When you're making just about any bank transaction, you’ll need to provide a bank account number. This typically includes both the bank routing number and bank account number.

But there are multiple types of bank account numbers. And if you've never had to locate them before, it may take a minute of two to track them down. This is especially true if you don't have any physical checks lying around your house.

In this guide, we'll explain each of the types of numbers that are connected to your bank account. And we'll also lay out the multiple ways to find them when you need them.

What Is Your Bank Account Number?

First, it's helpful to understand that there are three potential numbers you’ll need to keep tabs on in a bank transaction process. These include the routing number, SWIFT code, and your account number. Let’s take a closer look at each.

Routing Number

Routing numbers are assigned to individual banks. Each banking institution has its own unique routing number, but not each individual customer at those banks.

Many (or all) customers at a financial institution will share the same routing number. Some of the largest banks have multiple routing numbers though based on location or account type. So, for example, a Chase Bank customer located in California may have a different routing number assigned to their account than the one that's assigned to a Floridian Chase Bank customer's account.

In some cases, you may see the routing number referred to as the ABA number. That stands for the American Bankers Association. The ABA issues routing numbers to federal or state charted financial institutions.

SWIFT Code

You may need to provide a SWIFT code if you're dealing with international money transfers. A SWIFT code is an eleven-digit number that identifies international banking institutions.

The eleven digits are composed of a four-letter bank code, a two-letter country code, a two-digit location code, and an optional three-digit branch code. This code helps keep track of where money is coming from in a transfer.

Account Number

Finally, your bank account number is a unique series of numbers that identifies your account. Typically, account numbers range between eight to twelve digits.

If your account number is in the wrong hands, bad actors could potentially authorize a transfer of funds out of your account. So these numbers are especially important to safeguard.

Where To Find Your Bank Account Number

Now that you know the basics of bank account numbers. it's time to learn where you can find these three different numbers. Luckily, there are a few different places to look for this information.

Physical Checks

If you happen to have physical checks around the house, it can be the easiest place to look for your bank account number and routing number. Importantly, this is the one place you won’t find a SWIFT code.

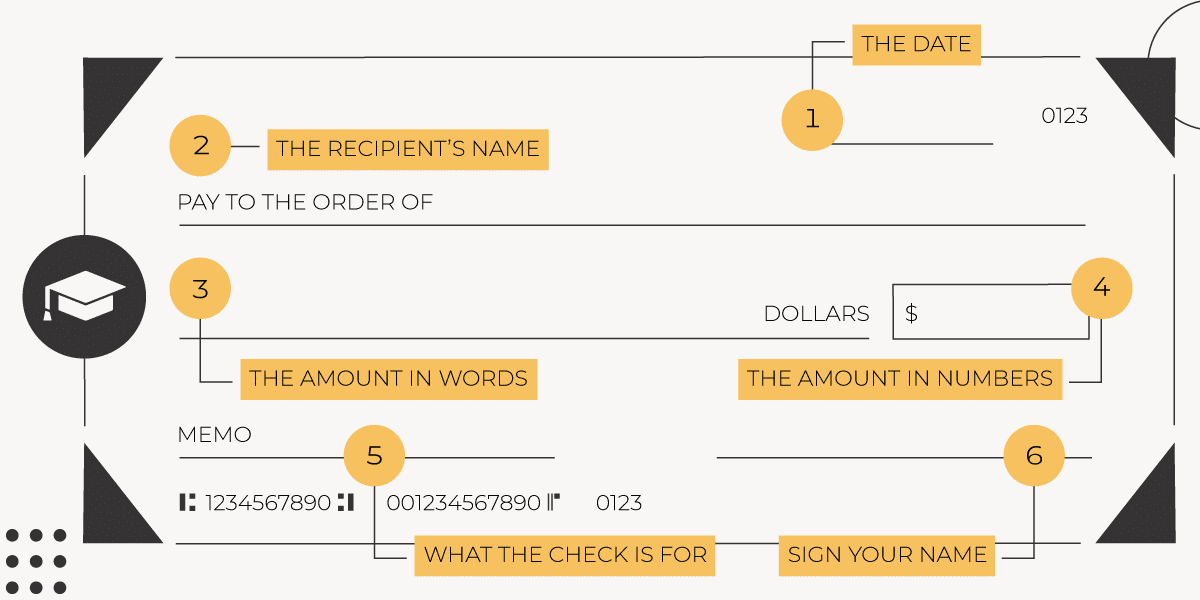

With your check in hand, you’ll typically find your nine-digit routing number in the bottom left corner of the check. After the routing number, you’ll see your account number.

Don’t let those last few digits confuse you! The final set of numbers of your check is just the check number.

Bank Account Statement

Whether you receive a paper bank account statement in the mail or receive paperless versions, you can find all of the account numbers you need. The exact placement of your account number will vary from bank to bank. But typically, this important information is near the top.

Bank Online Portal

Online banking portals can make life easier in so many ways. That includes when you need to find your bank account numbers. Simply log into your bank’s online portal. Once you're in, you’ll need to poke around to find your account number.

Different banks place the information in different places. But in some cases, you’ll see your account number right before your account name. In others, you may need to head to the account details area.

By default, many banks will only show the last few digits of your bank account number preceded by Xs. For example, you may see something like this: XXXX-XXX-1234.

Banks do this for privacy purposes so that if you happen to log in to your bank account's online portal in a public place, your full account numbers won't be visible. In most cases, you can simply click on the account number to unmask the hidden digits.

Need More Help? Call Or Visit Your Bank

Another way to find your bank account numbers is to give your bank a call. You can simply ask the automated service or representative something like "What's my SWIFT code?"

Note that you may need to provide additional information (such as security pins or passphrases) to receive your account number over the phone.

Finally, you can head to your local branch if you need more help. Be prepared to present appropriate identification to obtain the account numbers you're searching for.

Protect Your Bank Account Numbers

The routing number and SWIFT codes of any financial institution are readily available to all customers. You may even find these numbers on the home page of a bank or credit union.

But your bank account number is more confidential. Once you find your account number, make sure to keep it to yourself.

Never share your sensitive financial information with someone you don’t know. Additionally, take the time to scan over your bank transactions regularly. If you see something that you didn't authorize, contact your bank right away.

Final Thoughts

You can use your bank account numbers to facilitate banking transactions easily. Once you find the numbers you need, you can set up bill pay or direct deposit, both of which can make it easier to automate your financial life.

In the past, many people kept physical checks or handwritten notes handy to keep track of their bank account numbers. But thankfully with the advent of online banking, this information is now usually only a few taps or clicks away. Check out our favorite online banks here >>>

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller