Source: The College Investor

The newest age group entering the workforce is Gen Z. And like most generational differences, they have a different approach to many things - including money. So, how are Gen Z doing financially? What's the average net worth of Gen Z? Let's dive in.

First, it's important to realize that the Gen Z Age Range today is 12 to 27 years old. For the sake of talking about money and net worth, we're only going to focus on 22 to 27 year olds. Because, let's be honest, the net worth of 12 year olds isn't going to help us understand much.

Why should we can about Gen Z's net worth? Well, like the millennials before them, the media continues to portray young adults in this country as unable to get head. But is that really the case? Let's dive in.

Related: Millennial Net Worth By Age

Who Is Gen Z?

Gen Z is technically anyone born between 1997 and 2012 (always subject to change - with more people calling those born after 2012 Gen Alpha). Basically, these people are roughly 11 to 26 today. That's roughly 72 million Americans today. We more fully break down the Gen Z age range here.

What makes them unique as a generation? Well, Gen Z is the youngest generation in the workforce today. And they're entering the workforce during unprecedented events - like the Covid pandemic. This generation also had many formative years living through virtual schooling and other never-before-tried activities.

When it comes to money, Gen Z does have some of the highest student loan debt rates of any generation in history. The average Gen Z will graduate college with roughly $32,000 in student loans. See this article on the average student loan debt by graduate class/year.

So, it's really a mixed bag when it comes to Gen Z. Like millennials before them, they're really hard to define financially. Especially at such a young age.

When looking at net worth for Gen Z, these are all factors to consider.

Factors To Consider About Gen Z Net Worth?

When I think of the main factors that fall into Gen Z net worth, here's what we need to consider.

First, we need to consider when the Gen Z individual graduated. If Gen Z is roughly 11 to 26 today, some haven't even graduated college yet. However, if you're 26 today, you likely graduated from college 4 years ago - or 2019. That was right before the Covid pandemic.

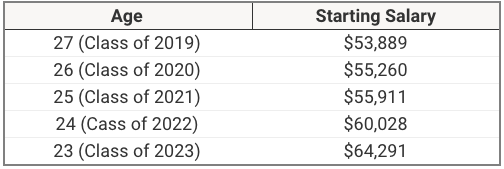

Second, we need to look at the average salaries of graduates by year. NACE has a great survey that they conduct to look at the average salary of college graduates each year. Look at how much inflation has impacted starting salaries!

Note: The "Class of" date is the year most of your age group graduated a 4-year college (you wouldn't likely be negative if you didn't go to college). For example, if you're 27 in 2023, you likely graduated college in 2019, and high school in 2015. This could be slightly off depending if you're older or younger for your age, or you graduated high school or college early.

Here's how that looks:

Source: The College Investor

Age | Starting Salary |

|---|---|

27 (Class of 2019) | $53,889 |

26 (Class of 2020) | $55,260 |

25 (Class of 2021) | $55,911 |

24 (Cass of 2022) | $60,028 |

23 (Class of 2023) | $64,291 |

Note: Gen Z has some of the lowest college attendance rates of the last few generations. More Gen Z individuals are skipping college and jumping right into the workplace. This can have a positive boost on net worth much earlier than those that did go to college. At 18 or 19, you have the potential to earn more money without student loan debt. However, since roughly 60% of Gen Z is still attending college, it's a big factor in the overall net worth picture. Most of our data also relies on college graduation data.

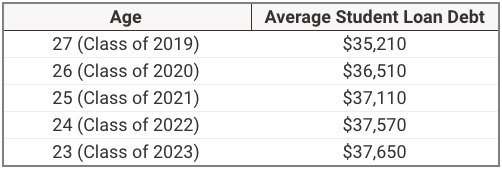

Third, we need to discuss student loans. Student loans are a huge factor in Gen Z net worth, so we want to consider the average amount of student loan debt Gen Z had when the graduated (data here).

Source: The College Investor

Age | Average Student Loan Debt |

|---|---|

27 (Class of 2019) | $35,210 |

26 (Class of 2020) | $36,510 |

25 (Class of 2021) | $37,110 |

24 (Class of 2022) | $37,570 |

23 (Class of 2023) | $37,650 |

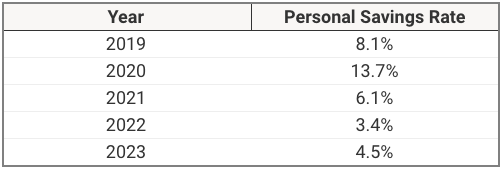

Finally, we do have to make some assumptions about saving. Remember, net worth is all about assets minus debt. But income plays a huge role and how much income is saved and how much debt is paid off really makes a difference. For the "average" Gen Z, I'm going to look at average savings rates for the calculation. For the above average Gen Z, we're going to factor in IRA and 401k savings, as well as home equity.

Source: The College Investor

Year | Personal Savings Rate |

|---|---|

2019 | 8.1% |

2020 | 13.7% |

2021 | 6.1% |

2022 | 3.4% |

2023 | 4.5% |

Gen Z Net Worth By Age

As we compare the net worth of Gen Z by age, I want to look at average and stretch goals. I think it's important to always consider the average, but I also want to leave you with a stretch goal to get yourself in the top 1%.

Remember, net worth is assets minus liabilities. As we discussed earlier, the main assets we're focusing on is savings, based on income. The main liability for Gen Z is student loan debt, but other forms of debt (specifically auto loans and mortgages) can seriously impact net worth as well.

Finally, I want to re-emphasize that these are just our estimates. The Federal Reserve data lumps everyone under 35 into one bucket, so while we have some starting points, things can always skew one way or another.

With that in mind, here's the Federal Reserve Data for under 35:

Under 35:

- Median Net Worth: $39,000

- Average Net Worth: $183,500

However, I think it's a great starting point for discussion, so let's jump into it. Remember, we're pulling and estimating based on some very sparse data points, as well as negative net worth for younger cohorts. This is an estimate! But based on years of experience, we think it's a fairly accurate estimate.

Average Gen Z Net Worth By Age

Here is the Gen Z Net Worth by Age estimate:

Source: The College Investor

Age | Net Worth |

|---|---|

27 | $8,142 |

26 | -$7,347 |

25 | -$17,293 |

24 | -$23,773 |

23 | -$31,571 |

Yes, the "average" net worth for Gen Z (who are now in the workforce) is negative. We put the average of everyone at -$19,496. The key year is 27 - that's when we're seeing Gen Z make the jump from negative to positive.

It's clear that both Covid and inflation are having a profound effect on this generation. Covid stifled wage growth in 2020, which hurt the Class of 2020. Inflation is helping the class of 2022-23 with wages, but the costs of goods are also skyrocketing.

Notes: This assumes that students don't work or work marginally during school, maintain an average amount of student loan debt, and get average employment after graduation

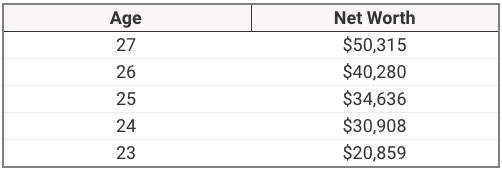

High Achiever Gen Z Net Worth By Age

Now that you've seen what average is, what does it take to be above average? Well, anything better than the chart above is above-average. But I want to give you a stretch goal. I call this the high achiever Gen Z net worth by age.

How do you get here? A few key areas:

- Eliminate Your Student Loan Debt (Read: How To Eliminate Your Student Loan Debt)

- Boost Your Income by 25% (Read: How To Boost Your Income)

- Save at least 25% of your income - can be through both personal savings or through employer matches to a retirement plan. (Read: How To Save For Retirement)

This chart below is calculated basically the same as the "average" net worth above, but with being student loan debt free, and having 25% higher income. Also, raising the savings rate by 25%.

Source: The College Investor

Age | Net Worth |

|---|---|

27 | $50,315 |

26 | $40,280 |

25 | $34,636 |

24 | $30,908 |

23 | $20,859 |

What are some of your thoughts on this? Do you think an 23 year old can have $20,859 saved up just one year after college graduation? I think it's definitely possible - especially the high achievers that started working at 16 (or earlier) and saved a bunch, minimized student loans, and invested.

I think that these high achiever net worth amounts are very do-able. They are a stretch, but not unheard of. And these amounts will clearly make you above average. Probably on track to be a millionaire in your 40s.

How To Boost Your Net Worth

Now that you know the average and above average net worth, how do you get there? It's time to start looking at ways to boost your net worth.

First, t's essential to track your net worth. I'm a fan of Empower, because it's free, has great tools, and it's online. Check out Empower here. But Empower isn't the only app or tool that can help. Check out our full list of the Best Budgeting Apps here.

The great thing is that you're still young and you have a ton of time on your side. Time is the biggest ally you have in building wealth. But if you want to grow it (and fast), here are two more key areas to focus on.

Boosting Your Income - As mentioned earlier, income is one of the key drivers in building assets and eliminating debt. The more income you have, the easier it is to grow your net worth. I want to challenge you to earn at least an extra $100 per month. We have a great list of ideas to get started. I'm a firm believer that everyone can earn more if they try. I personally went to college full-time, worked full-time, and managed to side hustle as well.

Eliminating Your Debt - One of the biggest struggles Gen Z have is overcoming a negative net worth and making it positive. Eliminating that student loan debt is key. Leverage your additional income but also look at student loan repayment strategies to help lower that debt.

Final Thoughts

Compared to the average millennial net worth when they were this age, it does seem that Gen Z is doing better. However, while Gen Z may be earning more, and have a slightly higher (albeit negative) net worth than the previous generation, they are facing big headwinds when it comes to the cost of living.

They're making more, but everything is costing more. As such, it can be harder to grow your net worth. Combine that with rising student loan balances, and it's challenging to get ahead.

The fact is, average is just that - average. It means that there are people doing better, and people doing worse. Keep working on your own situation to improve it and shoot for the high achiever numbers.

More From The College Investor:

The College Investor used data from the Federal Reserve Survey on Consumer Finances, the National Association of Colleges and Employers, and FRED Economic Research Data, combined with their own calculations and assumptions, to create these estimates.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Colin Graves Reviewed by: Chris Muller