Vanguard founder, Jack Bogle, was credited with founding the first index funds. Index funds are investments that track certain market indexes, including the S&P 500, and automatically give investors access to a broadly diversified portfolio.

Today, index funds are a common part of the investment landscape. They are collections of stocks of publicly traded companies.

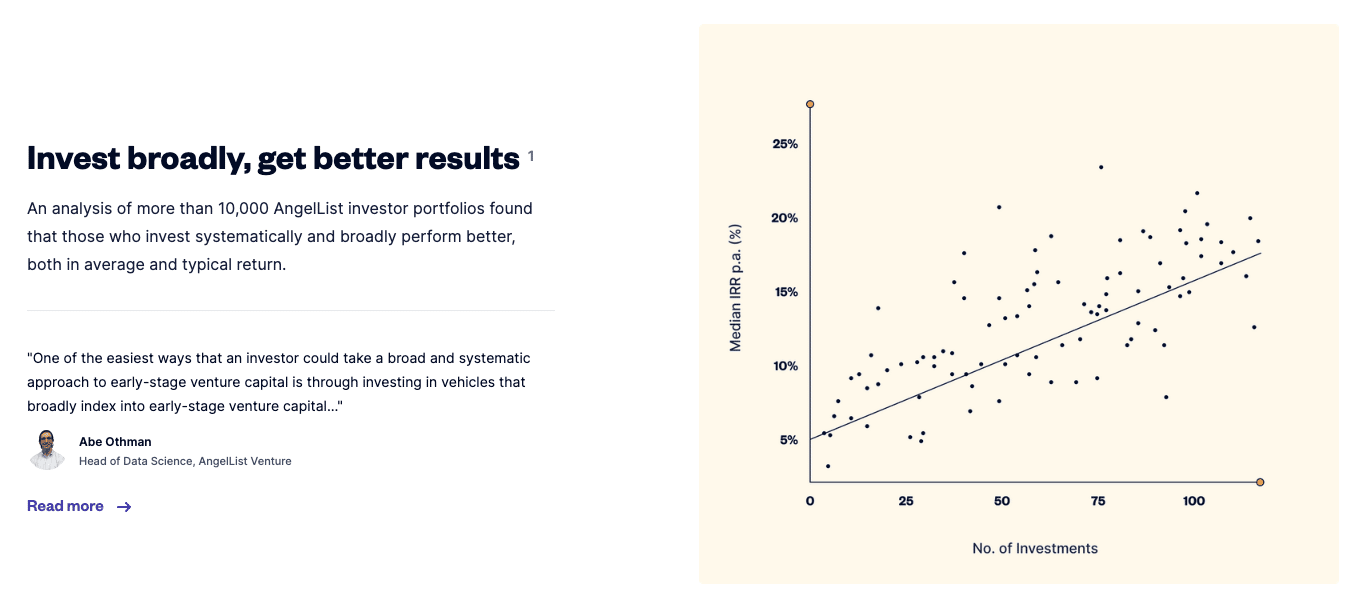

AngelList Ventures is creating a similar concept in the world of private equity. The company gives accredited investors access to hundreds of early-stage startups with a single investment. The broad diversification increases the odds that an investor will invest in a “unicorn” company that provides 100X returns or more.

AngelList also has a range of other early-stage investment opportunities that may be a fit for accredited investors. We explain how it works, and how investors can start to explore opportunities with AngelList Ventures.AngelList Details | |

|---|---|

Product Name | AngelList Venture |

Min Investment | Depends on the kind of deal |

Investor Fee | 1-2% |

Open to Non-Accredited Investors? | No |

Promotions | None |

What Is AngelList Ventures?

Founded in 2010, AngelList Ventures is famously one of the earliest investors in Uber. What started as a simple email list has since expanded into one of the largest venture capital marketplaces on the planet. The company seeks to bring more successful startups into the world by expanding access to private equity investment opportunities.

AngelList not only gives investors access to a continuous flow of investment opportunities but also allows investors to invest in managed funds. The managed fund creates a sort of “index” of all the private equity deals on the AngelList platform.

To date, investors have invested more than $10 billion through AngelList, and the investment opportunities continue to expand.

What Does It Offer?

AngelList is an online marketplace matching investors and startups seeking investment. But the company does more than creating markets. It smooths the startup investment process by managing the legal side of investments. Plus it enables broader investment diversification through the funds hosted on the AngelList platform.

Invest In Syndicated Deals

If you want to try your hand at true venture capital investing, review the individual investment syndications on the AngelList Ventures website. Each syndicated deal has a minimum investment and may carry certain fees. If you want to go for syndicated deals, you need to do your homework.

The companies seeking funding may be an investment unicorn, but many of the companies will fail. Research further to figure out whether the company is likely to succeed.

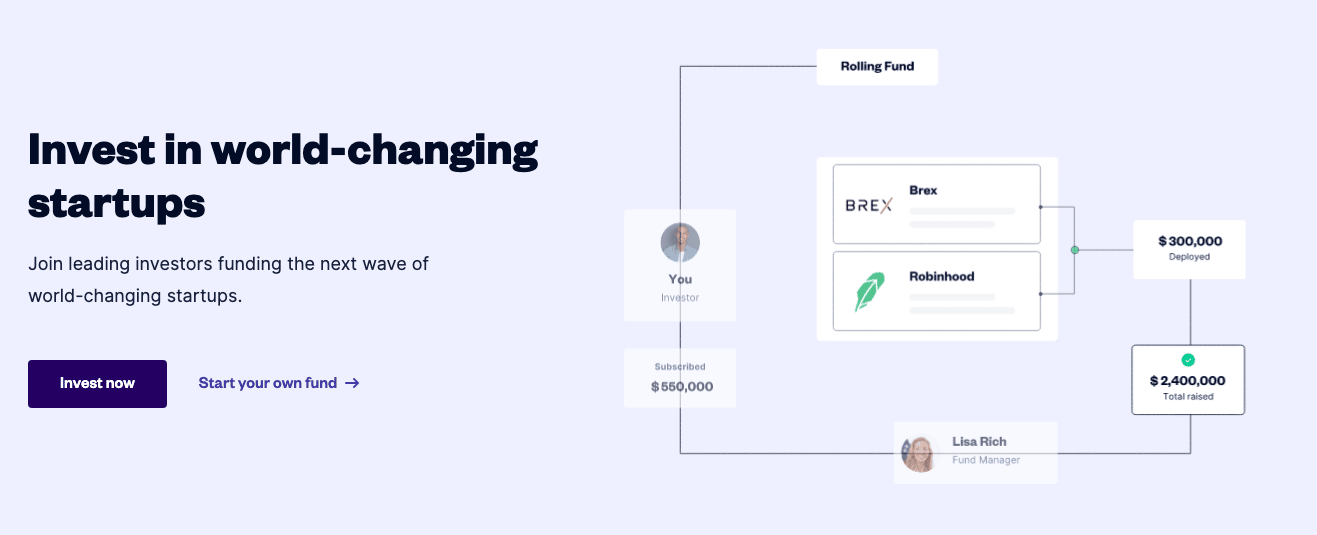

Invest Like a VC With Rolling Funds

Rolling funds are investments where a fund manager continually invests on behalf of fund subscribers. Fund subscribers commit a certain amount of money to the fund (typically $5,000+ per quarter) for a minimum of four quarters. The fund manager then invests their own money as well as subscriber money, according to an investment policy statement.

Most fund managers on AngelList are successful startup founders or successful VC investors. The investment funds may have a broad focus, such as a startup in India, or a narrow focus like sustainable agriculture in the American Midwest, but investors are made aware of the investment philosophy before they start.

You’ll only gain access to investments in the fund based on your investment date in the fund. Investing one quarter gives you access to past or future venture capital investments. Investing over time helps to boost diversification.

Diversify With Managed Funds

Managed funds like the AngelList Access Fund are broadly diversified funds that allow you to buy a piece of hundreds of startups each year. This “index” fund of startups carries similar costs as the rolling funds, but it offers broader diversification.

This can be a great way to invest in startups if you don’t have a strong investment philosophy leading you to invest in a rolling fund.

No Need To Do Private Equity Homework

Rather than researching every single investment deal on the market, you can invest using one of AngelList’s many funds. These give a fairly diversified range of investments that may boost returns over the long run.

It is important to note that investing in a single quarter does not produce a particularly diversified portfolio. If you continuously invest over many years, you’ll gain greater exposure to the investments.

Illiquid Investments

Typically venture capital investments have an exit after seven to 10 years. At this time, you don’t have the option to sell your investments in a secondary market. If you earn a positive return, you can expect to hold onto your investments for a decade or more before seeing the return.

Be prepared to lose money and to have it locked away for a long time. This is part of the reason that AngelList is only open to accredited investors.

Are There Any Fees?

Fee structures on AngelList vary by investment type.

The fund fees are structured like hedge fund investments where investors pay an annual management fee (typically 1 to 2%), and an administrative fee (0.15% annually). These fees are deducted from the overall investable capital which tends to mute returns.

On top of those fees, it is typical for funds to require a “carry” fee. The carry is the fund limited partner’s cut of profits when a fund outperforms. Typically, the fund limited partner receives a 20 to 30% carry fee. Sometimes the fee is reduced as well, depending on the individual investment.

Because this fee structure is a bit complex, AngelList has a fee calculator that breaks down investment fees for investors.How Does AngelList Ventures Compare?

AngelList is the largest VC investment site in the United States, and it gives investors access to global startups as well. Unlike many crowdfunding sites, AngelList leans heavily into the fund concept.

When looking at competitors, you're unlikely to find another site that has the volume of deal flow that AngelList has.

Your can “de-risk” by investing in large numbers of startups through funds. This increases the fee cost of the investment (managing the legal structure around these investments is expensive). On the flip side, it means you may worry less about losing your money on a single deal, and increase the odds that one investment yields a huge multiple.

One downside to investing through AngelList is the large capital requirements. You may need $75,000 or more per year to invest through the site.

Other crowdfunding sites like SeedInvest, Propel(X), and MainVest have much lower investment minimums. However, those sites have much lower deal flow than AngelList. These alternative investment platforms also have long holding periods and low liquidity.Header |  |  | |

|---|---|---|---|

Rating | |||

Min Investment | Depends on the deal, can be as low as $1,000 or higher | $100 | $100 |

Fees For Investors | $1-2% | 2% (up to $3,000) | $0 |

Fees For Companies | 0.75% of fund size | 7.5% | 6% |

Open To Non-Accredited Investors? | |||

Cell | Cell |

How Do I Open An Account?

You need to apply to join AngelList Ventures as an investor. The application process is a bit more rigorous compared with other accounts because it requires you to verify your accreditation status.

You must explain how you intend to use AngelList ventures, and add your LinkedIn profile. You must be approved for investment, which typically takes one day, before you can start investing. Anyone who invests through AngelList must separately be approved for fund investing and syndicated investing.

To access individual investments in a syndicate, you must also apply to join the syndicate and be approved. Some syndicates are much more selective in their approval process.

Is It Safe And Secure?

AngelList requires a lot of personal information. You must provide information about your income and net worth as well as provide access to your LinkedIn profile.

AngelList protects users through multiple layers of safety. On the digital security side, the company encrypts data and follows international and stateside rules associated with the use of personalized data. It only processes payments using encrypted data sources.

On the legal side, AngelList has a suite of tools designed to help investors and founders invest safely and securely. Investments are processed through a legal structure called a Special Purpose Vehicle. This ensures that all investments follow required laws to ensure investment returns end up in the hands of investors.

How Do I Contact AngelList Ventures?

AngelList is based out of San Francisco, California but has offices worldwide. It does not publish contact information for investors. However, people with questions can use a contact form to direct inquiries to AngelList.

Is It Worth It?

Investing in startups is risky, and AngelList is only open to accredited investors who can either sustain losses or endure illiquid investments for a decade or more. Those who invest don’t necessarily rely on these investments in order to meet their overall investment goals.

That said, venture capital investing is alluring. It’s exciting to invest money in startups that could change the world. The prospect of outsized returns is thrilling, especially for people with very long investment time horizons.

AngelList does a great job focusing on “deal flow” and diversification within the startup investment world. Not all investments will pay off, but the fund structure increases the likelihood that you’ll ultimately see positive returns.

Accredited investors who see value in startup investing, and have six figures or more available to invest are good candidates for AngelList.

It's not for everyone, but AngelList is a great platform for investors who want to diversify away from publicly traded companies.AngelList Ventures Features

Account Types |

|

Minimum Investment | Varies by the type of deal |

Investor Fee |

|

Investor Requirements | Must be an accredited investor |

Investment Term | Yearly or quarterly commitment |

Customer Service Options | None listed on the website, besides a contact us form. |

Mobile App Availability | None |

Promotions | None |

AngelList Review

-

Pricing & Fees

-

Customer Service

-

Diversification

-

Ease of Use

-

Products & Services

-

Liquidity

Overall

Summary

AngelList Ventures gives accredited investors access to hundreds of early-stage startups with a single investment.

Pros

- More than half of all major private equity deals in the United States are accessible through AngelList.

- Worldwide exposure to startup investments.

- Investors can choose to invest in single deals or funds.

Cons

- AngelList does not have any liquidation options, and most private equity deals require seven to ten years to reach maturity.

- Fees can be very high. Most funds charge a 2% annual fee plus the fund limited partner takes 20% of all profits (Carry fee)

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Claire Tak