It’s ideal to save for a major purchase, but not everyone does it. A buy now, pay later platform like Afterpay offers a quick solution if you don’t have cash on hand. But be warned, certain plans can be riddled with gotchas, high interest, and fees. Afterpay always offers interest-free financing and has a maximum late fee of only $8. The company even offers hardship plans for people facing tough times.

It’s important to understand that Afterpay works for retailers, not consumers. The company makes money when it shares your data with retailers when you spend money with its partners. Before you decide if this arrangement is worth it, find out what else Afterpay offers.

Afterpay Details | |

|---|---|

Product Name | Afterpay |

Spending Limit | Around $500 |

Monthly Fee | None |

Return Policy | Must contact retailer directly before Afterpay cancels any remaining payments. |

Promotions | None |

What Is Afterpay?

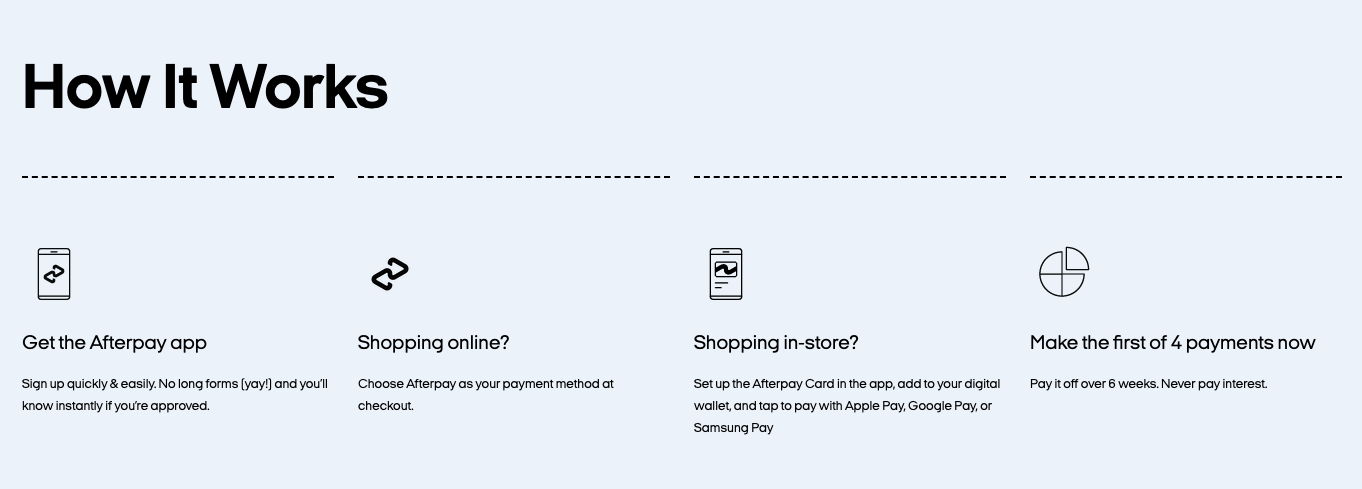

Afterpay is an online shopping portal that offers interest-free financing for products bought through the portal. Afterpay has relationships with thousands of online and in-store brands. When you use Afterpay to make a purchase, you put 25% down, rather than paying for it in full. Then you make equivalent payments every two weeks for the next six weeks. If you pay on time, you don’t pay interest or fees.

Afterpay offers consumer financing, but it isn’t a traditional credit company. It earns most of its profits through retail referrals. Afterpay doesn’t charge you interest and it only collects late fees if you fail to make a payment on your loan. The company never reports your activity to a credit bureau.

What Does It Offer?

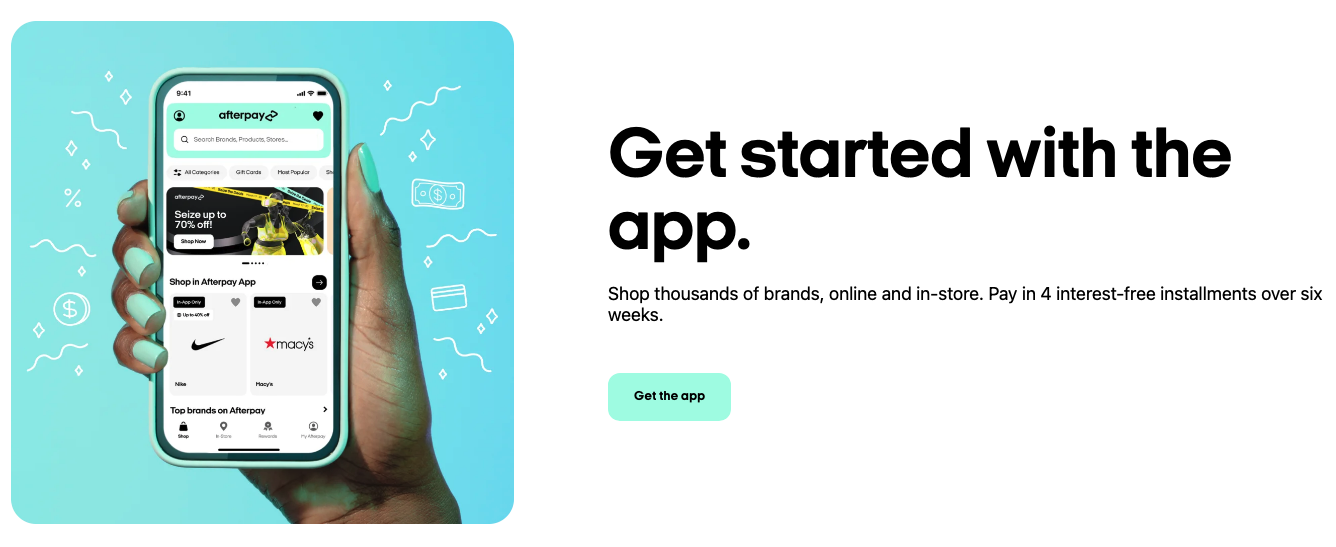

Afterpay’s main value proposition is its interest-free financing plans. The shopping app makes it easy for you to buy now and pay later.

Interest-free Financing on Consumer Purchases

Afterpay allows you to pay for home goods, clothing, toys, and other consumer purchases in four equal payments.

- The down payment is due immediately.

- The other three payments are due in two-week intervals following the first payment.

This two-week timing should make it easy to line up purchases with your paychecks.

The interest-free financing period isn’t as long as those offered by 0% intro rate credit cards. Of course, those “teaser” rates could cause you to walk into accidental debt, but Afterpay caps the amount you can owe.

Can’t Maximize Points or Rewards

Afterpay has a rewards program called Pulse Rewards. The Pulse Rewards program offers some reward-like incentives such as discounts at Afterpay’s retailers.

However, the discounts are more like coupons than true rewards since they are retailer-specific. The primary benefit of Pulse Rewards is the ability to delay payments by up to seven days.

Overall, Pulse Rewards is designed to get people to use Afterpay more, but the rewards aren’t valuable outside of the Afterpay ecosystem.

By contrast, many credit cards offer cash back or points that can be used for travel. These are valuable rewards that can help with travel hacking. While you won’t pay interest with Afterpay, you also won’t earn travel points or cashback rewards.

Soft Credit Checks

Applying for an installment plan with Afterpay won’t hurt your credit score. The company uses soft credit checks which aren’t reported to the credit bureaus. If you’re considering using Afterpay, the initial credit check won’t hurt your credit score.

Late Fees Capped

Afterpay charges a maximum late fee of $8 or 25% of the purchase price, whichever is less. Credit card companies often charge $25-$40 for late fees, so Afterpay’s fee is comparably reasonable.

Share Your Information with Affiliated Retailers

Afterpay earns money by sharing your information with its affiliates and referring you to shop at those retailer websites. Think of it this way: you’re Afterpay’s product, and the retailers are its customers.

Can’t Build Your Credit

Afterpay’s financing arrangements aren’t loans that get reported to the credit bureaus. If you use the loans, you won’t build your credit history.

A great credit score can lower rates on insurance products, make it easier and potentially less expensive to take out a mortgage, and even assist with renting an apartment.

Are There Any Fees?

Afterpay doesn’t charge interest, but you may be charged a late fee. The late fee is $8 or a maximum of 25% of the size of the order.

If you have a delinquent payment, Afterpay will not allow you to take out any additional installment plans with the company.

How Do I Contact Afterpay?

Afterpay is headquartered in Melbourne, Australia, but its North America headquarters is located at 760 Market St., Floor 2, San Francisco, CA 94102. The company’s customer service number is 855-289-6014.

The company’s customer service email address is info@afterpay.com. However, it may be more reliable to submit a form through Afterpay’s online contact portal. If you need any form of help, including the option of a hardship plan, the online contact portal is the best way to reach Afterpay.

How Does Afterpay Compare?

Afterpay’s interest-fee pricing plan, hardship payment plans, and limited “credit” lines make it a reasonable option for people struggling to keep an emergency fund in place.

Afterpay is the only major buy now, pay later company that offers interest-free financing on all its loans. Klarna and Perpay offer similar terms as Afterpay. There’s also Sezzle and Affirm, but neither platform can compete with Afterpay’s interest-free offer.

Pay Over Time

If you can't afford it now, Zebit lets you pay for it over 6 months.

The sticking point with Afterpay is the fact that the company works for retailers and not you, the consumer. This kind of business model may be disconcerting, since Afterpay shares your information with retailers. Also, if you want to return items, you have to contact the retailer directly before Afterpay cancels any remaining payments.

If you’re savvy, you might use Afterpay in the case of an emergency. It can help you get something necessary such as a new part for your car and pay for it over time. Even though it’s a slippery slope when it comes to buy now, pay later, Afterpay won’t allow you to make new purchases until your payments are paid in full. If you consistently make late payments, you may notice Afterpay reducing your spending limit.

Header |  |  | |

|---|---|---|---|

Rating | |||

Monthly Fees | $0 | $0 | $0 Credit-building option for $2 a month |

Interest Fees | None | None | None |

Spending Limit | $500 | Up to $2,500 line of credit | Based on your income |

Credit Check | Not needed | Not needed | Not needed |

Cell | Cell |

How Do I Open An Account?

The best way to start with Afterpay is to download the Afterpay app on your phone. To open an account, you have to be 18 years old, a resident of the United States, and have an email address and cell phone number.

Opening an account with Afterpay doesn’t guarantee that you’ll get financing from the company. It may not issue an installment loan to you depending on your current debt and income.

Is It Safe And Secure?

Afterpay follows bank-level security for collecting and handling personal data. It uses a well-known, secure third party to collect payments.

However, Afterpay doesn't lock down your data. It freely shares all kinds of information with retailers who can use the information to target ads towards you or to influence your spending decisions.

Be careful before you give your information away to companies like Afterpay that make money off of your information.

Is It Worth It?

Low-interest financing on mattresses, furniture, and appliances has long been a tactic used to get people to buy more and buy now. These interest-free financing programs purport to help people who are living paycheck to paycheck. However, saving up for the things you need in cash is always the smarter option.

The trouble with Afterpay and similar services is the subtle incentives to spend when you don’t have the cash saved to buy it in the first place. A spending and investing plan can allow for purchases and help you get ahead.

So while there may be a few edge cases where Afterpay makes sense, consider delaying any big purchases and save in advance.

Afterpay Features

Products |

|

Spending Limit | Around $500, but can increase over time |

Monthly Fees | None |

Late Fees | $8 or 25% of purchases, whichever is less |

Return Policy for Items | You must contact the retailer directly before Afterpay cancels any remaining payments. |

Customer Service Number | 855-289-6014 |

Customer Service Option |

|

Company Address | 760 Market St., Floor 2, San Francisco, CA 94102 |

Mobile App Availability | |

Web/Desktop Account Access | Yes |

Promotions | None |

Afterpay Review: Buy Now Pay Later, Interest-Free

-

Pricing & Fees

-

Ease of Use

-

Customer Service

-

Return Policy for Items

Overall

Summary

A buy now, pay later platform like Afterpay offers a quick solution if you don’t have cash on hand. It’s interest-free, but is it worth it?

Pros

- Interest-free financing on consumer purchases

- Spread out purchases over 6 weeks

- No effect on your credit score

Cons

- Makes it easy to overspend on unnecessary items

- No way to earn cash-back or points for purchases

- Information shared with affiliates

- Late fees can be as high as 25% of item(s) purchase price

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Claire Tak