If you're self-employed, you get the wonderful joy of filling out extra forms at tax time. That's no surprise - and these forms aren't that hard.

But if you're seeing these forms for the first time, you may have some questions about how they work, what you need to do, and more.

With today's tax software, it's rare you even look at these forms. But, nevertheless, we're here to help answer any questions you might have.

Let's dive into Schedule SE and what it means for your taxes.

The Basics of Schedule SE

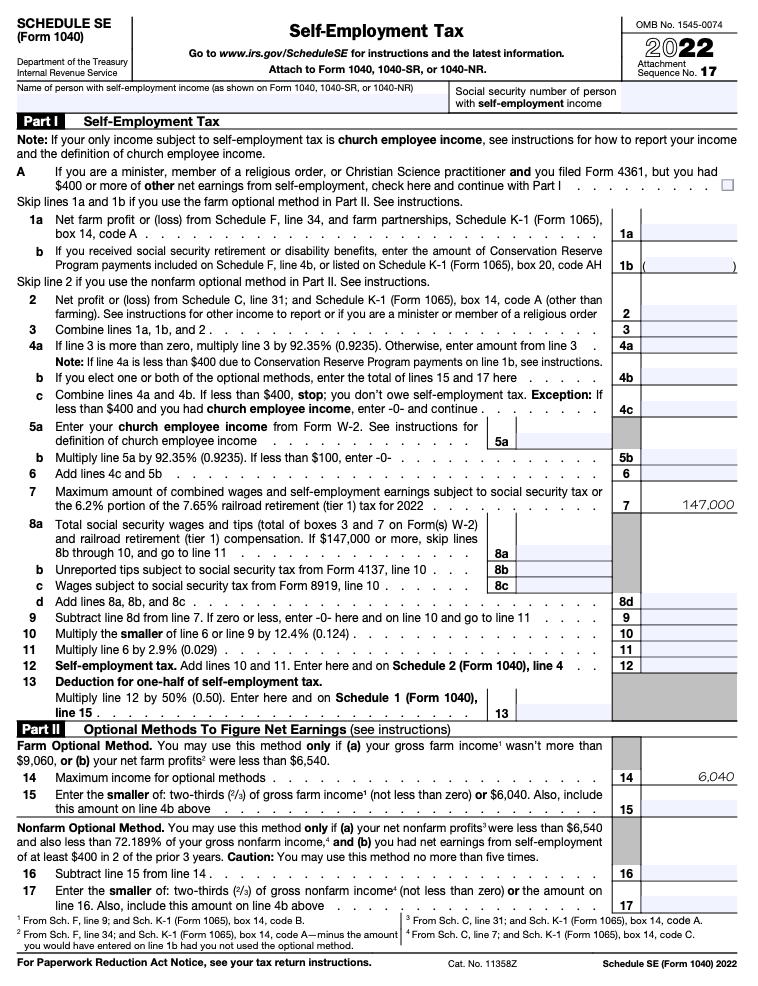

Schedule SE is for capturing taxes due from self-employment income. It is filed with Form 1040.

Specifically, Schedule SE is used to calculate the amount of Social Security and Medicare taxes due. The Social Security Administration uses the information from Schedule SE to calculate your Social Security benefits. Additionally, Medicare taxes are included.

As an employee, you pay Social Security and Medicare taxes. However, your employer pays half of these taxes, effectively matching your contribution. As a self-employed person, you don’t have an employer to match your tax contribution. This means you’ll have to pay the entire Social Security and Medicare tax bill.

How much are these taxes? Up to $128,400 in SE income is taxed at 15.3% for Social Security and Medicare. Anything over that amount is 2.9% plus $15,772.80. Your final SE tax calculation then goes into Form 1040.

Social Security taxes are taxed at a rate of 6.2% for employees and 6.2% for the employer for a total of 12.4%. Medicare works the same way. The employee pays 1.45% and the employer pays 1.45% for a total of 2.90%. The 15.3% number mentioned above comes from adding 12.4% and 2.9%. Remember the self-employed individual must cover both sides since the employer is no longer present to match.

The Social Security Administration provides some great examples of what happens to thresholds when you have employee wages and self-employed income. Taxes on wages are paid first, but only if total income exceeds $132,900.

Example 1: You have $30,000 in wages and $45,000 in net self-employment income for a total of $75,000. You’ll owe taxes on both incomes.

Example 2: You have $87,700 in wages and $45,500 in net self-employment income for a total of $133,200, leaving $300 in self-employed income over the threshold. Your employer will pay 7.65% (6.2% + 1.45%) in taxes on $87,700. You’ll pay 15.3% in taxes on $45,200 and 2.9% on $300.

Note that you can deduct 50% of your SE taxes due. The IRS considers the employer part of the SE tax to be a deductible expense.

Schedule C for business deductions should also be filed as well.

If you are employed and run your own business, you’ll receive W-2s. Social Security and Medicare taxes will automatically be deducted on your W-2. Its income will go into your Form 1040 along with any SE income. Income from any 1099s for contract work will factor into your SE income as well.

The latest version of Schedule SE can be downloaded here: https://www.irs.gov/pub/irs-pdf/f1040sse.pdf.

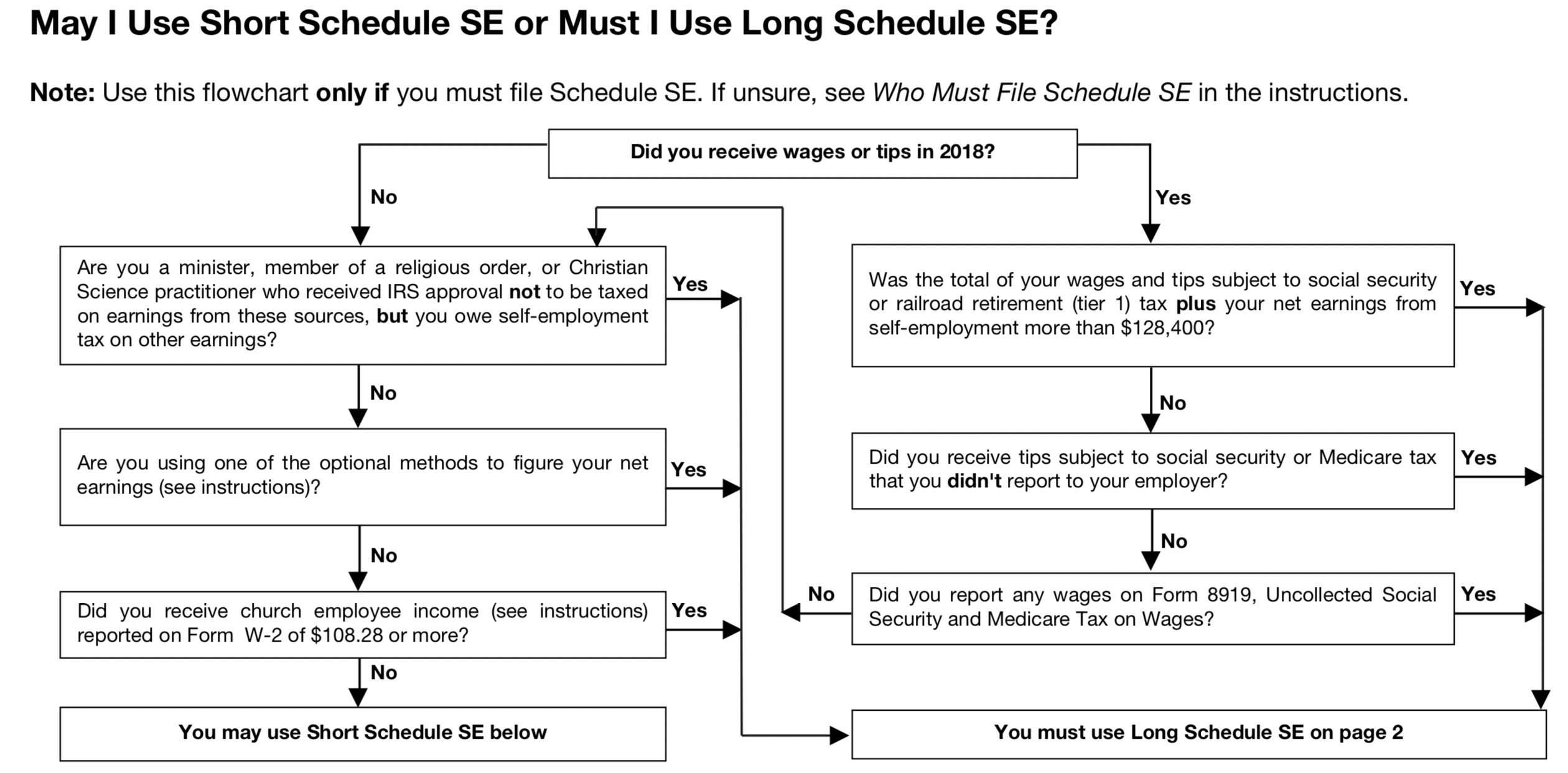

Short Schedule SE vs. Long Schedule SE

Schedule SE includes two sections: Short and Long. At the top of Schedule SE is a flow chart that helps you decide if you should fill out the Long section.

Most self-employed people who are not employees will complete the Short section. The Long section relates to church employee income and those who earned wages plus self-employed income. The Long section allows for more elaboration on sources of income.

Source (May Have Changed): https://www.irs.gov/pub/irs-pdf/f1040sse.pdf

Who Should File Schedule SE?

Self-employed individuals should file Schedule SE. If you make over $400 from self-employment activities, Schedule SE should be filed. If you had multiple businesses, it is not necessary to fill out multiple Schedule SEs. Instead, combine income from your businesses and enter it into a single Schedule SE.

Additional Medicare Tax

An Additional Medicare Tax of 0.9% may be applied if your SE income (line 4 or 6) exceeds the following thresholds:

- Married filing jointly: $250,000

- Married filing separately: $125,000

- Single, head of household, or qualifying widow(er): $200,000

If you are still working as an employee as well and have wages to report, the Additional Medicare Tax will be reduced by the amount of wages subject to Additional Medicare Tax.

Having a tax preparer help you work through Schedule SE is certainly worth the cost. Depending on your business, tax filings can get fairly complex. Don’t forget that Schedule C must also be filed. Both Schedule SE and Schedule C must be filed with your Form 1040.

Get Help With Your Taxes

If you're not planning on doing this yourself, you may be looking for the best tax software to help. We break down the best tax software every year, including the best small business tax software and the best side hustler tax software. Check out our full guide to the best tax software here >>

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak