One of the hardest parts of doing taxes yourself is simply gathering all of the information you need! If you have a side hustle, self-employment income, or are an investor then you’ve probably got quite a bit of tax forms coming to you. And it can be tough to get organized!

In preparation for the upcoming tax deadline, here’s how you can quickly get organized using an income tax binder. (This will save you a ton of time going forward!)

Plus, if you're using a tax professional, they will be so happy to see this!

If you don't even know where to start filing your taxes, check out our list of the best tax software!

Why Get Organized?

When it comes to filing your taxes, you need to take a lot of information and input it all at once - accurately. Where does this information come from? Various places (which makes things hard).

First, you'll likely get tax documents throughout the year - with the bulk of them arriving in December, January, and February.

Related: What to do if I'm missing late tax documents?

Second, you might have receipts and other forms that are separate from your tax forms. These could include copies of your property tax bill, auto registration, charitable donation receipts, and more.

Finally, you might have things related to your business or rental property you need to report.

With all of these different things to deal with, being organized is key. An income tax binder is a great way to streamline doing your taxes (whether you DIY or use a professional).

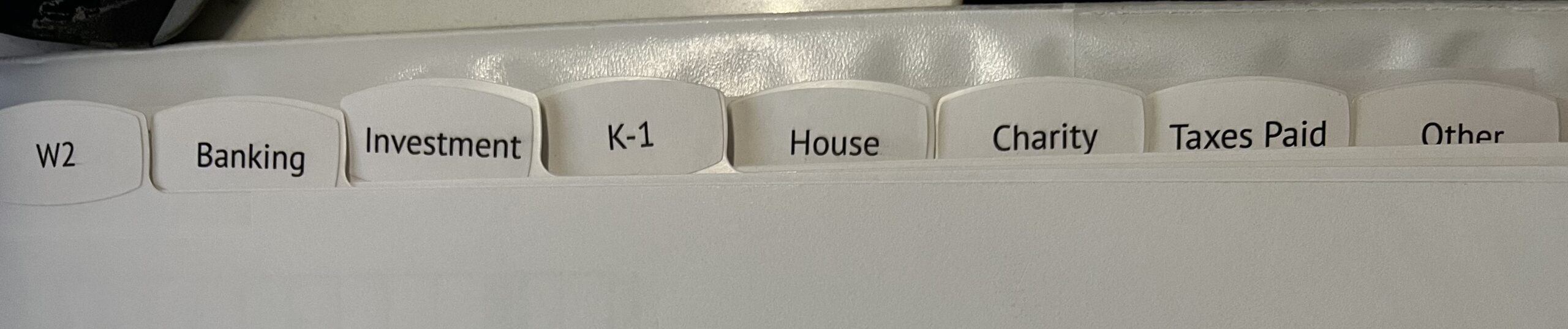

Make Tabs for Basic Categories

Your first step will be getting your binder plus divider tabs and making sections for specific categories.

Some categories you might want to include are:

- Income (Including W-2 and 1099 Income)

- Investment Documents (Retirement account statements, dividend income, etc.)

- Rental Property Income and Expenses

- Mortgage Interest Statements

- Education Payments

- Personal Information For Everyone Who Belongs On Your Tax Return

Make these tabs personalized for your specific situation.

Gather all of your documents and place them in the correct divider for easy access. When next year rolls around you can start filing documents as they come in.

Here's an example of my binder:

Create a Section for Expenses

If you have any rental or self-employment income then you’re going to want to meticulously track your expenses. Since receipts can be a pain to file in a binder a better option is to make copies of receipts, including several on the same page so that you can easily file and organize your expenses. You could also just include a plastic pocket divider for receipts if you don’t want to make copies.

Start doing this at the beginning of the year so that you don’t have to search through receipts right at tax time. This is a life saver if you have a ton of expenses to deduct each year.

Create a Folder for Last Year’s Taxes

Unless you’re doing your taxes with the same place as you did last year, you will need a copy of last year’s taxes for verification purposes.

Even if you are using the same tax prep software it’s still nice to be able to look back and compare different year’s taxes to each other.

Create a folder or a few tabs where you can place the previous year’s income tax returns. Remember, you should be saving at least 7 years of tax returns.

Create A Cover Sheet

Along with all the documents, I recommend creating a cover sheet that includes everything you need to know and remember. The helpful thing about a cover sheet is that you can re-use it from year to year and make sure you don't miss anything from the prior year.

What do I include on the cover sheet?

- Wages: What companies am I expecting W2s for?

- Income: Business, rental, where?

- Interest: What banks do I usually get a 1099 from?

- Investing: What brokerage firms do I usually get a 1099 from?

- Child Care Expenses: What the information for my children's child care

- Real Estate: Taxes, Mortgage Interest

- Personal Property Taxes: Vehicle Registration

- Donations: How much and to whom

- Estimated Taxes Paid: Date and Amount

I also include random things that might impact taxes. For example, when we got solar, I included all the information about our solar installation to make sure I got the tax credit.

Do Your Taxes and File This Year’s Info

Depending on how thick your income tax return is and how thick your binder is, you can move all of this year’s info to a new tab or you can file everything.

At the bare minimum I think it’s a good idea to keep at least the copy of your current income tax return in your binder for easy access.

Start Preparing for Next Year

Being organized really is half the battle. Once you have all of your information together the tax prep software you use will walk you through everything else you need to do. Putting this system together doesn’t take very long but can save your hours of searching for certain tax documents.

Keep your system together and next year filing your taxes will be a breeze!

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller