Source: The College Investor

Varo is an online-only bank with an amazing savings account. And it's not a "fintech neo-bank", it's a real bank!

Where have all of the high APYs gone? Even as the Fed Fund rates has been rising, yields on savings accounts still haven't been keeping up. In fact, the national average is currently 0.30% APY. That means with a $1,000 balance, you’ll earn $2.40 in a year!

But there are still places to find a high Annual Percentage Yield (APY) on Savings and Varo Bank is one of them. You can qualify to earn up to 5.00% APY* with a Varo Savings Account.

Varo Bank N.A., Member FDIC, is a modern fintech. This means it doesn’t have branches and you can’t easily deposit cash into your accounts. But if you are good with all of that, you could earn a strong yield on your deposits. In this article, we’ll go through what Varo Bank has to offer, along with some of its limitations.

Varo Bank Details | |

|---|---|

Product Name | Varo Bank |

Min Deposit | $0 |

APY | Up to 5.00% APY |

Account Types | Online Bank Accounts |

Promotions | None |

Who Is Varo Bank?

Varo Bank is an online bank that offers several deposit and loan products. It was founded in 2015 and is based in San Francisco. Colin Walsh is the CEO and Founder.

“As the first Fintech with a national bank charter, and within the regulated system, Varo will be able to offer a range of tech-driven products, solutions, and experiences that no Fintech and no traditional bank can," said Walsh in an interview with CrowdfundInsider.

Walsh also promised that the Varo Bank platform would "power true financial innovation across a range of payments, deposit, and credit products, along with advanced personalization, predictive insights, and virtual communities.”

Unlike other FinTechs, Varo is an actual bank - not just fancy software that actually holds your money at other banks.

What Do They Offer?

Varo Bank is an online-only bank. If you prefer dealing with your bank in-person, Varo is probably not a good choice. It also has no monthly fees on its Bank and Savings Accounts. You won’t be charged any of the following with a Varo Bank Account:

- Overdraft fees

- ATM fees at 40,000 U.S. based Allpoint® ATMs

- Foreign transaction fees

- Monthly maintenance fees

- Transfer fees

In addition to its low fees, Varo offers solid interest rates on its savings account, early direct deposit, interest-free cash advances, and more. Here's a closer look at what you get as a Varo customer.

Savings Account

Varo has a two-tiered savings account. You start earning 3.00% APY, then you can qualify to earn 5.00% APY¹ on your first $5,000.

Here are a few things you need to know:

- There’s no minimum balance to open a Savings Account or minimum balance to earn interest. Though, interest is paid out in whole cents only.

- You’ll start earning 3.00% APY and if you do a few extra things during each Qualifying Period², you’ll earn 5.00% APY on the first $5,000.

- Get one or more direct deposit(s) totaling $1,000 or more³;

- Have $0.00 or more in your Varo accounts at the end of the Qualifying Period⁴.

If you qualify, additional balances above $5,000 will earn 3.00% APY.

Varo can also help you save money automatically. You can move a percentage of your online checking account direct deposit into your Savings Account. This is called Save Your Pay. You can also use Save Your Change, which will round up a purchase made with your Varo Bank debit card to the nearest dollar and transfer the difference to your Savings Account.

Varo Bank Account

With the Varo Bank Account, you can get your paycheck with direct deposit and access it up to two days earlier than the average direct deposit.

Early access to direct deposit funds depends on timing of the payer’s submission of deposits. Varo generally post such deposits on the day they are received which may be up to 2 days earlier than the payer’s scheduled payment date.

There is a $2,500 per calendar day spending limit with your Varo Bank Visa® Debit Card. There is also a $1,000 per calendar day maximum cash withdrawal amount. If you lose your debit card, it can be locked right from the Varo Bank mobile app.

Related: These Are The Best College Student Checking Accounts

No Fee-Free Cash Deposits

If you deal with cash, Varo Bank may not be what you're looking for. There isn’t a way to directly deposit cash with Varo. Instead, you have to go to a Green Dot Network® location such as Walmart, CVS, Rite Aid, Walgreens, 7-11, Dollar General, Family Dollar, Albertsons, Safeway, Kmart, or Kroger.

These businesses charge a fee to deposit your cash. You can also purchase a Green Dot MoneyPak, but there may be a fee charged by merchants for that as well. These fees range from $4.95 to $5.95. Additionally, there is a limit on cash deposits of $1,000 per day with a maximum of $5,000 per month.

Withdrawing cash is much more convenient, however. You can get cash fee-free at over 40,000 U.S. based Allpoint® ATMs, with a limit of $1,000 per day. You also can ask for cash back at the register when using your Varo Bank debit card.Cash Advances

Varo Bank customers can access cash advances at the tap of a button with the Varo Advance Account. Once you qualify, you can get up to $500 right in the Varo Bank app. To qualify:

- Your account must be at least 30 days old with a balance of $0.00 or more.

- You must receive qualifying direct deposits in your Varo Bank Account and/or your Varo Savings Account of at least $1,000 over the past 31 days.

- Your Varo Bank Account and/or Savings Account must not be overdrawn, and your Varo Bank Account can’t be suspended or closed.

You won't ever pay any interest on these advances. But advances come with the following fees:

Advance Tier | Fees |

|---|---|

$20 | $1.60 |

$50 | $4 |

$75 | $6 |

$100 | $8 |

$200 | $16 |

$300 | $24 |

$400 | $32 |

$500 | $40 |

For cash advances, your qualifications will be evaluated daily, and your payment history and qualifications will be reviewed monthly for any credit limit increases. To continue to qualify for advances, payments must be made timely.

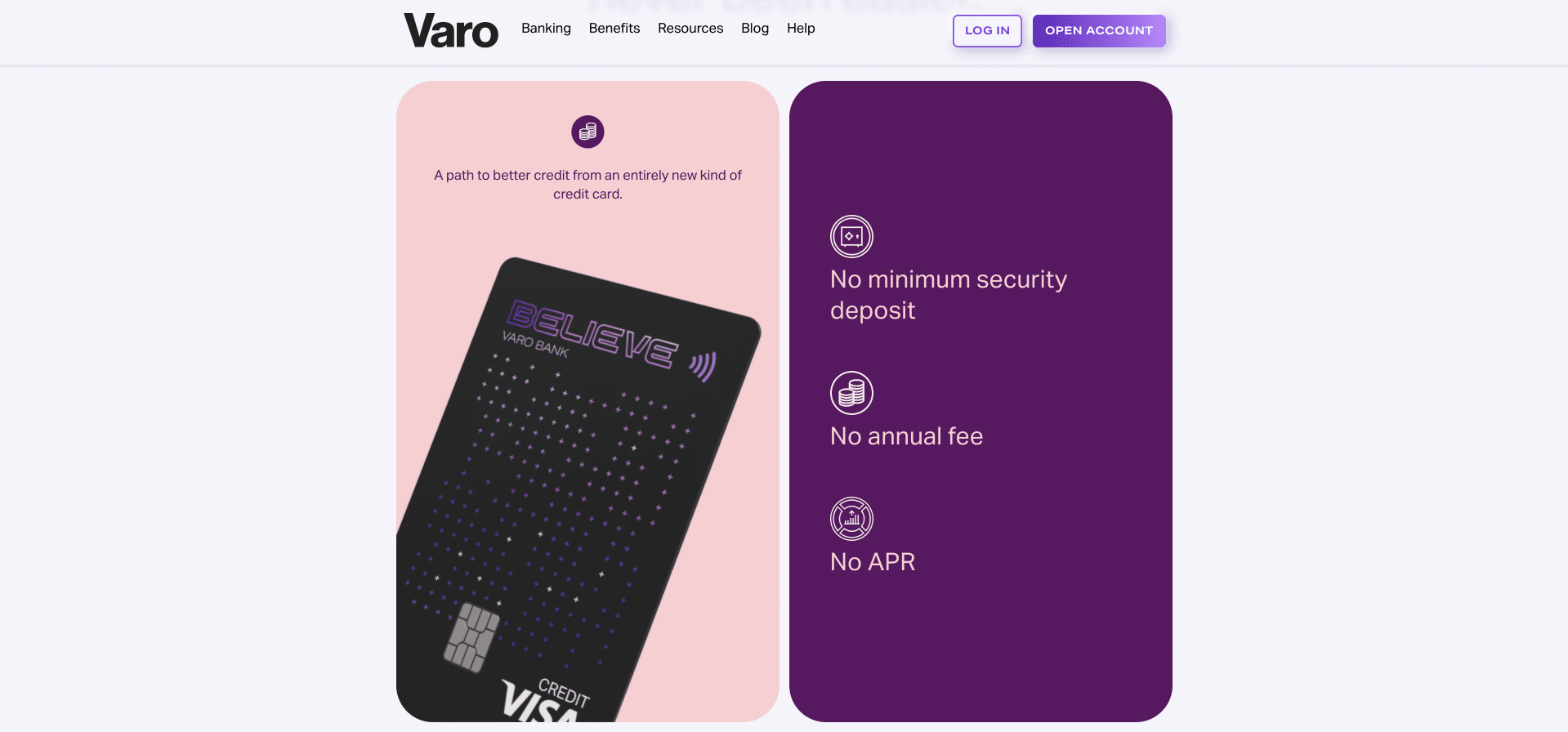

Secured Credit Card

Varo calls its secured card accounts "Varo Believe." The Varo Believe Secured Account has no minimum security deposit and cardholders are allowed to use their deposit to pay down their card balance. That adds a lot of flexibility if you're looking to build credit with a secured credit card.

What's perhaps most interesting about this card is that it charges no APR. It also doesn't have any annual fees. Plus, you can use your card to withdraw cash from an ATM with no fees at U.S. based Allpoint® ATMs. Combined, these features make Varo Believe one of the most consumer-friendly secured card accounts available today.

Varo Bank Secured Card. Screenshot By The College Investor

How Does Varo Bank Compare?

Varo's top APY and list of products are some of the best that you'll find anywhere for an online bank.

On the other hand, if you're looking for a bank that also offers a low-cost secured card to help you build credit, Varo could be a great choice. Check out this quick table to see how Varo compares.

Header |  |  |  |

|---|---|---|---|

Rating | |||

Top APY | 5.00% | 4.50% | 0.61% |

Monthly Fees | $0 | $5 (Can be waived) | $0 |

ATM Access | 40,000+ | 19,000+ Free ATMs | 91,000 Free ATMs |

Secured Card | |||

FDIC Insured | |||

Cell |

Are There Any Fees?

Varo charges a few fees, but none of them are hidden. They’ll charge a $25.00 fee for express shipping of replacement debit cards, and a $3.50 ATM withdrawal fee if you use a non-U.S. based Allpoint® ATMs. The ATM operator may charge an additional fee.

There are fees for getting a Varo Advance. You can see them here.

You may be charged a fee by a retailer should you choose to use a Green Dot Reload @ the RegisterTM to deposit cash to your Varo Bank account.How Do I Open An Account?

You can visit the Varo Bank website to open an account online. Click the purple "Get Started" or

Open Account" button and then simply follow the prompts. Varo says that the application process shouldn't take longer than five minutes. You can also apply by downloading the purple Varo Bank app from your app store and following the prompts on screen.

Is My Money Safe?

Yes, Varo Bank is an FDIC member bank. With FDIC insurance, you get up to $250,000 of federal deposit protection per account (owned by one person with no beneficiaries). Also, all of your information is protected with 256-bit AES encryption technology.

Contact

You can get in touch with Varo's customer service by chat, phone or email. Simply use the chat feature within the Varo app, call 1-877-377-8276 or send an email to support@varomoney.com. Customer service hours are Monday - Friday, 8 AM to 4:30 PM (MT).

Customer reviews for Varo are overwhelmingly positive. The bank currently has an "Excellent" rating of 3.8/5 on Trustpilot out of more than 2,450 reviews. It also has an A rating on the Better Business Bureau (BBB).

Why Should You Trust Us?

The College Investor has been actively tracking the best savings account rates since 2018, with a daily updated list that monitors roughly 50 banks and credit unions that have a history of great rates. But we also are always scouting out other banks that may compete on this list.

Unlike other well-known companies who create "best savings account rate lists", we strive to put out rates in order highest to lowest so that you can know you're actually getting the best rate. And if you don't make the cut, too bad. You can find the full list of our bank review here.

Who Is It For And Is It Worth It?

If you don’t deal with cash often or need branches, then Varo Bank could definitely be worth it for the high APY. In fact, it has one of the highest yields currently available.

And with no monthly fees on Varo Bank Accounts (regardless of your account balance), no foreign transaction fees, and once you qualify, cash advances in the app, there really is a lot to love about Varo Bank.

But Varo won't be a good fit if you deposit cash often or need branch access. If that's you, you'll probably want to look for high-yield savings or free checking options at full-service banks or credit unions.

Common Questions

Here are a few common questions that people ask about Varo.

Is Varo a real bank?

Yes, Varo is a chartered bank that is a member of the FDIC.

Does Varo offer credit-builder loans?

No, but it does offer a fee-free and interest-free secured credit card account that can help consumers build positive credit histories.

Is Varo Bank free?

There are no monthly fees with Varo and all transaction fees can be avoided. However, Varo can be an expensive banking option if you often make cash deposits as you'll need to pay a retailer service fee of up to $4.95 per deposit.

Does Varo Bank support digital wallets and transfer apps?

Yes, the Varo Bank debit card can be used with Apple Pay, Google Pay, and Samsung Pay.

Features

Account Types | Online Bank Accounts and Line of Credit |

Minimum Deposit | None |

APY | 3.00% To 5.00% APY |

Monthly Fees | None |

Foreign Transaction Fees | None |

Overdraft Fees | None (overdraft transactions will be declined) |

Debit Card Replacement Fee | None for regular shipping, $25 for express shipping |

Secured Card Annual Fee | None |

Secured Card APR | None |

Transfer Fee | None |

Branches | None (online-only bank) |

ATM Availability | 40,000+ (U.S. Only) |

Customer Service Number | (877) 377-8276 |

Customer Service Hours | Mon-Fri, 8am-4:30pm MST |

Mobile App Availability | iOS and Android |

Bill Pay | No |

FDIC Certificate | 59190 |

Promotions | None |

¹ Annual Percentage Yield (APY) is accurate as of December 1, 2022. Rates may change at any time without prior notice, before or after the account is opened.

² The requirements must be met within the Qualifying Period begins on the first calendar day of the month and ends at close of business (4:25 pm MST/ 3:25 pm MDT) on the last business day of the month. Meet the requirements in the current month to qualify to earn 5.00% APY for the following month.

³ Qualifying direct deposits are electronic deposits of your paycheck, pension or government benefits (such as Social Security or unemployment) from your employer or government agency. Tax refunds, government stimulus payments, Person-to-Person payments (such as Venmo), and funds deposited using a Varo routing number are not considered a direct deposit.

⁴ Your Varo Bank Account and Varo Savings Account balances must be greater than or equal to $0.00 at the end of the qualifying period.

Varo Bank Review

-

Interest Rates

-

Fees and Charges

-

Customer Service

-

Ease of Use

-

Tools and Resources

-

Products and Services

Overall

Summary

Varo Bank is an online-only bank that charges no fees, pays a high APY on deposits, and offers automatic savings tools.

Pros

- High APY on savings account

- No monthly bank account fees

- Cash Advance for qualifying custoemrs

- Secured card with no annual fee or APR

Cons

- No brick-and-mortar branches

- No fee-free cash deposits

- Fees for out-of-network ATM withdrawals

- No Zelle

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Colin Graves