Managing your money through a bank or credit union is a necessary task. But it doesn’t necessarily bring a smile to your face.

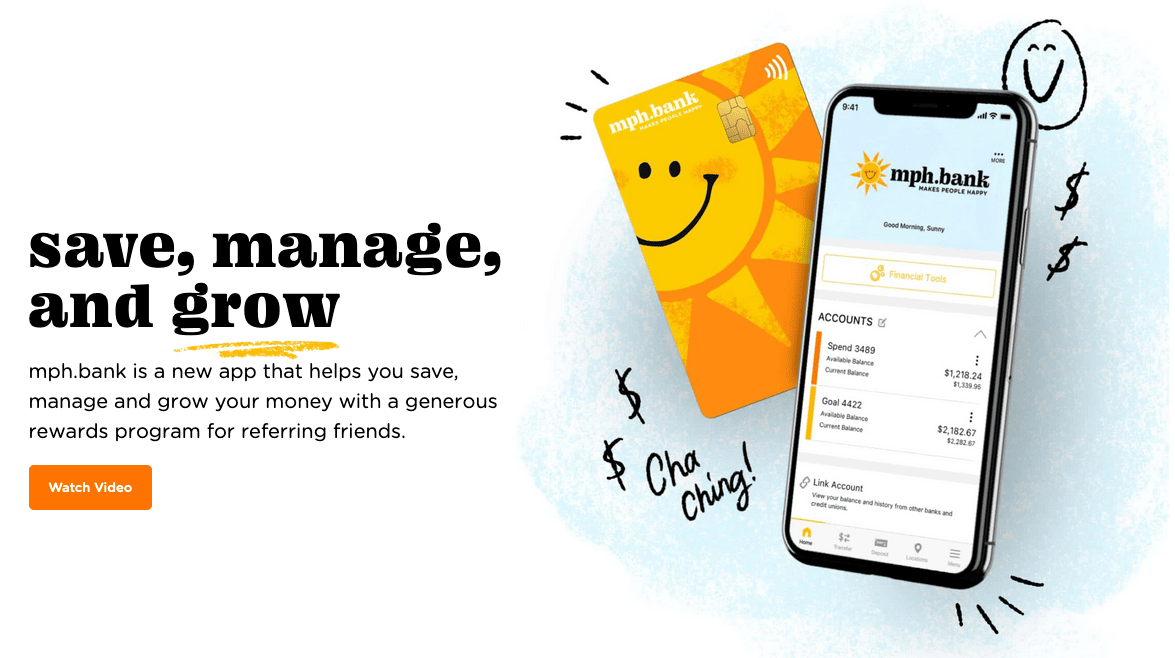

MPH.bank wants to change that. In fact, its motto ‘makes people happy’ seems to line up well with its helpful accounts built to help you meet your savings goals.

Ready to learn more about mph Bank? Here’s what you need to know.

MPH Bank Details | |

|---|---|

Product Name | No-fee digital checking account |

Min Deposit | $1 |

Monthly Fee | $0/mo |

APY | Up to 5.00% |

Promotions | None |

What Is MPH Bank?

MPH.bank is a neobank powered by Liberty Savings Bank. With the goal of making people happy, MPH.bank offers a streamlined mobile banking experience.

As a customer, you’ll find easy ways to build your savings. Plus, a robust rewards program that offers a monthly payout for everyone in your referral network.

MPH.bank is only available online.

What Does It Offer?

Curious about MPH.bank? Here’s what it has to offer.

Free Digital Checking Account

MPH offers a free digital checking account - simply called the "Free Account". This account is currently paying 5.00% APY on the first $50,000 in your account, as long as you set up direct deposits of at least $2,000. There are no monthly maintenance fees, no overdraft fees, and has access to 55,000 fee-free ATMs.

The account does require a direct deposit to your account of at least $2000 per month. Otherwise, it's a solid free checking account.

First Student Checking Account

MPH has a solid teen and college student checking account called the First Student Checking Account. This account is designed for students 10 to 26 years old.

This account also has no monthly maintenance fees, just like the Free Account, and you can set up unlimited 3.00% Goals (Pocket Savings) Accounts with Round-Up and Automated Transfers. Unlike the Free checking account, there is no direct deposit requirement.

When the child is under 18, the parents can determine debit card, mobile deposit limits, funds transfer, and Zelle peer-to-peer payments for students. Students can determine things when they turn 18.

Fresh Second Chance Checking

MPH also has a second-chance checking account called Fresh. If you're not familiar, second-chance checking accounts are designed for those who may not have the best banking score and, as a result, have issues opening a traditional checking account (yes banking scores are a thing).

This account has a $9 per month maintenance fee.

Money Market Account via SaveBetter

Currently, MPH Bank is best known for its top-yielding money market account. You can currently earn 4.36% APY on your money with the MMDA in partnership with SaveBetter, which is consistently at the top of our list of the best money market accounts.

This account only requires $1 to open, and has no monthly fees or minimum balance requirements to earn.

Check out the MPH Bank Money Market Account here.

Get A Big Picture Of Your Finances

MPH.bank offers the chance to easily see all of your accounts in one place. The unique thing is that you can even pull accounts from other banks into your MPH.bank dashboard. With that, you can keep an eye on your overall financial picture more easily.

The app also offers a budgeting tool to help you see how much you spend, identify spending trends, monitor your cash flow, and more. Plus, you can even check your credit score for free within the MPH.bank app.

It’s nice that the MPH.bank app is so comprehensive because there are no in-person branch options with this bank.

Interest-Bearing Spend Account

The Spend account comes with a debit card. Plus, you’ll earn interest on the funds in your Spend account.

You’ll need to make 15 purchases or make monthly deposits of $500 per month to unlock enticing rewards. The rewards include up to 0.55% APY on your Spend account balance. Additionally, this level of use will waive the $9 monthly membership fee.

The account also requires 15 purchases to unlock your monthly network Referral Rewards. You’ll earn $1 per person in your network, which includes up to 6 degrees of connections. MPH.bank pays out this reward every month, so the numbers can add up quickly.

Savings Goals

Saving goals are a key part of any healthy financial picture. Luckily, MPH.bank makes it easy to work towards your savings goals.

First, you’ll have the option to set up add-on ‘goals’ accounts for specific purposes. For example, let’s say that you want to get a puppy. You could set up an account specifically for that savings goal.

Once this sub-account is set up, you’ll have the option to automatically transfer spare change to your goal account. So, every time you make a purchase with your MPH.bank debit card, the spare change will be transferred directly to MPH.bank.

Are There Any Fees?

It depends on the account. The Free a checking and Money Market Accounts do not have any fees.

MPH.bank charges a $9 monthly membership fee for it's other products, including Fresh. However, there are no overdraft fees. And you’ll be able to withdraw cash at over 55,000 ATMs without a fee.

How Does MPH Bank Compare?

MPH.bank isn’t the only mobile-friendly banking experience with a focus on savings.

Another great option is Chime. The fintech prides itself on accounts with no fees and attractive APYs. Here’s where you can learn more about Chime.

If you're looking for a traditional savings account, check out Discover, which offers a consistently top rate on savings.

Header |  |  |  |

|---|---|---|---|

Rating | |||

Min Deposit | $1 | $0 | $0 |

APY On Savings | 5.00% | 2.00% | 3.90% |

Cell |

How Do I Open An Account?

The process of joining MPH.bank starts by going to their website and opening an account. You'll need to have the following information:

- Your email address

- Your mobile phone number

- Your child’s/children’s name(s)

- Your legal first and last name

- Your physical address

- Your date of birth

- Your Social Security Number

If you meet the criteria, MPH.bank will ask for documentation to confirm the information. To finalize your application, you must make a $25 opening deposit.

Is It Safe And Secure?

MPH.bank offers a secure banking experience. The website and app both have 256-bit encryption and bank-level security features.

Additionally, the funds in your deposit accounts are insured for up to $250,000. The FDIC insurance is provided through Liberty Savings Bank. All in all, you should feel comfortable conducting your banking business through MPH.bank.

How Do I Contact MPH Bank?

You can send a secure email through your MPH.bank account or call 800-892-8789. MPH.bank is also available through Twitter @mphbank. Or Instagram and Facebook @mph.bank.

The MPH.bank app has earned 5 out of 5 stars in the Apple App Store. But with only three reviewers, you might find a different experience.

Is It Worth It?

If you are looking for a streamlined way to manage multiple savings goals, MPH.bank offers a great solution. The ability to set up multiple savings goals and monitor your progress along the way can be very helpful. And its free digital checking account pays a high 5.00% APY, as long as you can meet the $2,000 direct deposit requirement.

Plus, their money market account through Raisin is top-notch at no cost.

However, the $9 monthly fee for their other products is a bit steep. If you are able to meet the requirements to waive the fee, then the attractive APY makes MPH.bank a good option. But if you can’t have the fee waived, then working with MPH.bank will add up quickly.

Ultimately, you’ll need to decide if you like the platform offered by MPH.bank. If not, there are plenty of other banking options out there. Take a minute to explore all of our favorite banks today.

MPH Bank Features

Account Types | Digital Checking, Money Market, First (Student), and Fresh (Second-chance account) |

Minimum Deposit | $1 |

APY | 5.00% |

Cash Back | 0% to 2% |

Monthly Fees | $9/mo |

Branches | None (online-only bank) |

ATM Availability | 55,000 Fee-Free ATMs |

Customer Service Number | 800-892-8798 |

Customer Service Hours | Monday-Friday, 8 AM-5 PM (EST) |

Mobile App Availability | iOS and Android |

Web/Desktop Account Access | Yes |

Direct Deposit | Yes |

Bill Pay | Yes |

FDIC Certificate | 32242 (through Liberty Savings Bank) |

Promotions | None |

MPH Bank Review

-

Interest Rates

-

Customer Service

-

Tools and Resources

-

Fees and Charges

-

Ease of Use

-

Products and Services

Overall

Summary

mph Bank is an online money market account with top interest rates powered by Liberty Savings Bank.

Pros

- Attractive APY

- Savings goals accounts

- Streamlined mobile experience

Cons

- Transaction or deposit requirements to waive monthly fee

- Limited customer feedback

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Richelle Hawley