Source: The College Investor

How much your student loan interest rate really matter when it comes to repaying a student loan? What is the impact of interest rates on loan payments?

The truth is: not that much.

One of the most popular "alternatives" to blanket student loan forgiveness has been the argument that the federal student loan interest rate should be set to 0%. But given the wide array of student loan forgiveness programs and other assistance - does your student loan interest rate really matter?

Let's look at how the interest rate impacts your student loans.

Related: Utilize Our Free Student Loan Calculator To Check Your Loan Payment Amount

Don't Double My Rate

Back in 2006, the Democrats included a pledge to slash student loan interest rates in half as part of their “Six for ‘06” mid-term election campaign promises. When it came time to implement this pledge, they limited it to just subsidized Federal Stafford loans for undergraduate students and phased in the interest rate reduction. They cut the interest rates from 6.8% over a four-year period, to 6.0% then 5.6% then 4.5% and last to 3.4%.

The legislation was set to sunset in 2012, returning the interest rate to 6.8%. This led to the “Don’t Double My Rate” campaign. After all, if student loan rates were a winning issue for one election, why not use the issue for another election?

Some borrowers reacted to the prospect of a doubling of the interest rates on new student loans by saying that they could not afford to have their student loan payments double.

But, doubling the interest rate on a student loan does not double the monthly student loan payments.

Doubling the interest rate on a federal student loan increases the monthly loan payment by only about 10% to 25% on a 10-year term. For this particular situation, an increase in the interest rate from 3.4% to 6.8%, the loan payments would have increased by 17% assuming a 10-year repayment term.

Impact Of Student Loan Interest On Payments

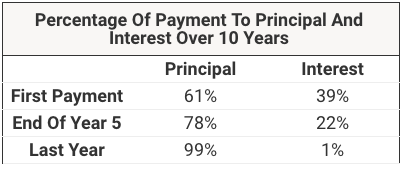

Like most loans, the monthly loan payment is applied first to interest and last to principal. Interest starts off as a big share of the monthly loan payment in the first years of repayment. But, as you make progress in paying down the debt, interest represents a smaller share of each month’s loan payment.

For example, a $10,000 loan at 5% interest with a 10-year repayment term has a monthly payment of $106.07. Of the first month’s payment, $41.67, or about 39%, is applied to the new interest that has accrued. By the end of the fifth year, the interest portion of the monthly loan payment has dropped to $23.76, or about 22%. By the last year of the loan, the interest has dropped to less than 5% of the monthly loan payment, decreasing to less than 0.5% of the last payment.

Averaged across the entire repayment term, however, interest is just 21% of the monthly loan payments.

Source: The College Investor

For the typical range of interest rates on federal student loans, interest represents only about 10% to 20% of the monthly loan payment on a 10-year term.

On a 25-year term, interest represents about 25% to 40% of the monthly student loan payment.

Student loan payments are applied first to the interest that has accrued since the last payment, second to the principal balance of the loan. So, the lower monthly student loan payment from a longer repayment term means that progress in paying down the loan balance is slowed, since less is applied to the principal balance. More of each payment is applied to interest, since the interest portion of the loan payment does not change. The total interest paid over the life of the loan is also higher.

Related: How Much Money Does The Government Profit On Student Loans

Impact Of The Student Loan Interest Deduction

The cost of student loan interest is offset somewhat by the student loan interest deduction. Up to $2,500 in interest paid on federal student loans and most private student loans can be deducted on the borrower’s or cosigner’s federal income tax returns. It is taken as an above-the-line exclusion from income, so the student loan interest deduction can be claimed even if the taxpayer does not itemize.

The deduction starts phasing out at $70,000 and $145,000 in income for single and joint filers, and is fully phased out at $85,000 and $175,000. It is not available to married borrowers who file tax returns as married filing separately.

Based on IRS Statistics of Income data, 12.7 million taxpayers claimed the student loan interest deduction in 2019, a total of $14.1 billion. That works out to an average of $1,112 per taxpayer. Since the 22% tax bracket is the maximum tax bracket eligible for the full student loan interest deduction, that means the average taxpayer saved up to $245 on their federal income tax return. The maximum potential savings was $550 if the borrower paid $2,500 in interest and was in the 22% tax bracket.

Borrowers who qualified for the payment pause and interest waiver during the pandemic may have had little or no interest eligible for the student loan interest deduction from 2020 through 2023. So, the IRS Statistics of Income reports for these years, which are not yet available, may be much lower than in 2019.

Impact Of Income-Driven Repayment Plans

Given that income-driven repayment plans set the monthly loan payment as a percentage of your discretionary income, interest does not play into the affordability of repaying your student loans under these plans.

Especially considering that, at the end of the repayment term, any remaining balance is forgiven. And with new plans like SAVE, any interest accrued beyond the monthly payment is forgiven.

Considering that upwards of 50% of student loan borrowers utilize income driven repayment plans, the interest rate on these student loans is moot.

The Impact Of Interest On The Affordability Of Student Loan Debt

The most significant problem with student loan affordability is the amount of debt, not the interest.

Of course, if you stretch out the repayment term as long as possible, you will pay more total interest over the life of the loan. Doubling the repayment term more than doubles the total interest paid over the life of the loan. A longer repayment term sustains the loan balance at a higher level by reducing the portion of each payment that is applied to the principal balance of the loan. It also charges interest for a longer period of time.

But, regardless of the interest rate and repayment term, you still have to repay the amount borrowed.

Even if the interest rate were permanently set at zero, you’d still have to repay the loan’s principal.

Government grants have not kept pace with increases in college costs. This shifts the burden of paying for college from the federal and state government to the families. Since family income has been flat for decades, families do not have more money to pay for college costs. They are forced to choose between sending their children to lower-cost colleges, such as from private colleges to public colleges and 4-year colleges to 2-year colleges, or borrowing more to pay for the higher college costs.

As the average amount of debt at graduation has increased, more students are graduating with an unaffordable amount of student loan debt each year.

If total student loan debt at graduation exceeds the borrower’s annual income, they will struggle to afford the monthly loan payments on a 10-year repayment term. They’ll have to choose a longer repayment term, such as extended repayment or income-driven repayment.

Mark Kantrowitz is an expert on student financial aid, scholarships, 529 plans, and student loans. He has been quoted in more than 10,000 newspaper and magazine articles about college admissions and financial aid. Mark has written for the New York Times, Wall Street Journal, Washington Post, Reuters, USA Today, MarketWatch, Money Magazine, Forbes, Newsweek, and Time. You can find his work on Student Aid Policy here.

Mark is the author of five bestselling books about scholarships and financial aid and holds seven patents. Mark serves on the editorial board of the Journal of Student Financial Aid, the editorial advisory board of Bottom Line/Personal, and is a member of the board of trustees of the Center for Excellence in Education. He previously served as a member of the board of directors of the National Scholarship Providers Association. Mark has two Bachelor’s degrees in mathematics and philosophy from the Massachusetts Institute of Technology (MIT) and a Master’s degree in computer science from Carnegie Mellon University (CMU).

Editor: Robert Farrington Reviewed by: Chris Muller