The Private College 529 Plan is a prepaid tuition plan from CollegeWell, an independent collective of nearly 300 private colleges and universities.

Most 529 prepaid tuition plans are offered by the state for in-state public colleges, with the Private College 529 Plan being the only one offered by a network of private colleges.

With the Private College 529 Plan, you buy Tuition Certificates that are worth a specific percentage of the current year’s tuition and fees. These certificates cover nearly 300 colleges nationwide, which means you're saving for all colleges in the plan.

The percentage of savings will vary by college, based on the tuition rates in the year the Tuition Certificate was purchased. The redemption value of a Tuition Certificate is based on the current tuition rate at each participating college.

Guarantees

Participating colleges guarantee that they will accept the Tuition Certificates as payment of tuition and required fees, even if they subsequently leave the plan.

In other words, you can use the Tuition Certificates for pay for tuition and required fees at a college or university that was in the plan when you purchased the Tuition Certificate, even if it is no longer participating.

Limitations

Tuition Certificates can only be used to pay for tuition and required fees. You cannot use them to cover other costs, such as housing, meal plans, transportation, books, supplies and equipment.

The following time limits also apply:

- Tuition Certificates must be purchased at least 36 months before they can be redeemed to pay for tuition and required fees. So, if you time the purchase right, you can buy Tuition Certificates just before the start of the freshman year to pay for the senior year, providing a hedge against inflation. (The plan year runs from July 1 to June 30.)

- Tuition Certificates must be held for at least 12 months before a refund may be requested, with an exception for the death of the beneficiary.

- Tuition Certificates expire 30 years after the issue date, at which point the account owner will receive a refund.

Refund Amount

The amount of a refund is the total contributions adjusted for net investment returns, capped at a maximum increase or loss of 2% per year (or 0% loss after July 1, 2024), compounded annually. According to the disclosure document, “The Refund Amount is not designed to provide a meaningful rate of return.”

If a student goes to a non-participating college, they will receive the refund amount toward tuition and required fees at the non-participating college.

Despite claims that there is no direct exposure to stock market volatility, a family that seeks a refund or sends the beneficiary to a non-participating college will be affected by a damped version of stock market gains and losses.

Note that state 529 college savings plans can be used to pay for any college, public or private. Investors in state 529 college savings plans receive the full return on investment, which is likely to be higher than the 2% cap on the Private College 529 Plan.

Contribution Limits

The maximum contribution limit is the cost of five years of full-time tuition and required fees at the most expensive participating college. This is $346,650 for the 2023 - 2024 academic year.

The contribution limit applies to all Tuition Certificates for the same beneficiary, even if they have different owners. You can use five-year gift tax averaging (super-funding) to make contributions to the plan.

The minimum initial contribution is $25, but the account owner must contribute at least $500 in the first two years after opening the account, or the contributions will be refunded to the account owner.

Thus, the minimum contribution is $500, which can be paid in installments as low as $25 over the first two years.

Contributions may be made manually, through automatic transfers from a bank account, through payroll deduction and through a lump sum contribution.

Participating Colleges

There are currently 295 member colleges.

Some of the more well-known member colleges include:

- Amherst College

- Berklee College of Music

- Boston University

- Brandeis University

- California Institute of Technology (Caltech)

- Carnegie Mellon University

- Case Western Reserve University

- Chatham University

- Claremont McKenna College

- Duke University

- Emory University

- George Washington University

- Georgetown University

- Hampshire College

- Harvey Mudd College

- Hiram College

- Johns Hopkins University

- Massachusetts Institute of Technology (MIT)

- Oberlin College

- Occidental College

- Pitzer College

- Pomona College

- Rensselaer Polytechnic Institute (RPI)

- Rice University

- Sarah Lawrence College

- Scripps College

- Sewanee: The University of the South

- Skidmore College

- Stanford University

- Stevens Institute of Technology

- Syracuse University

- University of Chicago

- University of Notre Dame

- University of Southern California

- Vanderbilt University

- Vassar College

- Wellesley College.

Flexibility

The Private College 529 Plan offers flexibility. You don’t have to choose a college at the time the Tuition Certificates are purchased, and State residency is not required.

You can change the owner of a Tuition Certificate to a family member, and a successor owner can be specified in case the owner dies.

You can change the beneficiary to a member of the family of the old beneficiary. Upromise Rewards can be linked to this plan, and distributions can be made to the college or the account owner, but not the beneficiary.

Impact on College Admissions

There is no guarantee of admission or graduation for a beneficiary of a Tuition Certificate. Member colleges may not discriminate in favor of or against a prospective student because of their status as a beneficiary of a Tuition Certificate.

Impact on Financial Aid

Tuition Certificates are reported as a parent asset on the Free Application for Federal Student Aid (FAFSA) if the student is a dependent student based on the refund value of the certificates.

This may affect eligibility for need-based financial aid.

Tuition Inflation Rate

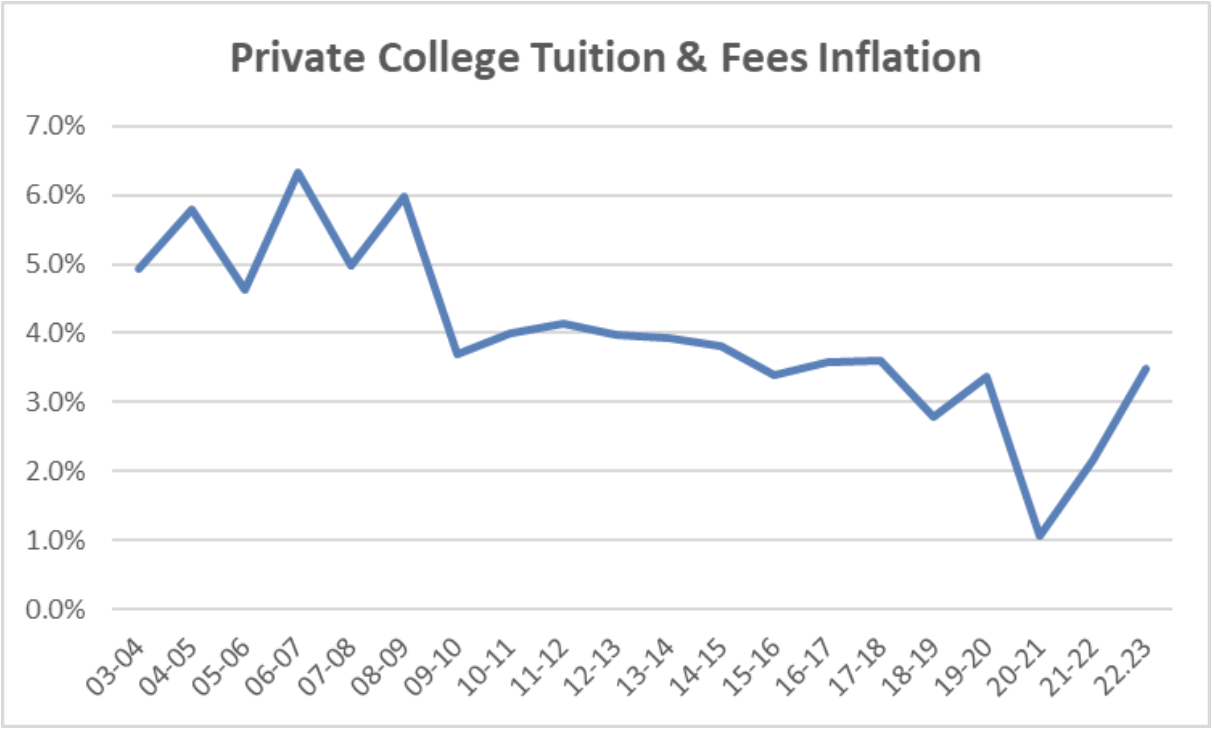

According to the Tuition Plan Consortium, LLC (TPC), which runs the Private College 529 Plan, the median tuition and fees among the participating schools increased by 4.29% per year from 2003-2004 to 2022-2023.

Note that this is the median and not the average or the highest change in college tuition among the member schools. Your performance may vary.

Among all private 4-year colleges, based on data from the College Board, the average annual increase in tuition and fees was 3.9% during the same time period. In 2018-2019, before the pandemic, tuition and fee inflation was 2.8%. This increased to 3.4% in 2019-2020.

The time period spans 20 years and may overstate the future tuition inflation rates, since tuition inflation rates have been trending downward, as shown in this chart.

Taxes

There is no state income tax deduction for contributions to the Private College 529 Plan.

Qualified expenses should be paid in the same tax year as a distribution from the plan to exclude such distributions from federal income tax or the 10% tax penalty.

You cannot specify which Tuition Certificate is redeemed. Rather, the Tuition Certificates are redeemed on a prorated basis. So, even though a more recent Tuition Certificate may have a different percentage earnings than an older Tuition Certificate, the tax liability of a refund will be the same.

Final Thoughts On The Private College 529 PLan

If you're in a position to purchase a prepaid Private College 529 Plan, the investment may be well worth it. It's a low-risk way to save on future tuition costs by locking in at current rates. After all, we know that the average cost of college isn't dropping anytime soon. And with the plan guaranteed by nearly 300 participating schools, the Private College 529 Plan offers plenty of flexibility.

Mark Kantrowitz is an expert on student financial aid, scholarships, 529 plans, and student loans. He has been quoted in more than 10,000 newspaper and magazine articles about college admissions and financial aid. Mark has written for the New York Times, Wall Street Journal, Washington Post, Reuters, USA Today, MarketWatch, Money Magazine, Forbes, Newsweek, and Time. You can find his work on Student Aid Policy here.

Mark is the author of five bestselling books about scholarships and financial aid and holds seven patents. Mark serves on the editorial board of the Journal of Student Financial Aid, the editorial advisory board of Bottom Line/Personal, and is a member of the board of trustees of the Center for Excellence in Education. He previously served as a member of the board of directors of the National Scholarship Providers Association. Mark has two Bachelor’s degrees in mathematics and philosophy from the Massachusetts Institute of Technology (MIT) and a Master’s degree in computer science from Carnegie Mellon University (CMU).

Editor: Colin Graves Reviewed by: Robert Farrington