Source: The College Investor

There are many benefits to 529 college savings plans. They provide tax and financial aid advantages to families who save for college.

Saving for college reduces student loan debt at graduation and increases college choice. But it can also affect eligibility for need-based financial aid.

Depending on who owns the 529 plan account, a 529 college savings plan may affect either the income or the assets reported on the Free Application for Federal Student Aid (FAFSA). In this guide, we'll explore how a 529 plan can affect your FAFSA and financial aid eligibility.

How Does A 529 Plan Affect Your FAFSA?

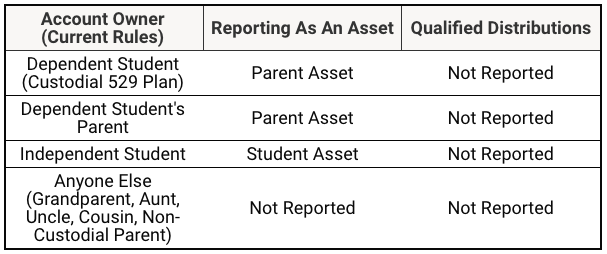

A 529 plan could affect either the "assets" or "income" portions of your FAFSA. Here's how it could impact your assets reporting:

- First, if a 529 plan is owned by a dependent student or a dependent student’s parent, it's reported as a parent asset on the FAFSA and qualified distributions are ignored.

- Second, if a 529 plan is owned by an independent student, it's reported as a student asset on the FAFSA and qualified distributions are ignored.

- Third, if the 529 plan is owned by anyone else, it's not reported as an asset on the FAFSA.

Next, let's consider qualified distributions:

- If the recipients are students or custodial parents, qualified distributions are not reported as income.

- But if the recipients are anyone else, qualified distributions count no longer count as untaxed income to the student. This includes 529 plans owned by the non-custodial parent if the student’s parents are divorced or separated.

This table provides a quick overview of how 529 plan account ownership affects the reporting of the 529 plan on the FAFSA:

Source: The College Investor

Finally, we'll discuss non-qualified distributions. The earnings portion of a non-qualified distribution will be included in the recipient’s adjusted gross income on their federal income tax return, regardless of who owns the account.

But the income may or may not be reported on the FAFSA, depending on who receives it. Here's how it works:

- If the non-qualified distribution is paid to the student or paid directly to the college, it's included in student income.

- If the distribution is paid to the account owner, it's included in the account owner’s income.

So if a dependent student’s parent is the account owner, the non-qualified distribution will be reported in parent income on the FAFSA. But if the account owner is anyone else, it will not be reported as income on the FAFSA.

How Does A 529 Plan Affect Your Financial Aid Eligibility?

The student aid index (SAI) is based on:

- Assets as of the date the FAFSA is filed

- Income from two years prior – the prior-prior year – as reported on federal income tax returns.

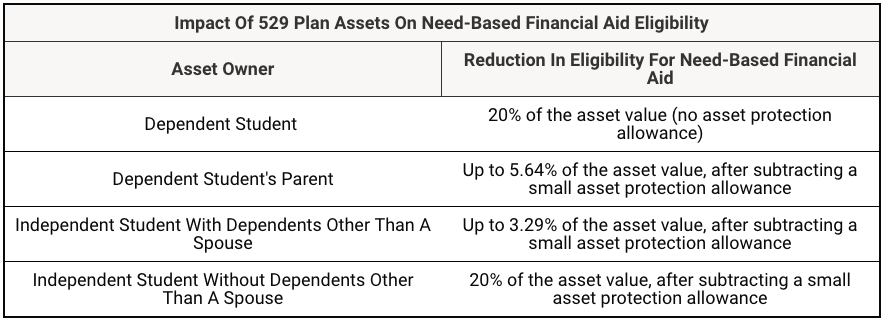

This means that if your 529 plan is reported as an asset or income on your FAFSA, it could reduce your eligibility for need-based financial aid. This table shows how 529 plan assets can impact your aid eligibility:

Source: The College Investor

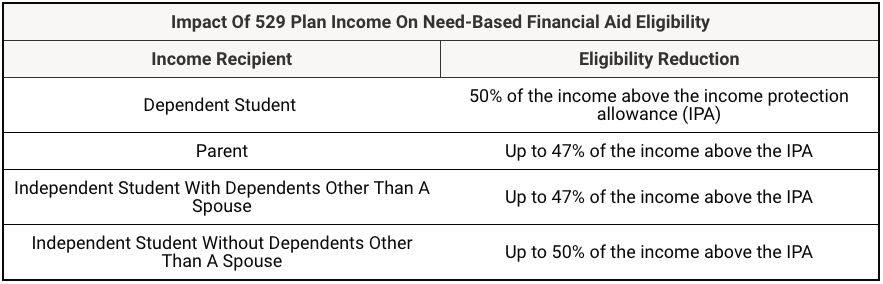

And this table shows how income from a 529 plan reduces your eligibility for need-based financial aid, depending on who received the income:

Source: The College Investor

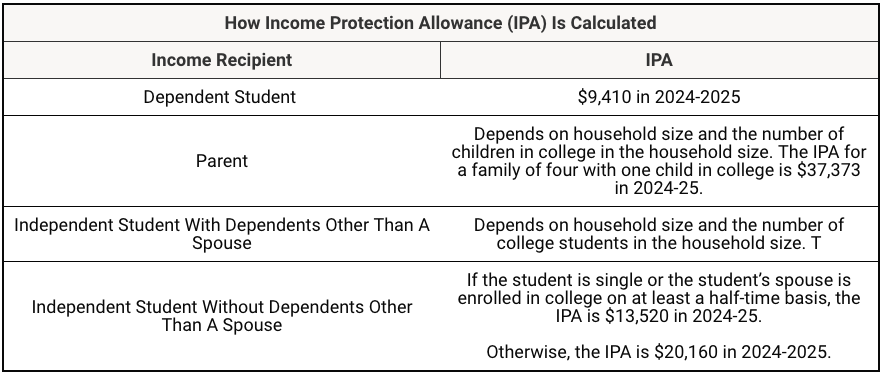

Here's how the income protection allowance (IPA) is calculated for each type of 529 plan owner:

Source: The College Investor

Note that the contribution from available income may be divided by the applicable number in college for parents and independent students. And that would, in turn, reduce the impact of income and assets on the EFC.

Note: Expected Family Contribution (EFC) was replaced by the Student Aid Index.

Examples Of How A 529 Plan Can Affect Your FAFSA And Financial Aid

Suppose there is $25,000 in a 529 plan and the full amount is withdrawn in a qualified distribution. The impact on aid eligibility will be as follows. If the 529 plan is owned by:

- A dependent student, it will reduce aid eligibility by as much as $1,410. (5.64%)

- A dependent student’s parent, it will reduce aid eligibility by as much as $1,410. (5.64%)

- An independent student without dependents other than a spouse, it will reduce aid eligibility by as much as $5,000. (20%)

- An independent student with dependents other than a spouse, it will reduce aid eligibility by as much as $823. (3.29%)

- Someone other than the student or a dependent student’s parent, such as a grandparent or non-custodial parent, it will reduce aid eligibility by as much as $12,500. (50%)

Compare this with money in a custodial bank or brokerage account, such as an UGMA or UTMA account, which reduces aid eligibility by as much as $5,000. (20%)

⚠︎ Use Our Financial Aid Calculator To See Your Aid Eligibility

The only way to see the exact impact of a 529 plan on your financial aid is to use a financial aid calculator and see the results. Check out our free financial aid calculator to get start.

How To Avoid The Negative Impacts Of 529 Plans On Eligibility For Need-Based Financial Aid

There are a few workarounds if a 529 plan is owned by someone other than the student or the parent, such as a grandparent. These workarounds can avoid the harsh impact of the 529 plan on eligibility for need-based financial aid.

Note that if the student and parents do not know about a 529 plan, they aren't required to report it on the FAFSA. But qualified distributions from such a 529 plan must be reported as untaxed income to the student, regardless of whether the family knows about the source of the money.

For example, gifts from a grandparent and distributions from a grandparent-owned 529 plan have the same impact on aid eligibility. But non-qualified distributions retained by the account owner do not need to be reported because the student and parents will not be aware of these distributions.

Nevertheless, it's better if the account owner makes the student and parents aware of the existence of the 529 plan. This creates an expectation that the student will go to college, significantly increasing the likelihood that the student will enroll in and graduate from college. If you're worried about how a 529 plan will affect your FAFSA and financial aid eligibility, here are a few strategies to consider.

Change The Account Owner From The Student To The Parent

Some 529 plans do not allow a change in account owner, except upon death or divorce. But, if this is permitted, changing the account owner avoids the 50% reduction based on distributions. Instead, the reduction would be up to 5.64% based on assets.

Rollover A Year’s Worth Of 529 Plan Funds To A Parent-Owned 529 Plan After Filing The FAFSA

Since the rollover occurs after filing the FAFSA, the money is not reported as an asset on the FAFSA. Since the distribution to pay for college costs comes from a parent-owned 529 plan, the distribution is not reported as untaxed income to the student on a subsequent year’s FAFSA.

Note that some states treat a 529 plan outbound out-of-state rollover as a non-qualified distribution. So the parent-owned 529 plan should be in the same state as the original 529 plan to avoid state recapture rules. (An out-of-state rollover is not considered a distribution from the federal perspective.)

Wait Until January 1 Of The Sophomore Year To Take A Distribution

Income on the FAFSA is based on income during the "prior-prior" year. So if the student will graduate in four years, there will be no subsequent year’s FAFSA on which to report a distribution on or after January 1 of the sophomore year in college.

If the student will take five years to graduate (e.g., for an engineering degree), wait an additional year to take the distribution. This means the family will have to find a different way of paying for college for the first 1.5 years.

Wait Until After Graduation To Take A Distribution

This option could be worth considering if it's if it is unclear how long it will take the student to graduate. A qualified distribution can be used to repay up to $10,000 in qualified education debt each for the beneficiary and the beneficiary’s siblings.

One can also use it to repay up to $10,000 in parent loans by changing the beneficiary of the 529 plan to the parent. The $10,000 limit is a lifetime limit, aggregated over all 529 plans.

Finally, one can take a non-qualified distribution to pay any additional costs. But the earnings portion of a non-qualified distribution will be subject to ordinary income tax at the recipient’s rate, plus a 10% tax penalty. Recapture of state income tax benefits may also apply.

Mark Kantrowitz is an expert on student financial aid, scholarships, 529 plans, and student loans. He has been quoted in more than 10,000 newspaper and magazine articles about college admissions and financial aid. Mark has written for the New York Times, Wall Street Journal, Washington Post, Reuters, USA Today, MarketWatch, Money Magazine, Forbes, Newsweek, and Time. You can find his work on Student Aid Policy here.

Mark is the author of five bestselling books about scholarships and financial aid and holds seven patents. Mark serves on the editorial board of the Journal of Student Financial Aid, the editorial advisory board of Bottom Line/Personal, and is a member of the board of trustees of the Center for Excellence in Education. He previously served as a member of the board of directors of the National Scholarship Providers Association. Mark has two Bachelor’s degrees in mathematics and philosophy from the Massachusetts Institute of Technology (MIT) and a Master’s degree in computer science from Carnegie Mellon University (CMU).

Editor: Robert Farrington Reviewed by: Clint Proctor