Building your credit is kind of like the chicken and egg problem—how do you get a credit card when you don't have any credit? Zolve, a platform to help credit building easier for everyone, simplifies this process. Zolve will likely approve you for a credit card as long as you meet certain requirements such as being a U.S. resident or a working professional about the move to America.

Zolve caters to everyone—U.S. residents, international students, working professionals, and their dependents.

They do this through offering a suite of products designed to help establish and build credit scores. They also create pathways for people who need to move to the U.S. and want a streamlined way to ease into the U.S. banking system with less stress.

Let’s explore how Zolve provides a streamlined pathway. Plus, whether or not the platform is a good fit for your situation.

Zolve Details | |

|---|---|

Product Name | Zolve |

Products And Services | |

Fee To Use Azpire Card | $0 |

Monthly Fee For Zolve Credit Card | Currently they do not offer a subscription fee for cardholders, but this may change in the future. |

Annual Fee | None |

Promotions | None |

What Is Zolve?

Zolve is a fintech company that aims to make building credit more simple. They offer a variety of financial products such as a credit card and loans, designed to help people establish a solid credit score. They also provide people who are overseas a way to apply for a U.S. bank account and credit cards. If you need to build a financial foundation in multiple countries, the platform can ease the transition.

What Does It Offer?

At the moment, Zolve provides access to a checking account, credit builder card, remittances, insurances and auto loans on its platform. Zolve offers the following products:

- Zolve Azpire Card

- Zolve Credit Card

- Zolve Account

- Zolve Remittance

- Zolve Boost Account

- Student Loan

- Insurance and Auto Loans

You Need To Apply For An Azpire Credit Card

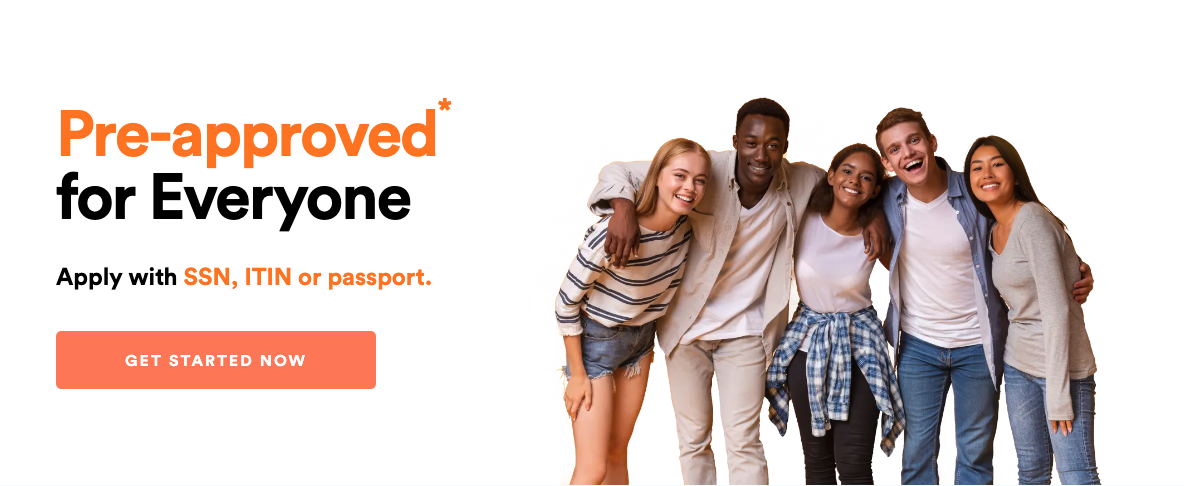

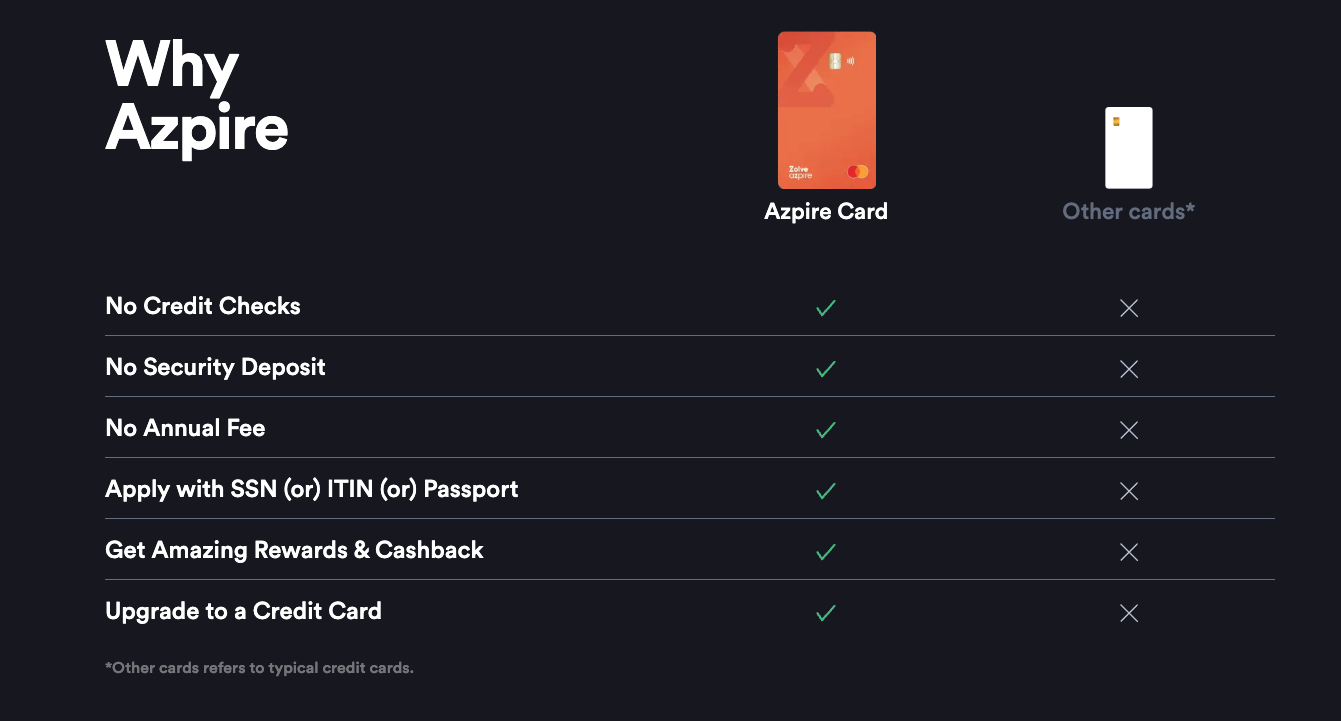

Through Zolve, you can apply for the Azpire credit card with either a Social Security Number, Individual Taxpayer Identification Number (ITIN), or passport. You can get approved without a credit check.

Unlike a traditional unsecured credit card, the spending limit is initially tied to your Zolve checking account balance. Although the website claims there is no security deposit required, your bank account balance is tied to the card. After opening an Azpire card, you can add money to your bank account.

Here’s how it works:

- As you use the Azpire card, Zolve will report your credit usage to the three major credit bureaus.

- Since you cannot spend more than your bank account balance, you don’t have to worry about taking on high interest debt.

- But in contrast to a debit card, you’ll build credit as you spend.

If you use the card responsibly, you might see your account upgraded to an unsecured credit card. According to Zolve, you can get a credit limit of up to $10,000 in as little as four months. Keep in mind that the upgraded credit card involves interest charges and other fees.

Along the way, you can tap into cashback opportunities. With the card, you can earn up to 10% cashback at over 10,000 retailers.

Get A Zolve Checking Account Without Any Hassles

With Zolve, you can get access to a checking account, which is FDIC insured, with very minimal documentation requirements.

For those who come to plan to move to the U.S., Zolve allows you to apply for a U.S. bank account before leaving your home country.

There are no minimum balance requirements or upfront account fees. Plus, you won’t need a Social Security Number to get started. After opening the account, you can land in the U.S. with a bank account that eliminates the need to transport large amounts of cash.

Through this bank account, you can connect to other payment options like Apple Pay, Google Pay, and Venmo. If you plan to receive direct deposits, this account can accept the funds seamlessly. Plus, you’ll find payment alerts and autopay options to start building your financial foundation on the right foot.

The Zolve Boost account is a step up from the basic bank account. You can score an annual boost rate of 2% to help you grow your savings.

International Transfers

Sending funds back and forth internationally can get expensive quickly and it makes sense to find a way to minimize costs. With the help of Wise, Zolve offers a relatively low-cost way to send funds and receive funds.

When sending funds, you’ll see a full breakdown of any costs. At the moment, Zolve does offer a relatively low cost transfer opportunity. But it’s helpful to check out all of your options to find the most affordable choice.Are There Any Fees?

The Zolve Azpire credit card doesn’t have an annual fee attached.

Zolve doesn't currently offer any subscription fees, but may charge in the future as they add more features to enhance the platform for cardholders. They disclose this in their website and pride themselves on this type of transparency.

The costs to transfer between the U.S. and other countries vary. But at the moment, Zolve does offer an affordable choice. If opting for a wire transfer, it costs $15 to receive funds in your U.S. account. But you also have the option to transfer through Wise, which can be more affordable.

How Do I Contact Zolve?

Zolve offers chat support around the clock. You can also email hello@zolve.com for support. However, there is no phone number listed for the company.

Overall, customers tend to be happy with their Zolve experience. The company has earned 4.1 out of 5 stars on Trustpilot, 4.2 out of 5 stars on the Google Play Store, and 4.4 out of 5 stars on the Apple App Store.

How Does Zolve Compare?

Zolve is a relatively unique option. They focus on helping underserved communities build a strong financial footprint and brighter future.

In terms of student loans, Zolve can help you search for lenders. However, it doesn’t directly offer student loans to customers. If you’re an international student, these are two student loan lenders that will work with you—Prodigy Finance, Ascent, and MPower Financing.

Header |  |  |  |

|---|---|---|---|

Rating | |||

U.S. Cosigner Required | No | Yes | No |

Origination Fee | Up to 5% | None | 5% |

Rate Type | Variable | Variable and Fixed | Fixed |

Terms | 7 to 20 Years | 5 to 15 Years | 10 Years |

Cell |

How Do I Open An Account?

The process starts by heading to the Zolve website. From there, you’ll select Get Started. Be prepared to provide an email address and add a password. Additionally, you can provide an SSN, ITIN or passport as identification documents. You might also need to provide your visa or other documentation.

The entire process should take a few minutes. You can streamline the process by having your identity documents ready.

Is It Safe And Secure?

Zolve accounts are secured with FDIC insurance of up to $250,000. Additionally, the platform uses 256-bit encryption to protect your information.

When using the credit card, the Mastercard includes zero liability protection for fraud. If you are unsure about a card’s security, you can freeze it at any time.

Is It Worth It?

Zolve offers a worthwhile opportunity to a specific customer. If you want to build credit or rebuild your credit without taking on debt or worrying about any late fees or interest, then you may consider Zolve.

Zolve Features

Products |

|

Fee To Use Azpire Card | $0 |

Monthly Fee For Zolve Credit Card | None for now, but this may change in the future. |

Annual Fee | None |

Wire Transfer Cost For Incoming Only | $15 |

Customer Service |

|

Help Page | |

FDIC Insured? | Yes |

Zolve Review: Seamlessly Build Your Credit

-

Fees

-

Application Process

-

Customer Service

-

Products And Services

Overall

Summary

Zolve is a fintech platform that makes credit building simple and accessible for everyone, even people who don’t reside in the U.S.

Pros

- Opportunity for anyone to build credit

- Can open a U.S. bank account from overseas

- Free to use Azpire credit card

Cons

- Monthly fee for Zolve credit card are unclear

- Transfer fees are not easy to find

- Out-of-network ATM fees are $2.50 per withdrawal

Sarah Sharkey is a personal finance writer covering banking, insurance, credit cards, mortgages and student loans. She has written for numerous finance publications, including MagnifyMoney, Business Insider and ChooseFI. Her blog, Adventurous Adulting, helps young adults get a handle on their finances.

Editor: Claire Tak