It can be hard to know when to file your quarterly estimated taxes - and if you even need to!

Side-hustling, self-employment, and entrepreneurship offer the promise of financial flexibility, but four times per year hustlers feel some pain.

That’s right, for self-employed people, tax time comes four times per year, and you'll almost always owe money.

This guide explains what quarterly tax estimates are, how to figure out how much to pay, and how to save money for the estimates. It also gives a step-by-step guide to paying for the quarterly estimates.

With this guide, the only pain you'll feel is the pain associated with paying taxes.

What Are Quarterly Tax Estimates?

When you work for a traditional employer, your employer withholds Federal income tax, state income tax, and Social Security and Medicare taxes from each paycheck. Your employer also kicks in its half of Social Security and Medicare taxes. This is called FICA taxes.

When you're self-employed, nobody withholds taxes from you. However, those taxes still need to be paid.

According to the IRS, you must make estimated tax payments for the current tax year if you'll owe at least $1,000 at the end of the year, and you expect to owe at least 90% of the total tax due on this year's return or at least 100% of the tax on the prior year's return.

Note: You also typically have to make estimated state tax payments as well. State tax rules may vary from the IRS rules.

If you're newly self-employed, and you've always received a refund in the past, you may expect that you won't owe at least $1,000. Unfortunately, for most self-employed people, that's not true. Since self-employed people have to pay Social Security and Medicare taxes on all their profits, they'll likely owe money, even if they don't owe Federal income tax. This includes people that side hustle driving for Uber or Lyft, and more!

Basically, if nobody is withholding money from you, you should expect to cut a check to the IRS every quarter (or you could face penalties)!

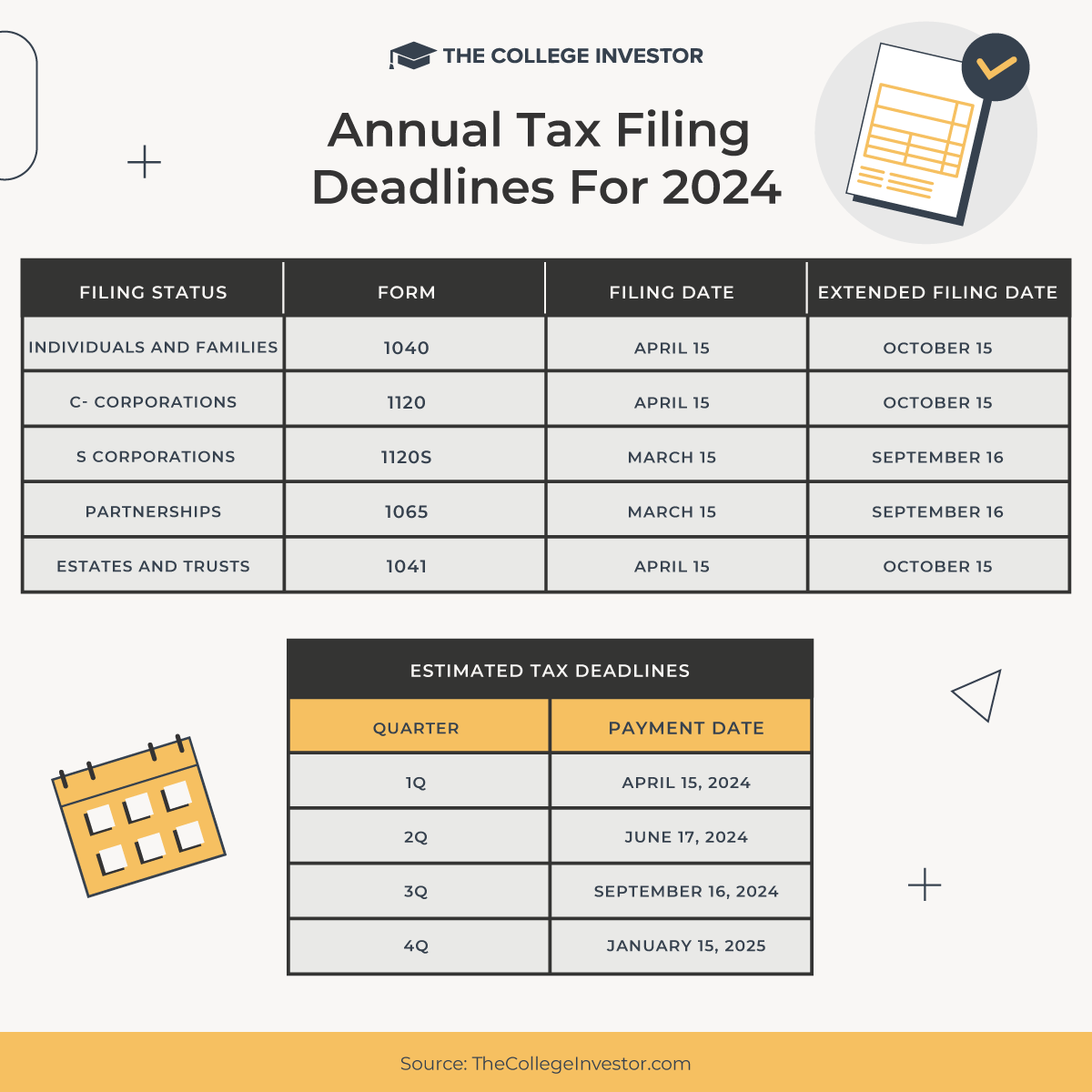

For tax year 2024, quarterly estimates are due on the following days (see our full list of tax deadlines here):

- April 15, 2024

- June 17, 2024

- September 16, 2024

- January 15, 2025

Thankfully, paying quarterly tax estimates isn't actually a huge hassle. You don't have to file any paperwork. You simply pay what you think you'll owe (more on that below) online or using a paper payment voucher.

If you end up overpaying or underpaying throughout the year, you can shore up the difference before April 15th, 2025 (tax day), and you'll be fine. If you underpay, you may owe some penalty interest, but even this penalty isn't too bad (unless you underpay by a lot). Right now the penalty rate is 4% per year, and is only calculated by the amount of time you owed the government money.

This year, you can use Form 2210 to figure out how much you owe (or simply use a tax software program to calculate it for you).

How Much Should I Pay Each Quarter?

As a business owner, estimating your quarterly tax payment is entirely your responsibility. Unfortunately, figuring out how much to pay is a bit of a guessing game. However, there are a few tricks to making the estimates.

Here are the five most common methods for estimating quarterly payments. Find one you like, and stick with it.

Withhold a Ton from Your W-2 Job

If you're a side-hustler with a W-2 job, you might get away with withholding more from your W-2 job. You can either claim a 0 (no deductions) to increase your withholdings, or specifically ask HR to increase withholdings.

People earning less than $1,000 per month can probably get away with withholding more from the W-2 job and avoid quarterly taxes altogether.

If you're married and filing jointly, you can also have your spouse increase withholdings. Between the two of you, you can likely withhold enough.

Again, this is only a strategy for side-hustlers or people who aren't earning a ton of profit from their business. If you have profits above $1,000 per month, you're going to need to choose another method.

This was the strategy that I personally used for most of my years of side hustling in college.

Use Last Year's Taxes

Using last year's taxes to make quarterly estimates is not an accurate way to pay quarterly estimates. However, it could be good enough for your situation, and takes almost no time.

To avoid paying a penalty, the minimum you need to pay, in most cases, is 100% of your total tax burden from last year. If you earned over $150,000, you need to withhold at least 110% of last years tax bill. To do this, simply look at your total tax burden from last year:

- Line 24 on the 1040

Now, divide that number by four. Pay this amount each quarter. For example, if you owed $8,000 last year, you'll pay $2,000 per quarter.

If you're married, and you file jointly, subtract the amount your spouse had withheld (Federal income tax only), and pay the remainder.

Just remember, if this is the method you choose, you may still owe money in April 2025. If possible, save a good chunk of your profits, so you can use savings to pay taxes rather than getting behind.

Estimate Using Tax Software

The IRS recommends that self-employed people estimate quarterly taxes using the 1040-ES. This requires estimating your total annual profit, and a lot of calculating by hand. To make this easier, you could use a free tax software program (like TurboTax, H&R Block, TaxAct, TaxSlayer, or others) to estimate your total tax burden for the year.

Most people who do this will multiply their first quarter revenues by four and their first quarter expenses by four. Then, they will plug those numbers into the software. The software will show an overall Federal tax burden. Divide that number by four, and pay that as your quarterly estimate. You can use the same amount each quarter or update it as the year goes along.

I used this method for a few years, and I always paid close to the right amount.

Withhold a Percentage of Profits

The previous three methods allow you to make the same tax payment each quarter, but this method offers a bit more flexibility while still being relatively easy to implement.

First, using your previous year's tax return, calculate your average tax rate.

That means divide the amount you paid in taxes:

- Line 24 on the 1040

By your adjusted gross income from last year:

- Line 11 on the 1040

This number gives you your average tax burden the previous year. If your average tax burden was 20%, then you can withhold 20% of your quarterly profit. If you (and your spouse) expect to earn more money this year, you can simply increase your estimated tax burden. For example, you might pay 25% of your income instead of 20%.

Use Great Business Accounting Software

Trying to figure out how much money to pay toward quarterly estimates may feel like more art than science. To make it easier, you may want to consider using a bookkeeping software program that generates tax estimates for you. Unfortunately, most highly rated bookkeeping software programs don't bother estimating taxes.

In fact, in our review, we only found that QuickBooks Self-Employed and Xero were up to the task. Both of these software programs clock in between $12 to $100 per month (depending on the package you choose), so they aren't overly expensive.

If you pay for business accounting software, consider switching to one that estimates taxes for you. It's a big timesaver, and makes cutting the quarterly check that much easier.

How Do I Actually Pay My Quarterly Estimates?

Once you decide how much to pay, it's time to pay your quarterly estimates. Again, the due dates for quarterly estimates are:

- April 15, 2024

- June 17, 2024

- September 16, 2024

- January 15, 2025

To pay, you could mail in a check with a voucher. You'll actually have to look at page five of the 1040-ES to figure out where to mail your check. Every state is different.

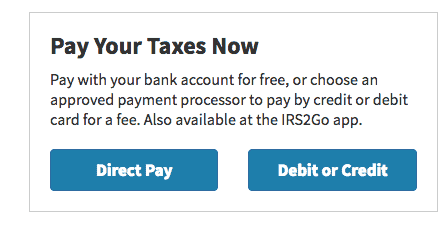

However, the easiest way to pay is online. Simply navigate to: https://www.irs.gov/payments.

Then find the box entitled, "Pay Your Taxes Now."

You can choose between direct pay (where you connect directly to your bank account), debit, or credit.

Paying with Debit or Credit Card

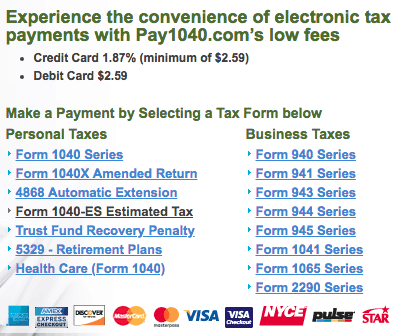

When you pay with debit or credit, you have to choose a payment processor. The least expensive is Pay1040.com. When you use Pay1040.com, you'll pay $2.58 for a debit transaction or 1.87% for credit transactions.

If you opt for this method, navigate to "Form 1040-ES Estimated Tax" on the Pay1040.com home page.

Then follow the steps which will require you to enter the amount you want to pay, your personal information (especially Social Security numbers, filing status, address, and more), and your payment information.

Checking out is similar to checking out from an online retailer, so it's fairly intuitive. Just be sure to save your receipt. You don't want to dig through a bunch of old credit card statements to figure out how much you paid when you file taxes next April.

Paying Using Direct Pay

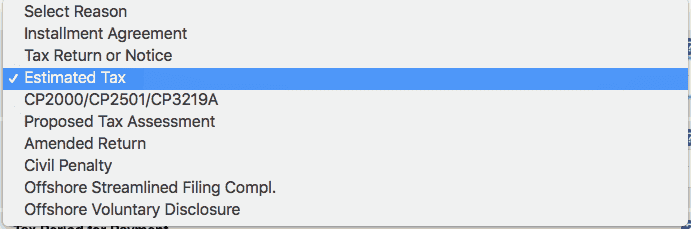

If you opt for direct pay, you then have to select "Make a Payment." Then you'll be directed to a new screen where you must select a reason for the payment. The reason should be "Estimated Tax."

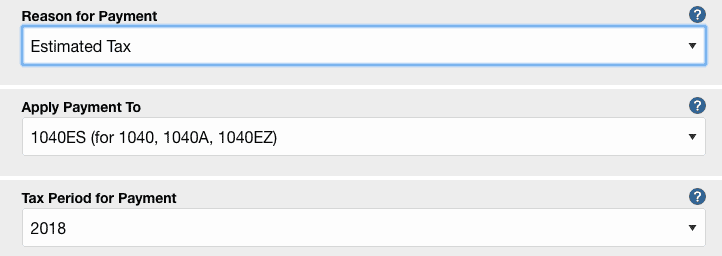

Then your form should look like this:

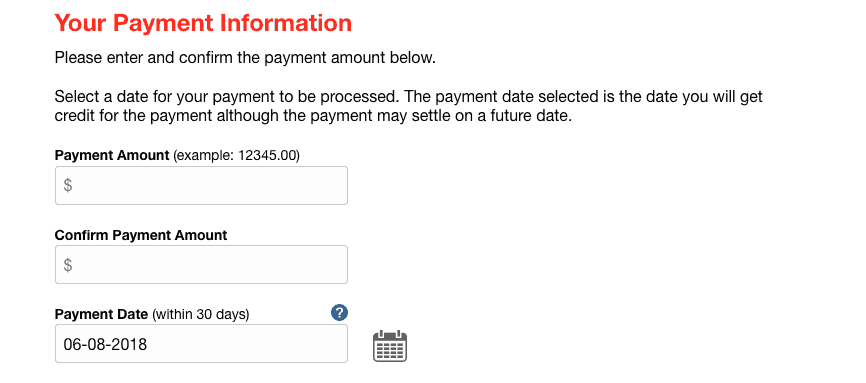

Then you'll need to verify your identity using information from previous tax returns. This should just take a few seconds to fill out. Then, you'll move onto the payment processing page.

Here, you'll enter your payment amount, your bank account information, and an email address where you can receive a receipt.

After that, you submit an electronic signature, and your payment goes through. From start to finish, the whole process takes three to four minutes.

How to Save Money to Pay Quarterly Estimates

If you run a profitable business (or side-hustle), you'll almost certainly have to pay taxes this year. If you have a low income, and qualify for an earned income tax credit, you might escape owing taxes, but that's the exception rather than the rule.

Self-employed people almost always owe taxes because they have to pay 15.3% of their profits toward Social Security and Medicare. On top of that, you'll have to pay whatever Federal income taxes you actually owe.

Personally, I've found that the easiest way to save money for taxes is to set my tax money in a separate online money market account. Money in this account pays for taxes and nothing else. Each time I get paid, I set a percentage of the income into the account.

Separating tax money from other money makes it easier to set aside.

If your business involves many transactions, setting aside a percentage of each transaction might not be realistic. Instead, each week when you pay bills for your business, "pay" a savings account with your tax bill. If you break your quarterly estimate into 13 even payments, you can save the same amount each week. If you can't afford the full amount one week, try to compensate the next week.

If saving money each week or each time you get paid isn't realistic, just do the best you can. Paying a little bit each quarter is better than paying nothing at all.

Another way is to pay yourself first to lower your tax bill. Take advantage of things like a Solo 401k to save for retirement, which will reduce your tax bill each quarter (and year). You can also open an HSA Account and save as well. We think the HSA account is one of the best to save for retirement (not medical expenses).

Should I Pay My Quarterly Estimates with a Credit Card?

When you pay your taxes with a credit card, you add 1.87% to your tax bill. Is that a waste of money, or is it a smart move? If you're not into credit card churning or travel hacking, just use direct pay. You don't want to wind up in credit card debt just to pay your taxes.

On the other hand, if you pay off your credit card in full each month, and you're into travel hacking, paying with a credit card makes sense. Here are three times paying with a credit card works out.

Credit card bonuses: If you're not a big spender, but you're working toward a credit card spending bonus, taxes are an easy way to get you over the hump. Just remember, you still have to pay the bill at the end of the month. Also, this only makes sense to do if you wouldn't get the bonus through regular spending.

For example, these credit cards have awesome bonus offers right now and you could make the spending limit in one month!

You're "hacking" the system: Another way to "use credit cards" to pay your taxes without actually using credit cards is to buy reloadable Visa gift cards. Reloadable Visa gift cards are actually debit cards, so they are only subject to the $2.58 fee.

Sometimes you can buy Visa gift cards at discount or with minimal fees. In a worst-case scenario, you can buy a $500 gift card for $5.95 through GiftCardMall.com. Between the $5.95 fee, and the $2.58 debit fee, you end up with a 1.7% total fee for each $500 in taxes. That's a little cheaper than a 1.87% credit card fee, and it gets you toward your bonus a little faster. As long as your card gives you at least 2% back (or helps you get a bonus), the extra fees make sense.

Significant spending bonuses: Every once in a while, you'll see Chase Freedom offer a 5% category bonus on PayPal. As it turns out, you can use digital wallets like PayPal to pay for taxes. It takes a bit of jumping through hoops, but you could spend $1,000 on PayPal, earn 5,000 points, and spend just 2% to process payments. In that case, you come out ahead. If you have cards with category bonuses, be sure to look for digital wallet bonuses to maximize your points.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Ashley Barnett Reviewed by: Chris Muller