Rally is an online investment platform that allows investors to invest in collectibles.

Investing in alternative asset classes can be an effective way to diversify your portfolio if you mostly invest in stocks and ETFs. But, for many investors, the idea of investing in assets like trading cards or luxury cars might seem more like gambling than diversification.

Thankfully, with Rally Rd., investors can get in on the action by buying shares in highly-collectible assets like sports cards, cars, and other luxury goods.

But investing in alternative assets can present risks for investors and it’s important to understand how Rally actually issues shares. That’s why our Rally Rd. review covers how this investing platform works and breaks down its potential benefits and risks.

Quick Summary

- Invest in fractional shares of collectible assets

- Commission-free trading and no account fees

- 90-day lock-up period after an asset's Initial Offering before it can be resold on the secondary market

Rally Rd. Details | |

|---|---|

Product Name | Rally Rd. |

Product Type | Alternative Investment App |

Supported Asset Classes | 6 Different Collections |

Open To Non-Accredited Investors | Yes |

Fees | Zero Trading Fees Or Account Fees |

Promotions | None |

What Is Rally Rd.?

Rally Rd, which generally refers to itself simply as "Rally," is an investing platform that specializes in buying and selling collectible assets. The company began in 2016 and has its headquarters in New York City.

Traditionally, if you wanted to invest in alternative assets like luxury watches or rare sports cards, you had to buy those assets yourself from a collector or at an auction. This requires a lot of time, research, and significant capital.

Alternatively, Rally lets you buy fractional shares in rare, collectible assets that its team believes will appreciate in value. If you’re looking for an alternative investment idea to stocks, ETFs, or cryptocurrency, Rally provides a solution.

What Does It Offer?

Rally Rd. has a free investing app for Android and iOS as well as a web-based version. Once you sign up, you can browse various asset classes and rare collectibles to invest in. Currently, Rally offers several asset classes, known as “collections,” including:

- Books

- Cars

- Comics

- One-of-a-kind collectibles

- Sports cards and memorabilia

- Trading cards

Rally's team acquires valuable assets in these collections. From there, assets are securitized so investors can actually buy equity shares. Rally typically offers shares from $5 to $35 per share, making it a beginner-friendly way to invest in alternative assets.

Rally works with FINRA-registered broker-dealers to issue shares and oversee the entire investing process. As mentioned, Rally Rd. also owns these assets. According to its website, Rally stores assets in a climate-controlled facility on the East Coast to ensure security.

Rally Collections - What Can You Invest In?

Rally Rd. shares information about each collection with investors, including asset origins and previous ownership history, numerous photos, and market prices of similar collectibles. Currently, Rally has dozens of investment opportunities spread out over the different collection categories.

One-Of-A-Kind

This category of Rally Rd. collections feature incredibly rare collectibles that are truly one-of-a-kind and aren’t mass-produced. Some current listings include:

- Signed 2016 Kobe Bryant Farewell Game Hardwood ($800,000 market cap, $8 per share)

- 1976 Apple I Computer, signed by Woz ($825,000 market cap, $25 per share)

- 1779 Broadside of the Declaration of Independence ($2M market cap, $25 per share)

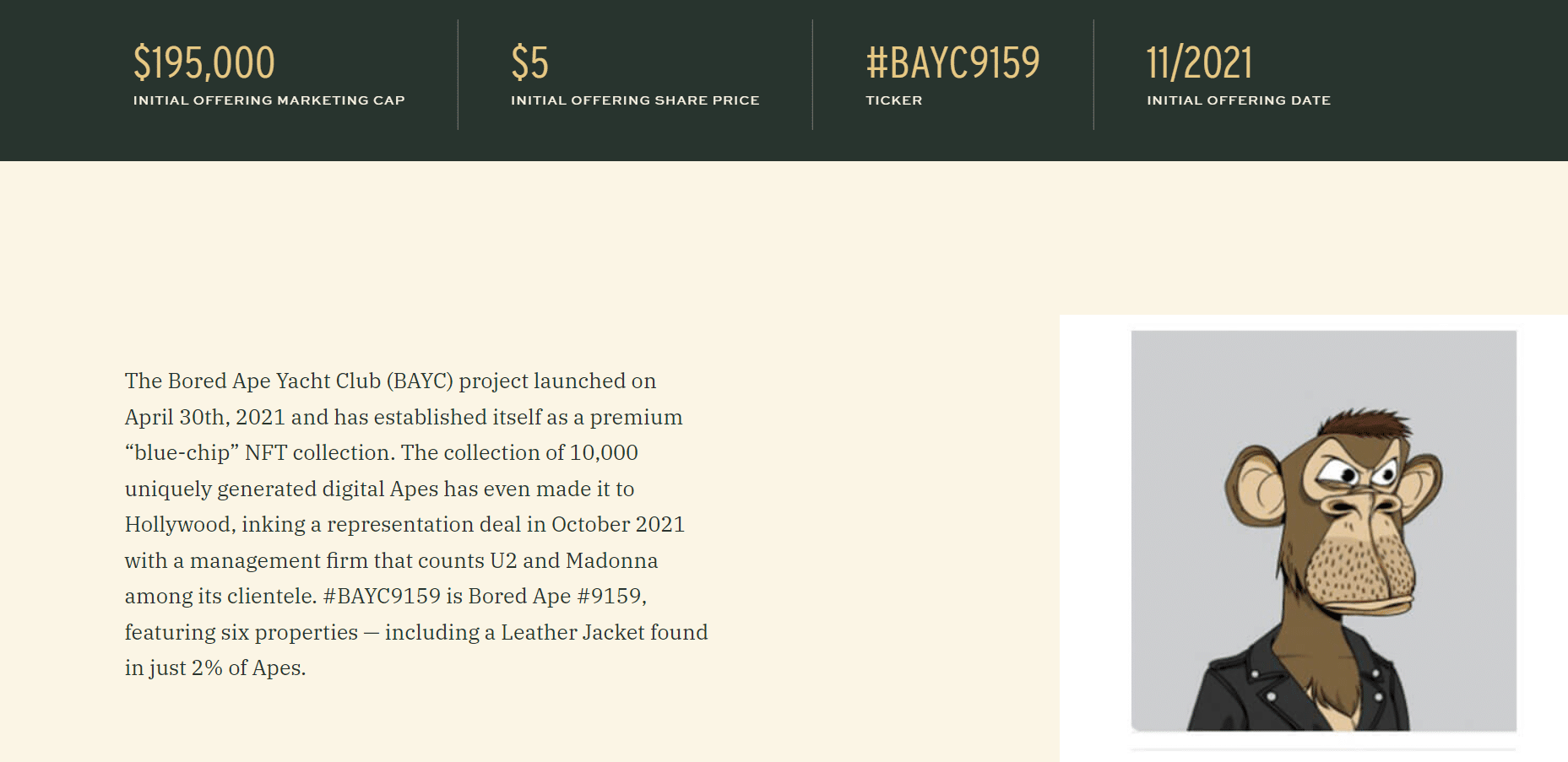

Recently, Rally has also been dabbling in non-fungible tokens (NFTs). For example, investors can buy shares of the Bored Ape #9159 NFT, which has a market cap of $195,000 and costs $5 per share.

Screenshot of a Bored Ape NFT for sale on Rally Rd

Rally Rd. doesn’t have nearly as many NFT opportunities as marketplaces like Rarible or OpenSea. But, it’s a positive sign that Rally continues to diversify its collections.

Sports

Sports memorabilia is another Rally collection. Examples of assets include:

- Signed 1998 Michale Jordan Nike Air Jordan III ($22,000 market cap, $11 per share)

- Signed 1960 Worn Mickey Mantle Jersey ($850,000 market cap, $20 per share)

- Signed 1934-39 Official American League Babe Ruth Baseball ($29,000 market cap, $14.50 per share)

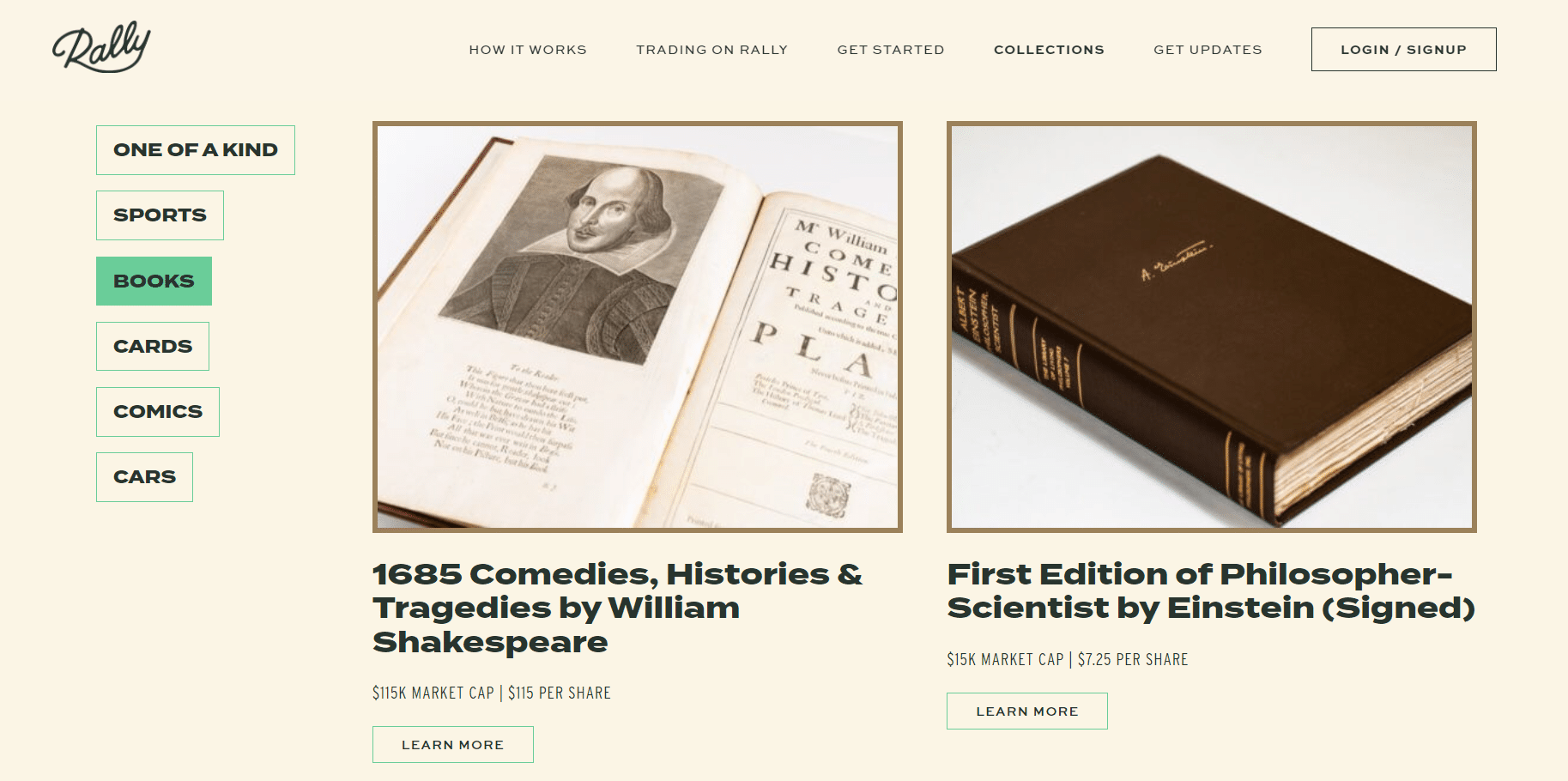

Books

If you want to invest in first-edition copies of classic and modern best sellers, this Rally collection is for you. Current investment opportunities include:

- First Edition, First Issue of The Great Gatsby ($200,000 market cap, $50 per share)

- 1997 First Edition Harry Potter ($72,000 market cap, $24 per share)

- 1685 Comedies, Histories & Tragedies by William Shakespeare ($115,000 market cap, $115 per share)

Screenshot from Rally showing books that are currently for sale

Cards

Sports cards are a classic collectible item for fans and are one of Rally's more extensive collections. You can also invest in rare Pokemon cards and other trading cards like:

- 1999 Pokemon First Edition PSA GEM MT 10 Complete Set ($125,000 market cap, $25 per share)

- 1979 Topps Wayne Gretzky $18 Rookie Card ($800,000 market cap, $40 per share)

- 1909-1911 T206 Honus Wagner Card ($520,000 market cap, $52 per share)

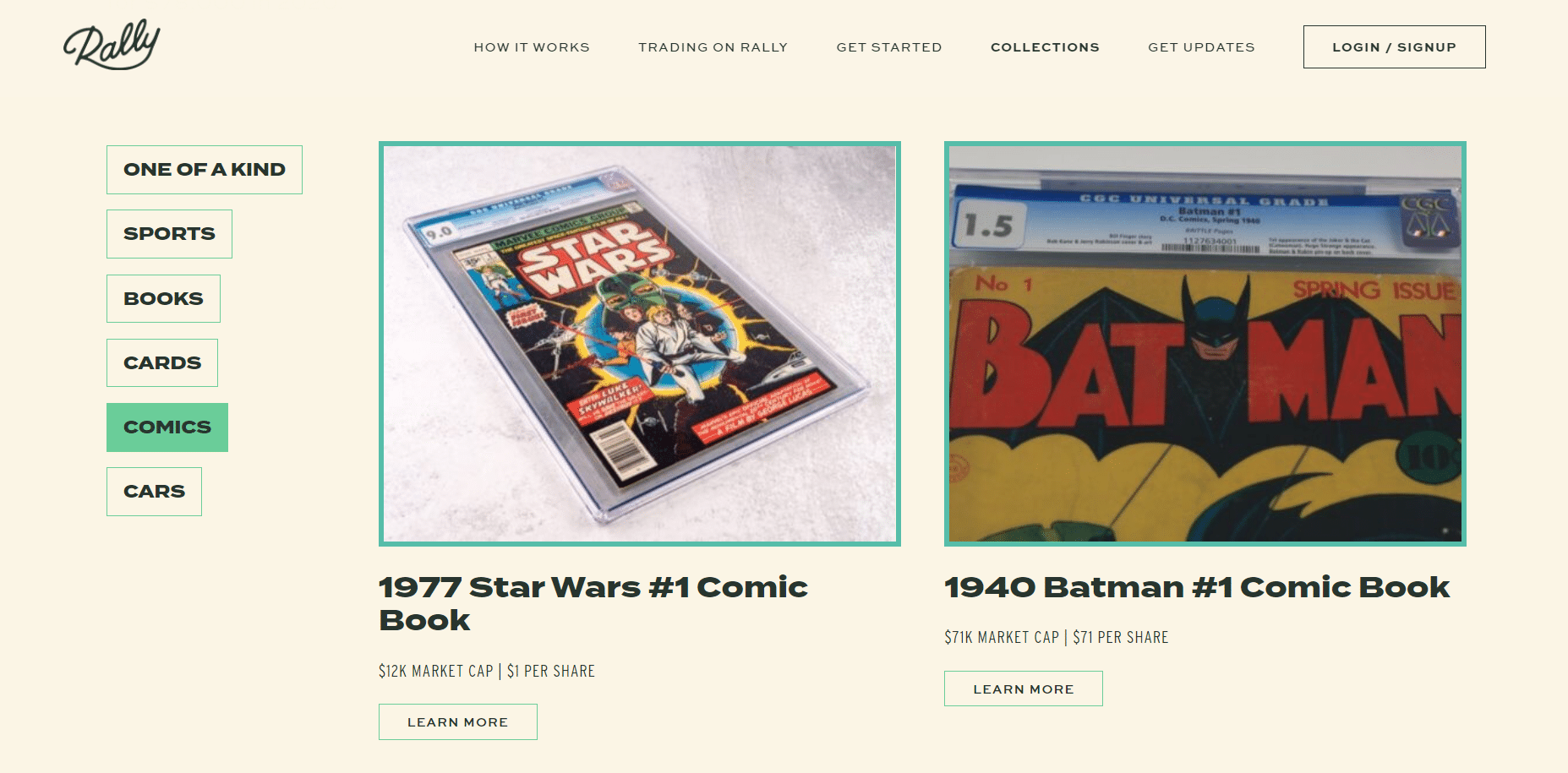

Comics

According to Rally Rd., the surge in superhero films is leading to a rise in vintage comic book prices and collector interest. Examples of comic books you can invest in include:

- 1977 Star Wars #1 Comic Book ($12,000 market cap, $1 per share)

- 1963 X-Men #1 Comic Book ($240,000 market cap, $20 per share)

- 1940 Batman #1 Comic Book ($71,000 market cap, $71 per share)

Screenshot from Rally showing comics that are currently for sale

Cars

Classic cars are another popular alternative asset class on Rally Rd. According to Rally, classic cars are also the second most popular alternative investment behind artwork. Current car investments include:

- 2003 Saleen S7 ($420,000 market cap, $125 per share)

- 1988 Lamborghini Jalpa ($135,000 market cap, $67.50 per share)

- 1955 Porsche 356 Speedster ($425,000 market cap, $212.50 per share)

How Does Investing With Rally Rd. Work?

Once Rally Rd. purchases and securitizes an asset, investors can buy-in during an Initial Offering. From there, investors must wait 90 days before selling their shares or adding to their position. After the 90-day lock-up period has elapsed, you'll have the option to sell your shares on a secondary market during “trading windows,” which open about every 90 days for each asset.

Once you own shares of an asset on Rally, you can generate a return in two ways. Firstly, Rally anticipates its assets will increase in value over time, meaning your shares can go up in value. Rally also pays dividends if the asset earns more money than operational costs. However, Rally is quite vague and doesn’t have information on historical dividend payments.

Appreciation is undeniably the main way to generate returns from Rally investments. You can also sell your shares to other investors using Rally's trading feature. Market hours are weekdays from 10:30 AM to 4:30 PM Eastern Time.

This is similar to buying and selling stocks or ETFs, except you’re selling to a much smaller pool of investors and must wait for trading windows. But the fact that Rally has a secondary market is a plus since it helps you liquidate your shares if you need capital.

Are There Any Fees?

This is one of the areas where Rally Rd. really shines right now. The platform doesn’t currently charge any investor fees such as commissions, management fees, or storage fees.

For now, Rally only makes money by investing in rare assets that appreciate in value. Of course, the company could always add fees down the road. But, for now, it appears to be a true low-cost leader.

How Does Rally Rd. Compare?

The "collectibles" space has historically been dominated by auction companies and sites. But Rally Rd is trying to make these assets more accessible by offering both fractional share investing in Initial Offerings and an integrated secondary market for trading assets after their lock-up period.

Right now, there aren't many sites or apps that are able to compete head-to-head with Rally. Mythic Markets had a similar business model, but it recently announced that it was closing down and had sold its assets to Heritage Auctions.

A few platforms do offer similar functionality to Rally, but they tend to focus on just one type of collectible asset. For example, Collectable focuses on sports memorabilia and Masterworks on fine art investing. Here's a quick look at how Rally Rd. compares to those two platforms.

Header |  |  |  |

|---|---|---|---|

Rating | |||

Min Investment | Varies - as low as $1 | $10 | $1,000 |

Assets | 6 different collections | Sports collectibles | Fine art |

Fractional Shares | Yes | Yes | Yes |

Secondary Market | Yes | Yes | Yes |

Cell |

How Do I Open An Account?

Opening a Rally Rd. account is free. You must be 18 or older and live in the United States to invest. Rally also has know-your-customer (KYC) requirements so you verify your identity and include your name, address, and social security number when signing up.

You don’t need to be an accredited investor to invest with Rally. However, non-accredited investors can’t invest more than 10% of their annual income or net worth.

Rally Rd. is available on Android and iOS as well as a web version. You create an account with your email and then fill out your personal information and SSN to finish setting up your profile.

Is It Safe And Secure?

Rally Rd. securities are regulated by the U.S. Securities & Exchange Commission (SEC.) Additionally, Rally works with registered broker-dealers that are members of FINRA and the SIPC in all 50 U.S. states. Assets are also insured and held in a secure storage facility.

However, Rally investments are more illiquid than more traditional investments like stocks. Since the pool of active investors is smaller, it could be difficult to sell your shares on the secondary market if you need fast cash and want to exit quickly.

It’s also worth noting that even though the Rally team does due diligence and invests in asset classes that historically appreciate, there aren’t any guarantees. You could make less than if you had invested in index funds or stocks, or even lose money.

Finally, in its disclaimer, Rally states one of the underlying asset risks is that the company “may be forced to cause its various Series to sell one or more of the underlying assets at an inopportune time." In other words, if Rally needs to selloff assets to generate cash for whatever reason, it’s free to do so regardless of what investors want.

How Do I Contact Rally Rd.?

You can contact Rally via email at hello@rallyrd.com or by texting 347-952-8058. The FAQ section also has numerous answers relating to customer support and how to invest.

Is It Worth It?

Rally Rd. presents a beginner-friendly way to invest in alternative asset classes without much capital. And, with other alternative investment platforms like Collectable for sports cards or Masterworks for fine art, investors have more options to diversify their portfolios than ever before.

The fact that Rally is commission-free and has numerous collection types are two advantages to this platform. However, it’s important to do your own due diligence and to consider the risks of these highly illiquid investments.

Ultimately, Rally is worth considering if you want to diversify a small portion of your portfolio with assets like classic cars or sports cards. But Rally's assets are very speculative and it’s probably best to focus on more traditional investments to grow your net worth first.

Rally Rd. Features

Product Type | Alternative investment app |

Min Investments | Varies by asset- as low as $1 |

Supported Asset Classes | 6 different collections |

Maintenance Fees | No |

Open To Non-Accredited Investors | Yes |

Supported Payment Types | ACH Transfer |

Insurance | Rally Rd. is regulated by the SEC and uses FINRA-approved broker-dealers for transactions. Assets are covered by insurance and are held in a secure facility. |

Security | According to Rally, your banking information and other sensitive details aren’t held on its servers. |

Fractional Shares | Yes |

Secondary Market | Yes |

Lock-Up Period | Assets cannot be bought or sold for 90 days after their Initial Offering |

Customer Service Number | 347-952-8058 |

Customer Service Email | hello@rallyrd.com |

Mobile App Availability | iOS and Android |

Web/Desktop Account Access | Yes |

Promotions | None |

Rally Rd. Review

-

Commission & Fees

-

Ease of Use

-

Products & Services

-

Diversification Options

-

Customer Service

Overall

Summary

Rally Rd. is a platform that allows investors to buy and sell equity shares of sourced and verified collectibles.

Pros

- Commission-free trading

- Offers a variety of collections to diversify your portfolio

- Fractional shares as low as $1

Cons

- Assets could be difficult to resell

- Rally can sell assets at any given time

Tom Blake is a personal finance writer with a passion for making money online, cryptocurrency and NFTs, investing, and the gig economy.

Editor: Clint Proctor Reviewed by: Ashley Barnett