Source: The College Investor

The PATH Act (Protecting Americans Against Tax Hikes) was designed to help combat tax refund fraud that was estimated to be costing the government over $100 million each year. An analysis found that a lot of fraud was being conducted using "refundable tax credits".

Tax credits reduce your tax liability dollar for dollar - and refundable tax credits can give you more money back than you even paid in taxes. This makes them prime for fraud.

However, the result of the Path Act is that individuals and families who file tax returns claiming these credits have to wait. They will see their tax refunds delayed.

Here's what you need to know about the PATH Act and when you can expect your tax refund if you claim PATH Act impacted tax credits.

What Is The PATH ACT?

The PATH Act, short for Protecting Americans Against Tax Hikes, was passed in 2015 as a tax reform bill. This bill had 50 tax credits and deductions, and made permanent several popular tax credits.

However, one of the biggest impacts of the PATH Act was a delay that was required for certain tax returns to combat tax fraud. Specifically, tax payers who filed tax returns that included the Earned Income Tax Credit (EITC) or the Child Tax Credit (CTC) could NOT receive their tax refund before February 15.

The reason for the delay is that tax refunds are processed "first come, first served". And if you wanted to file a fraudulent tax refund, you'd do so very early so that the real taxpayer would not have filed yet.

An assessment of fraudulent returns found that returns with EITC and CTC were common culprits because these tax credits were refundable - meaning that you could get back even more money than you paid in taxes.

PATH ACT Tax Refund Delays

As a result of the PATH Act, individuals and families filing tax returns with the EITC or CTC now have to wait until after February 15 each year. Given that the IRS begins processing tax returns in late January, and most filers can expect their refund within 21 days, this law delays millions of tax returns by over a month each year.

You can see our "normal" estimated tax refund calendar here.

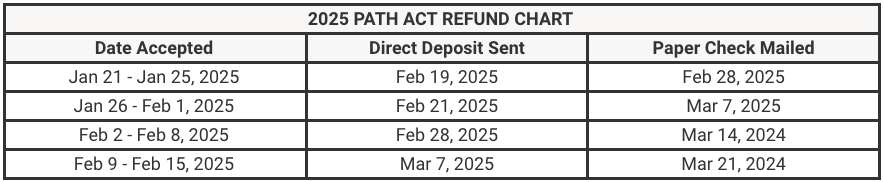

Based on prior years' data, people with PATH ACT refunds typically see their tax refunds arrive in the first week of March. For 2025, we expect that the earliest PATH Act tax refunds will arrive around February 19, but the bulk of earlier filers will see their refund the week of February 24 through March 3. Some may not even get their refunds until the week of March 9, depending on when you filed your tax return.

Remember, the IRS isn't likely going to open for e-File returns until January 21, 2025.

Source: The College Investor

Here is an HTML version of the Path Act Refund Chart:

2025 PATH ACT REFUND CHART | ||

|---|---|---|

Date Accepted | Direct Deposit Sent | Paper Check Mailed |

Jan 21 - Jan 25, 2025 | Feb 19, 2025 | Feb 28, 2025 |

Jan 26 - Feb 1, 2025 | Feb 21, 2025 | Mar 7, 2025 |

Feb 2 - Feb 8, 2025 | Feb 28, 2025 | Mar 14, 2024 |

Feb 9 - Feb 15, 2025 | Mar 7, 2025 | Mar 21, 2024 |

Note: We do expect some PATH Act refunds to go out as early as Feb 17, 2025. However, most early filers likely won't see their refunds until the following week. Remember, February 15 falls on a Saturday this year (so bank payments likely won't go out until the following week).

Remember, if you file your tax return after the mandatory delay period, your tax return (and tax refund) will process normally.

Unintended PATH Act Consequences

One of the biggest unintended consequences of the PATH Act is that millions of low income families have to wait almost an additional 6 weeks before receiving their tax refund. As a result, many of these same families are turning to tax advance refund loans to close the gap.

The Government Accountability Office (GAO) did a study and found that over 20 million households used tax refund loans, and that number is rising. Considering that 25 million households file the EITC (and 31 million are eligible for don't file a tax return to claim it) according to the IRS, the correlation is staggering.

While the PATH Act is cutting down on refund fraud and saving the government money, it could be costing tax payers nationwide money due to tax refund loan fees, interest, and more.

Common Questions

Here are some common PATH Act questions.

What Is The PATH ACT?

The PATH Act, short for Protecting Americans Against Tax Hikes, was passed in 2015 as a tax reform bill.

What Are The Biggest Consequences Of The PATH ACT?

The biggest consequence for taxpayers is that tax returns that include the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) cannot be processed before February 15. The result is that these tax refunds are delayed until early March.

Is The PATH ACT A Good Thing?

The PATH Act has reduced tax refund fraud, which is estimated to cost the IRS $100 million per year. However, the delay in processing tax returns puts a burden on many low-income Americans.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Ashley Barnett Reviewed by: Colin Graves