Credit scores are the gatekeepers of credit. They determine how much credit you’ll receive and under what terms. Credit scores have also become more influential and are now used for job and apartment applications.

Credit scores are obviously an area that none of us can ignore. But what impact do credit scores have on our money?

Generally, the higher your credit score, the more credit you’ll receive. As we’ll see, there are no hard and fast rules when it comes to how much credit a lender may extend to you.

From the worst scores to the best, there are score ranges that much of the population falls into. What those ranges mean for your money is what this article will dive into.

FICO Score

FICO Scores were introduced over 25 years ago and are the most popular credit scoring method; meaning, most lenders use FICO Scores for determining an applicant’s creditworthiness.

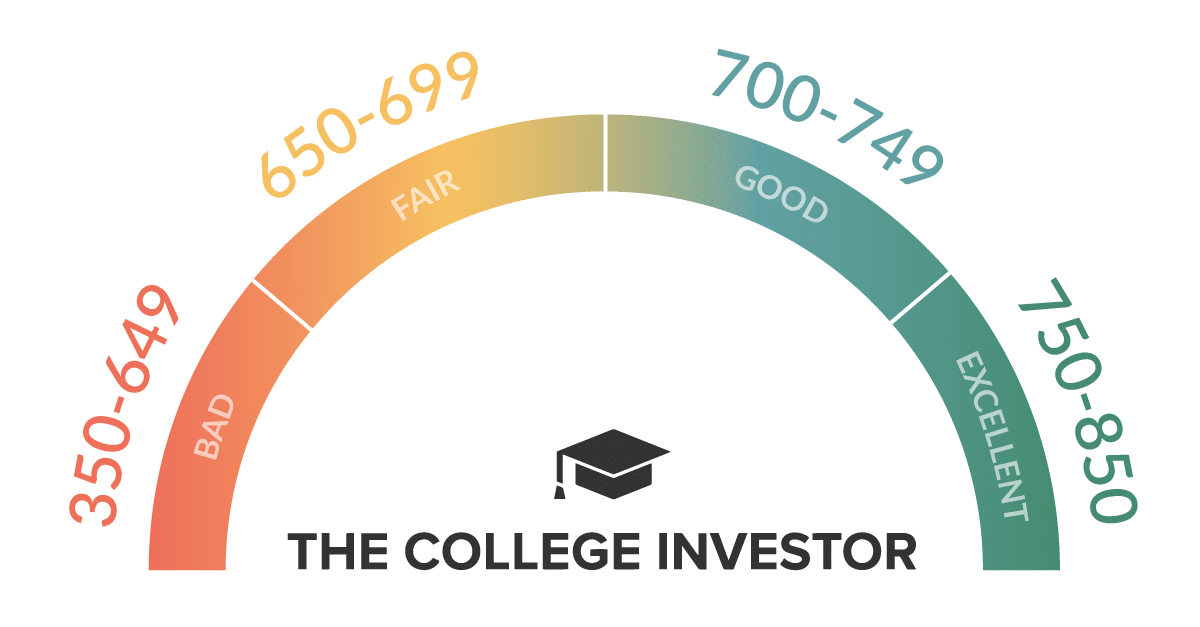

FICO Score ranges can be broken down as follows:

- Bad: 350–649

- Fair: 650–699

- Good: 700–749

- Excellent: 750–850

The above ranges are directly from myFICO.com, through an internal analysis of application approvals. These scores are from FICO Score 8, the most widely used. FICO Score 8 ranges from 300–850. There are also industry-specific FICO scores. These are used for bank cards, mortgages, and auto loans.

The following show APRs and monthly payments on a $300,000, 30-year fixed mortgage, and are based on FICO Scores 5, 4, and 2.

- 760+, 3.286%, $1,049

- 700+, 3.508%, $1,079

- 680+, 3.685%, $1,103

- 660+, 3.899%, $1,132

- 640+, 4.329%, $1,192

- 620+, 4.875%, $1,270

As you can see, the better your FICO Score, the better your interest rate, and the more money you’ll save.

Similar to score ranges are risk rates. Risk rates determine the likelihood that you’ll default on a loan. They’re a look at the other side of the application process — the lender’s view. See here:

- 67%: 300–499

- 55%: 500–549

- 39%: 550–599

- 25%: 600–649

- 13%: 650–699

- 6%: 700–749

- 2%: 750–799

- 1%: 800–850

In addition to FICO Score is VantageScore, which we will look at next.

VantageScore

VantageScore is similar to the FICO Score except that it is a single score derived from all three credit bureaus (Experian, TransUnion, and Equifax). This is unlike the FICO Score, which uses a score for each bureau. VantageScore was created by the three credit bureaus in 2006. The latest VantageScore model is 3.0.

While the FICO Score is the most popular, VantageScore has been gaining ground.

“In the past five years we’ve seen competition flourish. Within that time period, VantageScore credit score usage increased by more than 300 percent and the number of users increased by almost 12 percent. The continued growth in use of VantageScore credit scores and how we’ve changed the credit scoring industry for the better is a testament to our model’s ability to provide a highly predictive credit score to a greater number of consumers,” said Barrett Burns, president & CEO of VantageScore Solutions.

VantageScore follows the same range as the FICO Score: 300 to 850. The ranges for excellent to bad are also similar to the FICO Score ranges.

VantageScore claims that it is easier to understand and more consistent than other scoring methods. They have even created a website to help consumers understand the different reason codes associated with their credit. You can view the website at ReasonCode.org.

Just like the FICO Score, the higher your VantageScore credit score, the better rates and more credit you’ll be able to get, and of course, the more money you’ll save.

It's important to note that the VantageScore is what's used by most free credit monitoring programs.

How Scores Are Used by Lenders

While credit score ranges are a useful guide for estimating what payments, APR, and overall credit will look like, the truth is that lenders come to their own determination.

Many factors go into the credit application approval process. Credit scores are just one factor. Often, the larger the loan, the more that will go into deciding if you are approved or not (i.e., mortgage applications).

This doesn’t mean you should avoid the above score guide — the better your credit score, the more opportunities for credit you’ll have.

How to Get Your Credit Scores

Your FICO Score can often be retrieved from your bank or credit card company. Although, those financial institutions will have the score for only one credit bureau. If you want to see your score from all three credit bureaus, you can purchase a package from myFICO.com.

You can get a free credit report and scores here >>

Your VantageScore credit score can be obtained directly from Experian or TransUnion. There are also a number of other websites that you can get your VantageScore credit score from by checking here: https://your.vantagescore.com/where-to-go.

The government allows consumers to get a free report every 12 months from all three credit bureaus at https://www.annualcreditreport.com. But beware that these reports do not include your FICO Score or VantageScore credit score.

Beyond these places, check out our list of the best tools to help you improve your credit score.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller