (Free) |

Tax Extension | Yes (Free) |

Import Tax Return | Yes, from TurboTax, H&R Block, or TaxAct (Free) |

Unlimited Amendments | With Deluxe ($7.99) |

Self-Employment Income | Yes (Free) |

Itemize Deductions | Yes (Free) |

Deduct Charitable Donations | Yes (Free) |

Customer Service Email | support@support.taxhawk.com |

Customer Service Phone Number | Not listed |

Web/Desktop Software | Yes |

Mobile Apps | No |

Promotions | None |

TaxHawk Review

-

Navigation

-

Ease of Use

-

Features and Options

-

Customer Service

-

Plans and Pricing

Overall

Summary

TaxHawk is solid bargain tax software that is similar to its sister company FreeTaxUSA with some premium features.

Pros

- Free federal filing includes all forms

- Pro Support is competitively priced

- New W-2 support for 2024

Cons

- Must manually input all information

- The Paid Deluxe version doesn’t include access to tax experts

- Can’t import most tax forms

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment.

His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, Huffington Post, and other financial publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.

Editor: Colin Graves Reviewed by: Robert Farrington