If you have capital gains or losses (from selling stock, options, or crypto), or you had proceeds from the sale of your home, you're going to be using Schedule D for your taxes. But you may have never heard of it before.

For most people, their tax software or accountant will help with this form. But you may have questions about how it works, where to find it, or even what your tax implication may be.

Let's break down exactly what the Schedule D is, and how you should use it.

Schedule D Basics

Schedule D is used to report income or losses from capital assets. Assets owned by you are considered capital assets. These include your home, car, boat, furniture, and stocks, to name a few. There is a lengthy list of items that are not capital assets, which you can see on page D-2 of the Schedule D instructions.

Schedule D is where you list the total of asset proceeds with their cost bases. The cost bases are derived from specific asset entries on Form 8949, which was new for the year 2011. Schedule D was updated to accommodate Form 8949.

Cost basis can be calculated based on FIFO (first in, first out), average, or something specific you tell your broker. You can do this by sending a letter to your broker, letting them know how you’d like the cost basis calculated.

For example, you want to minimize your gain. You can do that by selling shares with the highest cost basis. FIFO is the IRS “default” method. It also yields the highest taxes. The average cost method is in between the FIFO and specific cost basis methods.

The average cost method is the simplest method for determining the cost basis. You might pay a little more in taxes when using this method but it will also save you time in having to do any tedious calculations. Note that you do not need to calculate a cost basis for assets in a retirement account.

Capital gains are not just about stocks. If you sell your home for more than you paid for it, you’ll have capital gains. When you sell your home, you’ll need to report it on Form 2119 (Sale of Your Home).

If the home is your primary residence, you can take advantage of a 121 exclusion and avoid capital gains. As you might expect, there are some rules that must be met to take advantage of a 121 exclusion. In the five years prior to the sale of the home, you must have lived in it for an aggregate of at least two years. A 121 exclusion allows you to exclude up to $250,000 in gains as an individual and $500,000 for joint filers.

As an example, you bought a house for $200,000 and five years later sold it for $300,000, resulting in a $100,000 gain. You lived in the house for two years during those five years. The $100,000 gain can be excluded from your income.

If you rented the home during those five years, things get more complicated and the exclusion may not apply. Additionally, you must meet the use and ownership test. You’ll want to speak with your accountant for clarification.

Let’s look more closely at the format of Schedule D.

Format of Schedule D

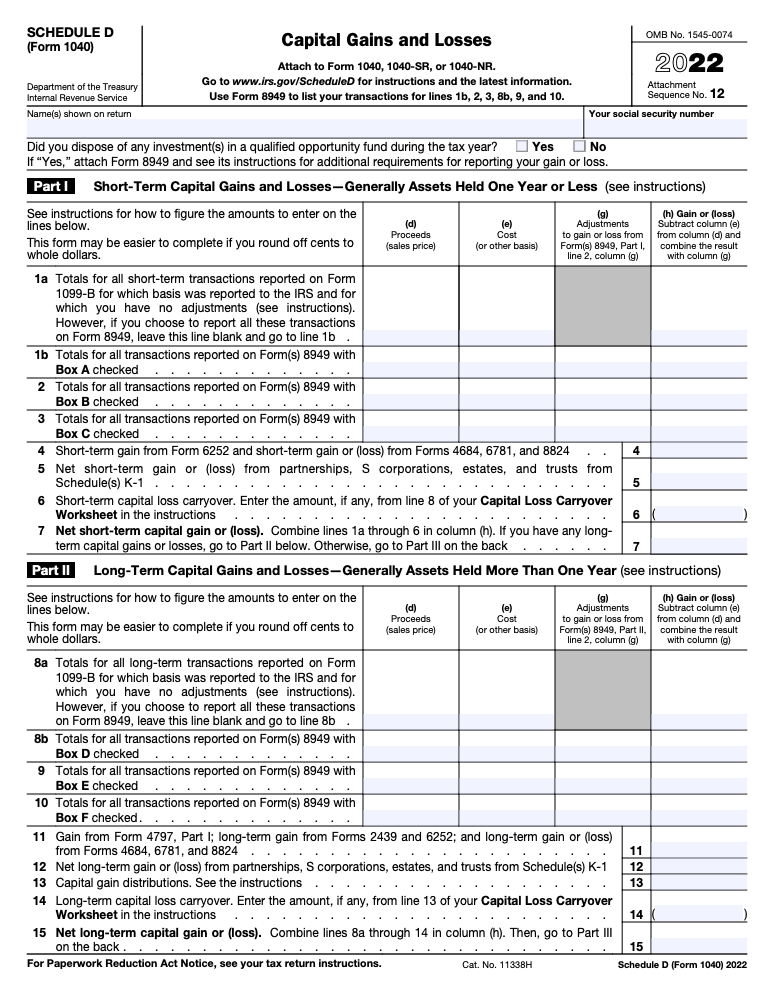

IRS Schedule D (1040) is broken up into three main parts, with each being labeled. The first part is for short-term gains and losses, which are those held for one year or less. The second part is for long-term gains or losses, which are held for more than one year. The final section is the summary.

Short-term gains are taxed at your ordinary income tax rate. Long-term gains are taxed at 0%, 15%, and 20%, depending on your income. A higher income will, of course, result in more taxes. The 0% rate applies to those making $0–$39,375 for single filers and $0–$78,750 for those who are married, filing jointly.

You can learn more about the capital gains tax brackets here >>

Form 8949

As mentioned above, Form 8949 contains individual entries for each capital gain or loss. If you received any 1099s (1099-B or 1099-DIV), your capital gains or losses should already be reported to the IRS. In that case, you do not need to fill out Form 8949.

Form 1099-B comes from your broker. Form 1099-DIV is for dividends from savings accounts, mutual funds, or other sources.

Declaring Losses

You can declare up to $3,000 in losses ($1,500 for married, filing separately) on Schedule D, line 21.

If you have more than $3,000 in losses, the remainder can be carried forward for future years. For example, let’s say your stock trading for the year resulted in $5,000 of losses. $3,000 can be reported on Schedule D and $2,000 can be carried forward. The $2,000 loss will be applied the next year to offset income.

After Schedule D has been completed, its results are transferred to Form 1040. The results of Schedule D will impact adjusted gross income on Form 1040. Just like many of the other related 1040 forms, it’s important to get your cost basis and any losses right so that your income is reduced and you don’t end up paying taxes on phantom income.

Filing Your Taxes

Unless you're filing your taxes by hand, you don't really need to know the intricacies of the Schedule D. Your tax software program, or accountant, will handle the details of filing this form in.

However, it's important to realize that having capital gains and losses will likely push up the costs of doing your taxes - you'll either need a premium tax software or you'll pay your tax preparer more.

Check out our guide to the best tax software for investors here >>

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak