Source: The College Investor

Key Points

- Hidden Costs Of College: Many colleges underestimate living expenses, leaving students with financial gaps of $10,000 or more.

- Impact On Students: Inaccurate cost estimates leave insufficient financial aid for students.

- Colleges Need To Improve COA Estimates: Colleges need to standardized non-tuition cost calculations to bring the cost of attendance more in-line with actual expenses.

According to a new report from John Burton Advocates for Youth (JBAY), College Cash Uncovered, there are significant discrepancies between colleges’ published cost of attendance (COA) budgets and the actual expenses students face. These discrepancies contribute to college affordability challenges and inadequate financial aid. This leaves some students with financial gaps of $10,000 or more.

John Burton Advocates for Youth (JBAY) is a nonprofit organization that focuses on improving the lives of youth who have experienced foster care or homelessness. They work on policy advocacy and providing resources to at-risk youth, including stable housing, education, healthcare and financial support. The organization tries to address higher education access, financial aid and foster youth transitions into adulthood.

What Is The Cost OF Attendance?

A college’s cost of attendance, or COA, is supposed to measure the total annual college costs for a student to attend the college. Each college may have a different cost of attendance.

The cost of attendance includes both direct and indirect costs. Direct costs are paid to the college, while indirect costs are not. The distinction does not matter much for families, since they have to pay both direct and indirect costs, and financial aid eligibility is based on the combination of direct and indirect costs. But, some colleges and trade groups emphasize just the direct costs, especially when trying to convince people that college costs have not increased.

The cost of attendance (sometimes called a student budget) includes allowances for the following costs.

- Tuition And Fees

- Housing And Food (also known as Room and Board): The housing allowance for college owned or operated housing must be based on the average or median housing charges, whichever is greater. The allowance for food must provide the equivalent of three meals a day.

- Books, Supplies, Course Materials, and Equipment: This includes an allowance for a personal computer, in addition to textbooks and educational materials.

- Transportation: The transportation allowance must cover the cost of commuting between school, home and work. The transportation allowance does not include the cost of buying a car, just the incremental cost of transportation.

- Personal Expenses: Personal expenses include laundry, clothing, toiletries and personal needs.

- Other Costs: Other costs can include dependent care costs, disability-related expenses, study abroad expenses and loan fees for federal loans but not private loans. It can also include the cost of professional licensing and certification and the cost of first-professional credentials. Dependent care costs include but are not limited to class time, study time, field work, internships and commuting time.

The cost of attendance is used to determine eligibility for need-based financial aid. Financial need is defined as the difference between the cost of attendance and the student aid index. The Student Aid Index (SAI) was previously known as the Expected Family Contribution (EFC).

Related: Financial Aid Calculator

What Are The Problems With The Cost Of Attendance Calculations?

The key issue is that some allowances in the cost of attendance differ from actual student expenses.

For example:

- Colleges tend to routinely underestimate allowances for textbooks and transportation.

- Some of the cost of attendance allowances are averages, as opposed to actual costs. Students from at-risk populations often have above-average costs.

- The accuracy of cost allowances is often unreliable. In many cases, colleges use outdated figures adjusted only by a standard inflation rate over the years, which fails to capture actual cost increases. At nearly a third of colleges, the non-tuition costs have not been adjusted for inflation at all. Additionally, allowances for off-campus housing often underestimate true costs, especially since rent is typically higher in college towns.

Source: College Costs Uncovered

Furthermore, many expenses are omitted from the cost of attendance:

- Many fees are not included in the allowance for tuition and fees, such as technology fees, activity fees, athletic fees, orientation fees, health center fees, library fines, lab fees, transcript fees and graduation fees.

- Technology costs, such as computers, software and peripherals are often omitted from the cost of attendance.

- Allowances for transportation often omit the cost of parking, insurance and maintenance.

- Housing allowances often omit the cost of utilities (electricity, heating, telephone, internet), renter’s insurance and security deposits. There may also be fraternity and sorority dues.

- The cost of attendance also does not include the cost of health insurance, insurance deductibles, copays and over-the-count medicine.

- Colleges routinely omit allowances for dependent care and disability expenses. Students must know to ask for these allowances.

It's also important to point out that even the cost of tuition may not be finalized until after students have had to accept enrollment. Many colleges don't finalize their exact tuition costs until June or July of the year, depending on the fiscal calendar. And since college prices tend to rise 3-5% per year, this can also create inaccurate estimates.

The JBAY report points out that cost of attendance budgets often fail to consider regional variations and the unique needs of diverse student populations, such as childcare or disability-related costs.

This results in a misleading representation of the real financial burden on students.

Bad Cost Estimates Harm Students

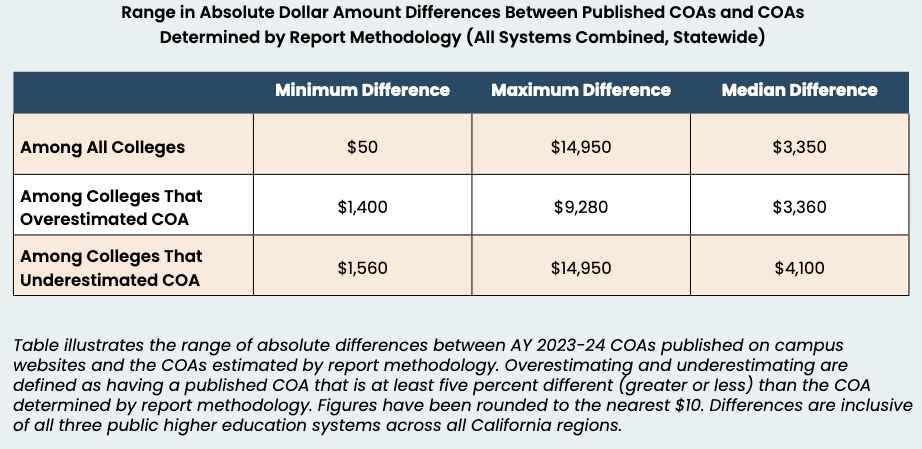

The JBAY report identifies discrepancies between colleges’ published cost of attendance (COA) budgets and the actual expenses students face. Underestimating actual living costs makes college unaffordable for many students, especially those from at-risk populations with limited financial resources.

Discrepancies in Cost of Attendance (COA) Budgets

Many colleges significantly underestimate the actual expenses faced by students, particularly for low-income, foster youth and other vulnerable groups. There is a wide gap between the published cost of attendance figures and the true costs for housing, food and transportation, especially in high-cost regions. This discrepancy results in a much heavier financial burden than is reflected in the college’s official cost of attendance estimates.

According to the report, over half of colleges use cost of attendance budgets that fail to account for the actual expenses, with underestimations sometimes exceeding $10,000 per year. Many students face food and housing insecurity and are unable to absorb discrepancies in the college cost of attendance, further exacerbating their financial hardships.

Disproportionate Impact On Vulnerable Students

The inaccurate cost of attendance estimates disproportionately harm low-income students, who often struggle to cover the true costs despite receiving financial aid.

The standardized cost of attendance budgets fail to consider the unique circumstances of foster youth and students without family support, who lack access to parental housing during school breaks. The unmet need for former foster care students is nearly double that of their peers.

Additionally, students with children have substantially greater expenses than the costs included in the college’s student budget. These inaccurate estimates result in severe financial stress, making it difficult for these students to succeed and persist in their academic pursuits.

Lack Of Transparency In Calculating Non-Tuition Costs

Many colleges do not disclose how they calculate non-tuition costs within the cost of attendance budget, nor do they proactively inform students about the process for requesting an adjustment based on actual expenses.

This lack of transparency makes it difficult for students to appeal for a higher cost of attendance, even when their expenses exceed the college’s estimates. Additionally, there can be significant variations in non-tuition cost estimates among colleges in the same geographic region.

Inadequate Financial Aid

The underestimates of actual college costs lead to lower financial aid offers that do not meet the students’ actual financial need.

The financial aid gaps make college unaffordable for many low-income and middle-income families, forcing them to work excessive hours, borrow from private student loan programs, and enroll part-time instead of full-time.

Ultimately, these financial pressures increase the likelihood that the students will drop out of college.

Key Recommendations

The JBAY report makes several recommendations for better aligning cost of attendance estimates with actual student expenses. This will help bridge financial gaps and support student success.

- Colleges need to improve the accuracy of cost of attendance calculations.

- The calculation of non-tuition expenses like housing, books and transportation must be standardized, with consideration of local and regional cost differences.

- Colleges must enhance the support for students needing financial aid adjustments and ensure that the adjustments reflect the student’s specific circumstances.

- Financial aid awards must be increased to cover the gap between the cost of attendance and the student’s ability to pay.

- The financial aid application and award process must be streamlined to avoid introducing barriers to college access and success.

Don't Miss These Other Stories:

Mark Kantrowitz is an expert on student financial aid, scholarships, 529 plans, and student loans. He has been quoted in more than 10,000 newspaper and magazine articles about college admissions and financial aid. Mark has written for the New York Times, Wall Street Journal, Washington Post, Reuters, USA Today, MarketWatch, Money Magazine, Forbes, Newsweek, and Time. You can find his work on Student Aid Policy here.

Mark is the author of five bestselling books about scholarships and financial aid and holds seven patents. Mark serves on the editorial board of the Journal of Student Financial Aid, the editorial advisory board of Bottom Line/Personal, and is a member of the board of trustees of the Center for Excellence in Education. He previously served as a member of the board of directors of the National Scholarship Providers Association. Mark has two Bachelor’s degrees in mathematics and philosophy from the Massachusetts Institute of Technology (MIT) and a Master’s degree in computer science from Carnegie Mellon University (CMU).

Editor: Robert Farrington