Earning cash back is great. But when you have to keep track of receipts and rotating deals, it can become a hassle to keep up with all of the potential rewards. That’s where Dosh can help.

Dosh offers an cash back experience that requires no effort on your part. After you sign up, Dosh will automatically monitor your transactions to maximize your cash back rewards.

It might sound too good to be true. But Dosh is working with thousands of popular brands to put more money in your pocket! Let’s take a closer look at what Dosh has to offer.

Dosh Details | |

|---|---|

Product Name | Dosh |

Payout Minimum | $25 |

Payout Methods | Bank, PayPal, and Venmo |

Platform | iOS and Android |

Promotions | None |

What Is Dosh?

Ryan Wuerch founded Dosh in 2016. Since then, the company has strived to achieve its goal of positively impacting “people’s lives by moving billions of dollars to millions of people.”

In 2021, the Austin-based company was acquired by Cardlytics for $275 million. Since its acquisition, Dosh has continued to provide useful cashback savings for its users.

What Does It Offer?

Dosh offers a streamlined cashback program. Here’s a closer look at its features.

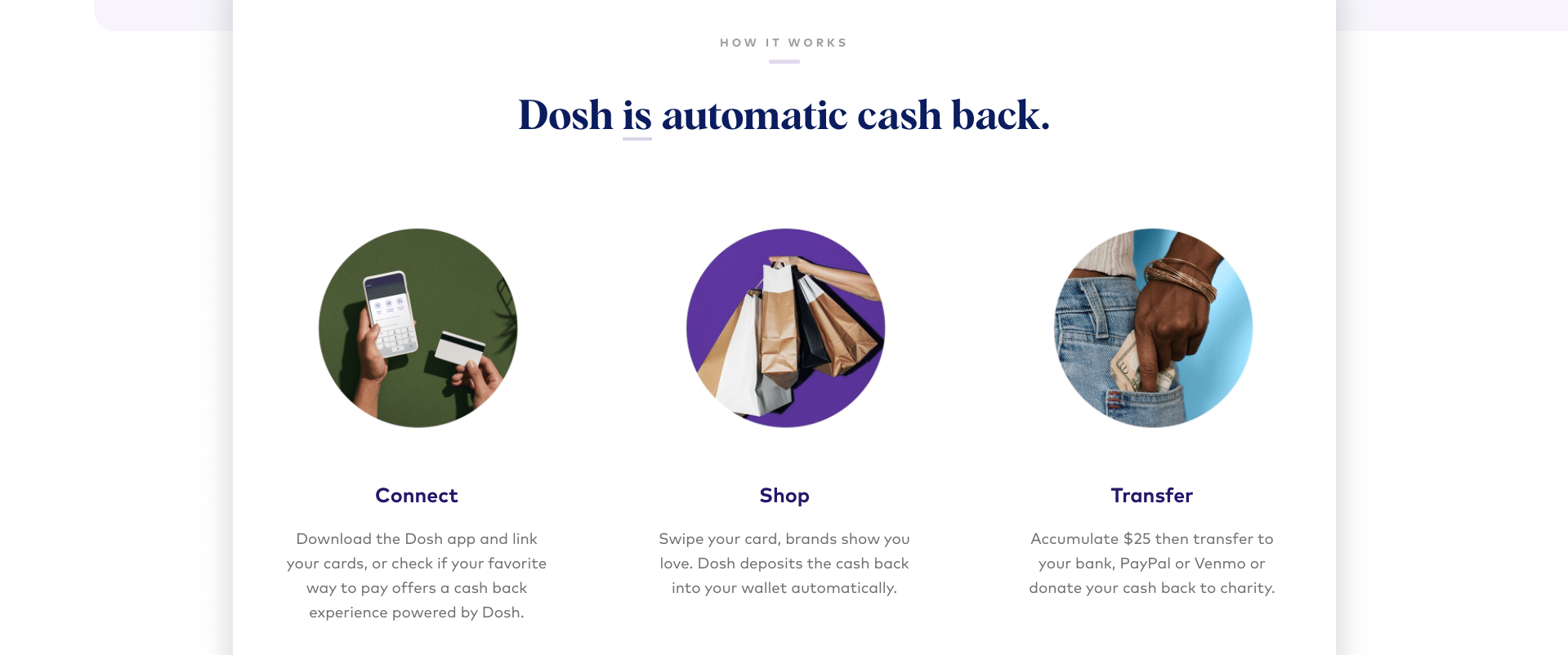

Automatic Cash Back

There are cash back opportunities everywhere. But many of us don’t have enough hours in the day to stay on top of all the available deals. After all, saving receipts and checking for coupon codes can be time-consuming.

Dosh makes the cash back experience entirely automatic. Once you set up your Dosh account and link a credit or debit card, the rewards will accumulate in the background whenever you spend money at a retailer that is offering cash back.

The only action you’ll ever need to take is to check in with how much you’ve saved through cash back rewards. That’s as painless as it gets!

Plus, keep in mind that if you link a cash back credit card to Dosh, you'll still continue to earn rewards through your card provider's program. So with Dosh, you can double-dip on the amount of cash back you earn when you shop!

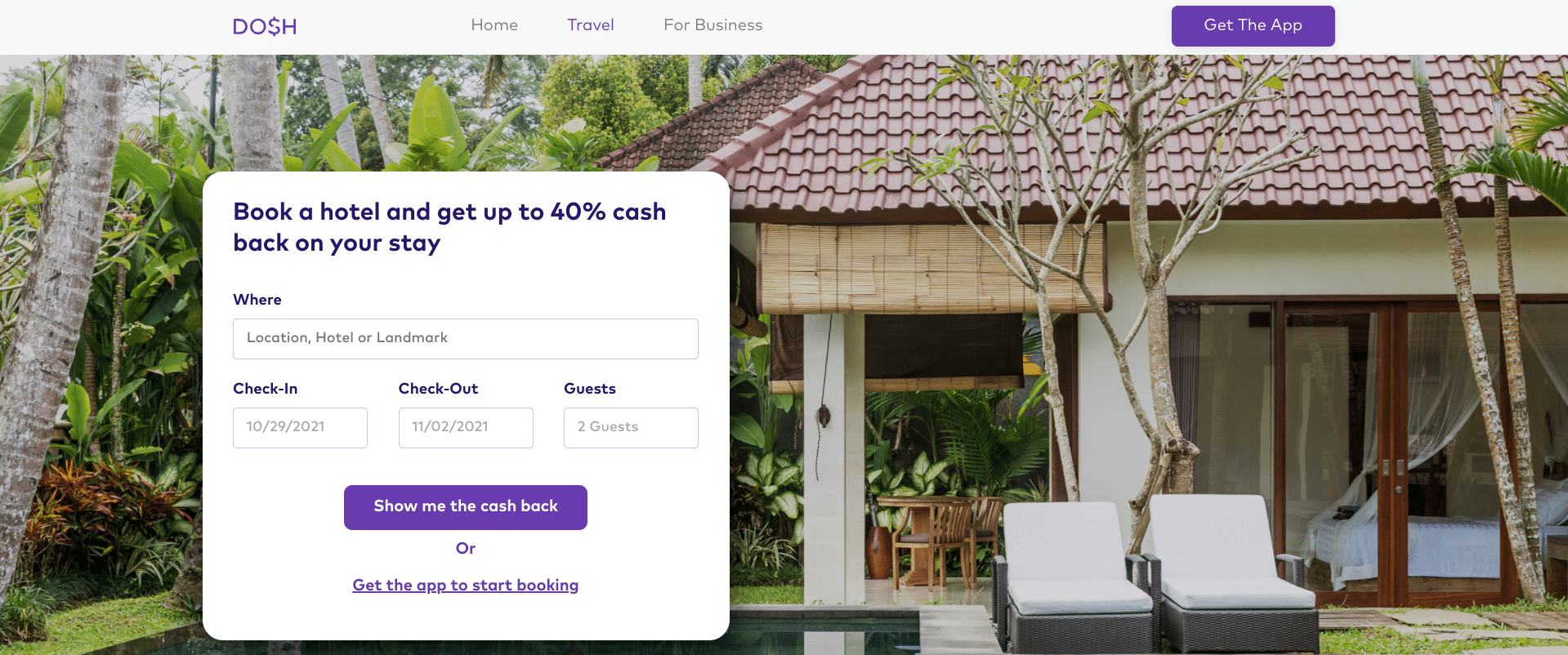

Earn Rewards By Shopping Or Traveling

Over ten thousand brands work with Dosh. A few of the most popular include Walmart, Instacart, Disney, Backcountry, Sephora, Dunkin’, and GNC.

But the earnings opportunities don’t end there. You can also score rewards with travel purchases. When you book through Dosh's travel portal, you can save up to 40% at over 600,000 hotels! For anyone with a serious case of wanderlust, those savings can add up quickly.

Easy Payout Options

Dosh makes it easy to enjoy your cash back rewards. You'll be able to transfer funds to your bank, PayPal, or Venmo. Plus, you can choose to donate your savings to charity if you prefer.

However, it should be noted that Dosh's cashout minimum is on the high side at $25. For comparison, you only need to earn $20 rewards with Ibotta before you can withdraw them. And cash out minimums with Shopkick starts at just $2 (Shopkick minimums vary by retailer and range from $2 to $20).

Are There Any Fees?

Dosh is completely free to use. However, if your account is inactive for a 12-month period, Dosh may charge an Inactive Account Maintenance Fee of $4.99 per month.

We personally hate to see inactivity fees on accounts. But the good news is that the fee will only be deducted from your Dosh account wallet. So you’ll never have to pay a fee from your personal bank account or credit card to fund a Dosh fee.

How Does Dosh Compare?

Dosh offers a relatively unique experience because the app automatically provides your cash back. You won’t have to search for coupon codes or scan receipts.

But some people are fine with taking an extra step or two if it means they may be able to earn more cash back. If that's you, you might want to check out other cash back apps like Ibotta or Honey.

Note that Dosh is one of the only cash back apps out there today that allows you to book travel directly from its own travel portal. Here's a quick look at how Dosh compares:

Header |  |  | |

|---|---|---|---|

Star Rating | |||

Cash Back | |||

Coupons | |||

Receipt Scanning | |||

Travel Portal | |||

Payout Methods | Bank, PayPal, or Venmo | Gift Cards, PayPal, or Venmo | Gift Cards or PayPal |

Cell |

How Do I Open An Account?

Ready to try Dosh? Here’s how to open an account.

The first step is to visit the website here. From there you'll be able to download the app from either the Apple App Store or Google Play Store so that you can link a debit or credit card. .

Once downloaded, you can select ‘Join.’

At this point, you’ll need to provide your email, phone number and link a credit or debit card. That’s it! From there, Dosh will take care of sending you cash back whenever possible.

Is It Safe And Secure?

Anytime you are handing over your credit or debit card information, it is understandable to be wary. But Dosh makes safety and security a priority.

First, Dosh doesn’t actually store your credit card or banking information. Instead, that information is stored with Braintree, a PayPal service that stores over 1 billion cards and is highly regarded for its security standards.

Dosh uses bank-level security to keep your information safe. And it supports multi-factor and two-factor authentication for added account protection. Finally, the company doesn’t sell your data to businesses or third parties (something that's important to confirm before using any cash back app).

How Do I Contact Dosh?

There's no customer service phone number listed for Dosh. However, you can reach out to Dosh via email during business hours by submitting a request. You can also reach out via Facebook, Twitter, LinkedIn or Instagram @Doshapp.

Based on user feedback, you should find a pleasant app experience. Dosh has earned 4.7 out of 5 stars in the Apple App store and 4.4 out of 5 stars in the Google Play Store.

Is It Worth It?

We think that Dosh could definitely be worth downloading if you want a highly convenient cash back program. You won’t have to manage receipts or regularly check in for deals. Instead, the app hunts down the rewards for you with no time commitment required on your part.

But it's important to note that "convenient" doesn't always mean "better." If you already have a referral program that you like, there's no guarantee that you'll accumulate more cash back with Dosh. We recommend testing it out for a month to see how your earnings compare.

If Dosh earns you the same (or more) as you were earning before with less hassle, great! But if your payouts take a significant hit, you may want to switch back to the higher-paying cash back program, even if it requires a bit more work.

Dosh Features

Features | Automatic cash back at retailers and hotels |

Mobile App Availability | Yes, iOS and Android |

Web/Desktop Account Access | No |

Supported Stores | 10,000+ |

Supported Hotels | 600,000+ |

Payout Methods | Bank, PayPal, and Venmo |

Payout Minimum | $25 |

Supported Card Issuers | Visa, Mastercard, and American Express |

Inactivity Fee | $4.99/mo (deducted from rewards balance) |

Customer Service Options | Contact form |

Security |

|

Promotions | None |

Dosh Review

-

Choice of Retailers & Hotels

-

Ease of Use

-

Redemption Options

-

Payout Minimum

Overall

Summary

Dosh provides automatic cash back when you use a linked card at over 10,000 retailers and more than 600,000 hotels. It provides multiple convenient payout methods but you won’t be able to transfer your rewards until you’ve accumulated at least $25.

Pros

- Automatic cash back

- Earn cash back when booking travel

- Strong network of participating brands

- Cash out via bank, PayPal, or Venmo

Cons

- Monthly fee is deducted from your account wallet after 12 months of inactivity

- Cash outs require $25 rewards balance

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller