Writing a check might seem obsolete or even unnecessary to most millennials in light of all the technological advancements in payment options these days.

In fact, a study by Wepay showed that 52% of millennials have never used a check. On the other hand, 72% of small business owners still prefer to receive cash and checks as payments as opposed to card payments. Additionally, a lot of landlords still take checks as their preferred form of rent payment.

What does this mean?

It means that while check-writing is in fact eventually going to die, checks are very much still in use and so it is important that everyone learns to write them correctly.

Although writing a check sounds simple, people do mess it up all the time.

In this post, we will go over how to write a check properly as well as give you free check-writing alternatives.

How to Write a Check

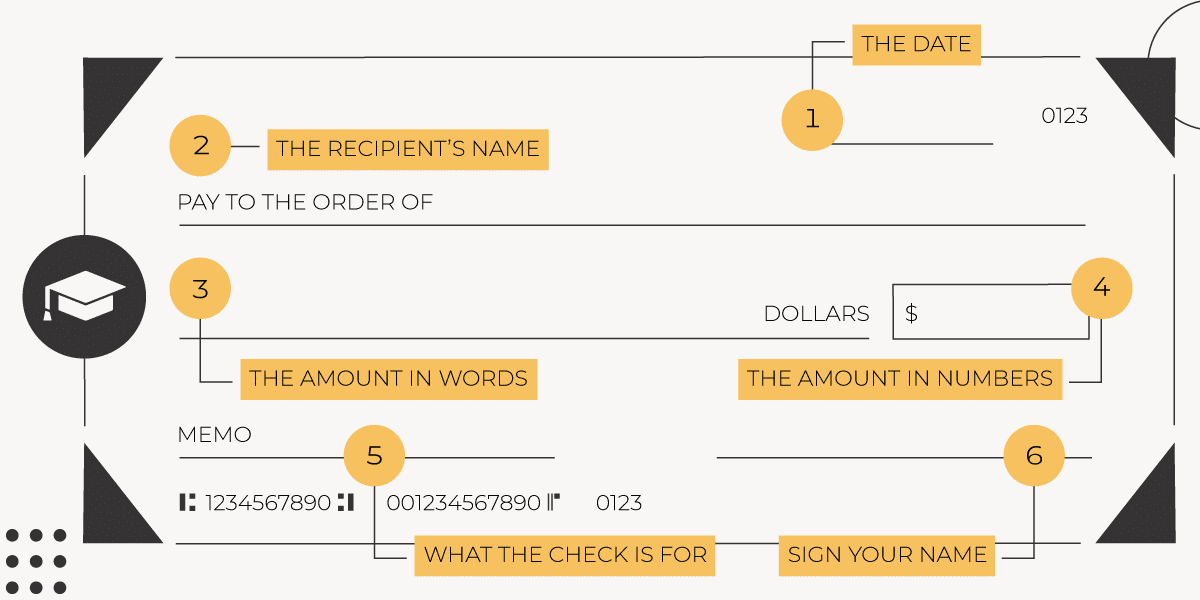

There are six steps to filling out a check correctly.

1. Write the Date

It’s important for you to write the date on the check for a few reasons.

First, it indicates when funds will become available in your bank account so that the recipient can cash the check. If for some reason you don’t have money in the account but still need to write the check, you can put a future date and communicate with the recipient that the money will be in your account on a particular date. (Hint: It is always just better to have the money in your account before you write a check.)

Second, placing a date on the check helps you keep a record of when the money went out.

2. Write the Recipient’s Name

The next line on the check allows you to write the recipient’s name. Write the legal name of the person or company you are making the check out to.

If you don’t write the legal name or the name that is on record with the person’s bank, it is possible that the check will be rejected. Nicknames will not work. When in doubt, ask the recipient what name should be placed on the check.

3. Write the Amount in Words

And this is where all those exercises in first grade on how to write numbers in words comes in handy. If you are writing a check for $50 you will indicate that by writing “Fifty and 00/100.” Some people prefer to write “Fifty ONLY.” It’s your choice.

The point of writing the amount in words is to remove any ambiguity as to the amount being received.

4. Write the Amount in Numbers

After writing the amount in words, you will write the amount in numbers in a box that is typically at the line where you wrote the recipient’s name.

5. Write What the Check Is For

Your check will have an area at the bottom left-hand corner that will say “For” or “Memo.” This is where you can indicate what the check is for. So for instance, if it is for rent, you will write “Rent” in this space.

If you're using a check to send a payment (for like a credit card), I like to write my account number in this spot so if your check gets separated from your payment stub, it's easier to line up.

6. Sign Your Name

The last thing you will do once all the other areas of your check are filled out will be to sign your name. Your recipient will not be able to cash or deposit the check if you don’t sign it, so make sure you do.

Follow these simple steps and you will be a check-writing master.

Free Check-Writing Alternatives

You just learned how to fill out a check properly, but you still hate the idea and want to know if there are check-writing alternatives?

Well, if your recipient is willing to receive payment without a check, then yes! Writing a check comes without transaction fees, so let’s look at a few ways you could send money to someone without writing a check.

Online BillPay: Most free checking accounts offer free Online BillPay. What most people don't realize is that you can use Online BillPay to send a check to a person (not just using it to pay bills with an account number). Say, you need to send your landlord a rent check? In BillPay, you simply enter their name and address, and your landlord will get a paper check from you!

PayPal: While PayPal does charge transaction fees to send money, if you are sending the money via the “friends and family” option, it is free.

Venmo: If you send someone money using Venmo and your transaction is funded by your Venmo balance, a bank account, or debit card, their 3% transaction fee is waived.

Zelle: Several banking apps including those from Bank of America, Capital One, Wells Fargo, Ally, and PNC Bank use Zelle to help you send money to people and pay for services from within their app.

Bank wire transfer/intra-bank transfer: Sending money by wire transfer if you and the recipient share the same bank may be free in some instances.

Also, you might check out these Google Pay alternatives that could be helpful!

All of these are easy and fast and don’t require you to get the date right or put the person’s legal name on a check. And they are free.

Related: The Best Money Transfer Apps (Domestic and International)

Closing Thoughts

It might be a few years before checks are completely obsolete and phased out.

For the time being, however, writing checks may be necessary when dealing with certain business entities.

In that case, we have shown you in this post how to properly fill out a check so that your payments are not late or your check is not bounced.

Do you still use checks or are you 100% digital when it comes to money?

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller