Have you ever thought about how big the number one million actually is? One million dollar bills, stacked on top of each other (at a thickness of .0043 inches per bill), would reach over 350 feet high. One million miles would get you to the moon and back (twice) with a little bit extra to spare. One million minutes is nearly two years. As you can see, a million is a very big number.

When it comes to becoming a millionaire, the path is different for everyone. If you aren't blessed with extraordinary athletic ability, rich parents, or a killer business idea, you'll likely have to take a slow and steady path to make your million.

With a bit of knowledge and discipline, most people can become millionaires (especially if you start young!)

Saving Your Way To $1,000,000

Let's take a look at how long it will take you to accrue one million dollars. If you save $50 every single day for 50 years, you still won't have a million dollars at the end of your savings.

You'll actually only end up with $912,500, and that's not even accounting for the fact that thanks to inflation, your million dollars won't be worth nearly as much as it would be worth today.

How Compound Interest Works

There is an easier way to save your way to $1,000,000 through the power of compound interest. Compound interest is a concept where your initial investment grows over time. But each time your investment grows, you get additional growth on top of your initial gains. This makes your investment grow at a faster and faster clip every year.

Would you rather have a penny that doubles each day for a month

or $1 Million?

While it becomes very difficult to save your way to $1,000,000 by keeping your money in your sock drawer or under your mattress (essentially a 0% return), by investing wisely, a million dollars is more easily in reach.

Investing Your Way To $1,000,000

There are two main factors that will determine how long it might take to invest your way to $1,000,000.

The first is how many years you have before you want to become a millionaire and the second is the return that your investments earn.

The more time you have to save and invest, the lower return that you'll need. Similarly, the higher the return that your investments earn, the fewer years it will take to become a millionaire. We'll explore this a bit more in the next section.

How Much Do You Need To Save To Be A Millionaire

Before asking yourself "How much do I need to save to be a millionaire,” it's a good idea to take a step back and assess your goals. This can help you decide how feasible your plan is, and how aggressive you might need to be with your saving and investing strategy.

If you want to be a millionaire by 25, you'll need a different plan than if you're just wanting to earn a million by the time you retire.

Here's a chart showing how long it will take you to earn $1,000,000 by saving $500 per month at different rates of return.

Rate of Return | Savings Rate | Years to $1,000,000 |

|---|---|---|

0% | $500 per month | 274 |

2% | $500 per month | 74 |

4% | $500 per month | 52 |

8% | $500 per month | 34 |

10% | $500 per month | 29 |

20% | $500 per month | 18 |

This table makes it very clear the importance of investing your money. If you keep your money under your mattress (0%), your chances of saving a million dollars before you die are quite low.

Even if you have your money invested in a savings account or CD (2% return if you're lucky), it will take quite a long time.

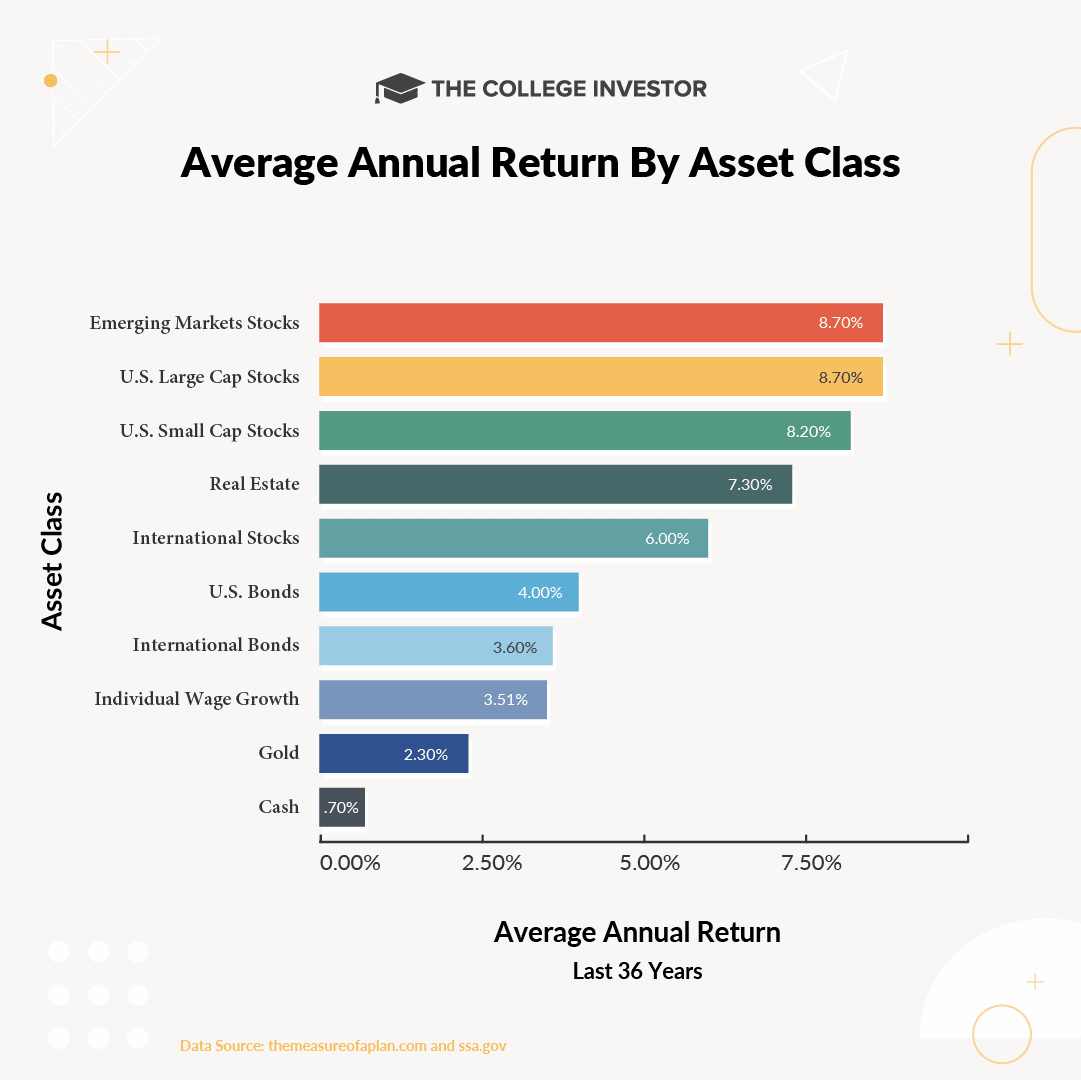

As you start earning higher returns, for example, in an index fund, the number of years starts decreasing to a more reasonable level. For example, you can see in the chart below that stocks have the potential to return 8% per year on average, where cash is near the bottom at less than 1%:

Here's another way to look at it. This table outlines a consistent rate of return at 8% and shows how much you'll need to save each month, depending on how many years you have until you want to be a millionaire.

Rate of Return | Savings Rate | Years to $1,000,000 |

|---|---|---|

8% | $140 per month | 50 |

8% | $309 per month | 40 |

8% | $706 per month | 30 |

8% | $1,747 per month | 20 |

8% | $5,517 per month | 10 |

As you can see, starting young and having a longer time horizon really makes a big difference.

Keep in mind also that all of these numbers are not accounting for inflation and the very real fact that $1,000,000 in 30 or 40 years will not have the same purchasing power as it does today.

The Bottom Line

So, can you save your way to $1,000,000? Yes, you can, but there's a few things that you can do to make your life easier.

The first is the importance of investing and earning a good return on your money. If you invest at 0% to 2%, your odds of ever becoming a millionaire are quite low.

But if you can earn 7% to 10% on your money, even a modest amount of monthly savings can add up quite quickly.

Start early—the more time you have, the better your chances of saving your way to a million are.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Claire Tak