Most people understand that musicians and authors earn money through royalties. Some earn hundreds of millions of dollars, even decades after they die. But most people don’t know about the investment side of royalties.

Record labels and major investors typically pay artists big money to earn a share of their royalties. However, smaller artists can also make a decent income from their royalties, even when record labels don’t sign them.

Historically, there hasn’t been a great marketplace for investors who want to buy royalties from smaller artists. But Royalty Exchange is trying to match investors seeking high yields and artists who want upfront money through an online marketplace. The company’s exchange makes it possible for investors to buy royalties and musical NFT.

Investors seeking a high yield investment outside of the traditional world of stocks and bonds may find Royalty Exchange appealing. However, this kind of investing is both expensive and risky. We offer insights, information, and warning for investors who may want to try out Royalty Exchange.

Quick Summary

- Buy or sell royalty streams from music and music NFTs

- Investor receive ongoing passive income

- Music creators receives fast, debt-free funding

Royalty Exchange Details | |

|---|---|

Product Name | Royalty Exchange |

Investor Fee | 1% (minimum $500) |

Seller Fee | 15% |

Open to Non-Accredited Investors | Yes |

Promotions | None |

What Is Royalty Exchange?

Royalty Exchange is a marketplace designed to match artists (primarily musicians and YouTube creators) and investors seeking to diversify. The company’s founder, Anthony Martini has long been in the business of helping artists get paid. Royalty Exchange is the most recent iteration of this goal.

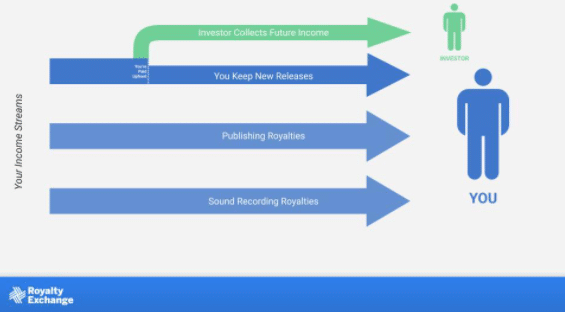

With Royalty Exchange, artists sell all or some of their royalty streams of income for several years. Investors pay an upfront price for the royalties, but receive passive income for several years.

Royalty Exchange provides investors and artists with a large amount of data to help them decide whether an investment is likely to pay off. Royalty Exchange is also allowing Artists to “NFT” their music.

What Does It Offer?

Royalty Exchange is an online marketplace that matches artists looking to monetize their music and investors hoping to buy streams of income. Royalty’s marketplace and auctions allow artists to price the future value of their royalties and get upfront funding for them. Investors who buy are entitled to revenue from the royalties.

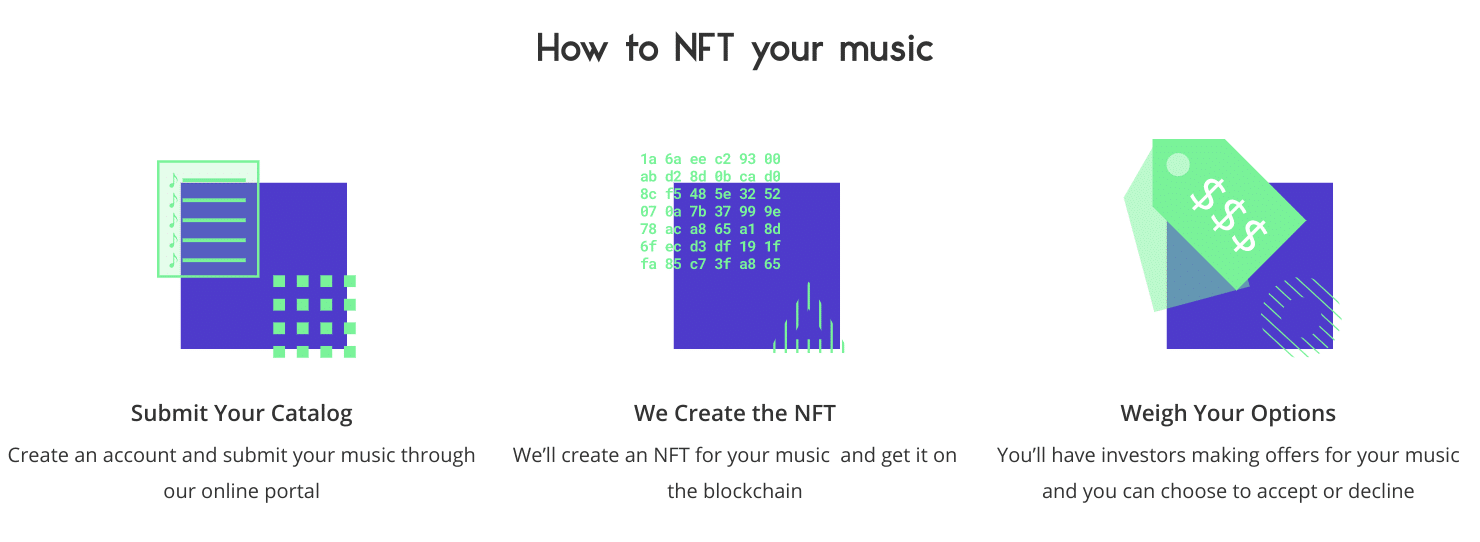

Buy And Sell Music NFTs

Musicians can mint and sell musical non-fungible tokens (NFT) through Royalty Exchange. These unique digital assets are bought and sold on the blockchain.

Just like typical “music rights”, NFTs are tied to an underlying stream of royalty income. The owners of NFT collect royalties when a third party uses the music in a video or some other format. These royalties are paid out once per quarter in Ethereum.

Royalty Exchange says that with this program, it is literally pioneering a new world of income-producing NFTs. Along with the launch of its NFT Catalog Sales program, it announced a proprietary token called RXT.

Additionally, NFT owners can later sell the NFT to investors who value it more. Unlike with traditional royalty rights deals (which we'll discuss next), artists can collect small commissions each time their original NFT is bought or sold.

Buy Or Sell The Rights To A Royalty Stream Of Income

Royalty Exchange allows musicians with a “backlog” of songs to sell all or a portion of their rights through a custom exchange. Investors seeking ongoing cash flow can purchase the right to the royalties.

While Royalty Exchange allows for a variety of sales, artists will typically sell only a portion of their royalties, for a set period. Artists retain the rights to the underlying music, and they never have to repay any investments even if their song fails to produce income.

Some of these investments are only available to accredited Investors, but the majority appear to be available to everyday investors who haven’t hit the required income or net worth standards.

Auction Format For Investments

Investors and artists can find investments through the Exchange. The Exchange hosts ongoing auctions where investors can bid for investments.

Artists or current owners of an asset can list “Buy Now” prices, or they can accept bids in an ongoing fashion. Investors can buy the royalty streams using standard currency (not cryptocurrency).

“All Access” memberships

Investors who want more information about investments and who want to waive fees can buy a costly ($4,997 upfront) All Access membership. The membership entitles investors to a variety of benefits, most importantly they receive more information than typical members can access.

Are There Any Fees?

Royalty Exchange typically charges artists a hefty 15% fee of the final sale price. It also charges a flat 1% fee (minimum $500) to investors who buy royalty income through the site.

As we just mentioned, investors can also buy an All Access membership for $4,997 to waive those fees and to gain access to special members-only information. The membership fee is $997 to renew annually. The All Access membership fee is very high. Only very serious royalty investors should consider that membership.

On the NFT side, sellers of NFT are charged up to a 5% royalty fee each time they sell an NFT that was minted on the Royalty Exchange. These fees go to the creator of the NFT.

How Do I Contact Royalty Exchange?

Royalty Exchange is based in Colorado at 1550 Larimer St. #769 Denver, CO 80202 U.S.

Despite its brick-and-mortar location, investors and artists should reach out to Royalty Exchange’s dedicated customer service team. The company’s phone number is 1-800-718-2269.

Site users and other interested parties may also choose to send questions to: info@royaltyexchange.com.

How Does Royalty Exchange Compare?

Royalty Exchange is tough to compare directly to competitors. The closest marketplaces include Collectable which sells sports memorabilia or MasterWorks which sells art.

However, these aren’t close comparisons. Musicians earn royalties from their art and the royalties behave more like dividends for a company. It’s unique to see an alternative investment that’s producing cash flow over time.

On the other hand, Royalty Exchange’s NFT marketplace is nothing new. OpenSea and Rarible both offer larger marketplaces that allow musicians to earn money from their NFT.

Header |  | ||

|---|---|---|---|

Rating | |||

Royalty Marketplace | |||

NFT Marketplace | |||

NFT Variety | Limited - Music Only | High | High |

Standard | 1% / $500 minimum | 2.5% | 2.5% |

Standard | 15% | 2.5% | 2.5% |

Cell | Cell |

How Do I Open An Account?

Registering an account with Royalty Exchange is quick for both artists and investors. Users simply go to the Sign-Up page and register using a Google account, Facebook, or an email address. Investors who want to place a bid will need to provide authenticating information, so Royalty Exchange can confirm your identity.

Is It Safe And Secure?

Royalty Exchange has basic security enabled, but it has far less than most brokerages. Its only form of security for the basic website is a username, password combination.

If you join an auction, Royalty Exchange places more safeguards in place. It verifies that both sides of the transaction were legally compliant before releasing funds to artists.

Overall, Royalty Exchange is safe enough to consider as an investing platform, but I would love for the company to beef up security.

Is It Worth It?

Royalty Exchange is doing a great job helping artists find funding for their work. The concept of getting paid today for royalties tomorrow will help artists do more and better work.

However, investors aren’t likely to see as much benefit from Royalty Exchange. The company offers a fascinating investment thesis, but the barrier to entry is likely to be too high for the average investor. The minimum fee (no minimum investment) is $500 and the price for most investments is in the mid-to-high five figures.

Most everyday investors will want to stick with stock market investments, which offer more accessibility and diversification through ETFs, mutual funds, and fractional share investing. But if you're really interested in NFTs, you may want to consider OpenSea or Rarible instead as both marketplaces have lower investor fees.

Royalty Exchange Features

Investor Transaction Fee | 1% (minimum of $500) Transaction fees are waived for All Access members |

Seller Transaction Fee | 15% Transaction fees are reduced to 12% All Access members |

All Access Membership Fee | $4,997 (renews annually at $997) |

Ongoing Admin Fees | None |

Open to Non-Accredited Investors | Yes |

Sale Options | Instant and Auction |

Royalty Payout Methods |

|

Distribution Frequency | Varies (determined by seller) |

Native Token | RXT |

Future Artist Commissions Allowed | Yes, for NFTs |

Automatic Investing | Yes, through "Standing Orders" |

Customer Service Phone Number | 1-800-718-2269 |

Customer Service Email Address | info@royaltyexchange.com |

Social Media Profiles | |

Mobile App Availability | None |

Promotions | None |

Royalty Exchange Review

-

Commissions and Fees

-

Earning Potential

-

Ease of Use

-

Products and Services

-

Customer Service

Overall

Summary

Royalty Exchange is an online marketplace that matches artists looking to monetize their music and investors hoping to buy streams of income.

Pros

- Invest in a unique asset class

- Allows artists to get up-front cash

- Most offerings are open to all investors

Cons

- High fees for both the investor and the seller

- Some information is locked behind an expensive paywall

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller