Sallie Mae Bank offers a variety of banking products, including some amazing certificates of deposit.

If you are looking for a place to put your cash to work, high APYs are likely a top priority. After all, you want your savings to work hard for your long-term financial future.

While you may associate the name Sallie Mae with student loans, it’s also a bank with some pretty competitive interest rates. Sallie Mae Bank offers customers a suite of products featuring high APYs. Plus, the streamlined online experience is the cherry on top.

Ready to make the most of your savings? Let’s explore what Sallie Mae Bank has to offer.

Quick Summary

- Sallie Mae offers a suite of deposit accounts

- You’ll find relatively high APYs tied to these accounts

- The SmartyPig provides an easy way to visualize progress towards savings goals

Sallie Mae Bank Details | |

|---|---|

Product Name | Sallie Mae 14-Mo No Penalty CD |

Min Deposit | $1 |

APY | 4.00% |

Account Types | Certificate of Deposit |

Promotions | None |

What Is Sallie Mae Bank?

While Sallie Mae started as a government-sponsored enterprise, it’s been an entirely private company since 2004.

In addition to offering student loans, the bank also offers a wide selection of banking products. Specifically, the online bank offers customers worthwhile high-yield savings and penalty-free CD options.

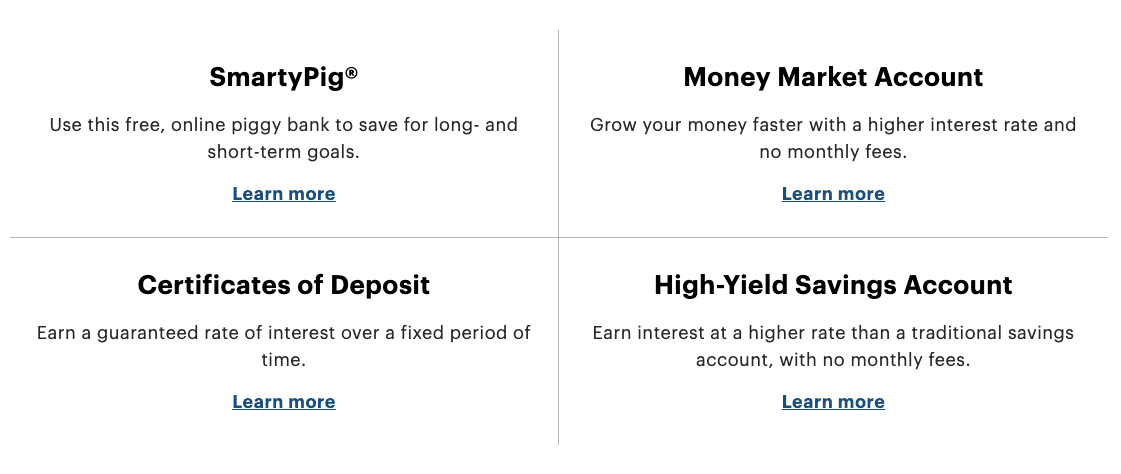

What Does It Offer?

When it comes to Sallie Mae’s offerings, there’s plenty to choose from. But for the purposes of this review, we’ll focus on the banking products Sallie Mae brings to the table.

SmartyPig

When it comes to personal finance, goal-setting is key. If you can stick to the right goals, you’ll be propelled to the financial future you desire. But sometimes, sticking to your money goals is easier said than done.

The SmartyPig account is specifically designed to help you create, track, and reach your savings goals. In many ways, you can think of this account as a virtual piggy bank ready to help you meet your savings goals.

Within the account, you can set up multiple savings goals, which are treated like sub-accounts. With that, you can track your progress to multiple goals at once.

As of Dcember 2023, you can earn up to 4.25% APY. And you won’t encounter any fees along the way.

High-Yield Savings Account

The high-yield savings account offered by Sallie Mae offers a straightforward way to put your savings to work. With the high APYs currently being offered, you can move towards your savings goals faster.

When using this account, you won’t encounter any monthly fees or minimum balance requirements. Keep in mind there aren’t any goal-setting features.

Certificates Of Deposit

In terms of certificates of deposit (CDs), Sallie Mae offers terms ranging from 6 months to 60 months. To get started, you’ll have to meet a minimum deposit of $2,500. But the rates offered could be worth it.

With an automatic renewal option, you can let your savings continue to grow over time with minimal effort.

Money Market Account

In addition to the high-yield accounts above, Sallie Mae also offers a money market account. A money market account allows you to grow your money with interest rates that are similar to a high-yield savings account. Money markets are great for people who prefer to keep their cash easily accessible.

As of January 2024, the account offers a 4.75% APY, which compounds daily and is paid out monthly.

There are no minimum balance requirements or monthly maintenance fees to contend with. Plus, you’ll even have the ability to write checks or make free transfers from your account.

Are There Any Fees?

Neither the high-yield savings account nor the SmartyPig account comes with a monthly fee.

When opting to open a CD with Sallie Mae, be aware of the early withdrawal penalties. If you pull your funds out of the CD before the maturity date, you’ll face a penalty fee. But that’s fairly normal for most institutions that offer CDs.

How Do I Contact Sallie Mae Bank?

If you need to get in touch with Sallie Mae Bank, the live chat feature on their website is a helpful place to start.

But if you prefer a phone call, you still have options. For questions about the CDs or high-yield savings accounts, call 877-346-2756.

If you have questions about the SmartyPig account, call 877-751-6884. Both of the lines are open from 9 a.m. to 6 p.m/EST on weekdays.

The bank has earned 1.7 out of 5 stars on Trustpilot. But keep in mind the bulk of the reviews are based on the bank’s student loan options.

How Does Sallie Mae Bank Compare?

If you are looking for a painless way to grow your savings, Sallie Mae isn’t alone in providing great rates through a high-yield savings account.

For example, Liberty Savings Bank is offering a savings account with a 4.50% APY while UFB Direct is offering a 4.83% APY on its savings account.

But neither offers the goal-setting features available through the SmartyPig account.

Header |  |  |  |

|---|---|---|---|

Rating | |||

Min Deposit | $0 | $1 | $0 |

Monthly Fees | $0 | $0 | $0 |

FDIC Insured | |||

Cell |

How Do I Open An Account?

Want to work with Sallie Mae? Start by scoping out the account options. When you find the right fit, select open an account. At this point, you’ll be asked to provide an email address and password to start the account creation process.

Additionally, be prepared to provide your Social Security Number, birthday, phone number, address, and current bank information. If approved, you can transfer funds into the account right away.

Is It Safe And Secure?

The deposit accounts offered by Sallie Mae Bank are FDIC-insured. With that, your funds are protected for up to $250,000.

Sallie Mae uses HTTPS encryption for its website to protect your information and offers two-factor authentication and verification checkpoints to prevent fraud.

Why Should You Trust Us?

The College Investor has been actively tracking the best savings account rates since 2018, with a daily updated list that monitors roughly 50 banks and credit unions that have a history of great rates. But we also are always scouting out other banks that may compete on this list.

Unlike other well-known companies who create "best savings account rate lists", we strive to put out rates in order highest to lowest so that you can know you're actually getting the best rate. And if you don't make the cut, too bad. You can find the full list of our bank review here.

Who Is This For And Is It Worth It?

It’s clear that Sallie Mae’s online bank offers high APYs to savers. Whether you are looking to tuck away a substantial sum or start working towards your savings goals, Sallie Mae makes it easy to put those funds to work for you.

As an online bank, you won’t have access to an in-person branch. But more than likely, you won’t have a regular need for a physical branch. You can always call customer service if you need to talk to a human.

While Sallie Mae offers high APYs, it still pays to shop around for the absolute best rates. Especially with the feds constantly raising rates in the recent months.

Our Picks for the Best Savings Accounts

Check out our list of the best high-yield savings accounts if you want to explore your other options.

Sallie Mae Features

Account Types |

|

Minimum Deposit | $0 |

Monthly Maintenance Fees | $0 |

Customer Service Options | Live chat, phone |

Customer Service Number |

|

Customer Service Hours | Monday-Friday, 9 a.m. to 6 p.m. (EST) |

Mobile App Availability | None |

Web/Desktop Account Access | Yes |

Direct Deposit | Yes |

ATM Availability | No |

FDIC Certificate | |

Promotions | None |

Sallie Mae Review

-

Interest Rates

-

Fees and Charges

-

Customer Service

-

Ease of Use

-

Tools and Resources

-

Products and Services

Overall

Summary

You may associate Sallie Mae with student loans, but it’s also a bank with competitive savings interest rates as well as a suite of other banking products. See if Sallie Mae Bank is right for you.

Pros

- Goal setting options

- Competitive APYs

- No monthly fees

Cons

- No physical branches

- Higher APYs available elsewhere

Sarah Sharkey is a personal finance writer covering banking, insurance, credit cards, mortgages and student loans. She has written for numerous finance publications, including MagnifyMoney, Business Insider and ChooseFI. Her blog, Adventurous Adulting, helps young adults get a handle on their finances.

Editor: Claire Tak Reviewed by: Robert Farrington