Does your spouse owe past-due taxes, late child support, alimony payments, or have delinquent Federal student loan debt? If so, all of the money from your joint tax return could be garnished to meet those obligations.

But as a married person filing jointly, you have some recourse against this. You can file IRS Form 8379: Injured Spouse Allocation. This form allows the injured spouse (that is the person who doesn’t owe the payment) to get a certain portion of the refund back.

Read on to learn how it works, and if it makes sense in your situation.

Who Is the Injured Spouse?

The injured spouse is the person who doesn’t owe past-due taxes, overdue child support or alimony, or unpaid Federal debts (including student loan debt). In the eyes of the law, this person should not have to pay for his or her spouse’s delinquent debts.

So, if you filed your taxes jointly, were expecting a tax refund, but saw the entire tax refund offset (garnished), the spouse that didn't owe any debts (the "injured spouse") may be eligible to get his or her portion of the tax refund back,

However, the IRS will not automatically give the “injured spouse” money back. You must file Form 8379: Injured Spouse Allocation to qualify for this.

How Much Money Could I Get Back by Filing Form 8379?

When calculating the amount you could get back by filing Form 8379, the IRS will treat you and your spouse as a married couple filing separately. Each person’s tax burden will be calculated separately based on the income and taxes paid on those forms. The amount of overpayment that came from the injured spouse will be returned to that spouse.

Sometimes, both spouses are self-employed (or are both side hustlers), and they both make estimated tax payments. In this case, the IRS will assume that the payments are split based on the proportion of tax that each individual owed.

In community property states (Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin), 50% of your joint overpayment would be put towards the delinquent debt while the other half would be returned to the injured spouse.

How To Fill Out Form 8379

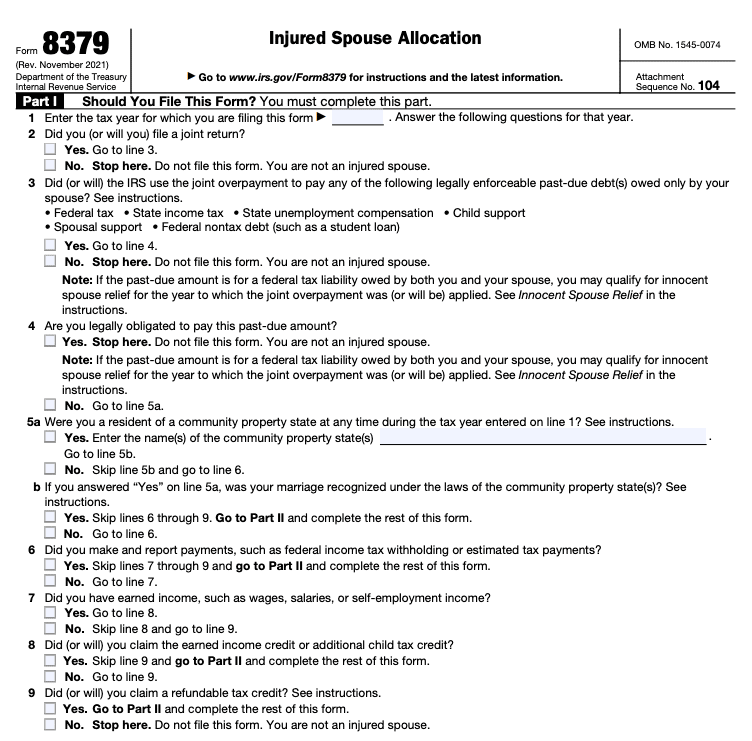

This form isn't too complicated to fill out. Part 1 simply asks for some basic information about your tax filing situation. See this here:

Part 2 is also very simple, just asking for your name and information from your joint tax return. Part 3 is where it can get a little bit complicated.

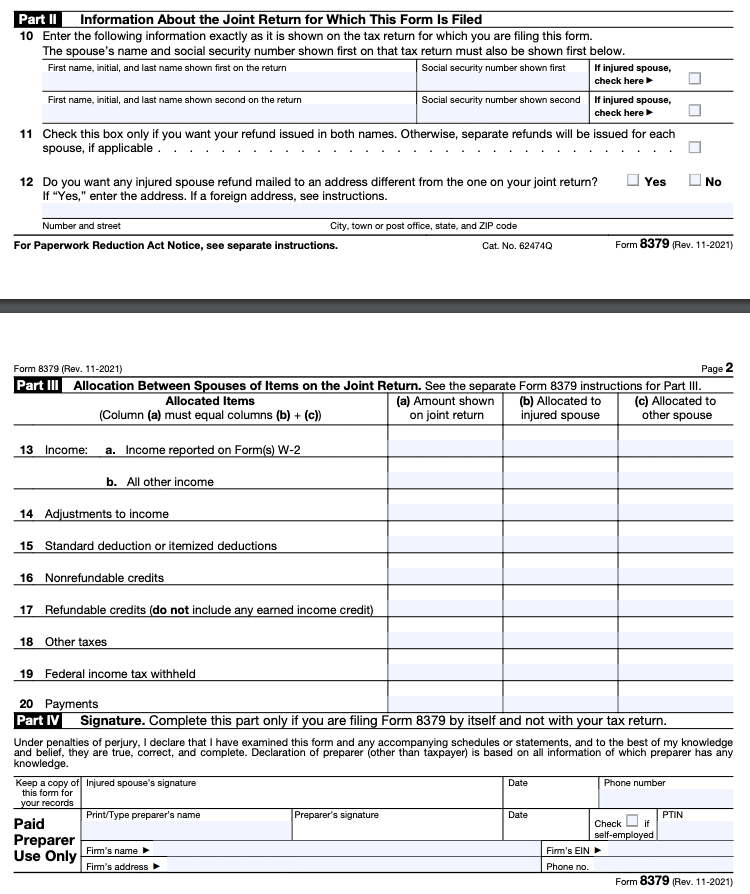

In Part 3, you have to divide your tax return into what's allocated to each spouse - both the injured spouse and other spouse. You do this for each "section" of the tax return: income, adjustments to income, deductions, credits, and taxes withheld.

Here's what Part 3 looks like:

How Long Does It Take to Process Form 8379?

Unfortunately, Form 8379 takes a long time to process.

The IRS gives the guidance that people who file Form 8379 electronically with their joint return should expect an 11-week processing time. Those who file it alone (after filing a joint return) should expect an eight-week filing. If you file using paper, it will take 14 weeks to process.

When Should I File Form 8379?

If you think that your refund may be garnished due to your spouse’s delinquent debts, file Form 8379 with your tax return. You can file this form with most major tax prep software including TurboTax, H&R Block, FreeTaxUSA, TaxSlayer, and most other programs.

You can file this form up to three years after the date of the original return. You must file a new Form 8379 each year that you want to qualify as an injured spouse.

Do I Have Any Options Besides Filing Form 8379?

If your taxes are already filed, Form 8379 is your best bet for getting some of your money back.

But you may be able to make moves to avoid having future tax repayments garnished. First, you can consider filing separately from your spouse. That way, none of your overpayment will be garnished. Plus, there can be benefits for your student loans if you file your taxes separately.

Second, you can work with your spouse to get on an income-driven repayment plan for Federal student loans. Income-driven repayment plans are designed to have low enough payments so that you can afford them on any income.

Here are the steps to follow to rehabilitate your loans, so you can get out of default.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller