Novo offers an online small business checking account and other tools to support your business.

Are you trying to grow a side hustle into a small business? Or perhaps you’re finally starting to see some passive income from online book royalties or from your online courses.

Whether you’re just getting started with a side hustle, or you’re already earning decent income, one of the most important steps you can take as an entrepreneur is to separate your business and personal income.

Using a business checking account for depositing your business income and making your business expenses can help you take your business to the next level. But what bank should you use for your small business checking account?

One company to consider is Novo. Novo is a fintech company that is making it easier for small business owners to open checking accounts. See how they compare to the other top small business checking accounts.

Here’s what you need to know about the company in our Novo review.

Novo Business Checking | |

|---|---|

Min Opening Deposit | $0 ($50 required to access all account features) |

Min Balance Requirement | $0 |

Monthly Fee | $0 |

Rewards | None |

ATM Access | Up to $7 of ATM fees waives per month |

Availability | Nationwide |

Promotions | None |

What Is Novo?

Novo isn’t a bank. It is a tech company that’s working to bring small business banking into the digital era. Its goal is to create a compelling banking experience by allowing small business owners to quickly open accounts and to use their banking data for bookkeeping and reporting.

Right now, Novo only offers online business checking accounts. Its accounts are offered through the company’s financial partner Middlesex Federal Savings F.A.

⚠︎ This Is A Banking Service Provider, Not A Bank.

Novo is a financial technology company, not a bank. While it uses partner banks to provide banking services, your FDIC-insurance protection may be limited. Read this article from the FDIC to understand the risks of using a non-bank company.

What Does It Offer?

For someone with no experience with business checking accounts, a business checking probably seems plain vanilla. However, opening a business banking account can be a frustrating experience. Additionally, business banking accounts often carry hefty monthly fees.

Novo’s business checking account differentiates itself on several points. Here are some of its tops features.

Multiple Funding And Spending Options

Novo makes it easy to fund your account with free ACH transfers from another bank account. You can also deposit physical checks by just snapping a picture.

The one missing feature on the funding side is simple cash deposits. While it's technically possible to load cash into your Novo account, the process is cumbersome. You'd need to purchase a money order from a retailer and then deposit it into your account using Novo's mobile check deposit tool.

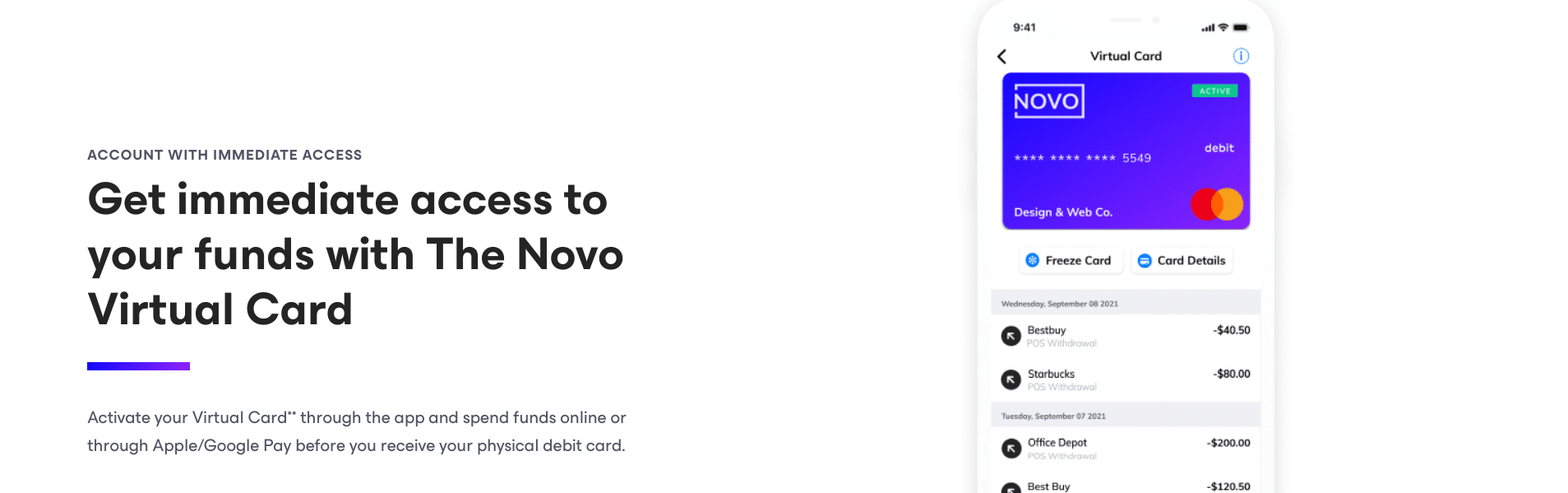

When it comes to spending your money, you also have a variety of options. While you're waiting for your physical debit card to arrive, you can use The Novo Virtual Card which can be used online or added to Apple Pay or Google Pay to use at physical retailers.

You'll also be able to pay your vendors however they prefer. This includes ACH transfers, wire, and mailed checks. You can even pay with cash if that's your vendor's preference as Novo refunds all ATM withdrawal fees.

Invoicing

Novo users can create, send, and manage invoices right in their checking account.

The company has made a series of improvements to invoicing, including a free, built-in tool that enables you to create and send unlimited invoices. Also, Novo customers can now connect to Stripe, Square, or PayPal to get paid via credit card, Apple Pay, Google Pay, PayPal, or Venmo.

Customers can also create unlimited one-off and recurring invoices while editing recurring invoices as needed. Other handy features include:

- Sending one-click reminders to payees

- Managing invoices on your phone or computer

- Invoicing payments syncs with your Novo account data, simplifying accounting and bookkeeping

Business Budgeting

With Novo Reserves, you can section off funds within your account to budget for an expense or pay themselves. You can create up to 20 Novo Reserve accounts, which is great for tax planning and is similar to Lili.

Novo also allows you to export your statements, so you can easily upload a spreadsheet to QuickBooks or other bookkeeping software.

These features really make Novo a solid online business account, especially if you follow business budgeting systems like Profit First.

Related: 5 Best Budgeting Systems And Tools

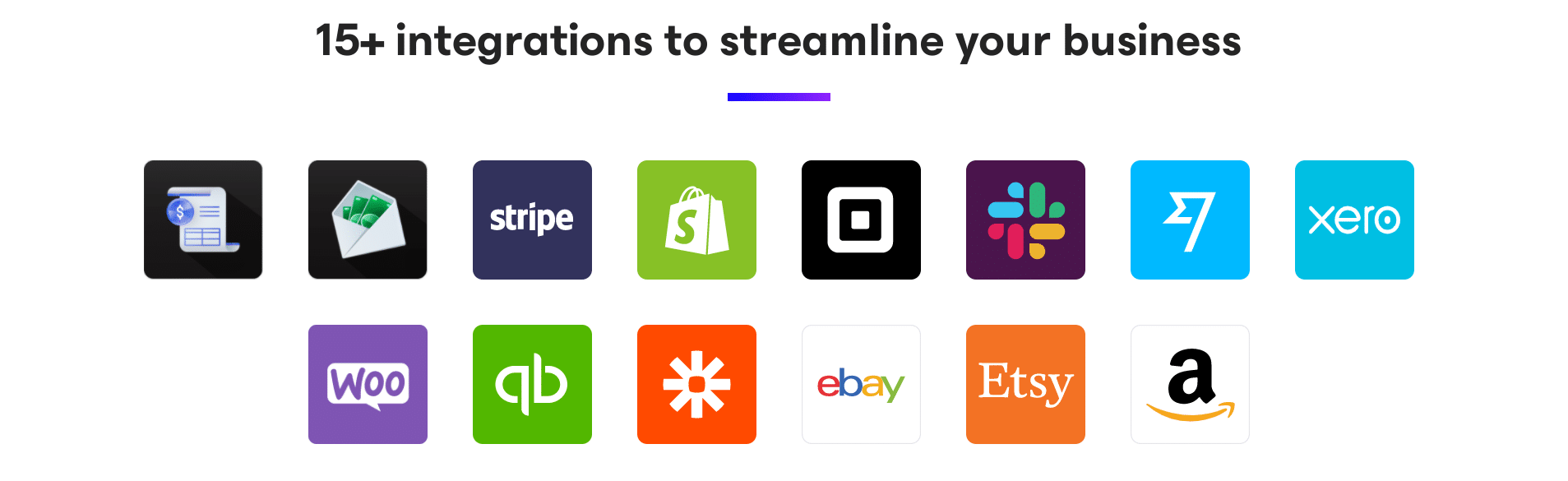

Novo Apps

Novo works with over one thousand business tools including popular ones QuickBooks, Amazon, Stripe, Xero, Shopify, and WooCommerce. Over 15 of these integrations are native inside the Novo app which eliminates the need to log into each app separately to get a birds-eye of your business's full financial picture.

Are There Any Fees?

There are no ongoing fees with Novo. You won’t pay for debit cards, a monthly fee, a statement fee, or any other ongoing fee.

Not only that, but Novo recently removed its $27 fee for non-sufficient items (NSF), and no longer charges NSF fees.

One fee you may incur, however, is an ATM fee. While Novo once offered free, unlimited ATM withdrawals, they now only offer ATM refunds up to $7 per month. This change takes effect January 1, 2024.

How Does Novo Compare?

While Novo was one of the first fee-free business accounts to focus on online businesses, it's not the only one today. In fact, the competition for best business checking account is heating up all the time.

Here is how Novo compares to some of the other top accounts:

Header |  | ||

|---|---|---|---|

Rating | |||

Monthly Fee | $0 | $0 | $0 |

Online Deposits | |||

Earns Interest | No | No | |

Cell |

How Do I Open An Account?

A Novo account is easy to open. You can get started by visiting its website here. You can open your business account as a sole proprietorship if you haven’t filed documentation for an LLC (or another corporate structure) in your state. The documents you'll need to upload are quickly identified.

Is It Safe And Secure?

Yes, your Novo funds are FDIC-insured up to $250,000 per depositor through its partner bank, Middlesex Federal Savings. The company's site is also protected with bank-level encryption and two-factor authentication (2FA) of accounts is supported.

How Do I Contact Novo?

You can reach out to the Novo support team by phone, email, or through the Novo app. Customer service hours are Monday - Friday 9 am - 6 pm (EST).

Email requests should be sent to support@novo.co. Novo doesn't publish its customer service number, but you can find it on the back of your debit card.

The Trustpilot rating for Novo is currently "Great" at 4.0/5 from over 900 customer reviews. However, Novo is not currently accredited or have a rating with the Better Business Bureau (BBB).

Why Should You Trust Us?

I have been writing and researching banking and personal finance products since 2009. At The College Investor, we've been comparing and reviewing banks since 2018, and track the best banks for savings and money market accounts daily from a list of over 50 major banks and credit unions.

We are also small business owners, and finding bank accounts that match our needs has been a challenge. That's what led us to review the best business banks and share those with you.

Furthermore, our compliance team reviews our rates every weekday to ensure that we are accurately showing the correct rates and terms so you can make an informed decision about where to open a bank account.

Who Is This For And Is It Worth It?

Opening up a small business checking account at a local bank shouldn’t be expensive or difficult. But for whatever reason, it is.

Few brick-and-mortar institutions offer free business checking accounts. And those that do require you to stand in line, bring a bunch of documentation, and fill out paperwork to officially open the account. For entrepreneurs who only earn a few hundred dollars in profit each month, the normal rigmarole is excessive.

Novo clearly eases the process. Since Novo’s accounts have no monthly fees, the business checking account seems like a good idea, especially for side hustlers and entrepreneurs who don’t have a business checking account yet.

Novo FAQs

Here are a few of the most common questions that we get asked about Novo.

Is Novo US-based?

Yes, its headquarters is in New York City and it supports US-based businesses.

Will Novo check my credit history?

No, your credit history will not be checked when you apply for a Novo account so it will have no impact on your credit score.

I have a virtual phone number. Can I still open a Novo account?

No, currently Novo is only able to accept applicants that have a US cell phone number (not a virtual number), a social security number (SSN), and a US address.

Can I open a Novo account for my crypto-related business?

No, Novo can't work with businesses that are affiliated with cryptocurrencies, privately-owned ATMs, marijuana/cannabis, gambling, crowdfunding, money services, or the adult entertainment industry.

Novo Features

Account Types | Business checking |

Minimum Deposit | $0 |

APY | N/A |

Debit Card Cash Back/Rewards | N/A |

Maintenance Fees | None |

Non-sufficient funds (NSF) Fee | None |

Branches | None (online-only) |

ATM Availability | ATM fees refunded up to $7 per month |

Mobile Check Deposits | Yes |

Send Paper Checks | Yes |

Cash Deposits | Not directly at ATMs; however cash can be converted to a money order and then deposited as a mobile check. |

Customer Service Number | Not published, but can be found on the back of the Novo debit card. |

Customer Service Hours | Monday - Friday 9 am - 6 pm (EST) |

Mobile App Availability | iOS and Android |

Web/Desktop Account Access | Yes |

Bill Pay | Yes |

FDIC Certificate | 28368 (through Middlesex Federal Savings) |

Promotions | None |

Novo Review

-

Fees and Charges

-

Products and Services

-

Customer Service

-

Ease of Use

-

Tools and Resources

Overall

Summary

Novo is a free online business checking account that integrates with dozens of business tools and no longer charges NSF fees.

Pros

- Fee-free business checking

- Send and track invoices

- Centralize your finances with Novo apps

- No NSF fees

Cons

- Depositing cash is a hassle

- Can’t visit local branches

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett