Beagle is working to be your financial concierge and help you rollover your old 401k and retirement accounts.

There’s a good chance you have an old 401(k) retirement account still sitting with one of your previous employers. You’ve switched jobs and either forgot you had it or would rather deal with it later.

Tracking down old accounts and figuring out how to roll them over can be a huge pain, which is why you should know about Meet Beagle. The company is a low-cost financial concierge designed to help people hunt down old retirement accounts and help to ensure funds are appropriately invested.

If your previous employers matched your contributions, you’re missing out on tapping into that free money—maybe hundreds or thousands of dollars just waiting to be found and properly invested. Meet Beagle offers a low-cost way to get it done.

Here’s what you need to know about this financial concierge service.

Meet Beagle Details | |

|---|---|

Product Name | Meet Beagle |

Service | 401(k) Rollover Assistance, Financial Concierge Service |

Monthly Fee | $3.99 |

Platform | Web |

Promotions | None |

What Is Meet Beagle?

Meet Beagle is a financial concierge startup based out of Silicon Valley. they’re focused on optimizing your retirement investments by sniffing out old 401(k) accounts, analyzing the fees, and helping people initiate rollovers. In the long-term, Meet Beagle aims to help you with various aspects of your financial life.

What Does It Offer?

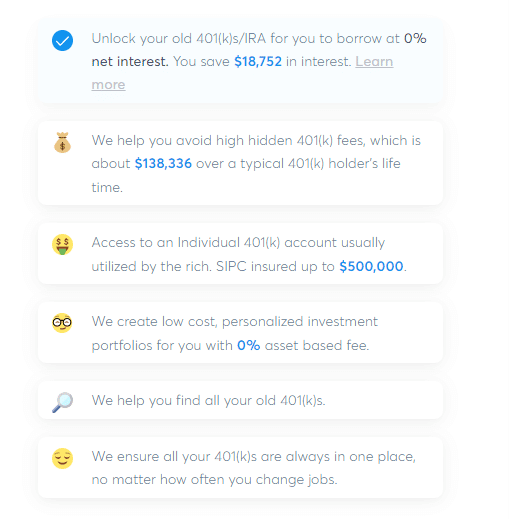

Meet Beagle’s concierge service covers finding old 401(k) accounts, exposing hidden fees, and helping investors optimize their portfolios. These are a few key offerings.

Services offered by Meet Beagle.

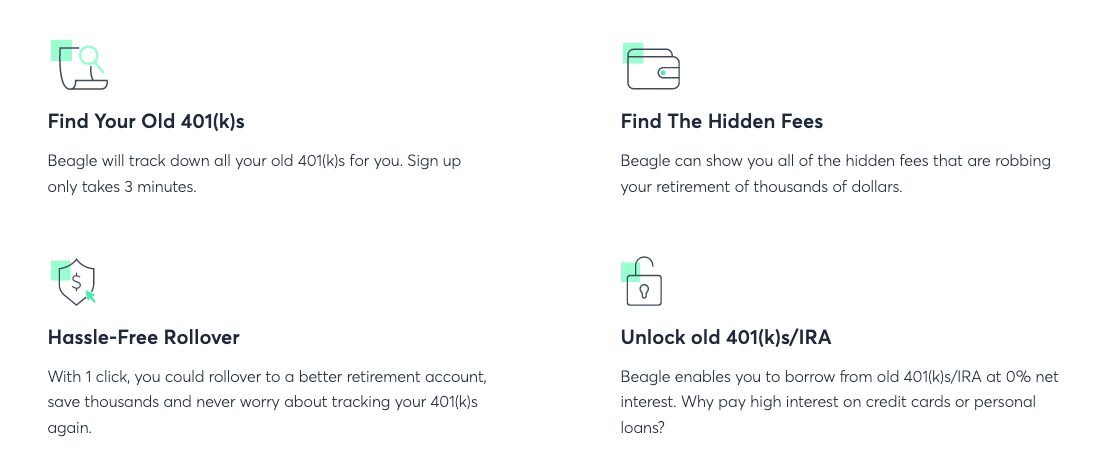

Find Old 401(k) Accounts

Capitalize, a competitor to Meet Beagle, estimates that Americans have $1.35 trillion in unclaimed assets in old 401(k) accounts.

Meet Beagle’s introductory service is a 401(k) finder. Basically, Meet Beagle’s technology tracks down old accounts for you so you can claim that money and roll it over to an account you control.

Understand Your 401(k) Fees

Meet Beagle allows users to roll over old 401(k) accounts into a new Rollover IRA, an existing IRA account, or into your new workplace plans. The company guides users through this complex process. Most of the company’s positive reviews on Trustpilot mention how well the company handles the rollover process. If you’ve been putting off a 401(k) rollover, Meet Beagle’s $3.99 monthly membership fee is likely worth it for you.

If you don’t have a great option for rolling over your 401(k), Meet Beagle can start and manage a rollover account for you. The company is a qualified broker and offers asset management services similar to robo-advisors like Wealthfront or Betterment.

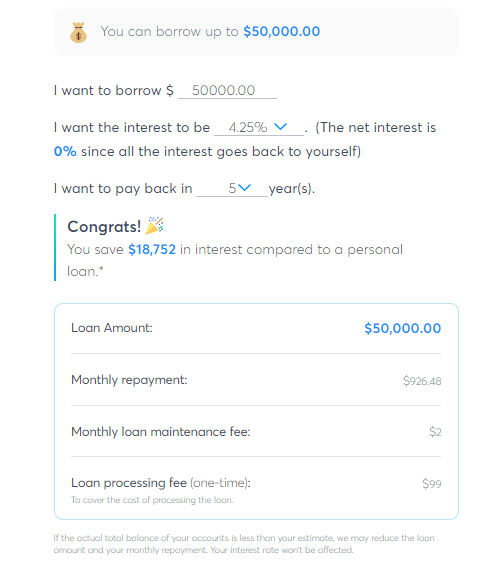

Take Out 401(k) Loans

Meet Beagle also enables you to borrow against your retirement account. The interest on the 401(k) loan is paid back to you and your repayments are reinvested in the market once you make the payments back to yourself.

The cost of this loan is a $2 monthly maintenance fee and a $99 issuing fee which are both paid to Meet Beagle.

Your loan limits depend on the amount of money you have in your old 401(k) plans.

Start A New Individual 401(k)

Beagle Invest is a subscription-based fee investment management firm. It recommends low-cost ETFs and hosts accounts for investors.

The only cost you’ll pay for the 401(k) is the $3.99 monthly membership fee. You will also pay the low-cost ETF maintenance fee (though those fees are managed by the issuing companies).

Are There Any Fees?

Meet Beagle’s primary fee is a $3.99 monthly subscription fee. This is the fee you’ll pay to find old accounts, initiate rollovers, and investigate fees. Opening a retirement account at Meet Beagle means that you’ll continue to pay the $3.99 monthly fee in perpetuity. However, the fee is reasonable compared to other Robo-advising platforms.

If you’re considering a 401(k) loan through Meet Beagle, you’ll need to understand the loan and fee structure. The company charges a $2 monthly maintenance fee and a $99 loan initiation fee. These fees are paid straight to Meet Beagle. The interest that you pay on the 401(k) loan is paid back to you, so it isn’t a true cost to you.

However, money that you borrow against your 401(k) is taken out and isn’t invested during the loan payback period. That means you lose out on valuable time for compounding growth.

How Do I Contact Meet Beagle?

The easiest way to contact Meet Beagle is through its email address, support@meetbeagle.com. The company is headquartered at 1049 El Monte Avenue, Ste C #588, Mountain View, CA 94040.

You can also call the company at (650) 456-2982. The phone number is primarily reserved for customers using Meet Beagle’s investment products.

How Does Meet Beagle Compare?

Meet Beagle’s primary competitor is Capitalize, which offers a free 401(k) rollover service. Like Meet Beagle, Capitalize is positively reviewed on Trustpilot with 98% of customers giving it a 5 Star Review.

Capitalize is free, while Meet Beagle’s fees are $3.99 per month. However, Meet Beagle isn’t merely a 401(k) rollover service. It also offers asset management and 401(k) loans. The asset management service is a decent deal, especially because the company recommends personalized portfolios for users.

On a $100,000 portfolio, that’s an annual management fee of less than 0.05%. That’s a lower fee than most robo-advisors. However, if you’d rather pay nothing, M1 Finance doesn’t have any fees and there are other low and no-fee investing platforms.

Header |  |  | |

|---|---|---|---|

Rating | |||

Monthly Fee | $3.99 | $0 | $0 |

Consolidate Multiple 401(k)s Into One IRA | |||

Rollover Into a New 401(k) | |||

Cell |

How Do I Open An Account?

You can open a Meet Beagle account without opening a loan or even paying for a membership. An account only requires a full name and email address.

To open an account, select the “Start Here” button on the Meet Beagle website. You may notice Meet Beagle heavily advertises its loans. You don’t need to worry about that since you’re not signing up for a loan.

To unlock the membership services, you’ll need to provide old account information, and pay the $3.99 monthly fee. The monthly fee is automatically renewable but the subscription can be canceled at any time.

Is It Safe And Secure?

Meet Beagle uses industry-leading best practices to ensure the safety and security of user information. Any personal information that you share with Meet Beagle is encrypted and stored in a secure online environment.

Meet Beagle limits sharing personal information except to complete the services you’ve paid for. For example, this includes finding old financial accounts or starting investment portfolios.

Of course, no online environment is 100% safe. If you sign-up for Meet Beagle, the company collects your personally identifiable information along with financial account numbers and other secure information. While Meet Beagle takes security seriously, this information could fall into the wrong hands in the event of a hack.

Is It Worth It?

Meet Beagle wants to be a low-cost investment concierge for everyday people. The company offers investment services for just $3.99 each month.

However, none of Meet Beagle’s services are ground-breaking. There are already companies offering free investment management services, free rollover services, and free individual 401(k) options.

Meet Beagle’s key differentiator is its ability to bring all these services under a single digital roof. If you’re seeking a company that can help you organize your investments, Meet Beagle may be the concierge service for you.

Meet Beagle Features

Company Name | Meet Beagle |

Service | 401(k) tracking, rollover, and transfer |

Cost | $3.99/month |

Consolidate Multiple 401(k)s Into One IRA | Yes |

Rollover Into Self-Directed IRA | Yes |

Asset Management Services | Yes |

Tax Advice | No |

Customer Service Options | Email and phone |

Customer Service Email | support@meetbeagle.com |

Customer Service Number | (650) 456-2982 |

Social Media Profiles | |

Web/Desktop Platform | Yes |

Mobile App Availability | None |

Promotions | None |

Meet Beagle Review

-

Pricing and Fees

-

Ease of Use

-

Tools and Resources

-

Customer Service

Overall

Summary

Tracking down your old 401(k) accounts and rolling them over is a pain. Meet Beagle hunts down old accounts and ensures funds are invested.

Pros

- Track down your 401(k) plans

- Understand the fees you’re paying on old retirement accounts

- Ability to take out low-cost loans on old retirement plans

Cons

- Monthly fee for the duration of the loan

- No free trials

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Claire Tak Reviewed by: Chris Muller