Parents of college-bound children who are considering high-cost private non-profit colleges often wonder how to qualify for institutional merit grants. These grants may or may not really be based on merit, but rather function as a discount on the cost of attendance.

Students who want to increase their chances of receiving an institutional merit grant at a private non-profit 4-year college should apply to moderately selective colleges (especially higher-cost colleges), have stellar grades and test scores, pick wealthy parents, do not take a gap year and enroll in college full-time.

We look all the statistics of which students are getting institutional merit grants.

Average Institutional Grants

Based on data from the 2015-16 National Postsecondary Student Aid Study (NPSAS), 80% of students at private non-profit 4-year colleges receive grants, an average of $15,820 per recipient. But, this includes grants from sources other than the college itself, such as Federal Pell Grants.

More than half of the students (57%) receive institutional grants, an average of $16,027. This includes institutional merit-only grants (36%, $12,060), institutional need-based grants (31%, $12,354) and institutional non-need grants (13.3%, $6,289). Combining the institutional merit-only and non-need grant categories, 44% receive institutional non-need and merit-only grants, an average of $12,008.

The institutional non-need grants include institutional grants that are not based on need or merit, such as tuition and fee waivers for faculty and staff.

The institutional merit-only grants theoretically are based on some type of merit, such as academic or athletic talent, but may also include other criteria, such as the student’s status as a full-pay student.

So, more than a third (36%) of students at private non-profit 4-year colleges get institutional merit-only grants, an average of $12,060 per recipient. The median is $11,000. A quarter of the students who receive institutional merit grants get $16,000 or more and 10% cent $21,600 or more.

Which Colleges Award Institutional Merit Grants

The most selective colleges, such as Harvard, Princeton and MIT, do not award institutional merit grants. All of their financial aid is awarded based on financial need, not merit.

The next tier down, however, award some institutional merit grants. They use the grants as a recruiting tool to attract wealthy students and talented students.

Of the students receiving institutional merit grants at private non-profit 4-year colleges, 22% are enrolled at very selective colleges, 69% at moderately selective colleges, 6% at minimally selective colleges and 3% at open admission colleges.

The odds of receiving an institutional merit grant at a private non-profit 4-year college are 30% at very selective colleges, 52% at moderately selective colleges, 19% at minimally selective colleges and 9% at open admission colleges. These figures are overall averages. The odds of receiving merit grants varies by college within each category.

The average merit grant also varies by type of college, from $13,853 at very selective colleges to $7,730 at open admission colleges, probably correlating with the cost of attendance.

Private non-profit 4-year colleges that offer online classes are less likely to offer institutional merit grants (45% vs. 21%). This is especially true of colleges that provide their entire program online (44% vs. 4%).

Grants Based On Academic Merit

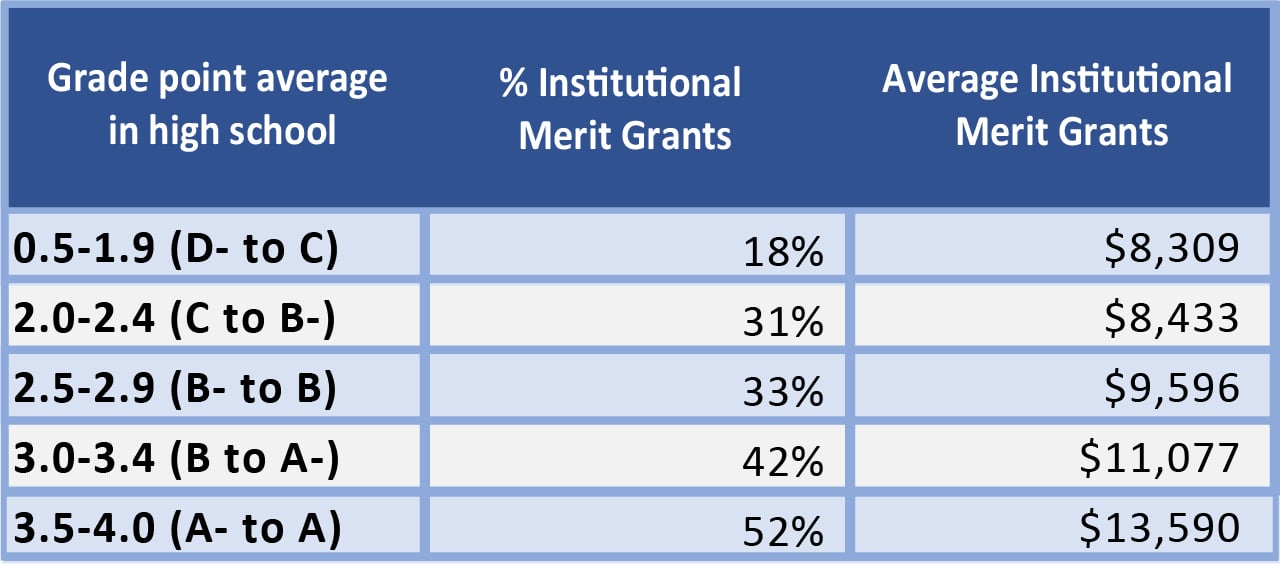

This table shows that more than half of students with a 3.5 to 4.0 high school grade point average (GPA) receive institutional merit grants. But, it also shows that even students with a less than 2.0 GPA can receive institutional merit grants.

Of students who receive institutional grants, more than half (58%) have a 3.5 to 4.0 GPA, a quarter (27%) have a 3.0 to 3.4 GPA, 9% have a 2.5 to 2.9 GPA, 5% have a 2.0 to 2.4 GPA, and 1% have less than a 2.0 GPA.

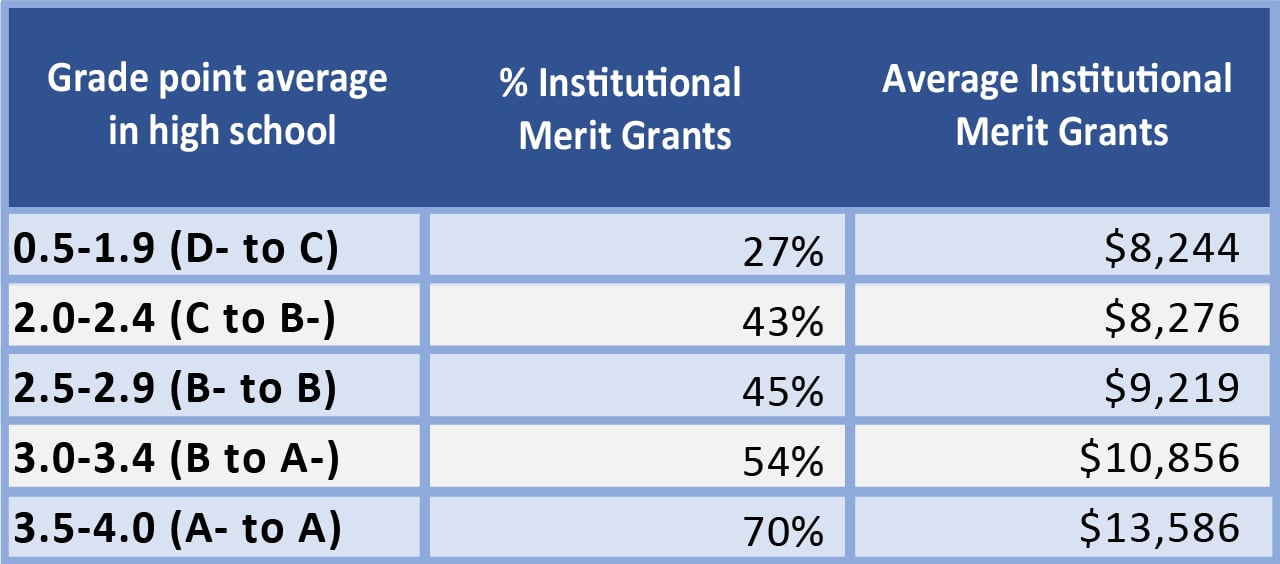

This table shows similar statistics, but limited to moderately selective private non-profit 4-year colleges. The percentages receiving institutional merit grants are higher, although the average merit grant is similar.

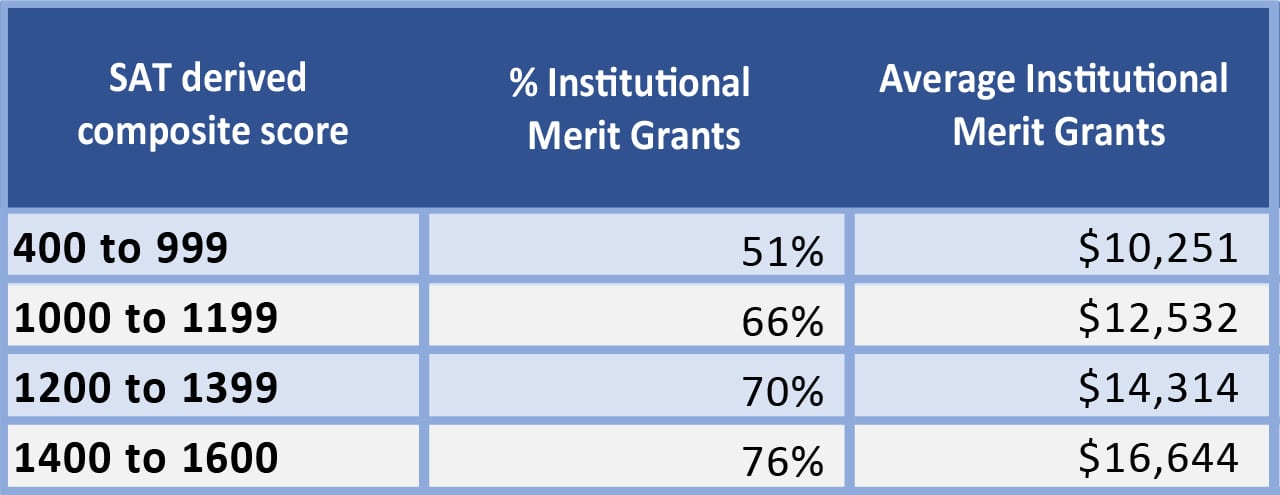

This table shows that SAT test scores do not correlate well with the likelihood of receiving institutional merit grants at private non-profit 4-year colleges. The average grant does increase with higher test scores, perhaps because the students enroll at more expensive colleges.

Of the students receiving institutional merit grants, a third (33%) have below-average SAT test scores, 40% have SAT test scores of 1000 to 1199, 22% have SAT test scores of 1200 to 1399 and 5% have SAT test scores of 1400 to 1600.

The lower percentage of students with a 1400 to 1600 SAT test score who receive institutional merit grants may be due to these students being more likely to enroll at more selective colleges.

This table limits the data to moderately selective colleges, demonstrating that students with better test scores are more likely to receive institutional merit grants.

Thus, students with better SAT test scores are more likely to receive institutional merit grants, unless they enroll at very selective colleges.

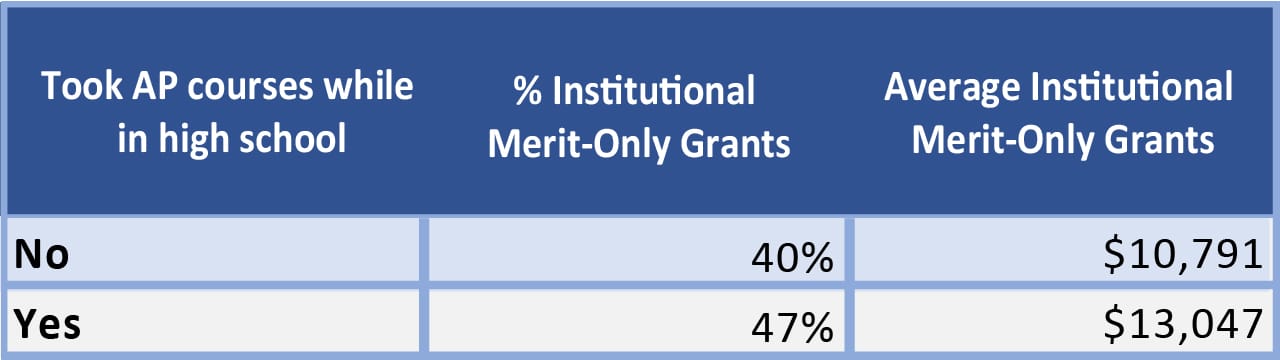

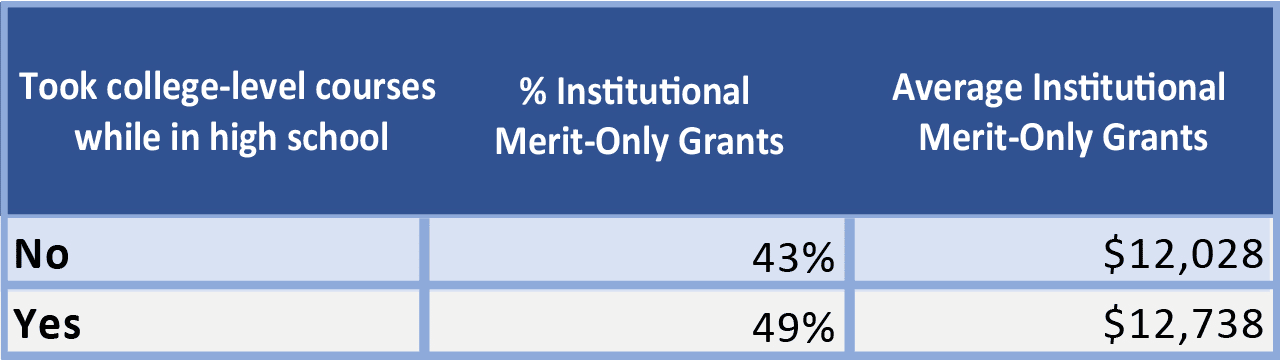

These tables show that students who take AP classes or college-level classes while in high school are slightly more likely to receive institutional merit grants.

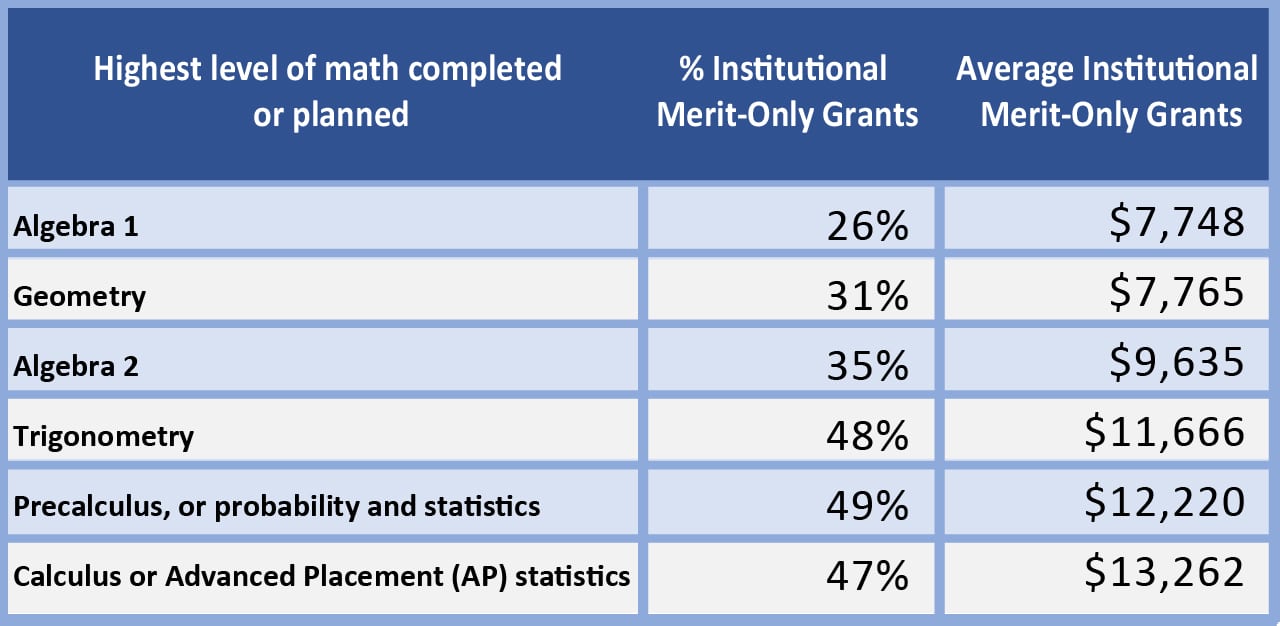

This table shows that students who take more advanced math classes in high school are more likely to receive institutional merit grants. They also receive larger grants.

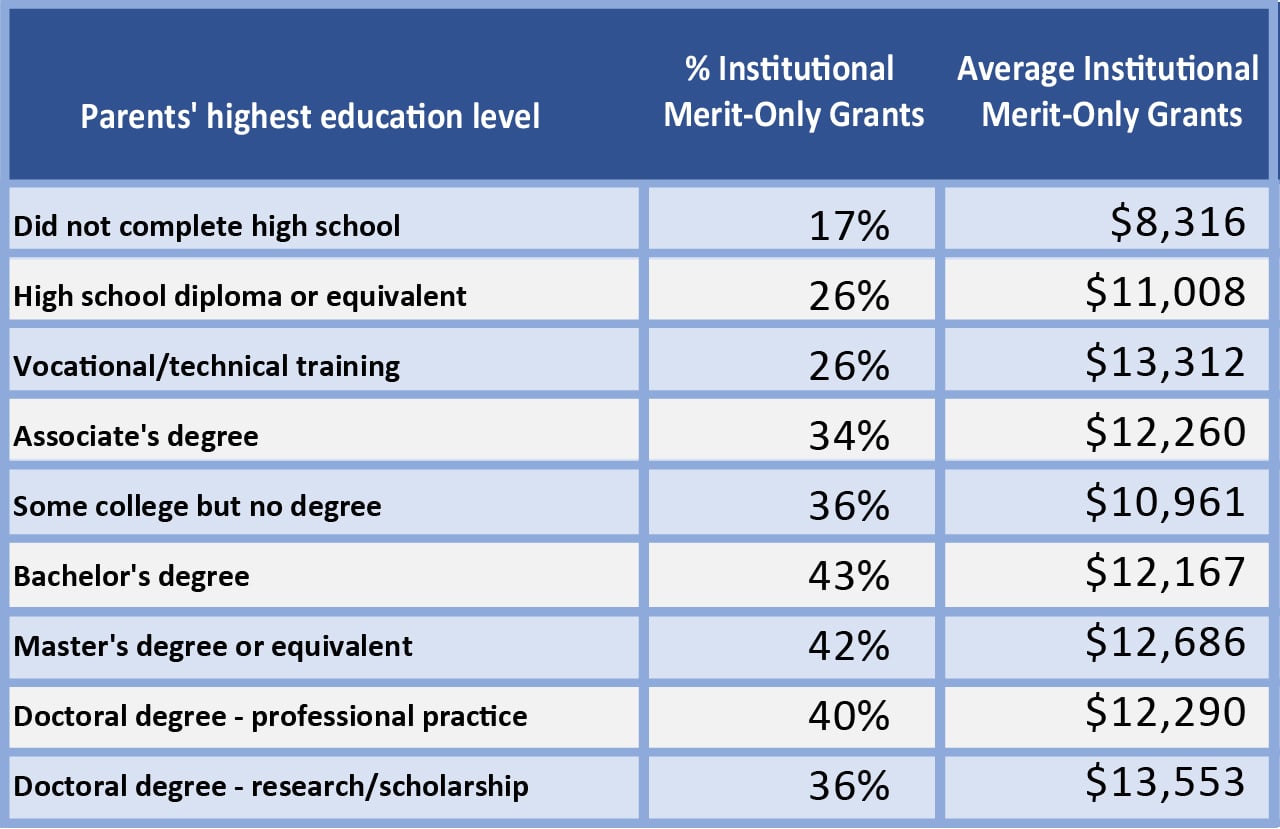

This table shows that students whose parents have a more advanced education are more likely to receive institutional merit grants and larger grants.

Grants Based On Income

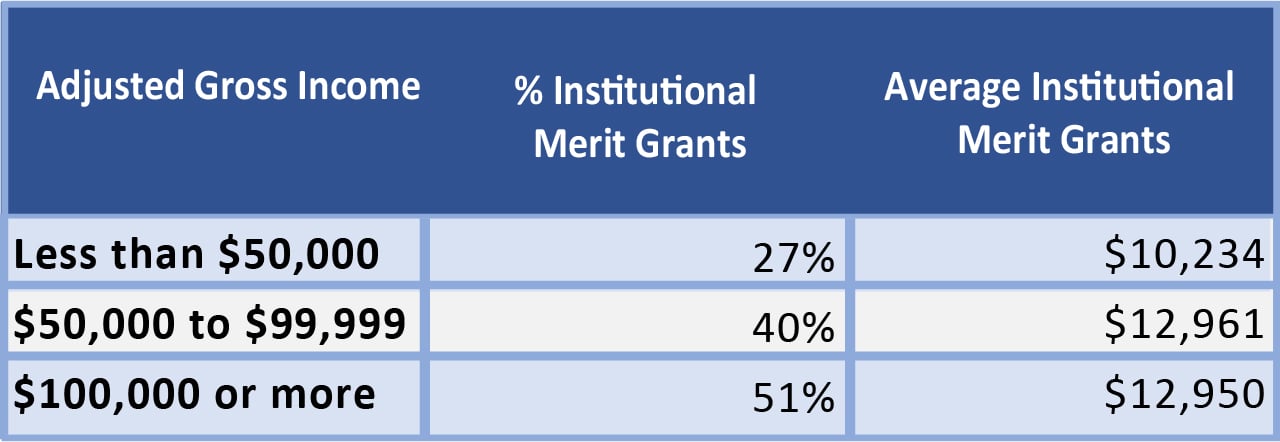

Students from wealthier families are more likely to receive institutional merit grants at private non-profit 4-year colleges, as shown in this table.

Of the recipients of institutional merit grants, a third (32%) are low-income, a quarter (27%) are middle-income and 41% are high-income.

Grants Based On Cost Of Attendance

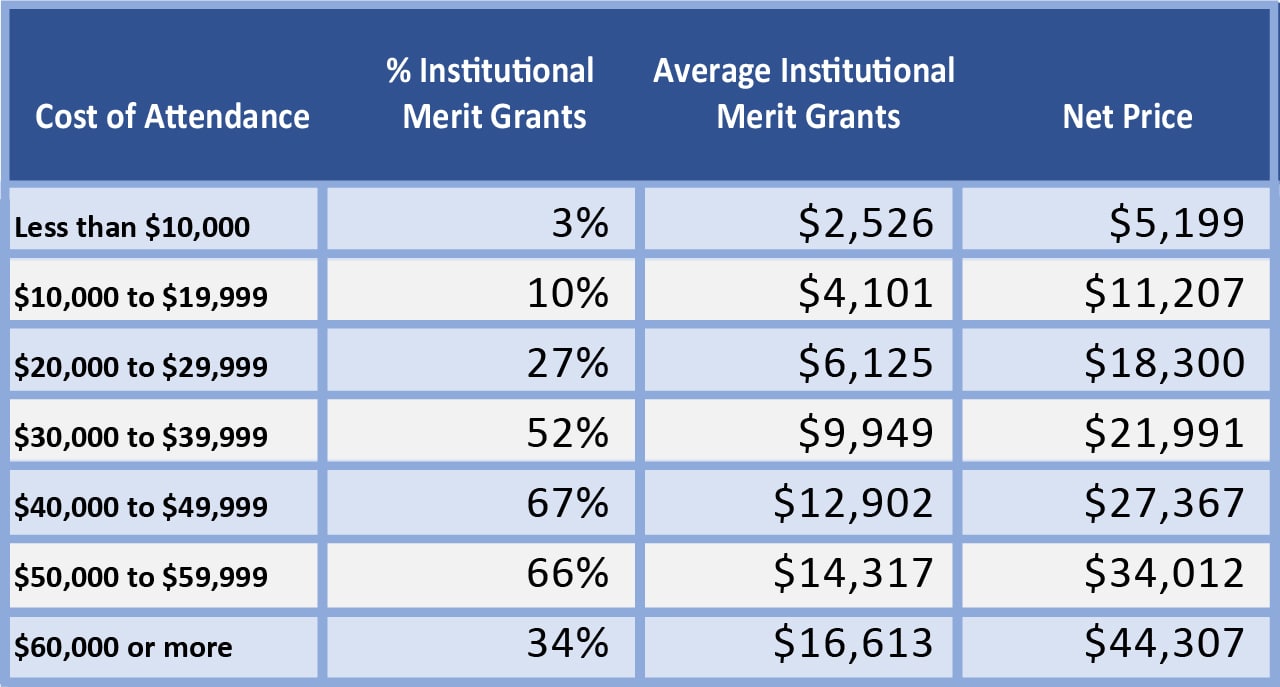

This table shows how the percentage receiving institutional merit grants and the average grant increase as the cost of attendance increases. Wealthier colleges have more money available to provide institutional grants. However, a parent still pays more at a high-cost college that gives out an institutional merit grant of $10,000 or more than at a lower-cost in-state public college.

The percentage receiving institutional merit grants does decrease at the most expensive colleges, which may include some of the most selective colleges that do not award institutional merit grants, dragging down the percentage.

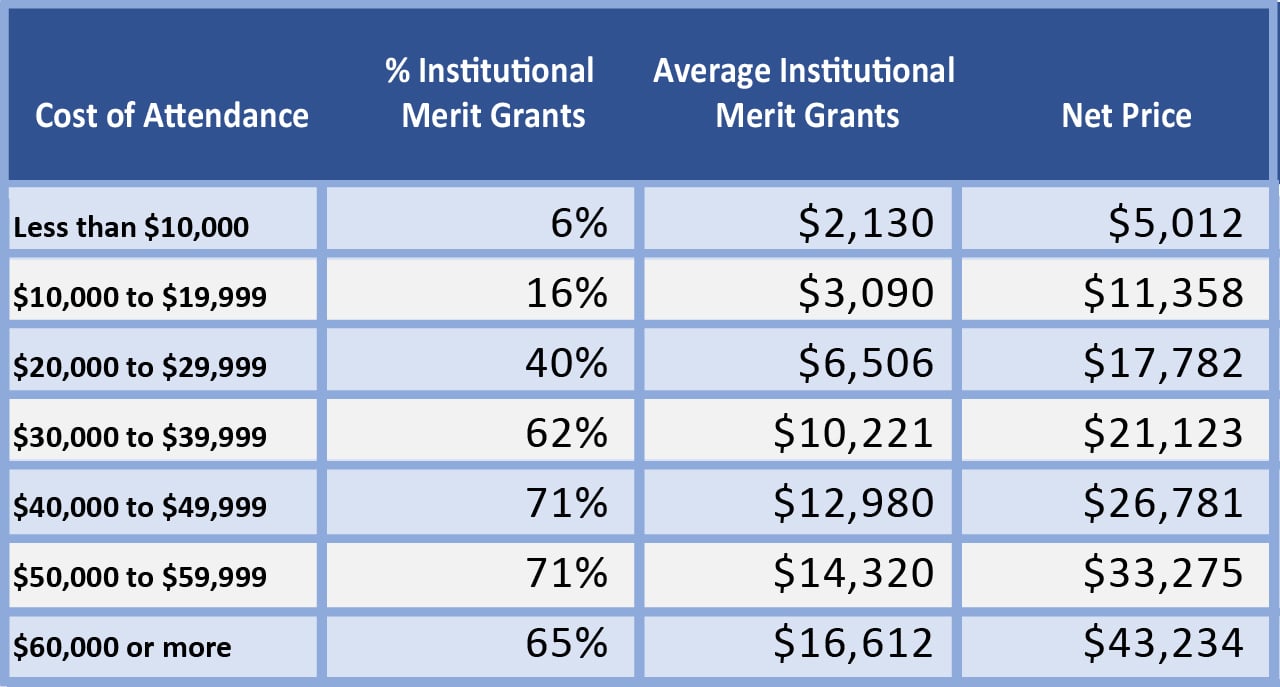

This table shows the same data limited to moderately selective colleges. The percentage receiving institutional merit grants still decreases at the most expensive colleges, but not as much.

Grants Based On Gender And Race

Men and women are equally likely to receive institutional merit-only grants, and the average award amount is about the same.

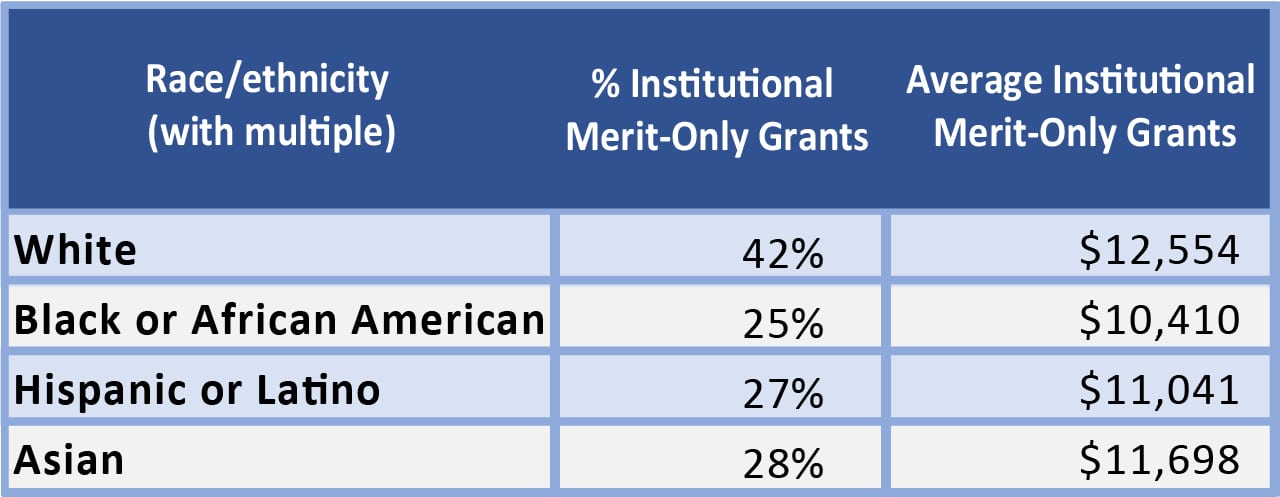

This table shows that White students are more likely to receive institutional merit-only grants than minority students. They also receive larger grants.

Grants Based On Enrollment Status

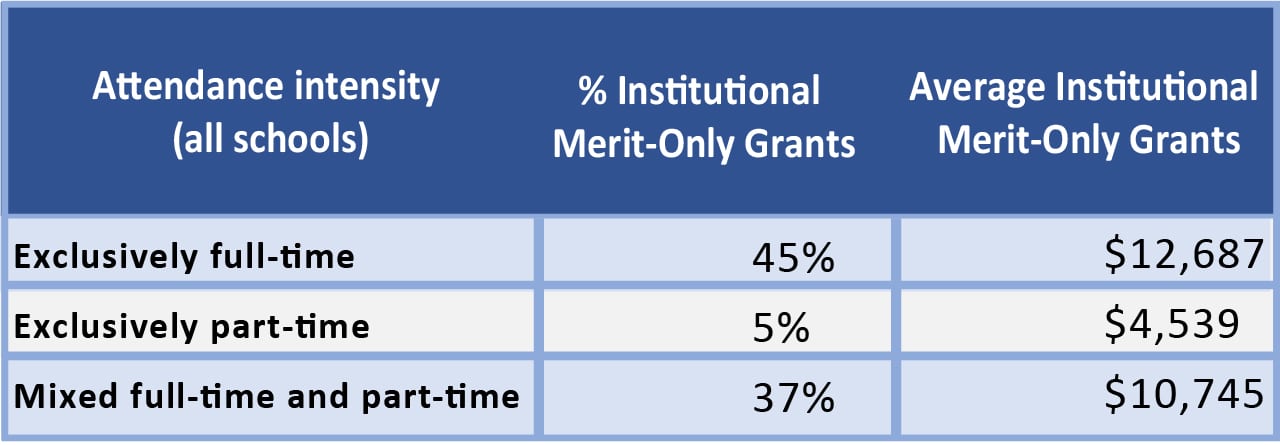

This table shows that students who enroll full-time are much more likely to receive institutional merit grants than students who enroll part-time.

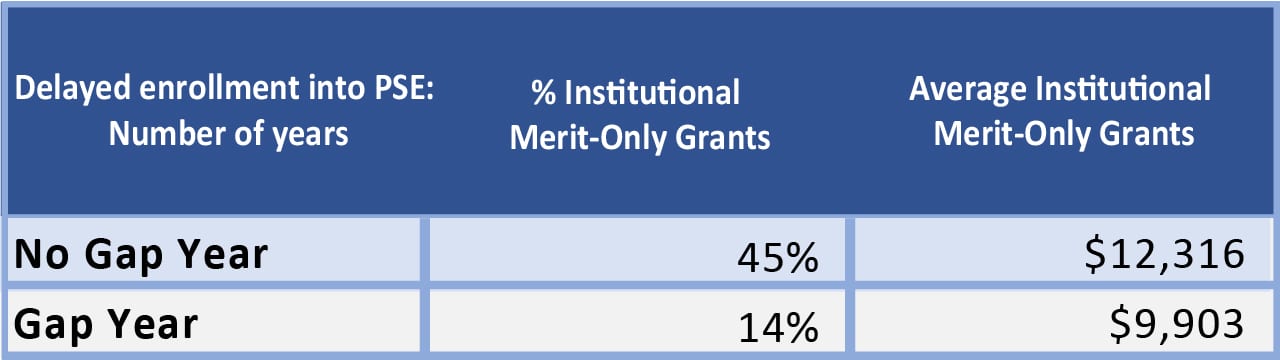

Students who take a gap year are much less likely to receive institutional merit grants, and the grants are lower.

Grants Based On Dependency Status

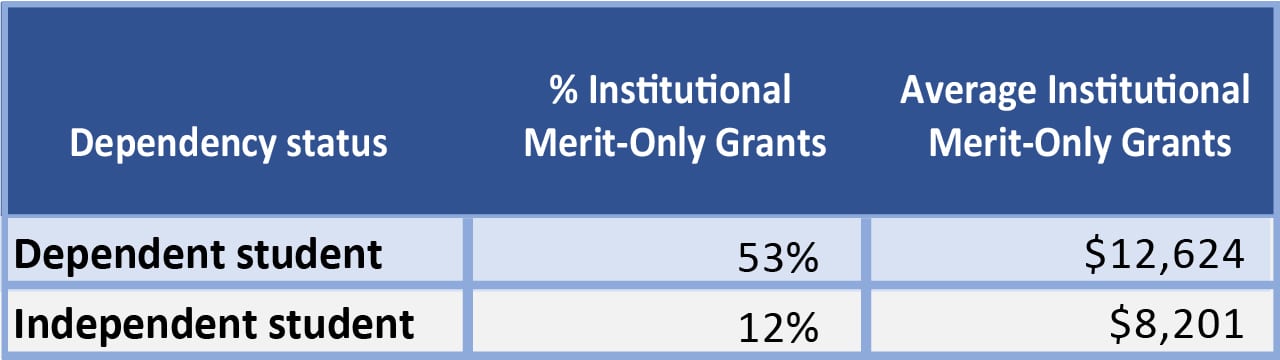

This table shows that dependent students are more likely to receive institutional merit-only grants than independent students. They also receive larger grants.

At moderately selective colleges, 66.8% of dependent students and 18.9% of independent students receive institutional merit-only grants.

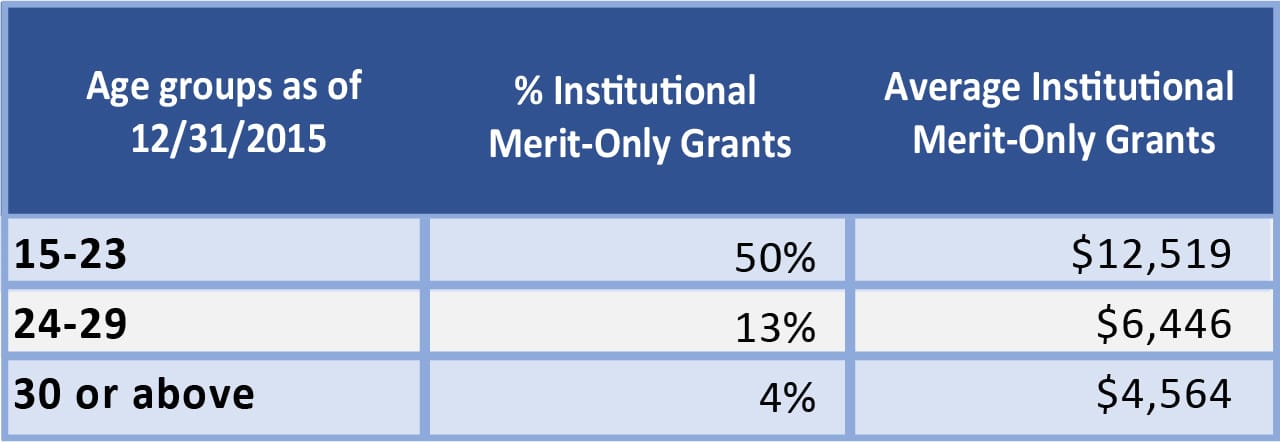

This table shows a similar result when the data is based on the age of the student. Students age 24 and older are automatically independent.

This table shows that veterans are less likely to receive institutional merit grants. Veterans are automatically independent. They are also less likely to enroll in Bachelor’s degree programs.

Related: Guide To VA And Military Education Benefits

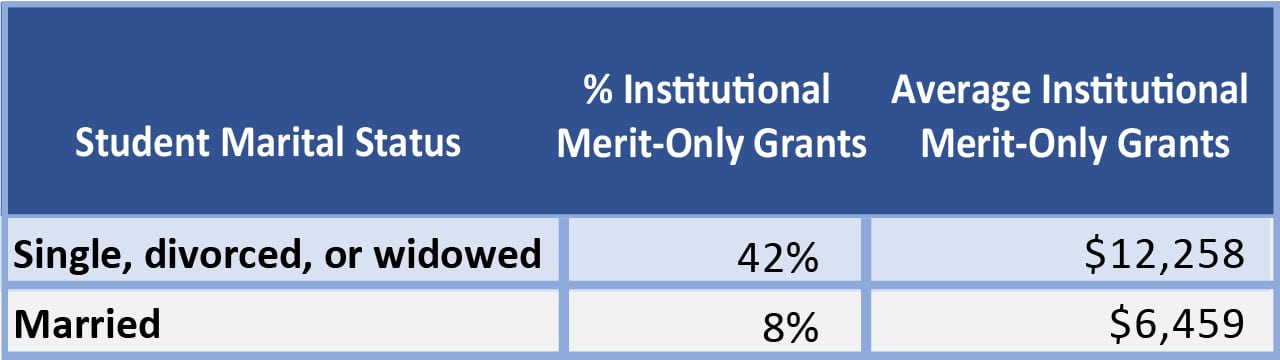

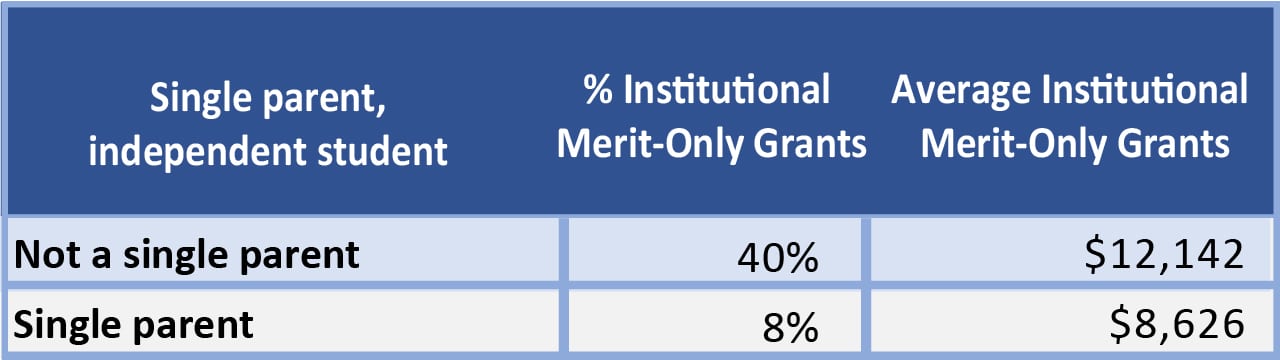

The next two tables show that students who are married are less likely to receive institutional merit grants. Married students and students with dependents are automatically independent.

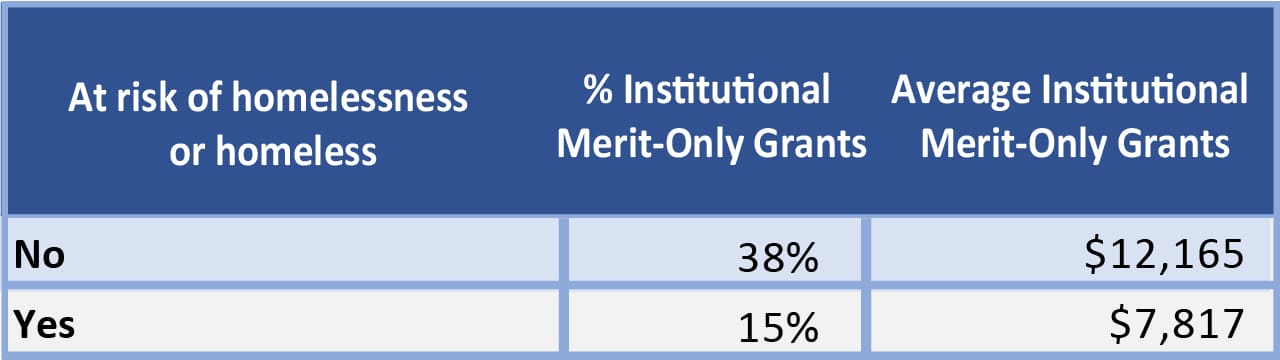

This table shows that homeless students are less likely to receive institutional merit grants. Homeless students are automatically independent.

Grants Based On Financial Need

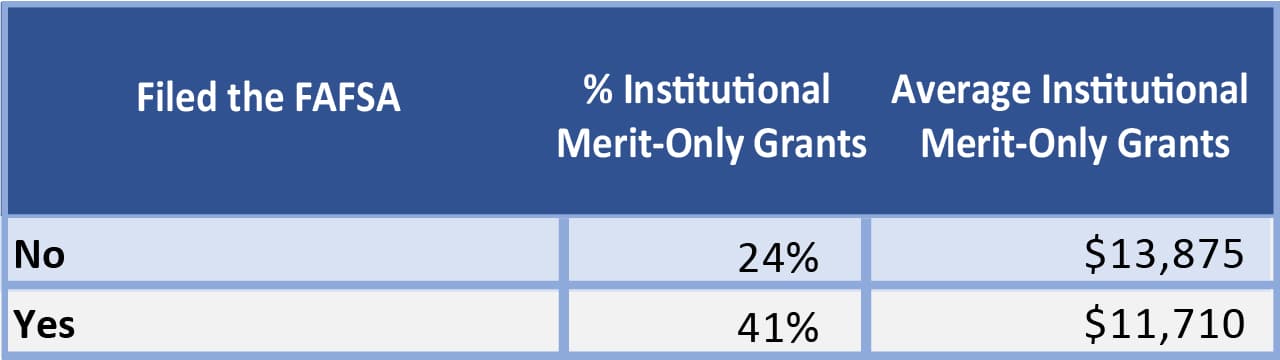

This table shows that students who file the FAFSA are more likely to receive institutional merit grants.

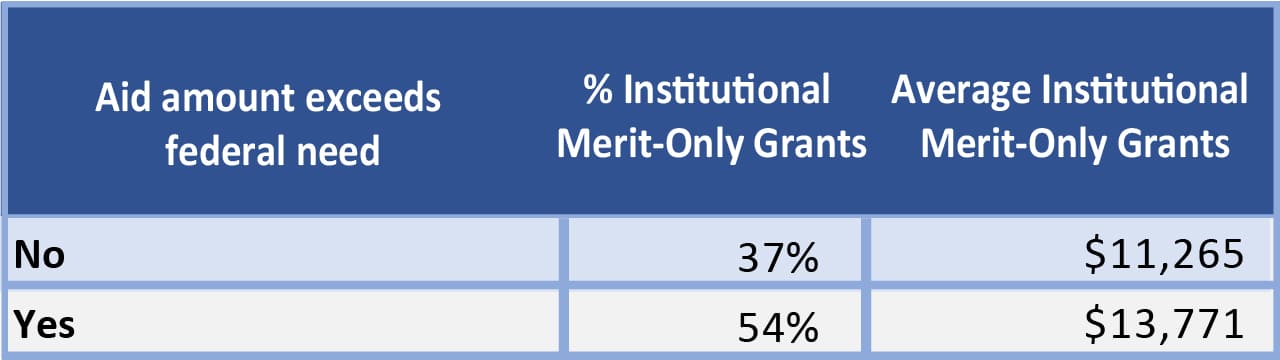

This table shows that students whose financial aid exceeds their financial need are more likely to have received institutional merit grants.

Mark Kantrowitz is an expert on student financial aid, scholarships, 529 plans, and student loans. He has been quoted in more than 10,000 newspaper and magazine articles about college admissions and financial aid. Mark has written for the New York Times, Wall Street Journal, Washington Post, Reuters, USA Today, MarketWatch, Money Magazine, Forbes, Newsweek, and Time. You can find his work on Student Aid Policy here.

Mark is the author of five bestselling books about scholarships and financial aid and holds seven patents. Mark serves on the editorial board of the Journal of Student Financial Aid, the editorial advisory board of Bottom Line/Personal, and is a member of the board of trustees of the Center for Excellence in Education. He previously served as a member of the board of directors of the National Scholarship Providers Association. Mark has two Bachelor’s degrees in mathematics and philosophy from the Massachusetts Institute of Technology (MIT) and a Master’s degree in computer science from Carnegie Mellon University (CMU).