ATM stands for Automated Teller Machine.

If you’re brand new to the banking and ATM world, there are certain things you should know about using ATMs. For one, you may not even need to bring your ATM card. Some banks like Chase allow you to go to an ATM and make your transactions with their mobile app.

Also, there are limitations for how much cash you can withdraw from an ATM. For example, Chase may have a $500 daily limit while Ally Bank has $750. These restrictions are based on the type of account you have, so if you aren’t sure, be sure to call and ask.

Know how much it costs if you use an ATM machine that is outside of your bank’s network. Online banks are known for issuing ATM reimbursements—a great money-saving perk. For example, Ally Bank reimburses you for the out-of-network fees.

So whether you need to withdraw or deposit cash, you’ll need to stop by an ATM—let’s take a closer look at how to use an ATM.

What You Can Use ATM For

You can use an ATM to withdraw cash, deposit cash, or check your account balance. Your bank’s mobile app can be used if you need to deposit checks.

Before you get started with an ATM transaction, take a look around. It’s critical that the area is a safe option. Whether you are using a walk-up or a drive-thru, make sure the area isn’t too secluded. It’s best if plenty of other people are around. Additionally, nighttime withdrawals are best done in well-lit locations.

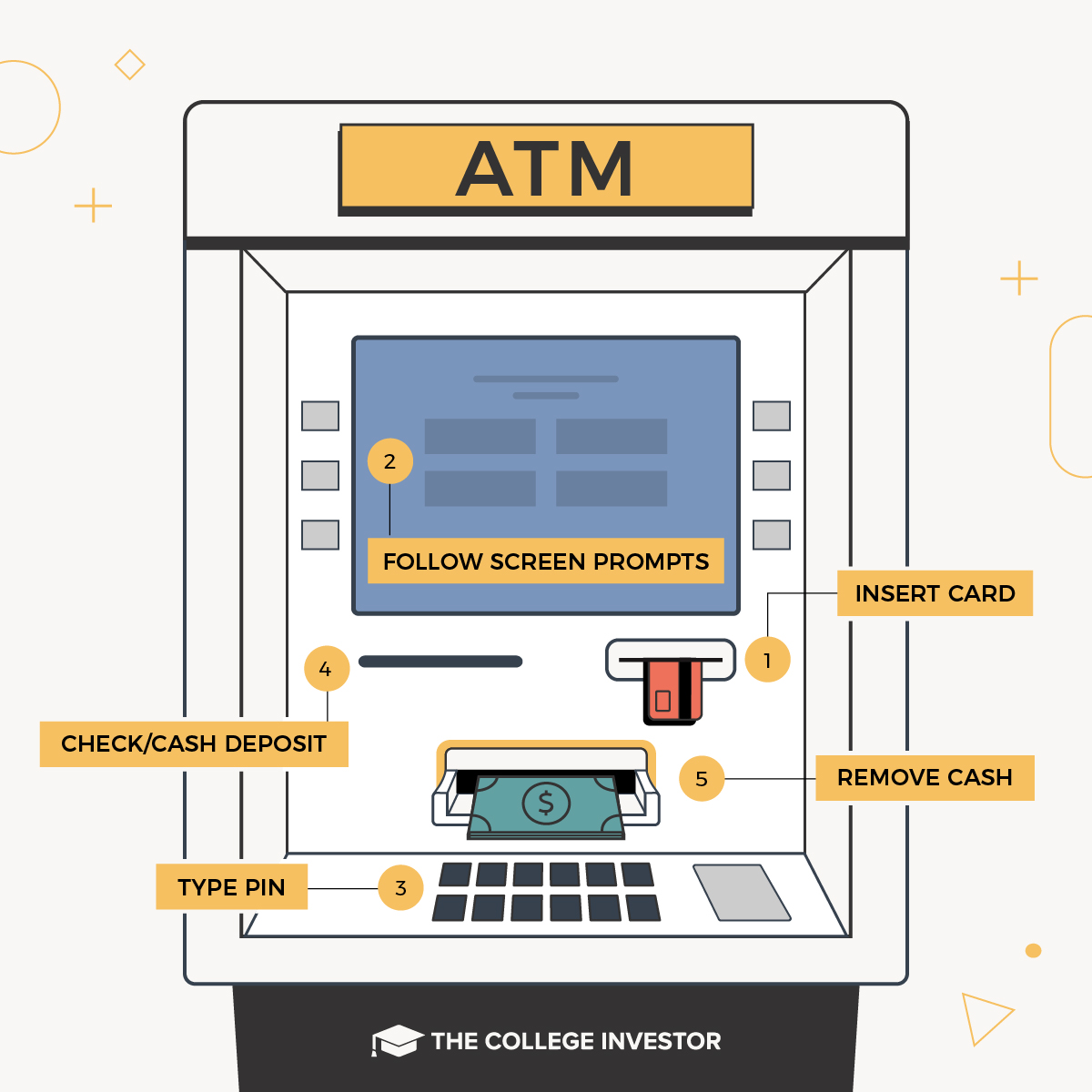

Below you’ll find step by step instructions for your ATM needs.

How To Withdraw Money From An ATM

When we think of an ATM, most of us think about withdrawing cash from our accounts. Here’s how to make a withdrawal.

- Confirm your safety: The first step is to survey the area. If you don’t feel completely comfortable, go to a different ATM.

- Insert your debit card: Depending on the ATM, you may need to leave the card inserted for the entire transaction or swipe it.

- Enter your PIN: You must enter your PIN before moving forward. If possible, cover the keypad to protect your PIN.

- Choose the amount you want to withdraw: In some cases, you can ask for specific denominations of bills. For example, you might want to withdraw $100 in the form of $20 bills.

- Out-of-network ATM: If you are using an ATM that isn’t within your bank’s network, you’ll be alerted of the fee. You may also incur a separate fee from your bank as well.

- Take the cash: After confirming the transaction, the ATM will spit out cash into a specific tray.

- Take the receipt: If the ATM prints a receipt, take it from the machine. In some cases, you can skip the paper trail and opt for an email confirmation of the transaction.

- Remove your card: If the ATM requires you to leave your debit card inserted, it will prompt you to remove it from the machine.

- Confirm you are logged out: Before leaving the ATM, confirm that the home screen has returned. It’s important to avoid accidentally leaving your account open for someone else to access.

How To Deposit Cash Into An ATM

If you have cash on hand that you want to deposit through an ATM, that’s an option at some ATMs. Here’s how to make a deposit:

- Check out the location: Before getting started, confirm you feel safe in using the ATM. If you don’t feel safe, find another ATM.

- Insert your debit card: You may need to swipe your card or leave it inserted for the entire transaction.

- Enter your PIN: Discreetly enter your PIN to gain access to your account.

- Select the deposit option: If the ATM accepts deposits, you’ll see that option on the screen. Keep in mind, not all ATMs accept cash deposits.

- Choose the amount: If the ATM accepts cash deposits, enter the amount you are depositing. It’s a good idea to count your cash again.

- Put the money into the ATM: Some ATMs accept cash without an envelope. If there is an envelope required, you must seal the envelope before placing it in the machine.

- Get a receipt: When depositing cash through an ATM, it’s always a good idea to get a receipt.

- Remove your debit card: If you were required to leave your debit card in the ATM during the transaction, it’s time to remove it.

If you aren’t able to make your cash deposit via an ATM, then you might need to head inside a bank.

How To Check Your Balance At An ATM

Even if you don’t need to deposit or withdraw cash, an ATM can still come in handy. The machine can help you check your account balance. Here’s how to check your balance.

- Confirm your safety: Double check that you feel safe before using an ATM.

- Insert your debit card: Depending on the ATM, it might hold your debit card for the entire transaction or just require a swipe.

- Enter your PIN: The ATM will require a valid PIN to confirm your identity.

- Select your account: At this point, will be prompted to view your checking or savings account balance. Pick which one you want to see.

- Remove your debit card: After getting the information you need, remove your debit card.

If you don’t want to go to a physical bank location, consider checking your balance through your bank’s online platform.

ATM Tips

When using an ATM, there are some tips to make for a smooth process. Here are the top tips for a streamlined ATM experience:

- Look for low fees: ATM fees can add up quickly. If possible, choose an ATM that offers a low fee structure for your bank account.

- Avoid convenience fees: Convenience fees are added to some ATM transactions. You can often avoid these by using your bank’s ATM network. In many cases, online banks offer a more flexible option for free access to a wide selection of ATMs.

- Consider limits: Many ATMs come with withdrawal limits. For example, you might only be able to withdraw $500 in cash per day. If you need a larger amount of cash, it might require a trip inside the bank.

- Get cash back while shopping: Many stores allow you to obtain a small amount of cash back at check out. For example, you might be able to get $100 in cash when checking out at the grocery store. It’s an affordable and safe choice if you have limited cash requirements.

Bottom Line

Before heading over to the ATM, assess whether you can use your bank’s mobile app to do things like check balances or deposit checks. When you need cash or need to deposit cash, keep your safety at the top of mind and make the trip during the daytime in a location with plenty of people.

Remember to keep tabs on any ATM fees you’re paying, as these can add up. You may consider switching to an online bank.

Sarah Sharkey is a personal finance writer covering banking, insurance, credit cards, mortgages and student loans. She has written for numerous finance publications, including MagnifyMoney, Business Insider and ChooseFI. Her blog, Adventurous Adulting, helps young adults get a handle on their finances.

Editor: Claire Tak