Building credit as a student sets your finances up for success after graduation. A common way of building credit as a college student is through opening a credit card. But without the proper budgeting know-how, a credit card in the hands of a college kid could create mindless spending without a clear plan to pay it back. To provide more options, there’s Fizz debit card, created to help you build credit.

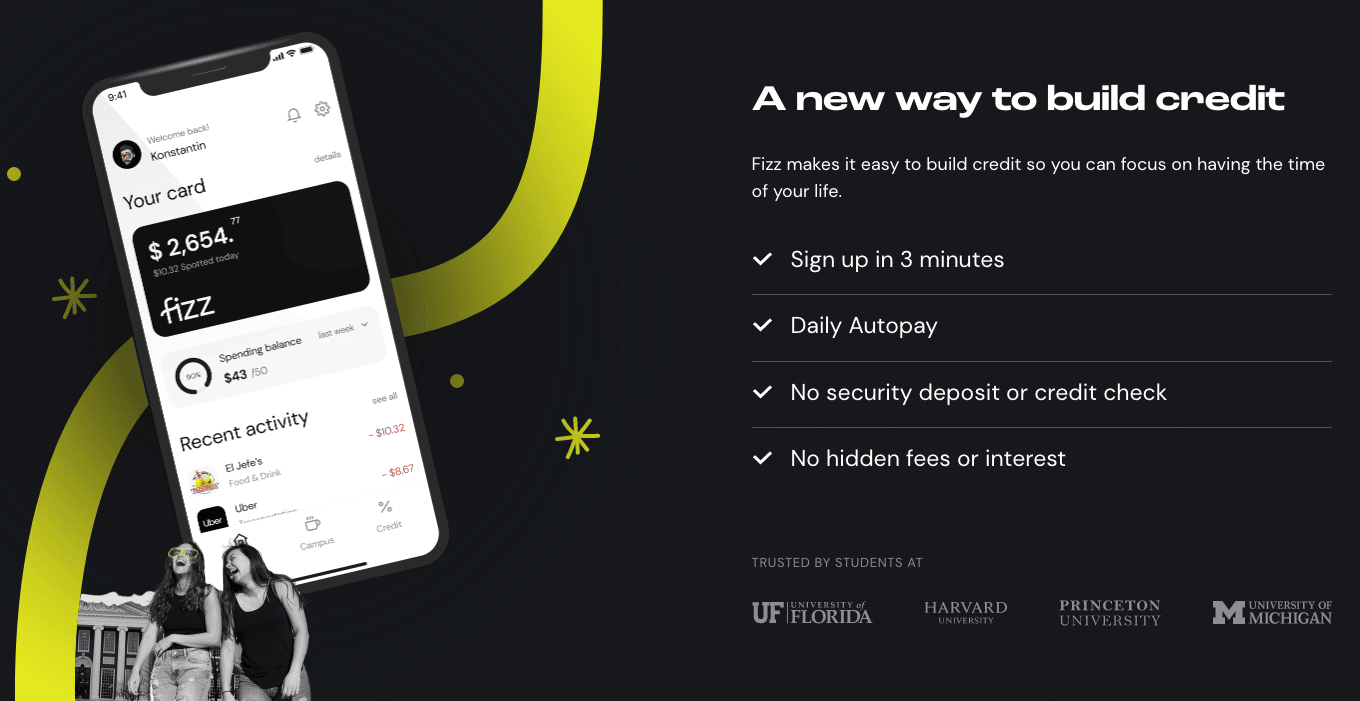

The Fizz debit card was created to help you avoid the trap of overspending and build credit at the same time while in school. Fizz helps you establish your credit score, plus, as you spend at your favorite stores, you can earn cash back rewards.

Quick Summary

- Fizz is a debit card that can help you build credit.

- Your daily transactions are reported to credit bureaus as payment history.

- Fizz users can tap into cash back rewards for brands they love.

Fizz Details | |

|---|---|

Product Name | Fizz Debit Card |

Min Balance | None |

Monthly Fee | None |

APY | N/A |

Promotions |

|

What Is Fizz?

While studying at Harvard, Fizz co-founder Carlo Kobe was denied a phone plan due to not having a credit score (Carlo is orginally from Germany). Meanwhile, co-founder Scott Smith was studying at Cornell, where he noticed a large number of fellow students struggling with credit card debt. The two eventually dropped out of school to find solutions to these problems.

Before long, they created Fizz to offer a credit-building opportunity to college students. The company’s mission is simple: to help young adults achieve their dreams. Specifically, Fizz is working to empower college students to achieve financial freedom and the credit score they need, post-graduation.

- Fizz is available on the Apple App store.

- Android users can add their name to be notified when our Android app launches.

- Use code COLLEGE when signing up to get a $10 signup bonus.

If you're more concerned about earning rewards and have a firm grasp on your spending habits,

check out our top choices for rewards credit cards.

What Does It Offer?

Fizz is focused on helping college students build credit. Here are the features that make the goal a reality.

Build Credit

Fizz is a debit card, not a credit card. But unlike a regular debit card, it can still help you build your credit profile and credit score.

The process starts when you link your bank account. Fizz will grant you a line of credit based on your bank account balance. You can start using the virtual version of the debit card immediately or wait for the physical option to arrive in the mail.

Instead of waiting until the end of the month to pay your bill, Fizz has an optional daily Autopay feature that pays off your balance on a daily basis. But if you aren’t comfortable with automatic payments, you can pay off your monthly statement instead.

Fizz reports your transactions as credit payments each month to the credit bureaus. If it doesn’t receive funds for a bill within 45 days, Fizz reports a missed payment.

Want to build credit?

Consider a secured credit card.

Here are the best secured credit cards to consider while you're still in school.

No Credit Check

There’s no need to pass a credit check to work with Fizz. After all, the company recognizes you’re in the early stages of credit building and wants to help you.

No Temptation To Overspend

The temptation to spend without a clear plan to pay the debt back is a slippery slope for college students and credit cards. The credit card limit will likely be higher than your checking account balance, which makes it feel like it’s a lot of money you can freely spend. A little bit of spending here and there can add up and get expensive, especially with credit card APRs hovering at around 18% these days.

Since Fizz is connected to your checking account, its debit card won’t let you spend more money than you have in your bank account. So, it’s not possible to overspend.

Rewards For College Spending

When you use the Fizz debit card, you’ll earn rewards at your regular haunts. A few partners that offer cash back rewards include Insomnia Cookies, Chipotle, and Starbucks. Fizz also allows you to select a monthly 3X category, such as gas, dining out, entertainment, etc. Plus, there are campus-specific rewards for your college town favorites.

Take Advantage of the Best Student Discounts

We compiled a list of the best music, streaming, and subscriptions that give students a discount.

No Security Deposit Required

Fizz is not a secured credit card, which requires users to fork up a security deposit in order to spend. With Fizz, you won’t have to fund any money upfront to open this credit building account. Instead, the debit card will provide a link between your checking account and a line of credit to regularly build credit.

Are There Any Fees?

Fizz doesn’t charge any fees or interest. Instead, the company makes money through the interchange fees charged to merchants when you use your credit card. That means there are zero hidden fees for you to pay. It’s a win-win, all around.

Although there is no minimum account balance, the company recommends keeping $150 in your checking account if using the autopay feature.

How Do I Contact Fizz?

You can connect with Fizz at hello@joinfizz.com or reach out through the chat feature on the app. If you want to connect over social media, contact @joinfizz on TikTok, YouTube, and Instagram.

How Does Fizz Compare?

Fizz is a great option for college students who want to build credit but worry about racking up debt. But if you have a confident grasp on your budget and finances, then consider a student credit card to tap into worthwhile rewards.

Two student credit cards to consider are the Deserve EDU Mastercard for Students and the Bank of America Mastercard for Students.

If you want to check out more student credit cards, take a look at our favorites below.

Student Credit Cards

Check out the best student credit cards to help you build credit.

How Do I Open An Account?

As of January 2023, the waitlist is gone and you can sign up in just a few minutes. Fizz is available on iOS and Android. Simply download the apps to get started. Be prepared to provide your personal details and checking account information.

Is It Safe And Secure?

Fizz is backed by Mastercard and offers PCI-DSS compliant accounts. Beyond that, your virtual card is Face ID-secured. With all of these protections in place, you should feel comfortable working with Fizz.

Is It Worth It?

Fizz is a debit card that promises to help you build credit. If building credit is your primary goal, then keep in mind that you have other options, such as a student credit card or secured card. But as a college student, if you don’t trust yourself and think you’ll potentially overspend, Fizz might be a worthwhile option for you.

Fizz eliminates the concern of spending more than you have in your account. But if you already have a strong handle on your spending behavior, you may want to compare Fizz rewards with some of the leading student credit cards before signing up. Fizz's has its 3X bonus points category, which is attractive, but their higher spending limits may allow you to earn more rewards.

Fizz Features

Account Types | Debit card linked to your checking account |

Standout Feature | Ability to build credit when you use the debit card |

Minimum Deposit | $0 |

Savings Rewards | N/A |

Monthly Fees | $0 |

Branches | None (online-only) |

ATM Availability | N/A |

Customer Service Email | hello@joinfizz.com |

Customer Service on Social Media | TikTok, YouTube, Instagram: @joinfizz |

Mobile App Availability | |

Web/Desktop Account Access | Yes |

Availability | Open to everyone |

Promotions | Use code COLLEGE when signing up to get a $10 signup bonus. |

Fizz Debit Card Review: Build Credit In College

-

Min Opening Deposit

-

Min Balance Requirement

-

Fees

-

Ability to Build Credit

-

Availability

Overall

Summary

The Fizz debit card was created to help you avoid the trap of overspending and build credit at the same time while in school. Fizz helps you establish your credit score, plus, as you spend at your favorite stores, you can earn cash back rewards.

Pros

- Payments reported to credit bureaus

- No credit check

- No overspending

- No fees

Cons

- Campus-specific rewards not available on every campus

Sarah Sharkey is a personal finance writer covering banking, insurance, credit cards, mortgages and student loans. She has written for numerous finance publications, including MagnifyMoney, Business Insider and ChooseFI. Her blog, Adventurous Adulting, helps young adults get a handle on their finances.

Editor: Claire Tak Reviewed by: Robert Farrington