Active cryptocurrency traders may enter hundreds or thousands of trades in a single calendar year. Even passive cryptocurrency users may see hundreds of transactions if they earn from mining or staking their currency. No matter what, every single cryptocurrency transaction must be tracked for tax purposes. That’s where tax software like TaxBit enters the picture.

TaxBit offers individual and enterprise-level cryptocurrency tax software. With real-time profit tracking and helpful year-end tax reports, TaxBit is an excellent choice for those with large or complex cryptocurrency portfolios looking for a reliable platform to do their crypto taxes.

Editors Note: For 2024, TaxBit has shifted it's focus to only corporate tax preparation and accounting. For personal tax preparation needs, check out our list of the best crypto and NFT tax software.

Quick Summary

- Get free automated tax forms across 500+ platforms

- Above-average security measures

- Formerly supported plans and exchanges no longer available

TaxBit Details | |

|---|---|

Product Name | TaxBit |

Service | Cryptocurrency Tax Reports |

Price | $0 as long as you use one of the exchanges that are part of the TaxBit Network |

Exchange Integrations | 500+ |

Tax Filing Included | No |

Promotions | None |

What Is TaxBit?

Launched in 2018, TaxBit is a crypto tax software enabling streamlined cryptocurrency taxes. The Salt Lake City-based company provides real-time insights into the tax implications of every crypto trade in your exchange and wallet accounts. It also generates IRS Form 8949 or IRS Form 1099 for crypto traders.

While TaxBit isn’t the oldest crypto tax filing service, it's one of the best-funded. Backers include PayPal Ventures, Winklevoss Capital, and other big-name investors. In 2022, we named TaxBit the best tax software for Ongoing Support in our annual rankings of the Best Crypto and NFT Tax Software. Here’s a closer look at how it works for your 2023 taxes.TaxBit - Is It Really Free?

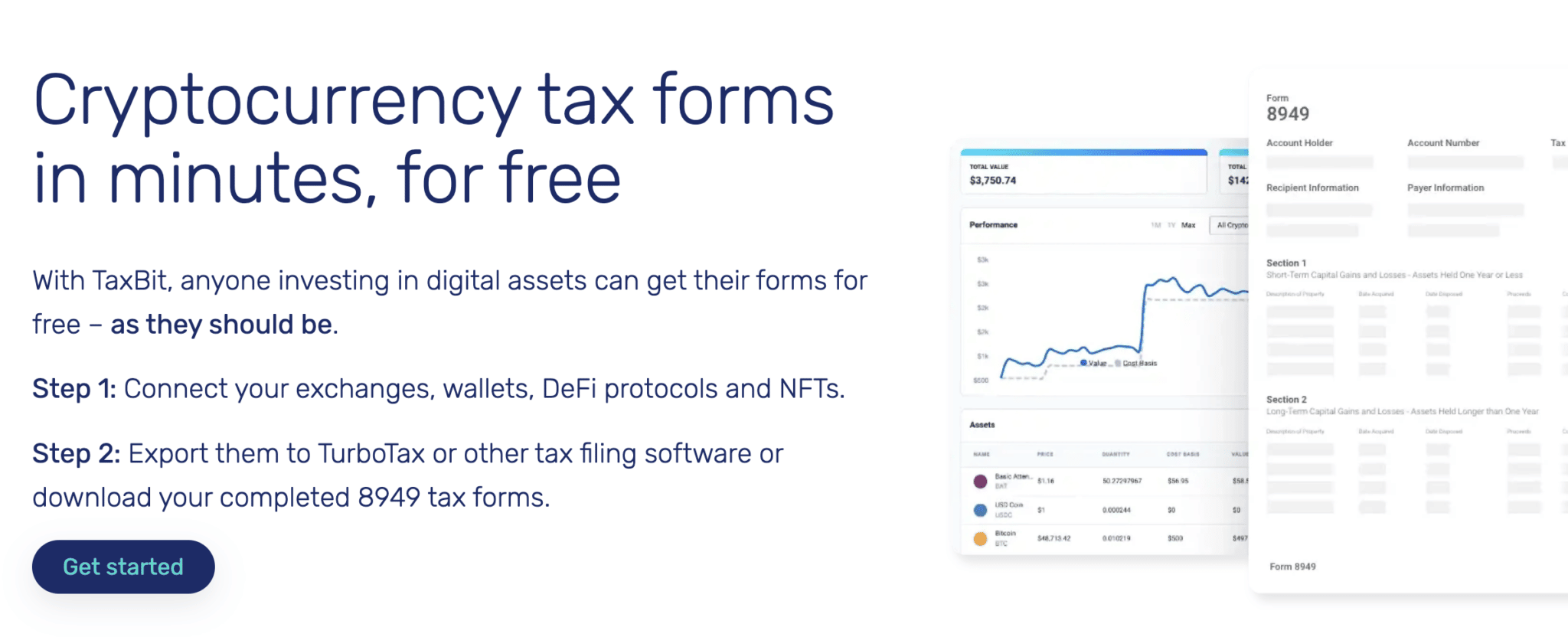

TaxBit offers many free features, including basic cryptocurrency tax forms. Most users should be able to use the free version if they only want tax forms.

TaxBit used to offer premium tiers for a fee, but these are no longer available as of January 2023. Additionally, some features and supported exchanges available in 2022 were removed, with no plans to return support for those specific exchanges.

What’s New In 2023?

After a lackluster year in the cryptocurrency markets, we’re not surprised to see that TaxBit software mostly unchanged from last year. That’s not bad, however, as the platform does a good job at supporting a wide variety of cryptocurrency platforms with unbeatable pricing, if you only want basic tax forms.

Even without a lot of updating, the support for a broad number of exchanges and wallets makes it a solid choice for many cryptocurrency traders.

Does TaxBit Make Tax Filing Easy In 2023?

TaxBit is designed to make tax filing easy before and during the tax season. The company generates forms 1099-B and IRS form 8949 for each user. These forms can be imported into mainstream software programs like TaxAct or TurboTax.

The company provides real-time reports that show a user’s estimated tax burden. This proactive reporting can help you take advantage of market swings and harvest tax losses to lower your taxes.

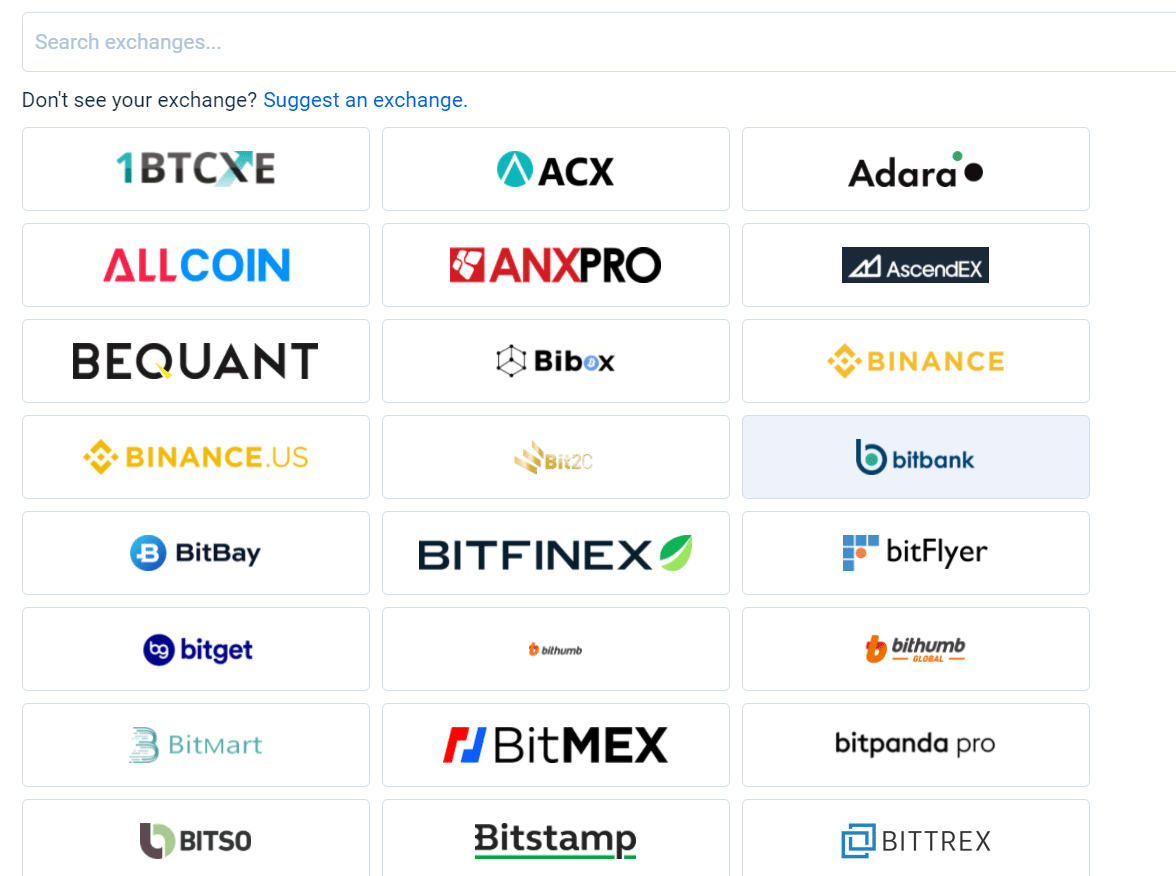

Many of the “500+” supported cryptocurrency exchanges include support to connect and download your information using an API. However, a large swath requires downloading a .CSV file of your transactions and uploading to TaxBit, requiring an extra few steps.

The biggest problems will arise for users of formerly supported exchanges that have been removed from the platform. TaxBit specifically states it does not support transactions from those removed exchanges.

TaxBit Features

With strong financial backing, TaxBit has grown to be a high-quality crypto tax software. Here’s a look at some of the most important features.

Free Tax Forms Via The The TaxBit Network

The TaxBit Network includes 500+ crypto exchanges. That's one of the largest list of supported platforms that we've seen from a crypto tax software company.

But what's even more impressive? Through using one of these platforms, you can generate basic crypto tax forms with TaxBit for free with no transaction limits.

This is a huge benefit, as most other tax software right now have strict transaction limits on their free plans, if they have a free tier at all.

Behind the scenes, the companies that are part of the TaxBit Network are paying so that they can give users access to the company's software. But for the consumer, the software is accessible for free.

Screenshot of TaxBit's API Integrations

Real-Time Reporting

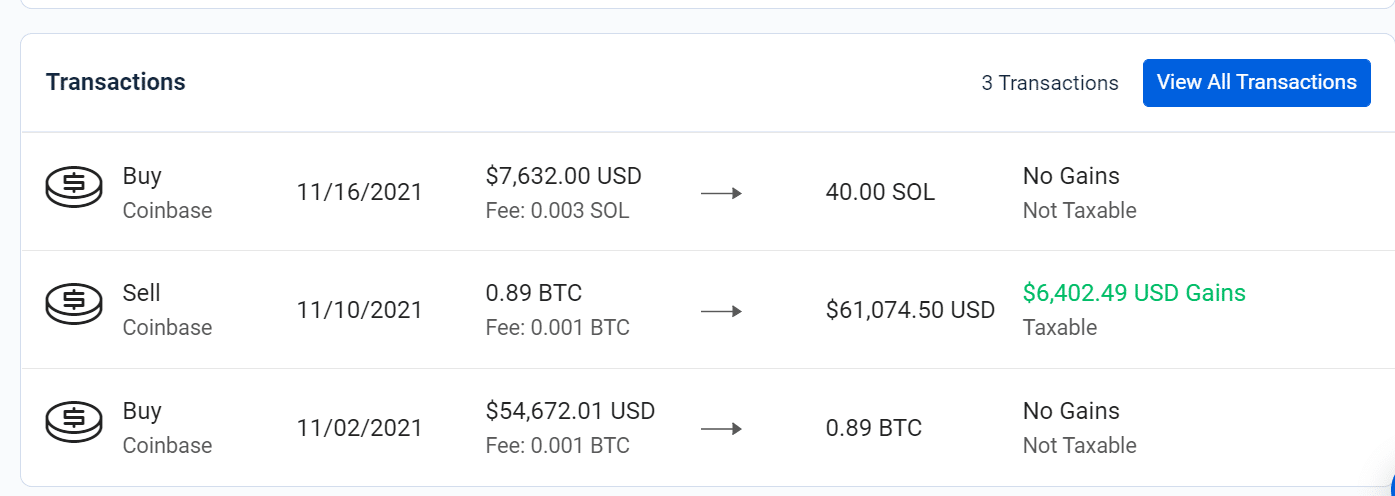

TaxBit provides real-time reporting for crypto traders. This reporting shows more than just a portfolio's value. It also shows the taxable gains associated with each trade. With this reporting, traders can avoid huge tax bill surprises the next time they file.

Real-time view of gains and losses

TaxBit Drawbacks

TaxBit is a robust software that is competitively priced and easy to use. However, it has a few drawbacks, which we break down below.

Premium Plans No Longer Available

It appears that TaxBit has removed their premium plans from their website completely. Therefore, individuals looking for premium plans can no longer sign up. Formerly supported services from CPAs, for example, are no longer offered.

Spotty Support for Exchanges

One of the biggest problems is if you run into unsupported exchanges. For example, certain transactions at the Kraken exchange won’t import.

If you use multiple exchanges and wallets, check that they’re supported before you begin connecting accounts and uploading transactions.

How Much Does It Cost?

Provided that you used one of the exchanges that are part of the TaxBit Network, you can use the Free plan, regardless of the number of transactions you had last year. Former premium plans are no longer available to sign up on the TaxBit website.

How Does TaxBit Compare?

TaxBit’s Free level is one of the best values in the business. People engaged in high-volume crypto trading should absolutely consider this option. If you’re only looking for tax forms and don’t need much else, it’s a solid choice.

But traders with fewer than 2,500 transactions who need access to historical forms or tax-loss harvesting may find better features elsewhere. CryptoTrader.Tax, for example, offers a great deal for people with up to 1,500 Trades (Day Trader tier for $99). Here's a closer look at how TaxBit compares.Header |  |  |  | |

|---|---|---|---|---|

Rating | ||||

Software Pricing | $0 | $49 to $199/yr | $0 to $999/yr | $0 to $179/yr |

Exchange Support | 500+ | 280+ | 400+ | 500+ |

Tax Software Integrations | TurboTax & TaxAct | TurboTax & TaxAct | TurboTax | TurboTax & TaxAct |

Cell |

Is It Safe And Secure?

TaxBit boasts security measures that go beyond the accepted practices within the crypto community. The company has achieved an independent SOC 2 certification. That means it has better than typical security practices to keep user information safe.

Of course, the large number of capital investors will make TaxBit a valuable target for hackers. So this level of security may be required.

As with all software, TaxBit could suffer a security breach and user information could be leaked. While this is unlikely to cause users to lose their crypto, the leak of identifiable information could be a loss. Traders should do their own security assessments before using any tax software.

How Do I Contact TaxBit?

TaxBit doesn't publish a customer service phone number. However, it does have a robust Help Center and offers Live Chat and email support on all of its plans. The customer service email address is support@taxbit.com.

TaxBit receives mostly positive customers reviews on Trustpilot. Out of more than 350 reviews, its average rating is currently 3.8/5. Positive reviews generally focus on an easy overall tax prep experience. Complaints focus

Is It Worth It?

TaxBit offers plenty for crypto traders to love in 2023. The unlimited free tier is currently unmatched in the industry. And the real-time reporting and annual CPA review that available with the Pro plan are features that few other companies are offering.

Traders with fewer than 1,500 trades who want to take advantage of tax-loss harvesting are likely to prefer CryptoTrader.Tax which has better DeFi support. However, TaxBit is a good choice for just about all other active crypto traders.TaxBit FAQs

Let's answer a few of the most common questions that people ask about TaxBit:

Can TaxBit help me file my crypto investments?

TaxBit is designed to help users with CeFi (exchange-based) crypto investments. The company’s DeFi support is still in Beta, so NFT users may want to choose an alternative platform.

Can TaxBit steal my crypto?

No, TaxBit allows users to upload CSV information about their trading activity. Users can also connect to exchanges using a read-only key plus their secret. TaxBit does not store any information that would allow the company to steal your tokens. However, we recommend that users opt for Hardware wallets to store their crypto.

Does TaxBit work with Coinbase?

Yes, Coinbase is one of the more than 500 crypto exchanges that TaxBit currently supports. Some users report challenges linking Coinbase’s advanced platform.

Can international traders use TaxBit?

TaxBit says that its tax engine is currently configured to help users who file returns with IRS, however users from outside the United States have reported that they've been able to use the software without issue.

TaxBit Features

Price | Individual plan is free, as long as you use one of the exchanges that are part of the TaxBit Network |

Exchange Integrations | 500+ |

Most Popular Exchanges Supported By TaxBit | |

Tax Filing Included | No |

Tax Software Integrations |

|

Cost Basis Methods |

|

Audit Trail Report | Yes |

Report Revisions | Unlimited |

Margin Trading Support | Unclear |

IRS Audit Assistance | Yes |

Refund Period | Refunds can be requested at any time as long as you have not downloaded your tax form or exported 2,500+ transactions. |

Security Features |

|

Customer Service Options | Live chat, Email, Help Center |

Customer Service Email Address | support@taxbit.com info@taxbit.com (for general questions) |

Mobile App Availability | None |

Web/Desktop Account Access | Yes |

Promotions | None |

TaxBit Review

-

Pricing

-

Products & Services

-

Third-Party Integrations

-

Customer Service

Overall

Summary

TaxBit is a crypto tax software that offers individual and enterprise-level support with real-time profit tracking and year-end reports.

Pros

- Main feature are free for users of supported TaxBit Network companies

- Independent security certifications

- Extensive support for 500+ exchanges

Cons

- DeFi support is still in Beta

- Premium plans no longer supported

- Some exchanges no longer supported

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment.

His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, Huffington Post, and other financial publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.

Editor: Claire Tak