Even the most boring investors dream of buying a unicorn company and seeing the company (and their investment) soar to success. Angel Investing (investing in startup companies) allows investors to put some of their money towards these potentially lucrative investment opportunities.

Historically, Angel Investing was limited to a few well-connected individuals who could find the deal flow. Today, digital platforms, including small ones like Propel(x) are making Angel investing more accessible than ever before. We explain how the platform works, and how prospective angel investors should approach the platform.Quick Summary

- Syndicated investments in early-stage startup companies

- Invested in high-tech companies with huge growth potential

- Many companies won’t have a successful exit, but those that do typically take 5 to 7 years

Propel(x) Details | |

|---|---|

Product Name | Propel(x) |

Min Investment | $5,000 |

Investor Fee | 2% platform fee for syndicated opportunities a 7.5% fee |

Open To Non-Accredited Investors? | No |

Promotions | None |

What Is Propel(x)?

Propel(x) is a relatively small company that syndicates Angel investment opportunities. As of June 2022, the company has raised $32 million for 100+ startups. Investors who use the platform can invest in deep technology startups that have massive potential for gain, but could also fall flat.

What Does It Offer?

Propel(x) is a digital investment platform that allows accredited investors to invest in high-growth potential startups. Companies on the platform have the potential to become investment unicorns and yield massive returns. But, as with investing in general, this isn’t always the case. There is the likelihood of companies that will inevitably fail.

Invest in Syndicated Startup Investments

Propel(x) curates startups that are in the early stages of fundraising. Most of the companies featured on the platform have some unique technology component that could allow for incredible growth over time. Investors can directly invest in these startups, or they can participate in syndicated investments. Every deal has a slightly different structure depending on factors including which funding series the company is seeking and how mature the company is.

Available to Accredited Investors

Investments on the Propel(x) platform are only available to accredited investors. These are people who earn more than $200,000 per year or have more than $1 million in net worth (excluding their primary home).

A $5,000 investment minimum

Syndicated investments on the Propel(x) platform require a $5,000 minimum investment. Investors also pay a 7.5% upfront fee on any investments they make on the platform.

Highly Illiquid Investments

Startups have an extremely risky investment profile. According to Propel(x), most money is locked up for 5 to 7 years on average. Startups that have a successful exit pay handsomely, but they do so without regard to investor timelines.

Are There Any Fees?

Yes. Propel(x) charges both investors and the startups seeking funding.

- Investors who directly invest in a company pay a 2% platform fee.

- Investors who opt for syndicated opportunities have to pay a 7.5% upfront investment fee.

- They also pay 10% of the investment funds if there is a successful exit from the platform.

High Fees And High Risk

If you're the type of investor who is okay with a lot of risk, Propel(x) could be an exciting investment opportunity for you. However, if you tend to be cautious when diversifying your investment portfolio, you may want to give Propel(x) more thought and research before you dive in.

Compared to other types of investments out there, these are relatively hefty fees considering they're volatile investments.

How Does Propel(x) Compare?

So far, Propel(x) has raised just $32 million for 100+ startups. The company, which was founded in 2013, seems to have a very low deal flow.

As of June 2022, they've had a few notable exits:

- zPredicta - acquired by Predictive Oncology, (POAI)

- MoQuality - acquired by SNAP

- Tissue Analytics - acquired by Net Health

- Drastin - acquired by Splunk (SPLK)

- Deep Space Industries - acquired by Bradford Space

- Intellivision - acquired by Nortek Security and Control (NSC)

- Abtum acquired by undisclosed

- Smoltek AB - IPO on the Swedish stock exchange (SMOL)

Header |  | |

|---|---|---|

Rating | ||

Min Investment | $5,000 | $500 to $10,000 (or as little as $200 per company with Auto Invest) |

Term | 5-7 years | 5+ years |

Fees | 2% platform fee | 2% processing fee per investment (up to $300) |

Cell |

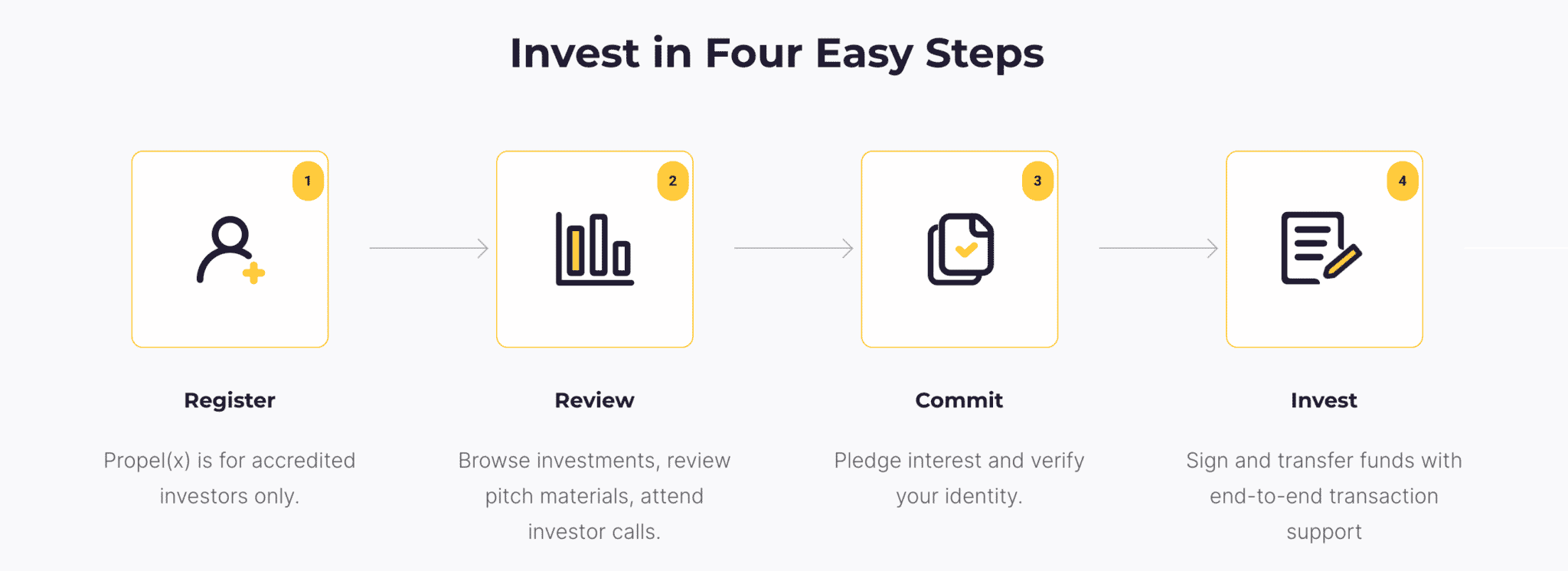

How Do I Open An Account?

Signing up for an investment account at Propel(x) is very simple. Just go to the investment website and create a user profile. You must confirm your accredited investor status. After that, you have access to Propel(x) and its curated deal flow.

Interested customers can have an onboarding call with the Propel(x) team to learn more about how to evaluate opportunities and look for deals on the platform. Accountholders have no obligation to fund a deal.

Is It Safe And Secure?

From a money movement perspective, Propel(x) seems to be a safe company.

Accountholders don't necessarily have to fund any deals on the Propel(x) website. If you choose to invest in a startup, you will sign a commitment, but are not required to fund the deal until the appropriate commitment amount has been achieved.

Funds are then collected and held in escrow until they are invested.

That said, angel investing in startups is a risky investment class. It’s possible to lose all your money on any given investment. Angel investment often becomes a numbers game, so that you can see a few huge payoffs make up for the massive losses incurred by other investments.

How Do I Contact Propel(x)?

Propel(x) has an online chat that is staffed by people most of the week. This is likely the best place to get information about the company.

Prospective customers can also send questions to info@propelx.com.

Is It Worth It?

Propel(x) is a small platform with a limited number of high-risk investments. Most people should not lock up their money in these types of investments. However, people who want to put a small portion of their net worth into these extremely risky deals should consider Propel(x) and other investment platforms. Investing in many startups increases the likelihood that several will pay off.

Propel(x) Features

Account Types |

|

Minimum Investment | $5,000 |

Investor Fees |

|

Other Costs to Be on Propel(x) |

|

Investor Requirements |

|

Diversification Options | Invest in up to 40 startups |

Investment Term | 5 to 7 years |

Investing Funding Options |

|

Share Redemption Program | None |

Secondary Market | None |

Customer Service Options | Chat and email |

Customer Service email | info@propelx.com |

Mobile App Availability | None |

Web/Desktop Account Access | Yes |

Promotions | None |

FAQ Page |

Propel(x) Review

-

Pricing & Fees

-

Ease of Use

-

Customer Service

-

Products and Services

-

Diversification

-

Liquidity

Overall

Summary

Propel(x) is a digital investment platform that allows accredited investors to invest in high-growth potential startups.

Pros

- No fees on the standard retail platform

- Allows investors to invest in a range of notes

- Asset returns are typically not directly correlated to the stock market

Cons

- Must be an accredited investor

- Requires some amount of active investment

- $500 minimum investment per note

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Colin Graves