FileYourTaxes.com is a tax filing software designed to make tax filing quick and easy. It has helpful calculators and built-in error detection. However, it’s expensive and difficult to navigate, putting it near the bottom of our recommendation list for your 2024 taxes.

Below, we detail the areas of disappointment and a few areas where FileYourTaxes.com offers its most useful features, in case you’re thinking about using it's platform to file your taxes.

If you’re shopping around and know FileYourTaxes isn’t ideal for your needs, here’s our list of the best tax software.

FileYourTaxes.com - Is It Free?

FileYourTaxes.com comes with a significant price tag. Most returns cost $45 for Federal filing and $40 per state. Business owners and others with more complex taxes will pay a base fee of $65.

While it says on the FileYourTaxes.com website that you can “e-file” for free, it’s definitely not a free tax filing service. The company charges for both state and federal filing. Pretty much every competitor includes electronic filing with any tier.

Free versions are available to through the IRS Free File program if you meet these requirements:

- Seniors age 66 or above earning between $8,500 and $79,000 per year

- Active duty military earning under $79,000 per year

If you're looking for a free alternative, check out our list of the best free tax software.

What’s New In 2024?

The first thing we noticed that’s new for 2024 is the pricing. Most filers will pay $5 to $10 more than prior years, depending on their filing needs. Otherwise, the app is mostly the same as last year.

The software is updated for changes to the tax code for the 2023 tax year (filed in 2024) from the IRS. The new tax brackets and limits for credits and deductions due to recent inflation were most notable.

It’s nice to see modest improvements, but FileYourTaxes would need to make a big leap forward to justify the high cost.

Does FileYourTaxes.com Make Filing Easy In 2024?

FileYourTaxes has a robust backend that includes useful calculators and robust error checking. It offers useful error messages to users when something seems off. Unfortunately, this functionality alone doesn’t make tax filing easy.

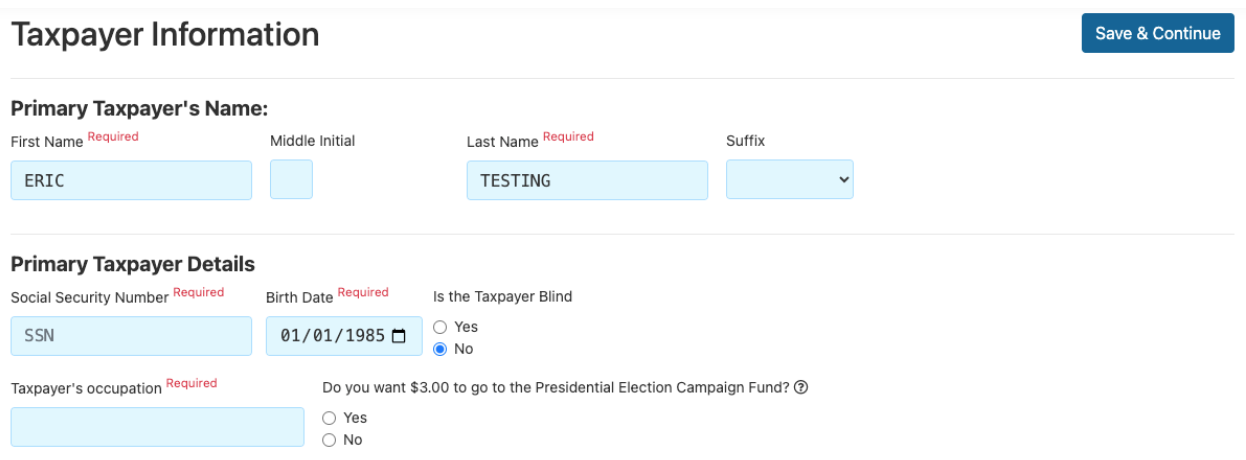

FileYourTaxes has jumbled, poorly designed screens that remind us more of 1990s Windows apps than modern web applications. Users have to answer questions that the software should determine on its own. The company has too much text on every screen, leading to tax-filing fatigue.

Website errors, including inconsistent pricing between pages and spelling issues in the main navigation menu give us little faith that the final result will be accurate and easy to achieve.

FileYourTaxes.com Features

FileYourTaxes.com is quite different from most other tax programs we tested. Most of the differences are detractors, but the software has a few shining moments.

Excellent Error Messages

Any time a user receives an error message, File Your Taxes explains why there is an error and what corrective action the user should take. This can be helpful when users might have missed a simple check mark in a box or a dollar amount.

Helpful Intra-Section Summaries

Some competitors don’t provide in-section or end-of-section summaries to help users assess whether they’ve completed the section properly. FileYourTaxes.com has many useful summaries showing users the effects of everything they’ve done.

Useful summary for net income from a rental property.

FileYourTaxes.com Drawbacks

Most of the FileYourTaxes.com drawbacks relate to the user experience. Filers may be able to use it effectively but will have a terrible time while completing taxes.

Poorly Designed Interface

The FileYourTaxes user interface looks like a website from the early 2000s. The text and boxes are often crammed onto the screen with poor alignment. This may seem like a small issue, but it can cause lots of mistakes when users can’t see the information their entering.

No Option To Import Information

Users can’t import tax forms like W-2 or 1099 forms. Given the price of FileYourTaxes.com, users should expect to snap pictures and have the software enter information on their behalf. However, FileYourTaxes doesn’t have this option, so users must manually transcribe information from their tax forms to the software.

Too Much Text

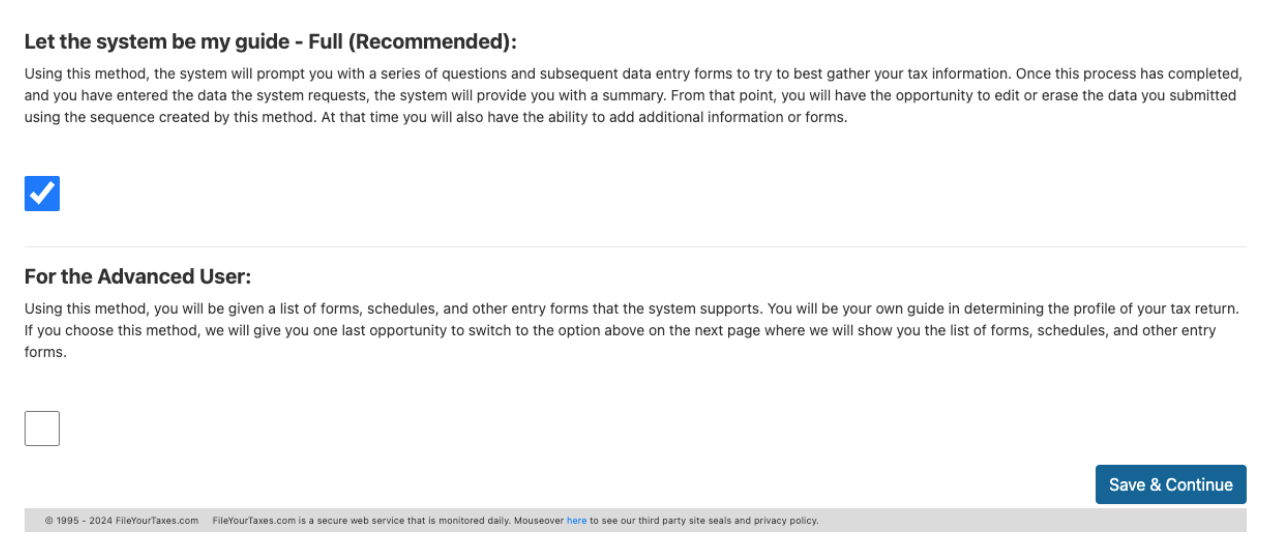

A primary issue with FileYourTaxes is the amount of text on each page. Filers need to read lengthy questions afterward and continue scrolling to complete each screen. The sheer volume of text on each screen causes filing to take much longer than necessary. Plus, it could lead you to glaze over an important detail buried in the fine print accidentally.

FileYourTaxes.com Plans And Pricing

FileYourTaxes.com breaks pricing into two major buckets. The basic tier covers most people except those who are self-employed. The Complex tier covers self-employed people and business owners.

Plan | Basic | Complex |

|---|---|---|

Best For | Anyone who isn't self-employed | Self-employed people |

Federal Price | $45 | $65 |

State Price | $40 per state | $40 per state |

Total Cost | $85 | $105 |

FileYourTaxes.com doesn’t offer many extras. You can use the site to file extensions or amended returns, but other major software services offer similar options (and are easier to use).

How Does FileYourTaxes.com Compare?

FileYourTaxes.com is priced at the high end of the market, but bargain competitors like Cash App Taxes and TaxHawk offer a better user experience.

We also compared FileYourTaxes.com to H&R Block, which is premium software that makes filing easy for almost all users.

Header | ||||

|---|---|---|---|---|

Rating | ||||

Stimulus Credit | Basic | Free | Free | Free+ |

Unemployment Income (1099-G) | Basic | Free | Free | Free+ |

Student Loan Interest | Basic | Free | Free | Free+ |

Import Last Year's Taxes | Not Supported | Free | Free | Free+ |

Snap a Picture of W-2 | Not Supported | Not Supported | Not Supported | Free+ |

Multiple States | Basic | Not Supported | $14.99 Per State | Free+ |

Multiple W2s | Basic | Free | Free | Free+ |

Earned Income Tax Credit | Basic | Free | Free | Free+ |

Child Tax Credit | Basic | Free | Free | Free+ |

HSAs | Basic | Free | Free | Deluxe+ |

Retirement Contributions | Basic | Free | Free | Deluxe+ |

Retirement Income (SS, Pension, etc.) | Basic | Free | Free | Free+ |

Interest Income | Basic | Free | Free | Free+ |

Itemize | Basic | Free | Free | Free+ |

Dividend Income | Basic | Free | Free | Premium+ |

Capital Gains | Basic | Free | Free | Premium+ |

Rental Income | Complex | Free | Free | Premium+ |

Self-Employment Income | Complex | Free | Free | Deluxe+ |

Small Business Owner (Over $5k In Expenses) | Complex | Free | Free | Self-Employed |

Audit Support | Not Available | Free | Deluxe | Worry Free Audit Support Add-On ($19.99) |

Advice From | Not Available | Not Available | Pro Support | Online Assist Add-On (starts at $39.99) |

First Tier Cost | Basic $45 Fed & | Free $0 Fed & | Free $0 Fed & | Free $0 Fed & |

Second Tier Cost | Complex $65 Fed & | N/A | Deluxe $7.99 Fed & | Deluxe $35 Fed & |

Third Tier Cost | N/A | N/A | Pro Support $39.99 Fed & | Premium $55 Fed & |

Fourth Tier Cost | N/A | N/A | N/A | Self-Employed $85 Fed & |

Cell |

How Do I Contact FileYourTaxes.com Support?

Customer support is not one of FileYourTaxes.com's strengths. Unlike its competitors, there are no options to receive advice from tax pros or even audit assistance.

Basic customer service is available by phone at 805-256-1788 and via secure messaging.

Operating hours for the phone support team are Monday to Friday, 9 a.m. to 4:30 p.m. (PT). Support by phone requires an additional fee of $17.50.

If you email them - taxman@FileYourTaxes.com - the typical response time of 24 to 48 hours.

If you'd prefer to try to find questions on your own, you can check out the free self-help section of the website.

Is It Safe And Secure?

FileYourTaxes uses multi-factor authentication and boasts multiple independent security credentials. It uses encryption to keep user information safe and secure.

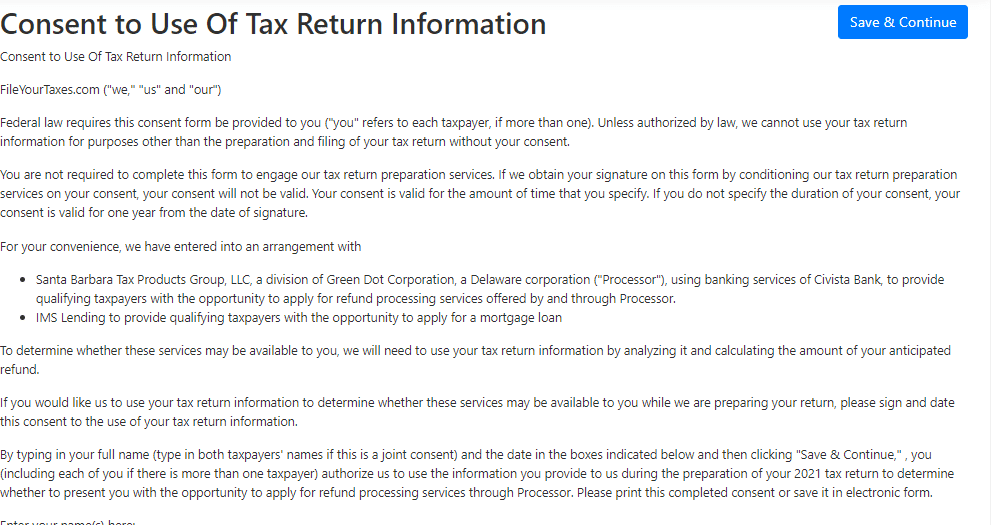

However, FileYourTaxes does appear to share your information with others. After completing a basic information section (including a required user agreement), FileYourTaxes asks for consent to sell your information to two specific lenders - and one of them doesn't even have to do with tax filing but rather mortgage loans.

Of course, users can decline, but the decline button is a small check box, whereas the consent button is large and blue. We don't like this somewhat misleading practice.

Slipping in a long boring form that agrees to give your information to lenders

Why Should You Trust Us?

The College Investor team spent years reviewing all of the top tax filing options, and our team has personal experience with the majority of tax software tools. I personally have been the lead tax software reviewer since 2022, and have compared most of the major companies on the marketplace.

Our editor-in-chief Robert Farrington has been trying and testing tax software tools since 2011, and has tested and tried almost every tax filing product. Furthermore, our team has created reviews and video walk-throughs of all of the major tax preparation companies which you can find on our YouTube channel.

We’re tax DIYers and want a good deal, just like you. We work hard to offer informed and honest opinions on every product we test.

How Was This Product Tested?

In our original tests, we went through FileYourTaxes.com and completed a real-life tax return that included W2 income, self-employment income, rental property income, and investment income. We tried to enter every piece of data and use every feature available. We then compared the result to all the other products we've tested, as well as a tax return prepared by a tax professional.

This year, we went back through and re-checked all the features we originally tested, as well as any new features. We also validated the pricing options.

Who Is This For And Is It Worth It?

FileYourTaxes.com offers calculators and useful summaries in 2024. Still, the software's strengths aren’t enough for us to recommend it.

It's far too expensive for what you get, and users paying a premium price for software can find better alternatives. Rather than using FileYourTaxes.com, filers should check out the best tax software for their situation.

FileYourTaxes.com FAQs

Let's answer a few of the most common questions that people ask about tax software sites like FileYourTaxes.com:

Can FileYourTaxes help me file my crypto investments?

FileYourTaxes supports crypto trading, but filers have to manually enter each transaction on the Capital Gains and Losses Listing Page. The page is long and complex and filers can only enter one transaction per page. Rather than enduring the cumbersome task of manually entering information, crypto traders may want to use software like TurboTax Premier and upload IRS form 8949 from TaxBit.com.

Can FileYourTaxes.com help me with state filing in multiple states?

Yes, FileYourTaxes supports multi-state filing. Users must select all the states requiring returns, and FileYourTaxes charges $40 per state return.

Does FileYourTaxes offer refund advance loans?

No, FileYourTaxes.com doesn’t directly offer refund advance loans.

FileYourTaxes.com Features

Federal Cost | Starts at $55 |

State Cost | $50 per state |

Pay With Tax Refund | Yes, $29.95 extra cost |

Audit Support | Not available |

Support From Tax Pros | Not available |

Full Service Tax Filing | Not available |

Printable Tax Return | Yes (but for only up to 6 months after filing) |

Import Tax Return From Other Providers | No |

Import Prior-Year Return For Returning Customers | No |

Import W-2 With A Picture | No |

Stock Brokerage Integrations | None |

Crypto Exchange Integrations | None |

Self-Employment Income | Yes, Complex tier |

Itemize Deductions | Yes, Basic tier |

Deduct Charitable Donations | Yes, Basic tier |

Refund Anticipation Loans | Not offered |

Customer Service Options | Phone and secure messaging |

Customer Service Phone Number | 805-256-1788 |

Customer Service Email | taxman@FileYourTaxes.com |

Web/Desktop Software | Yes |

Mobile Apps | No |

Promotions | None |

FileYourTaxes.com Review

-

Navigation

-

Ease of Use

-

Features and Options

-

Customer Service

-

Plans and Pricing

Overall

Summary

FileYourTaxes updated its user experience for 2024, making it simpler than previous years. That’s not to say the software is necessarily easy to use, but it performs much better than in previous years.

Pros

- Plenty of intra-section summaries

- Robust calculators

- Helpful error messaging that contains corrective actions

Cons

- Request to sell information added in the “Basic information” section

- Too much text on every screen

- No option to import tax forms

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment.

His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, Huffington Post, and other financial publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.

Editor: Colin Graves Reviewed by: Robert Farrington