Crypto tax calculators like TaxBit, ZenLedger, and CryptoTrader.Tax all create IRS Form 8949 for crypto traders. This form is required for filing taxes on crypto trading activity. But tax filers need more than just a spreadsheet filled with their transactions. They need to attach the form to their tax return, and correctly transfer the information into the tax software.

Because crypto is relatively new, very few tax software services support crypto trading. As far as we can tell, TurboTax is the only tax software company that’s actively working to support crypto traders in a meaningful way. However, even this robust software has seen new issues pop up in the last week or so. TaxAct has a “backdoor” support option that allows people with insider knowledge to upload their forms into the software.

If you’re trying to attach your IRS Form 8949, this is the best guidance we can give as of mid-February 2022. Software bugs may be resolved in the next few weeks making this even easier.

How To Import IRS Form 8949 To TurboTax

TurboTax has the best support for crypto traders. This article from TurboTax gives detailed instructions on how filers can upload a .csv file with their crypto trades to the software. It also has a video showing step-by-step instructions on how to import the file.

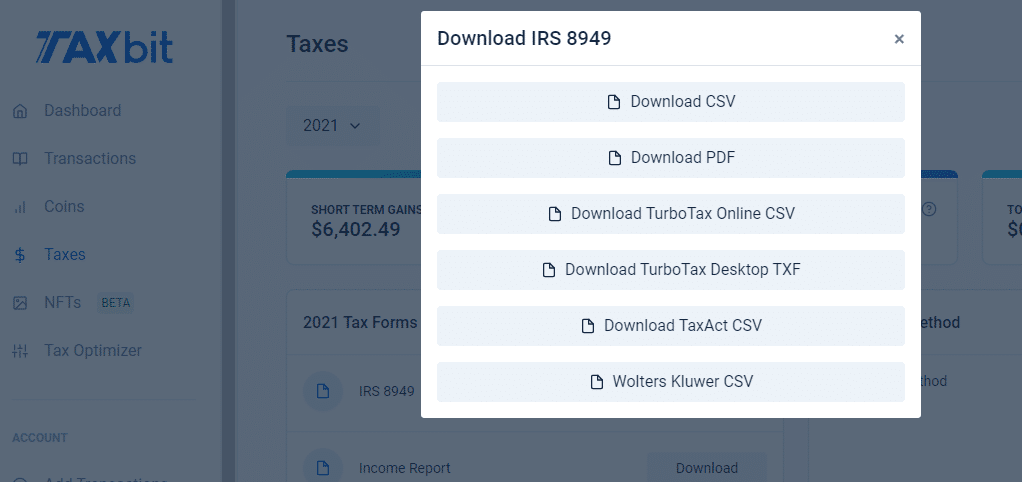

To get a .csv file with your crypto trades, you’ll need to download a file from your “crypto calculator” software. We recommend using TaxBit since it is free for all users.

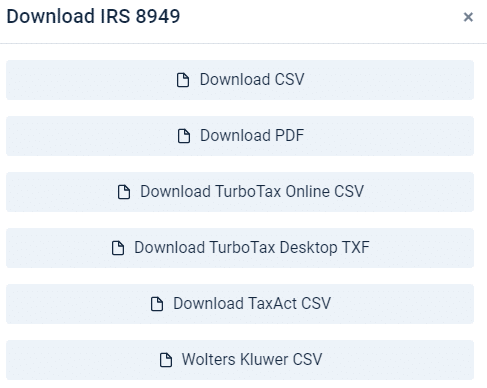

From the Taxes section, you’ll need to select IRS 8949 and choose to Download TurboTax Online CSV.

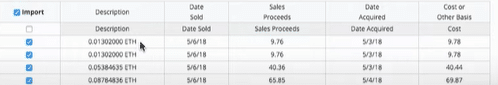

The CSV is formatted in the following order:

- Currency Name

- Purchase Date

- Cost Basis

- Date Sold

- Proceeds

If you’re using TaxBit, The files are zipped, but you can right-click on the zipped file to unzip it. Once unzipped, you can unzip see the names of the files. The files you need will include the name ".TurboTax" in the title.

Once the file is downloaded to your local machine, you can upload it to TurboTax.

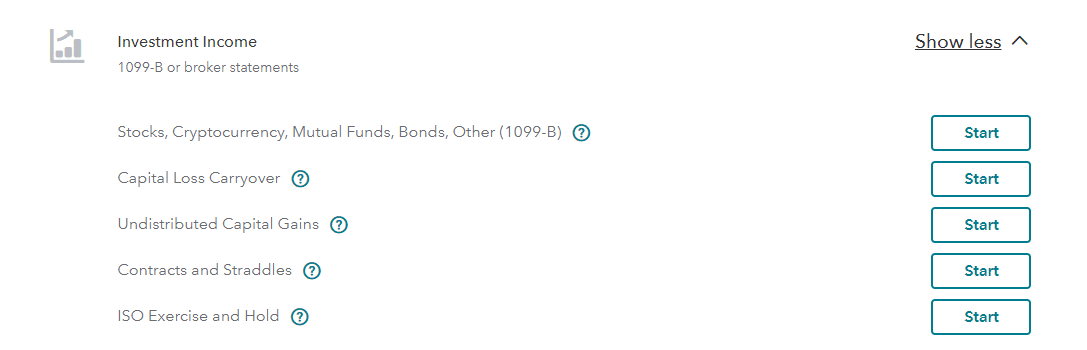

To upload the file, go to Wages and Income and visit the Investment Income Section and choose Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B).

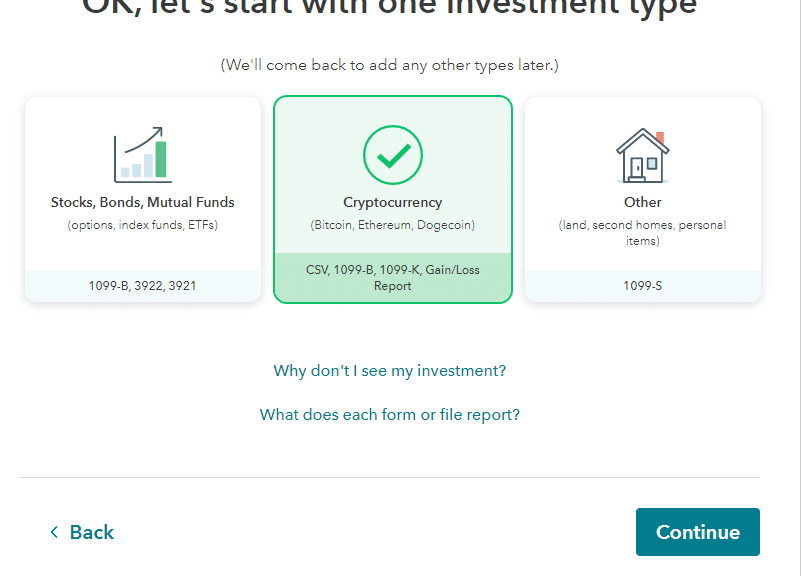

Then select Cryptocurrency and continue.

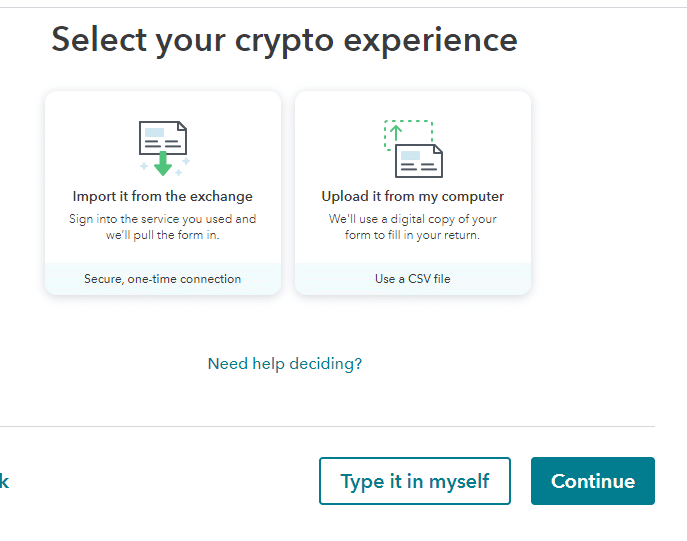

Then you’ll need to select import it from my computer.

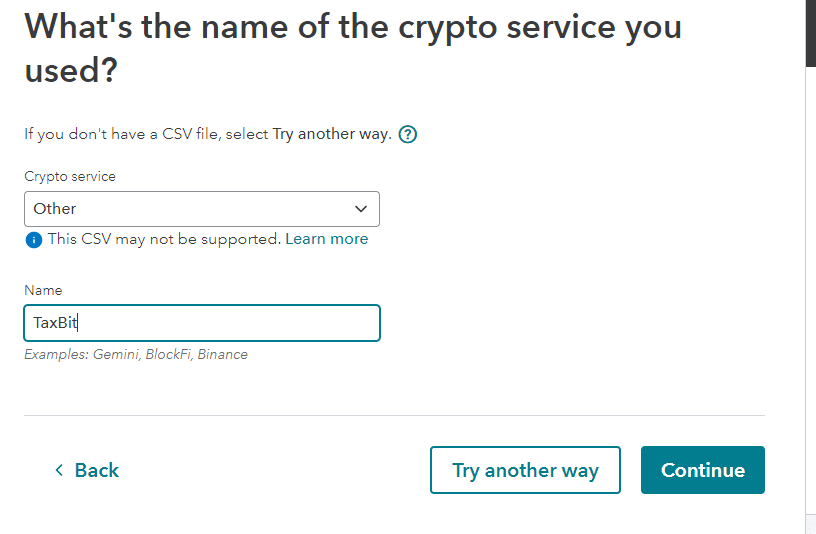

Select the service provider (if the service provider isn’t listed select Other). We selected Other and typed in TaxBit. Then we uploaded the file.

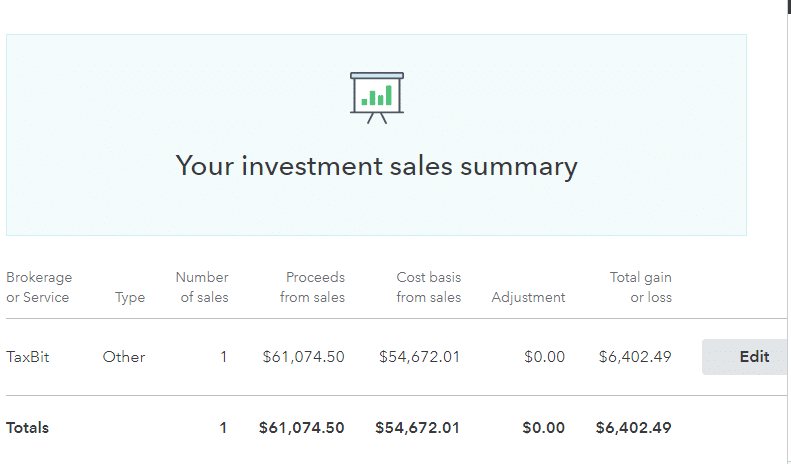

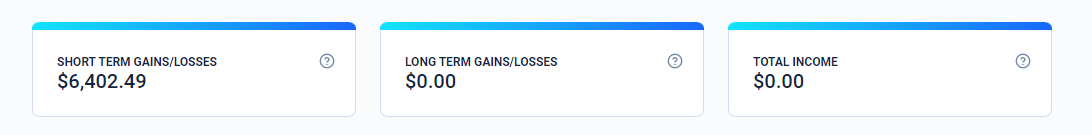

Once uploaded, you’ll see a full summary of your gains or losses.

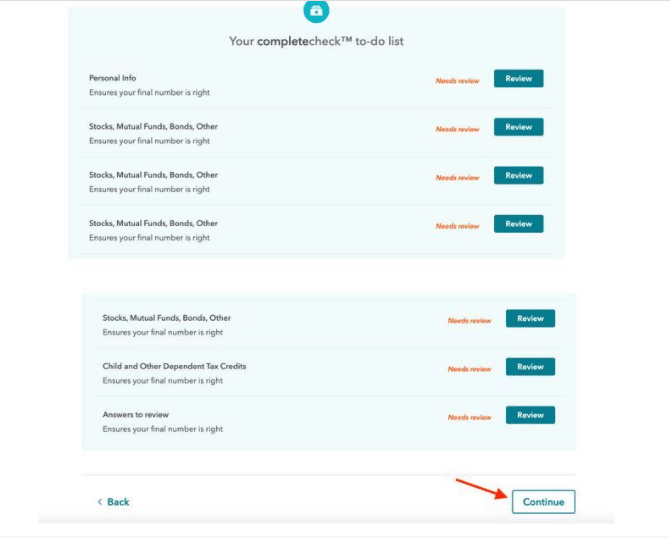

Several users are reporting that file uploading functionality doesn't work immediately. Users are being asked to confirm every single transaction (often hundreds). The workaround for this is selecting Continue in the completeness section.

We were unable to replicate the bug in testing, but several Reddit commenters also claimed that the workaround allowed them to complete their tax return.

How To Upload Form 8949 To TaxAct

TaxAct’s support for crypto traders isn’t as robust as TurboTax’s, but the company allows users to import a CSV if they know what they're looking for.

Folks looking to use TaxAct should download a file specifically for TaxAct. All the major crypto tax calculators seem to include the appropriate format.

Once the file is downloaded locally, users have to find a place to attach it within the software.

To attach the file, users should navigate to the Help Section, and enter Form 8949. They can select CSV Import. Although the button says Stock CSV, filers can include crypto CSV.

Once uploaded, users must confirm that the file is in the format that TaxAct selects. Then they can choose to “Import all transactions”. From that point, the software will take care of calculating gains and losses for users.

What If I'm Not Using TurboTax Or TaxAct?

If you’re not using TurboTax or TaxAct, you can use your Tax Summary statement, and enter all your short-term gains as a single transaction, and your long-term gains as a single transaction. The dates associated with the trades can be “various” and the asset name can be “various”.

You can use the summary report from TaxBit or another tax calculator to correctly enter this information.

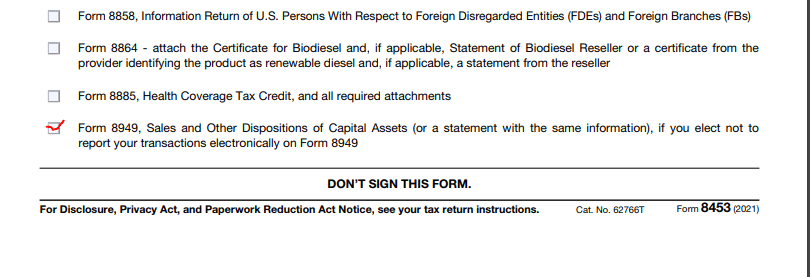

Once you enter the information into your tax software, you’ll need to mail Form 8949 and cover letter Form 8453 to the IRS

This sounds like a huge hassle, but you’ll simply print your IRS Form 8949, and Form 8453. Check the box in the Form Letter, and mail it to:

Internal Revenue Service

Attn: Shipping and Receiving,0254

Receipt and Control Branch

Austin, TX 73344-0254

This is a relatively easy way to get around the problem of having many transactions.

Final Thoughts On Upload Form 8949

In 2022, we’re strongly recommending that crypto traders use TurboTax Premier to file their taxes. While the software is pricey, the software pays off in terms of ease of use. Filers using TaxAct have a workaround built into the software, but it’s certainly not intuitive.

People using other software have to make sure their tax forms exactly match what they enter into the tax software. This sounds like a recipe for errors, but it allows filers to use bargain software which could be worthwhile.

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Robert Farrington