Source: The College Investor

An IRS cycle code is an 8-digit code on your IRS tax transcript that indicates the day your return was posted to the IRS Master File.

Understanding this number can help you determine when your tax refund is likely to be processed and deposited. It can also help you figure out the date that pending holds and other issues are likely to be resolved.

Here’s everything you need to know about understanding and finding your IRS cycle code.

What Is An IRS Cycle Code?

An IRS cycle code is an 8-digit number found on your IRS tax transcript, representing when a certain tax activity is input into the IRS Master File.This could be your refund date, but also could be the release of a hold or other items.

The code is broken into three parts: the tax processing year, the week of the year, and the day of the week. These numbers can help you estimate when the IRS received and processed your return, which can give you a better idea of when you might receive your tax refund.

For example, the code “20240604” would break down like this:

• 2024: The tax year

• 06: The sixth week of the year

• 04: Wednesday (the day your return was processed)

If you translate that into a "real" date, that would be: Wednesday, February 7, 2024.

Knowing this information helps you track where your return is in the process and gives you a clue as to when your refund might be deposited.

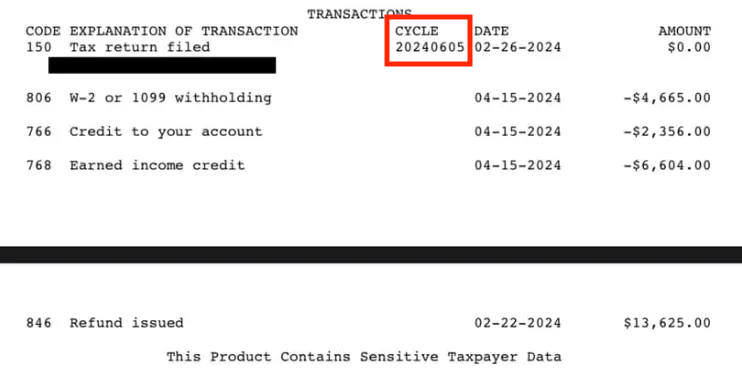

Where To Find IRS Cycle Code

To locate your IRS cycle code, you’ll need access to your IRS tax transcript. You can easily obtain this through the IRS’s “Get Transcript” tool, which allows you to view or download your transcript for free.

Once you have your transcript, look under the “Transactions” section, where you’ll see the heading “Cycle” followed by the 8-digit code. This number is your cycle code and gives you a snapshot of when your return was posted to the IRS Master File for processing.

Here's an example:

IRS Tax Transcript with Cycle Code Highlighted. Source: The College Investor

How To Read Your Cycle Code

Reading your IRS cycle code is straightforward once you understand the format. The first four digits refer to the tax year. The fifth and sixth digits represent the week of the year, and the last two digits tell you which day of the week your return was processed.

Here’s a step-by-step guide to decoding your cycle code:

- Year: The first four digits correspond to the tax processing year. For example, in “20240604,” the year is 2024.

- Week of Year: The fifth and sixth digits represent the week of the tax year. In this example, “06” means the return was processed during the sixth week of the year, which would fall in early February.

- Day of the Week: The seventh and eighth digits tell you the day of the week that your return was processed.

The IRS uses a numbering system for the days, where:

- 01 = Friday

- 02 = Monday

- 03 = Tuesday

- 04 = Wednesday

- 05 = Thursday (reserved for weekly processing)

So, “20240604” means the return was processed on a Wednesday during the sixth week of 2024. If you take that to a calendar, you'll see that actually translates to Wednesday, February 7, 2024.

Other Key Things To Know

Here are some other key things to know:

IRS Code 846: Refund Issued

While the cycle code is useful in understanding when your return was processed, the most important code to look for is IRS Code 846. This code indicates that your refund has been approved and a direct deposit date has been set. Once you see this code on your transcript, you can expect your refund to be deposited soon, often the day after your cycle code’s day.

For example, if your transcript shows Code 846 and a cycle code of “20240604,” it means your refund will likely be deposited on Thursday, the day after the processing.

What The IRS Cycle Codes Don't Tell You

While IRS cycle codes are helpful for understanding when your return was processed, they aren’t a foolproof method for predicting your refund date. Various factors, such as IRS delays, backlog, or additional review of your return, can push your refund timeline beyond what the cycle code indicates. Additionally, statutory limitations like the PATH Act, which delays refunds for taxpayers claiming the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC), can further complicate predictions.

How To Check Your Refund Status?

The easiest way to check your refund status is by using the IRS’s “Where’s My Refund?” tool. You’ll need your Social Security number, filing status, and the exact amount of your expected refund. While this tool updates daily, you may not see any changes until your return has been processed, which can take time depending on the volume of returns the IRS is handling.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.