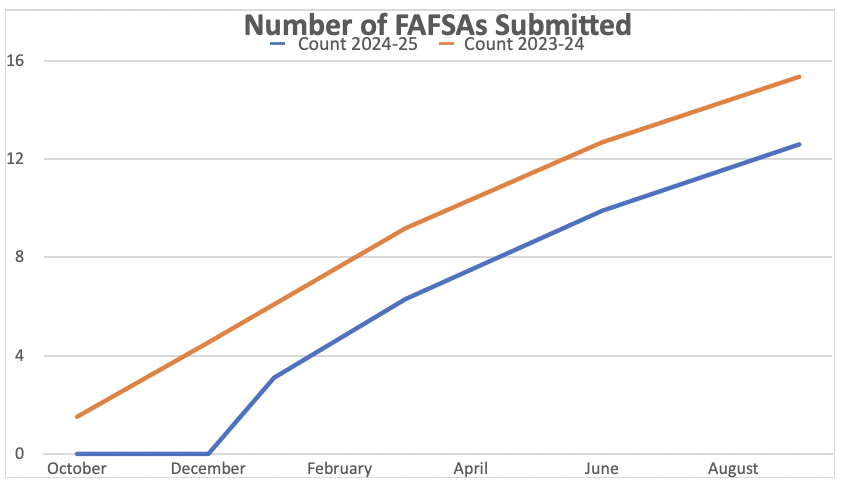

The bungled launch of the 2024-25 FAFSA has caused a significant drop in the number of applications for federal student aid. While the number of applications has increased since FAFSA processing started, the deficit is still not being closed.

This may lead to a sharp decline in college enrollment in fall 2024. The drop is severe enough that it may cause some colleges to close.

Limited Data on Number of Submitted Applications

The U.S. Department of Education has not published any statistics concerning the number of submitted applications, other than rounded numbers included in five press releases as shown in this table.

Date | Count |

|---|---|

1/8/2024 | 1.0 million |

1/30/2024 | 3.1 million |

2/5/2024 | 3.6 million |

2/13/2024 | 4.0 million |

2/28/2024 | 4.7 million |

3/15/2024 | 5.8 million |

As of March 15, 2024, a total of 5.8 million FAFSAs have been submitted, down 30% from the same time last year, when about 8.4 million FAFSAs had been submitted.

Based on current trends, the number of FAFSAs submitted by the end of August 2024, will be about 2.8 million lower than the same time last year, representing a decrease of 19%.

This U.S. Department of Education has compared the 2024-25 FAFSA rollout to the 2016-17 FAFSA, the last year with a January 1 start date. Starting in 2017-18, the FAFSA has had an October 1 start date.

While the 3.1 million 2024-25 FAFSAs submitted by January 30, 2024 exceed the number of 2016-17 FAFSAs submitted by January 30, 2016, the number of 2024-25 FAFSAs submitted in February slowed considerably.

By February 28, 2024, a total of 4.7 million FAFSAs had been submitted, compared with 5.5 million by the end of February 2016.

If this trend continues, by the end of August 2024, the number of FAFSAs submitted will be 3.7 million lower than the number submitted by the end of August 2016.

The number of FAFSAs submitted dropped to 55,000 per day in February 2024, down from 103,000 per day in January 2024. The higher figure in January was probably due to pent-up demand. The number of FAFSAs submitted per day in February is similar to the average daily total in previous years, or about 52,000 per day. The number submitted per day in the second half of February, however, has slowed to about 47,000 per day, which is less than the same time last year or in February 2016.

The decrease in the overall number of FAFSAs submitted suggests that the number of Federal Pell Grant recipients will be about the same as last year, despite the new Federal Pell Grant formula making it easier for students to qualify for the grant.

It is possible that applicants are waiting until the FAFSA is fully functional to submit the form. Low-income students and first-generation college students do tend to submit the FAFSA later than middle- and high-income students.

This graph shows the total number of FAFSAs submitted in total each month in 2024-25 and 2023-24. The blue line shows a projection of the number of FAFSAs that will be submitted in March through the end of August, if current trends continue.

Unless there is a spike in the number of FAFSAs submitted after the FAFSA becomes fully functional, the number of 2024-25 FAFSAs will never catch up to the number of FAFSAs submitted in 2023-24.

What's Important To Watch

What is worth watching is whether there is a big increase now that theoretically the FAFSA results are starting to flow (more accurately, trickle) to the colleges. There will probably be an uptick, but probably not enough to fully erase the deficit.

In fact, anecdotally, there have parent groups that have been urging parents to wait until FAFSA processing begins to even submit (which was likely not great advice). Now that processing has begun, it will be interesting to see if the gap starts to close.

Consequences of the FAFSA Fiasco

The problems with the 2024-25 FAFSA and the “soft launch” period have prevented many students from filing the FAFSA.

- The delayed start to the 2024-25 FAFSA means that applicants were able to start filing the FAFSA three months late.

- Some applicants and contributors have been unable to obtain the FSA IDs needed to file the FAFSA or have encountered other problems that prevent them from submitting the FAFSA.

- Some of the workarounds offered by the U.S. Department of Education do not work.

- Inadequate testing of the new FAFSA has caused a significant number of implementation problems, especially with the FSA ID.

- The call center of the Federal Student Aid Information Center (FSAIC) has been overwhelmed, preventing some callers from reaching a representative even after waiting on hold for hours. Call disconnects are common. Some callers reach voice mail messages that tell them to call back later. Applicants and contributors have not received responses to email messages sent through the secure online messaging form.

Many students have been unable to see their Student Aid Index (SAI) or saw an inaccurate SAI.

- The delayed decision to adjust the financial aid formula for the 18.3% inflation from April 2020 to April 2023 contributed to the delays in implementing the 2024-25 FAFSA.

- Some students are unable to see the Confirmation Page with the Student Aid Index (SAI), depending on whether they or their contributors completed their section of the FAFSA first. This means they won’t be able to get their SAI until they receive the FAFSA Submission Summary.

- Some students saw their SAI before the inflation adjustments were made.

Delayed processing of submitted FAFSAs caused other problems, such as:

- Delayed delivery of Institutional Student Information Records (ISIR) to colleges, leading to delays in the receipt of the FAFSA Submission Summary by applicants. The U.S. Department of Education says that the ISIRs will start being sent to colleges in the first half of March, which may mean that the first ISIRs aren’t sent to colleges until the Ides of March (March 15) and it will take several weeks for colleges to receive all of their ISIRs.

- Applicants are unable to make corrections to the FAFSA or to add and delete colleges from the FAFSA until they receive the FAFSA Submission Summary.

- Due to the delayed receipt of ISIRs, there will be a delay in colleges sending financial aid offers to admitted students. Normally, financial aid award notifications are sent to students in early March. Now, the award notifications will not be sent to students until April in the most optimistic scenario.

- Colleges are delaying the Decision Day deadline for students to accept offers of admission to May 15 or June 1.

Some students are more likely to be affected by the FAFSA problems than others.

- Low-income students, first-generation college students, rural students and underrepresented minority students are more likely to be affected by the FAFSA problems.

- Students in Nevada, Utah, Arizona, Florida and Alaska are least likely to have submitted the FAFSA.

- Texas, Louisiana, Mississippi, California and Tennessee have experienced the greatest declines in the number of FAFSAs submitted.

Mark Kantrowitz is an expert on student financial aid, scholarships, 529 plans, and student loans. He has been quoted in more than 10,000 newspaper and magazine articles about college admissions and financial aid. Mark has written for the New York Times, Wall Street Journal, Washington Post, Reuters, USA Today, MarketWatch, Money Magazine, Forbes, Newsweek, and Time. You can find his work on Student Aid Policy here.

Mark is the author of five bestselling books about scholarships and financial aid and holds seven patents. Mark serves on the editorial board of the Journal of Student Financial Aid, the editorial advisory board of Bottom Line/Personal, and is a member of the board of trustees of the Center for Excellence in Education. He previously served as a member of the board of directors of the National Scholarship Providers Association. Mark has two Bachelor’s degrees in mathematics and philosophy from the Massachusetts Institute of Technology (MIT) and a Master’s degree in computer science from Carnegie Mellon University (CMU).

Editor: Colin Graves Reviewed by: Robert Farrington