It’s that time of year when we look back on what we have and haven’t accomplished and decide what to tackle in the second half of the year. Even though we're in extraordinary times, most people will still have getting out of debt and building wealth as top goals.

If eliminating some of your debt while simultaneously improving other parts of your financial life are among your goals, this post is for you. It’s time to take back control and kick your debt to the curb.

It can sound like paying off large amounts of debt in a short period of time is impossible - but it's not! You can even pay off $10,000 in debt in just one year. Whether you have student loan debt or credit card debt, there are options.

Here’s how you can pay off $10,000 in debt in one year.

Step 1: Work Backwards

The first step in any good debt pay-off plan is knowing how much money you need to come up with in order to meet your goal. Saying that you’re going to pay off $10,000 in debt in one year isn’t good enough. You need to breakdown that number so that you can hit smaller milestones.

The simplest way to make this calculation is to divide $10,000 by 12. This would mean you need to pay $833 per month to have contributed your goal amount to your debt pay-off plan. This number, though, doesn’t factor in the interest on your debt.

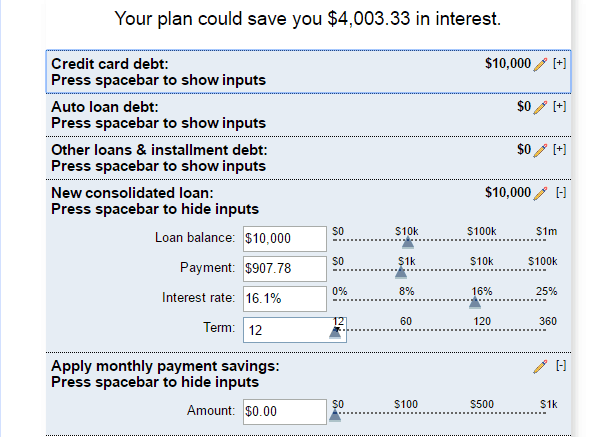

If you want to see the impact of interest and how much you can save by accelerating your debt pay off plan you can use a debt calculator like the one provided by BankRate.

In the example below we’re assuming a $10,000 credit card balance at a 16% interest rate. In order to pay the balance off in one year payments of $907 per would be needed which would save over $4,000 in interest – a huge savings!

You can use this calculator to tally up all of your current debts and see what you could save with an accelerated debt pay-off plan.

I can tell you that after a decade of helping people get out of debt, simply getting organized and understanding your debt is the number 1 reason why people don't make forward progress.

Step 2: Decide On Your Strategy

If you only have one loan or credit card you don’t need to worry about coming up with a strategy. (Other than how much your monthly payments will be, of course.) You can simply choose to automate your payments and consider yourself done.

However, if you’re working with multiple loans and debts you’ll have to determine in what order you’d like to pay those off. There are two popular strategies for doing this: the debt snowball and the debt avalanche.

Debt Snowball Method – With this method you’ll list your debts from smallest balance to largest balance and work on paying off the smallest balance while making minimum payments on everything else. Once the smallest balance is paid off you move on to the next smallest while still meeting all other minimum payments.

This is the method popularized by Dave Ramsey, and the goal is to get some early wins by eliminating small debts - which in turn boost your attitude towards paying off the remaining debts. Plus, putting that extra money towards the next debt helps eliminate it faster.

Debt Avalanche – With this method you list all of your debts from highest interest rate to lowest interest rate. You then focus on putting all of your extra money toward your highest interest rate while making minimum payments on the rest.

This method is mathematically the lowest cost approach to paying off your debt, but it could also mean a longer stretch before you see wins.

There’s a lot of debate over which method you should use and there is NO right answer. The debt snowball method is a great option if you like quick wins and want to eliminate smaller bills. The debt avalanche method is great if you’re focused on saving the most money in interest.

Once you pick your strategy you should also consider how often you’ll make extra payments and whether or not to automate your plan.

Step 3: Free Up Money in Your Budget

At a glance, paying off $10,000 in a year can seem like a huge number. However, once broken down coming up with the extra money isn’t as hard as it seems.

If you’re serious about getting rid of your debt one of the first places you should look is your current spending. There are always ways to stretch more out of a budget with minimal effort.

Here are some things to consider:

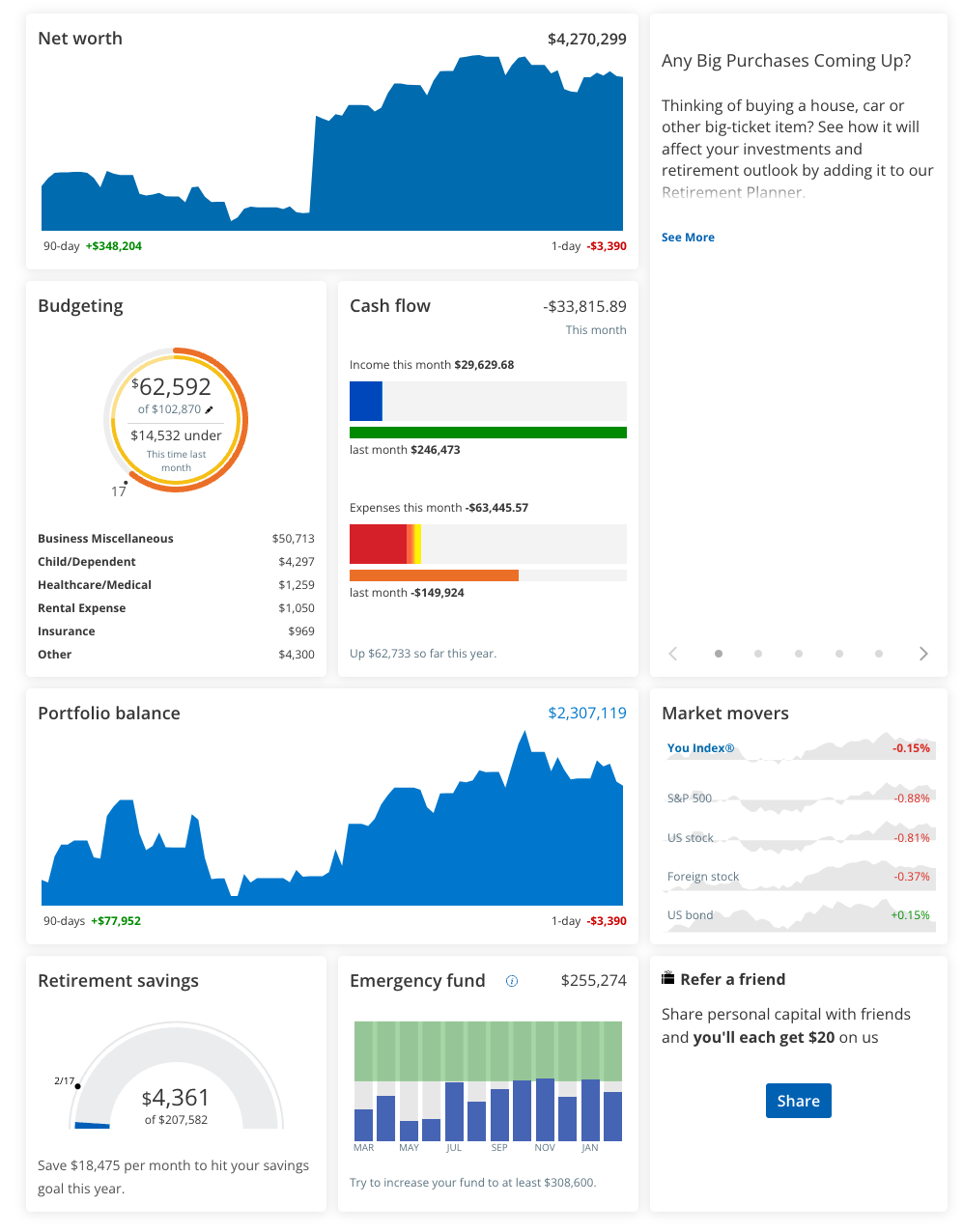

Monitor Your Spending – It’s impossible to know where to cut back if you don’t know where you’re spending. You can sign up with a service like Empower for free. Empower will automatically monitor and categorize your spending after you link your bank accounts.

You can also check out our list of the best budgeting apps here.

Participate in Uber Frugal Month – Cutting back on spending has just as much to do with mindset as it does with actual needs. Early retirees Mr. and Mrs. Frugalwoods have had immense financial success through practicing frugality and without feeling deprived. In January they are hosting an Uber Frugal challenge for a month. This challenge can help you lower your costs and discover alternative ways of utilizing your money.

You can sign up for the challenge here.

Easily Save an Extra $500 per Month – It’s very likely that you are needlessly spending money without realizing it! This post breaks down fifteen simple ways you can squeeze an extra $500 out of your budget each month. If all of these ideas are applicable to your situation you’ll free up $7,000 over the course of the year.

Budget for Your Personality – One of the biggest mistakes new budgeters make is trying to adopt a system that doesn’t fit their personality and that they won’t stick with. The trick to making a budget work is finding a way to make it a regular part of your life.

This post will breakdown different ways you can create a budget that works for you.

Step 4: Earn More If You Need To

While it’s always a good idea to trim away the fluff in your budget it’s also important to look for ways to earn more if needed.

Depending on how much extra money you need you may be able to get by with putting in a couple hours per week overtime or you could start a side hustle to earn more.

Earning more money is a perfectly viable option for the majority of the U.S. population. You can look at some of the hundreds of different ideas already listed on this blog.

This was one of the most important strategies for myself when it came to paying off my student loan debt. I was able to earn an extra $2,000 per month by selling stuff on eBay and starting this blog.

Step 5: Track Your Progress

Paying off $10k in a one year is not an easy feat. It will take hard work and you’ll probably have to recommit to your goal a few times. One of the best ways to keep yourself motivated is to continually track your progress and celebrate the small wins.

When things get hard don’t give up. In a year from now you’ll be thanking yourself for sticking with the plan!

Finally, make sure you do reward yourself at small milestones. It's a lot of work to pay off debt, so congratulate yourself every now and then!

Check Out These Related Articles:

* Offer from H&R Block. Requires 1) opening of new Spruce Accounts between 1/1/23 and 6/30/23; and 2) $200 in qualifying direct deposits within 45 days of opening. Qualifying direct deposits are ACH credits, including direct deposits (but not tax refunds). Deposits that do not qualify are mobile check deposits, internal transfers, transfers within Spruce from external accounts, or cash transfers. $50 will be deposited within 14 business days after completing all requirements. Spruce Accounts may not be closed or restricted at payout. You are responsible for tax treatment of funds. Limit one per customer. May be modified or discontinued at any time.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak