It can be confusing to understand whether you're a dependent or independent student for FAFSA and financial aid purposes.

Given the current cost of higher education, college students need all the help they can get when paying for college. There are a variety of different ways to pay for college, including paying your own way, scholarships, grants, and student loans.

Nearly all forms of financial aid start with filling out the Free Application for Federal Student Aid (FAFSA) form that is made available by the U.S. government. And one of the key sections of the FAFSA form is determining whether you are a dependent or independent student.

Here's what you need to know.

Filling Out The FAFSA Form

The FAFSA form is the primary form for financial aid in the United States, administered by the U.S. Department of Education. A common misconception is that the FAFSA form is only for student loans—it's actually used by many colleges as one part of their process for awarding scholarships. Filling out the FAFSA form each year and sending it to the colleges that you are considering can help you figure out the best academic and financial fit for you.

That's why it's important to fill out the FAFSA form every year, even if you aren't planning on taking out any student loans. The Department of Education estimates that it will take about one hour to fill out the FAFSA form, as there are several steps. The first several steps have you create a Federal Student Aid (FSA) ID and enter in your demographic and basic financial information. Then you will answer a series of questions to see if you will be classified as an independent or a dependent student.

Understanding Dependent and Independent Student Status: Key Differences

As you look for different options to pay for college, it's important to understand the difference between being a dependent student and an independent student. A dependent student is required to also have their parent or guardian fill out the parent's information on the FAFSA form. That parental financial information will also be used in the calculations to determine the student's Student Aid Index (SAI).

An independent student will only have their own information used in financial aid calculations.

Determining Whether You Are An Independent Student

The FAFSA form first will ask you if any of the following are true of the student:

- Age 24 or older as of December 31 of the award year

- A graduate or professional student

- Married

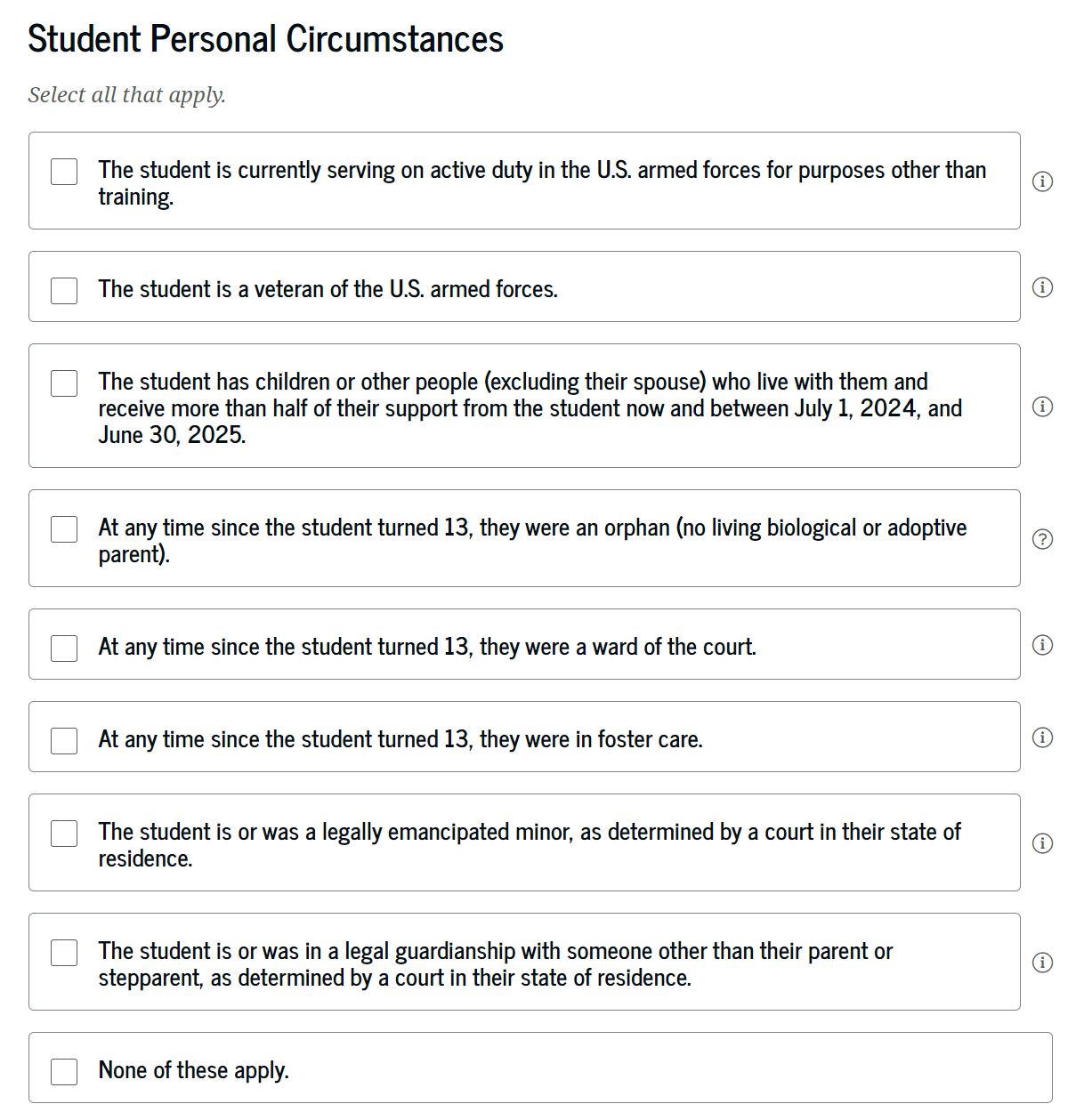

If any of those are true, the student will be classified as an independent student. If none of those are true, the student will be asked a series of eight questions that you will answer (yes or no) to identify the student's personal circumstances.

- The student is currently serving on active duty in the U.S. armed forces for purposes other than training

- The student is a veteran of the U.S. armed forces

- The student has children or other people (excluding their spouse) who live with them and receive more than half of their support now and between July 1, 2024, and June 30, 2025

- At any time since the student turned 13, they were an orphan (no living biological or adoptive parent)

- At any time since the student turned 13, they were a ward of the court

- At any time since the student turned 13, they were in foster care

- The student is or was a legally emancipated minor, as determined by a court in their state of residence

- The student is or was in a legal guardianship with someone other than their parent or stepparent, as determined by a court in their state of residence

If you answer yes to any of these, you will be classified as an independent student.

If none of them apply, you are considered a dependent student.

Dependent Students: Financial Aid Basics

Dependent students are required to have their parent or guardian also enter in their financial information as part of the FAFSA process. There are also rules for how divorced parents should fill out the FAFSA. Generally, a dependent student will qualify for lower amounts of financial aid than an independent student, due to their parents' income. Filling out the FAFSA as a dependent student is also required to determine eligibility for Parent PLUS loans.

Independent Students: Financial Aid Challenges and Opportunities

If you are an independent student or paying for college as an adult, you'll generally qualify for more grants and loans than a dependent student with a similar situation. That's because independent students do not have to enter their parents' financial information on the FAFSA. In most cases, that means that these students have a lower Expected Family Contribution and therefore a higher likelihood of qualifying for needs-based scholarships, loans, and grants.

Because of this, you might be tempted to stretch the truth on some of the qualifying questions to attempt to be classified as an independent student. This is very unlikely to work, and may put you at risk of fines or other legal trouble. Your college's financial aid department will likely ask for proof of any special circumstances, and will easily see through any situation that is not on the up and up.

The Bottom Line

One of the key sections of the FAFSA form is the one that determines whether you are an independent or a dependent student. Dependent students are required to have their parents or guardians also enter in their own financial information, while independent students do not have this requirement.

Because of this, it is typical that independent students will receive more funding from the FAFSA than dependent students. No matter what type of student you are classified as, make sure to check out the best student loan rates to find the loan that works best for you.

Dan Miller is a freelance writer and founder of PointsWithACrew.com, a site that helps families to travel for free / cheap. His home base is in Cincinnati, but he tries to travel the world as much as possible with his wife and 6 kids.