If you have federal student loans, that monthly payment can easily feel like a burden. The CARES Act gave those with federal student loans a welcome break from making payments throughout the turbulent economic fallout of the pandemic.

However, another benefit that many didn't realize is, if you made payments on your student loans during the last 24 months, you can ask for a refund of your payments.

Let’s take a closer look at what you need to know about getting a refund of your federal student loans - and whether you should consider it.

CARES Act And Student Loan Payments

If you are a borrower with federal student loans, the CARES Act stepped in to pause your federal student loan payments when the pandemic disrupted the economy. Not only did the new legislation pause your payment due dates, but it also set the interest rate on your loan to 0%.

The benefits began on March 13, 2020. After multiple extensions, these benefits are currently available through August 30, 2023.

If you decided to continue making payments to your federal student loans after March 13, 2020, that would effectively help you get out of debt faster. But there was no obligation to keep up with your payments during this system-wide pause.

What Student Loans Are Eligible For A Refund?

The last three years have been a rollercoaster ride. Your income may have expanded, contracted, or both in recent months due to the rapidly changing economy. With that, you may want to get a refund on those extra student loan payments due to a change in your financial situation.

If you made a student loan payment during the suspension period, you are eligible for a Department of Education refund. Specifically, the loan must meet the following requirements:

- Federal student loans only. Private student loans aren’t eligible for a refund.

- Direct loans and Dept. of Education held FFEL loans only. Commercially-held FFEL loans don't qualify.

- Payment window. You can only receive a refund on student loan payments made between March 13, 2020, and the end of the payment pause (which is August 30, 2023).

If you made student loan payments before the start date of March 13, 2020, those payments wouldn’t be eligible for a refund.

How To Get A Refund Of Your Federal Student Loan Payments

If you want to get a refund on your federal student loan payments, here’s how to create your student loan refund request.

Gather Payment Information

The first step is to track down which payments you want to have refunded.

Look for the payment amount and the date of your payment. If you made the payment between March 13, 2020, but before the end of the payment pause in August 2023, it is eligible for a refund.

Most servicers will require proof of payment. So, get a copy of your online student loan payment history, your bank statements showing the transaction, or a payment confirmation email.

Talk To Your Loan Servicer

Once you have the details about the payments you’d like refunded, it’s time to reach out to your loan servicer. Let them know that you’d like a refund on eligible payments.

Depending on your servicer, you may be able to reach out over the phone. That might be the best option because this is a relatively unique request.

But an email/secure message will work too. Here’s a template to use when making your request:

To whom it may concern:

I am eligible for a student loan payment refund due to the CARES Act. I’d like my payments made from X date to X date refunded. Let me know if you need any additional information. Thank you!

After you hear back from the servicer, they should let you know how the payment will be processed. Typically, the servicer will send the refund back via the original payment method. So, if you made a payment via your checking account, the funds should be deposited there.

Timing

Once your refund request is received and processed by your loan servicer, it will be sent over to the Treasury Department for processing.

It will likely take 4-6 weeks from when you first request your refund until you get payment into your bank account.

Should You Ask For A Refund?

A refund on your student loan payments isn’t always the best option. After all, if you get a refund now, you’ll eventually have to pay back those funds later.

Let’s explore when pursuing a student loan refund makes sense.

Financial Hardship

A lot can happen in two years.

Your financial picture may have been stable in March 2020. At that point, continuing to make payments on your student loans throughout the pause may have made sense for your financial goals.

But if life has thrown some challenges your way, your financial picture may look dramatically different now. For example, a job loss or increase in your everyday expenses may make it difficult to make ends meet.

If you are experiencing financial hardship, those student loan payments could really come in handy right now. With that, pursuing a refund might be the right move.

You Are Seeking Loan Forgiveness

If you are seeking a student loan forgiveness option, then a refund on your student loan payments is the most financially efficient option. That's because the months of forbearance allowed by the CARES Act will continue to count towards your forgiveness eligibility. As such, by making payments on your loans, you're giving the government extra money that likely would be forgiven!

"Never give the government extra money!"

For example, if you are pursuing forgiveness through the Public Service Loan Forgiveness program, each month of Public Service Employment from March 13, 2020 through the end of the payment pause will automatically count for PSLF - making a payment won’t make a difference. So, there’s no reason to pay more than you need to.

Other Opportunities

This option is more risk, but could you use the money for another opportunity - such as buying a house or investing?

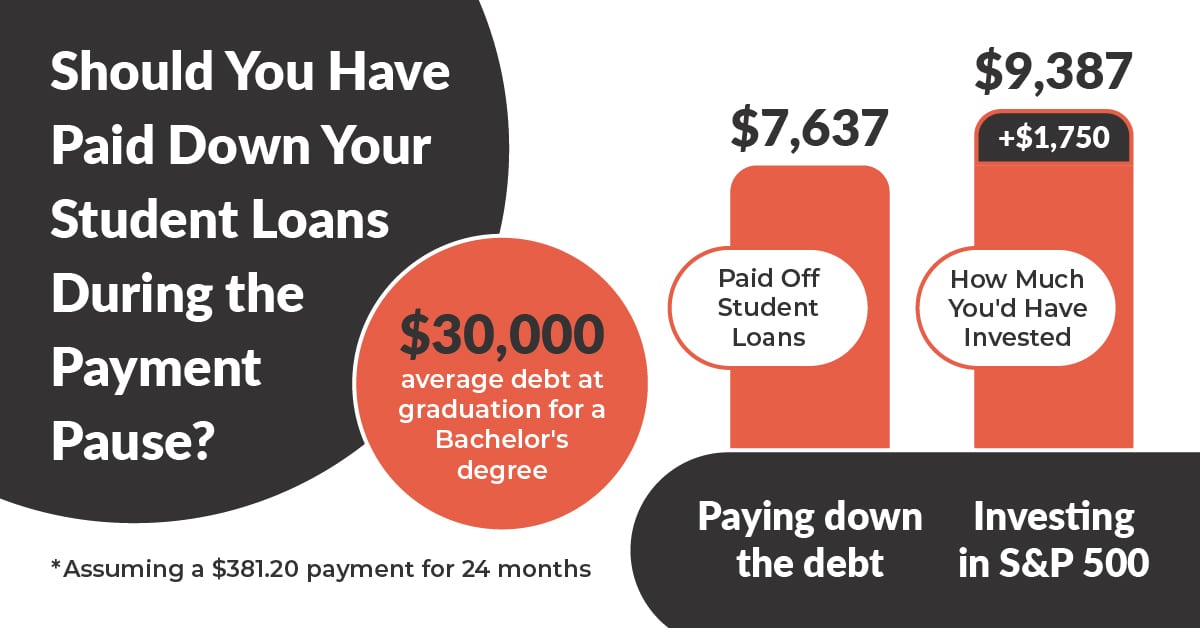

We recently ran the numbers on Whether You Should Have Paid Down Your Student Loans Or Invested during the pandemic - and the average student loan borrower would have been $1,750 richer if they had invested their loan payment dollars instead of giving them to the government.

However, you can't change the past - so making the switch to investing today could be a different story. The stock market is in a much different place, and we are likely much closer to the end of the repayment pause (though some argue it's possible to extend the repayment pause forever).

Final Thoughts

If you made federal student loan payments from March 13, 2020 through the end of the payment pause in August 2023, the CARES Act states that you are entitled to a refund if you want it.

The refund is a worthwhile possibility for those who need the funds now or want to take advantage of a forgiveness option. But if your finances are in a good position and you aren’t pursuing forgiveness, you may want to hold off on this influx of cash and enjoy the fact your loans are paid down a bit.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller