Student loan default doesn’t mean your credit is ruined for life. While missed payments and a default will show up on your credit report and certainly do decrease your credit score, there are steps you can take to get the default removed.

Along the way, you’ll be repairing your credit.

If you're in default, though, you need to take steps to get back on track. Student loan default is not pretty - it can mean wage garnishments, student loan tax refund offsets, and more. Your student loan debt can even get you fired from your job.

In this article, we’ll cover five easy steps to help you get out of student loan default.

Important Update: President Biden announced the Fresh Start program to help borrowers in student loan default get a "fresh start" after student loan payments resume in 2023. It's essential that you call or go online to take action and get out of default before collection activity resumes in 2024.

Fresh Start

The Fresh Start program is an initiative to help those in student loan default get a fresh start. To qualify for Fresh Start, you must be in default on an Federal Direct Loan, Federally-held FFEL loan, or Federally-held Perkins Loan.

If you qualify, you must make payment arrangements by visiting myeddebt.ed.gov or by calling the Default Resolution Group at 1-800-621-3115. When you payment arrangements, their loans will be transferred to a new loan servicer and the default status will be removed from their credit reports.

Your payment arrangement can be an income-driven repayment plan. You must take action during the 12 month grace period or collection activity will resume.

1. Decide on Loan Rehabilitation, Loan Consolidation, or Paying in Full

These are the three paths for getting out of student loan default. Deciding which one to use is the first step to getting out of default.

Those steps are:

- Paying off the student loan balance in full

- Student loan consolidation

- Student loan rehabilitation

The fastest way is to pay off your student loans in full. For many, this is usually not practical. The next two options are loan rehabilitation and loan consolidation.

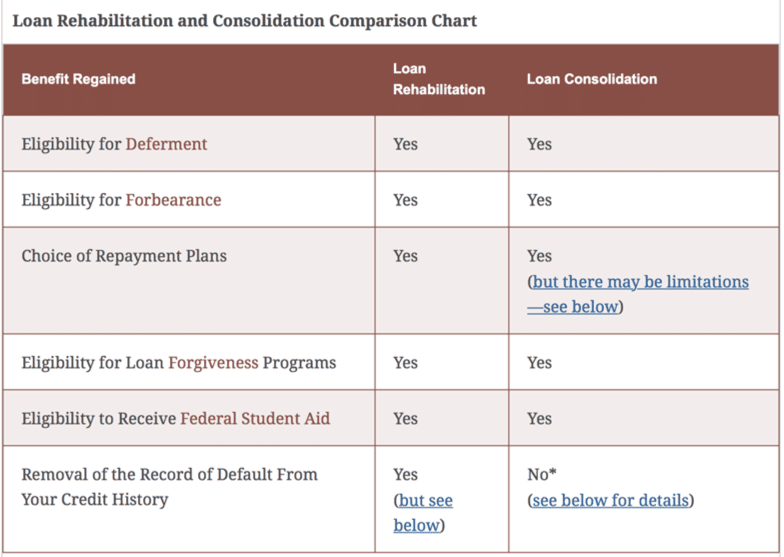

Loan consolidation doesn’t remove the default from your credit report and there can be limitations on repayment plans. One advantage of loan consolidation is that it’s much quicker than loan rehabilitation. The chart below summarizes these differences.

Given the disadvantages of loan consolidation, this article will focus on loan rehabilitation.

Be aware that student loan rehabilitation can only be used once. It’s important to make sure you are financially ready, which is what we’ll cover next.

2. Prepare Your Finances

You’ll need to make consistent, on-time student loan payments for a set period of time. It’s important that your finances be in order so you don’t miss any payments. Preparation is the key.

In preparing for your student loan payments, you may need to make a few changes in your lifestyle. For example, eating out less, not going to the movies as much, and maybe even moving in with your parents temporarily, all in an effort to allocate more money to student loan payments.

If you aren’t already using some type of financial software, now may be a good time. It will help you better create a plan for the next 10 months while you are making rehabilitation payments. You’ll also be able to track expenses and income more easily and compare them against your payment budget. Such detailed tracking will remove any guesswork and give you exact numbers to work with.

3. Contact Your Loan Servicing Company

Even though you have a government student loan, your payments will often go to a servicer who is managing the loan on behalf of the government. You’ll want to let your loan servicer or holder know that you’re wanting to enter into loan rehabilitation.

Your loan servicer will also determine your monthly payment amounts. Depending on your financial situation, you can work with your loan holder to try and get the payment amount decreased.

You student loan may also be with a debt collector if you've been in default a long time. Here's the student loan debt collectors and how to find your loans.

4. Make Nine Voluntary, Reasonable, Affordable Monthly Payments

You can find the necessary forms for loan rehabilitation here. After you’ve completed your application and have been notified that it’s been approved, you’ll begin making payments.

The required payment will be based on your financial situation. You must make 9 consecutive payments in 10 months and each payment must be within 20 days of the due date. Once you have completed the nine payments, the default will be removed.

Your wages are probably already being garnished in order to meet student loan payments. Garnishment will still occur even while you are making the nine required payments. This is why the second step is critical to the success of meeting all nine payments.

Your budget will have to take in your regular nine payments plus any wage garnishment payments.

5. Take Action After the Final Payment

Now that you’re in loan rehabilitation and making payments, ensure you never miss a payment by signing up for automatic payments. Auto payments will draft your payment from your bank account by the due date every month. No more forgetting to make a payment. Just be sure that your bank account always has enough in it to cover your monthly loan payment.

If you’d like to see how much you owe and confirm your payments are being processed, you can log in here.

On a final note, be vigilant and stay on top of your loan holder as your application is being processed. Simply meaning, confirm and verify everything you are able to. The Consumer Financial Protection Bureau (CFPB) found problems with intermediaries or loan holders in processing applications. Complaints from students included delayed applications and higher monthly payments than those that were negotiated.

“This matches what I have been seeing on the ground,” Adam Minsky, a lawyer specializing in student debt, told The Washington Post of the CFPB’s findings. “During rehabilitation, I see an array of issues and problems that could derail borrowers — irregularities in calculating a borrower’s monthly payment, failure to deduct payments properly . . . failures to lift wage garnishment orders.”

Final Thoughts

Getting out of default is the best thing you can do if you haven't been making your student loan payments. Student loan rehabilitation is a great way to make it happen, but the other options are good as well.

What's important is, after you're back on track, you make every effort to pay off your student loans faster and make positive progress. Make sure you never fall back into student loan default again.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller