OLT.com is a budget-priced tax software with an all-in price tag of around $10 to $16 for most tax filers.

Short for OnLine Taxes, OLT isn’t the most robust tax software on the market, but it does a good job of giving you what you need at a low price tag.

With OLT.com, you get what you pay for. It doesn’t come with advanced features like data and tax form imports. But it could be right for you if you want low-cost tax software that can cover most tax situations with a reasonably good user experience.

Here’s what you need to know about OLT.com when shopping around for the best tax software for your unique needs.

See also how OLT.com compares to our top tax filing software options.

OLT.com Details | |

|---|---|

Product Name | OLT.com |

Federal Price | Starts at $0 |

State Price | Starts at $9.95 per state |

Preparation Type | Self-Prepared |

Promotions | None |

Is OLT.com Free?

OLT.com offers free federal tax filing for all users on its basic tier, including complex tax situations. Filers pay $9.95 for each state return. Those in the few states with no required state tax return can use OLT.com for free.

For most users, we recommend upgrading to the Premium Edition for $7.95, which includes live customer support, audit support, and a $2 discount on each state return ($7.95).

Most users will pay $9.95 per year (Free Edition with a single-state return) or $15.90 for Premium plus one state. While it’s not really free for most people, the pricing is extremely competitive and much lower than what you’d pay for premium experiences with industry leaders TurboTax or H&R Block.

However, it is slightly more expensive than Cash App Taxes (which does have limitations), and FreeTaxUSA.

What's New In 2024?

For 2024, OLT.com made updates across the board to ensure accurate tax filing updates driven by the IRS. That includes updated limits for tax brackets, deductions, and credits. With its 100% accuracy guarantee, you should get identical results with OLT.com versus a competing app.

Does OLT.com Make Tax Filing Easy In 2024?

OLT.com makes filing easy for many filers doing their 2023 taxes, which happens in early 2024. It’s best for those with fewer tax forms and those without active investing accounts, as you can’t upload or import PDF tax forms or spreadsheets with your investment data. You have to manually type in all of those W-9, 1099, and other tax forms by hand.

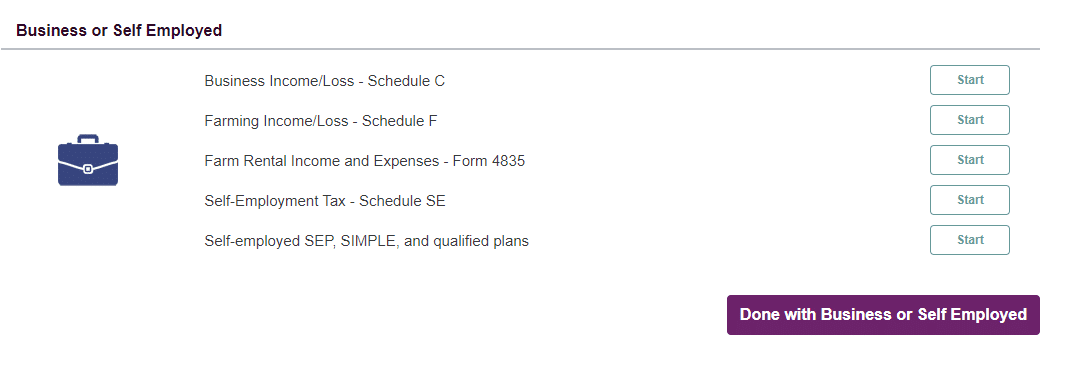

However, the software includes multiple checkpoints where users can verify whether they’ve entered the information correctly. Because self-employed people and landlords can easily navigate to anything they need, it’s a particularly good deal as long as they don’t have too much information to enter.

Active stock and cryptocurrency investors may want to steer away from OLT.com and consider TurboTax or another competitor. Having to manually enter all of your trades one at a time can be extremely cumbersome and prone to typos and manual errors.

OLT.com Features

With software upgrades for last year’s tax season, OLT.com has several features that help it stand out from other bargain-priced software.

Simple User Experience

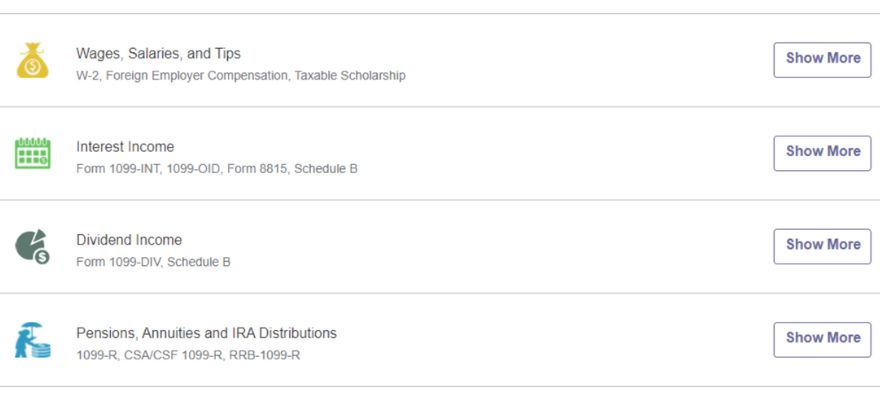

OLT.com upgraded the user experience of its software last year to simplify tax filing. The app now has a menu-driven navigation where you choose each section you want to enter.

Filers can review each sub-section before moving forward, helping users detect errors before changing their attention to something else. The software also has robust, built-in calculators, which helps filers claim the correct depreciation and depletion expenses.

Example of a simple menu inside the OLT.com software

Section Summaries

Users can easily track filing progress and review financial outcomes with section summaries. The summaries show each section's income, deduction, or credit activity. OLT.com displays detailed sub-section summaries, so users can catch mistakes as they work through their return.

Affordable Live Customer Support

The Premium Edition upgrade costs less than $10 and gives you access to live chat and phone customer support and audit support should you need it in the future. Some competitors charge much more for access to human support.

However, it’s worth noting that live support is limited you may experience long waits during peak filing periods. Customer service support helps you with questions about OLT.com but doesn’t include personalized tax advice.

With the free version of OLT.com, you can ask questions via email, with a longer delay before you see a response.

OLT.com Drawbacks

OLT.com isn’t a perfect product. Here are some drawbacks to consider before you sign up.

No Options To Import Forms

OLT.com doesn’t allow users to import W-2 or 1099 forms. That means that filers must enter all this information by hand. Some filers won’t mind the extra step, but those with several bank or investment accounts may want to choose a more expensive and sophisticated software.

Some Screens Overly Cluttered

While OLT.com made notable strides in its user experience, some of the screens remain cluttered with a design that still feels a bit dated. There’s a lot of information on some screens, making it easy to miss something important.

OLT.com Plans And Pricing

OLT.com has maintained its pricing structure from last year. The free federal tier includes all major forms for filing, but it only includes email-based support.

The Premium edition includes live chat, technical support, and audit assistance. If you start with OLT.com, amended returns are available at no additional charge.

Plan | Free Edition | Premium Edition |

|---|---|---|

Best For | All forms (includes email support) | Audit assistance, live chat technical support |

Federal Cost | $0 | $7.95 |

State Cost | $9.95 per state | $7.95 per state |

Total Cost | $9.95 | $15.90 |

How Does OLT.com Compare To Other Tax Software?

OLT.com comes with a low cost, so our comparisons focus on other software with similar pricing structures.

In 2024, we’re comparing OLT.com to FreeTaxUSA, Cash App Taxes, and TaxSlayer. OLT.com rivals the user experience at FreeTaxUSA and offers slightly lower prices.

Cash App Taxes has a somewhat better product, and the price is free, but it doesn’t support multi-state filing and lacks support for a few other important scenarios for some filers.

TaxSlayer is the most expensive product in the bargain category, but it offers the most functionality.

Header |  | |||

|---|---|---|---|---|

Rating | ||||

Stimulus Check | Free | Free | Free | Free |

Unemployment Income | Free | Free | Free | Free |

Student Loan Interest | Free | Free | Free | Free |

Import Last Year's Taxes | Only From OLT.com | Free | Free | Free |

Import/Picture of W2 | Not Available | Not Available | Not Available | Not Available |

Multiple States | $9.95 per state | $14.99 per state | Not Supported | $0 to $44.95 Per State |

Multiple W2s | Free | Free | Free | Free |

Earned Income Tax Credit | Free | Free | Free | Free |

Child Tax Credit | Free | Free | Free | Classic |

HSAs | Free | Free | Free | Classic |

Retirement Contributions | Free | Free | Free | Free |

Retirement Income (SS, Pension, etc.) | Free | Free | Free | Free |

Interest Income | Free | Free | Free | Classic |

Itemize Deductions | Free | Free | Free | Classic |

Dividend Income | Free | Free | Free | Classic |

Capital Gains Income | Free | Free | Free | Classic |

Rental Income | Free | Free | Free | Classic |

Self-Employment Income | Free | Free | Free | Classic |

Audit Support | Premium | Deluxe | Free | Premium |

Support From Tax Pros | Not Available | Pro Support | Not Available | Premium |

Small Business Owner (over $5k in expenses) | Free | Free | Free | Classic |

First Tier Price | Free $0 Fed & | Free $0 Fed & | Free $0 Fed & | Free $0 Fed & |

Second Tier Price | Premium $7.95 Fed & $7.95/State | Deluxe $7.99 Fed & $14.99/State | N/A | Classic $37.95 Fed & $44.95/State |

Third Tier Price | N/A | Pro Support $39.99 Fed & $14.99/State | N/A | Premium $57.95 Fed & $44.95/State |

Fourth Tier Price | N/A | N/A | N/A | Self-Employed $67.95 Fed & $44.95 State |

Cell |

Is OLT.com Safe And Secure?

OLT.com requires users to enable multiple forms of authentication. The multi-factor authentication requirement protects users in the event of a password breach. The company also protects and encrypts personally identifiable information and credit card numbers.

The company also meets third-party standards for data privacy and consumer data protection. Despite the credentials, no website can 100% guarantee the safety of information shared online. Follow password and cybersecurity best practices to keep bad guys out of your account.

How Can I Get Support From OLT.com?

With the Free Edition, your support options with OLT.com are limited to email support and self-help by using the website's Knowledge Base and FAQs. If you upgrade to Premium, you’ll get audit assistance and live chat and phone tech support.

The audit assistance looks like a good value at first. However, Cash App Taxes offers a similar guarantee for free. And unlike other bargain software companies, like TaxHawk, OLT.com does not have an upgrade option that provides access to tax pros.

Why Should You Trust Us?

The College Investor team has spent years reviewing all of the top tax filing options, and our team has personal experience with the majority of tax software tools. I personally have been the lead tax software reviewer since 2022, and have compared most of the major companies on the marketplace.

Our editor-in-chief Robert Farrington has been trying and testing tax software tools since 2011, and has tested and tried almost every tax filing product. Furthermore, our team has created reviews and video walk-throughs of all of the major tax preparation companies which you can find on our YouTube channel.

We’re tax DIYers and want a good deal, just like you. We work hard to offer informed and honest opinions on every product we test.

How Was This Product Tested?

In our original tests, we went through OLT.com and completed a real-life tax return that included W2 income, self-employment income, rental property income, and investment income. We tried to enter every piece of data and use every feature available. We then compared the result to all the other products we've tested, as well as a tax return prepared by a tax professional.

This year, we went back through and re-checked all the features we originally tested, as well as any new features. We also validated the pricing options.

Who Is It For And Is It Worth It?

Thanks to OLT.com’s thoughtful user experience enhancements, the software is one to consider for people who want an inexpensive option. Cash App Taxes is a better choice for many qualifying users, but multi-state filers and people with K-1 forms can’t use that platform.

These filers may want to consider OLT.com as a low-cost alternative. In many cases, OLT.com will have the lowest price for filers who must file in multiple states.

OLT.com offers a great product, but it isn’t perfect. Active traders can opt for an alternative like H&R Block or TurboTax. No matter what you’re seeking, we have recommendations for software based on your filing situation.

OLT.com FAQs

Here are the answers to a few of the questions that filers frequently ask about online tax software like OLT.com.

Can OLT.com help me file my crypto investments?

OLT.com supports crypto filing, but it doesn’t do much to make the filing process easy. Users cannot import IRS Form 8949, so they are left manually entering each transaction. Most crypto traders would be better off using a service like TurboTax Premier to file their returns.

Can OLT.com help me with state filing in multiple states?

Yes, OLT.com supports multi-state filing. On the Free tier, filers pay $9.95 per state. On the paid tier, the price per state drops to $7.95 per state.

Does OLT.com offer refund advance loans?

No, OLT.com isn't offering refund advance loans in 2024. You can pay your OLT.com fees for $29.99 with the “bank product,” which we suggest you avoid.

OLT.com Features

Federal Cost | Starts at $0 |

State Cost | Starts at $9.95 per state |

Premium Edition | $15.90 |

Pay With Tax Refund | Yes, $29.95 extra cost |

Audit Support | Yes, with Premium Edition purchase |

Support From Tax Pros | Not available |

Full Service Tax Filing | Not available |

Printable Tax Return | Yes |

Import Tax Return From Other Providers | No |

Import Prior-Year Return For Returning Customers | Yes |

Import W-2 With A Picture | No |

Stock Brokerage Integrations | None |

Crypto Exchange Integrations | None |

Self-Employment Income | Yes |

Itemize Deductions | Yes |

Deduct Charitable Donations | Yes |

Refund Anticipation Loans | Not offered |

Customer Service Options | E-mail, Live Chat, Phone, Knowledge Base, FAQ's (Live Chat and phone support required Premium Edition purchase) |

Web/Desktop Software | Yes |

Mobile Apps | No |

Promotions | None |

OLT.com Review

-

Navigation

-

Ease Of Use

-

Features and Options

-

Customer Service

-

Plans and Pricing

Overall

Summary

OLT.com is a value-priced online tax software built to handle most tax situations. The app has made usability improvements in 2024 while continuing to offer low prices.

Pros

- Cost-effective product

- Simple menu navigation

- Well-designed calculators

Cons

- Some screens are still overly cluttered

- Can’t import any forms (including W-2)

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment.

His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, Huffington Post, and other financial publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.

Editor: Colin Graves Reviewed by: Robert Farrington