Ava is a credit building app that claims to help improve your credit score fast.

When it comes to managing your personal finances, building a good credit score might be a top priority. A better credit score often means lower interest rates for major purchases. Since most of us tap into financing to make major purchases like a home or vehicle, a good credit score can make a big difference. For some, building your credit score now could translate into thousands of dollars saved when it’s time to pay off a car or mortgage.

In the past, establishing solid credit hasn’t always been inclusive of people who don’t have access to banks or traditional ways of building credit, such as through credit cards. But now, platforms like Ava are making credit building more accessible. Let’s take a closer look at what Ava has to offer.

Ava Details | |

|---|---|

Product Name | Ava |

Monthly Fee | $9 |

Credit Builder Card | No interest or fees, instant approval |

Credit Monitoring & Alerts | Receive updated score each week, plus text message alerts about your credit |

Promotions | None |

What Is Ava?

Ava is a mobile platform designed to help you build credit through a variety of tools. Additionally, you can monitor your credit-building progress along the way.

According to Ava’s website, the goal of the platform is to help you navigate the financial system more effectively. Several top-tier investment funds have backed Ava including Greylock, Firebolt Ventures, and Precursor Ventures.

What Does It Offer?

Ava is on a mission to help you build credit and navigate the financial system more efficiently. Here’s a closer look at the features that make Ava stand out.

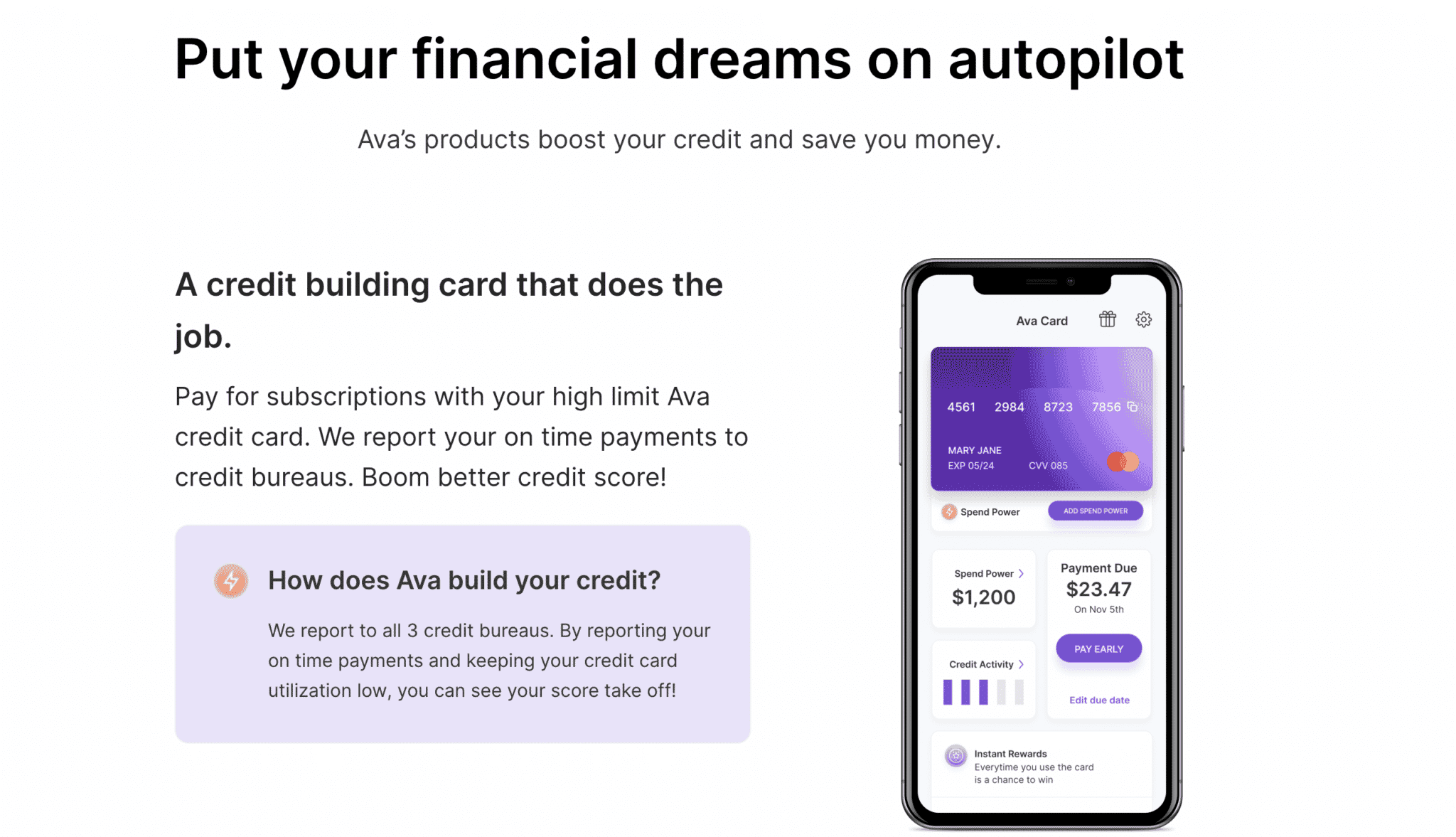

Credit Builder Card

First up is the credit builder card. You can get approved for this credit card without any credit check required.

Once approved, you’ll be able to use the card to cover select streaming services. Some of the allowed charges include Netflix, Spotify, and more. As you pay off the card each month, Ava will report your progress to all three major credit bureaus.

Savings Builder

The Savings Builder plan offers the chance to build credit and savings at the same time. The savings plan is a type of credit builder loan, but you won’t encounter any interest charges embedded into the plan.

As you build savings, you’ll make regular payments with each paycheck. After you’ve completed a savings plan, you’ll get access to the savings. Along the way, Ava will report your on-time payments to the credit bureaus.

Credit Score Monitoring

When you are working hard to build your credit score, it’s helpful to keep an eye on your progress. Regular access to your credit score and a more visible progress may serve as a motivational reminder for you to stay on track.

Ava gives you a bird’s eye view of your credit score. Each week, you can check in with your updated credit score. Ava will also give you a breakdown of what’s impacting your score. If you make a credit mistake, Ava will send you an alert to help you get back on the right track.

SavingsMonitor

Ava offers a chance to save money with help from its AI assistant. The SavingsMonitor will automatically look for a better way to pay off your debt.

For example, if you are stuck with high interest credit card debt, the SavingsMonitor will scope out personal loan options for lower interest rates and monthly payments. The tool will also seek out better rates for auto loans.

Are There Any Fees?

When you work with Ava, you’ll pay a $9 monthly subscription fee. You’ll have access to all of the products on Ava’s platform without encountering any other fees or interest charges.

How Do I Contact Ava?

If you need to get in touch with Ava, you can email support@meetava.com. According to the website, a company representative will get back to you within 24 hours.

Based on the user reviews, you should expect a positive experience with the platform. Ava has earned 4.9 out of 5 stars on the Apple App Store and 4.5 out of 4 stars on the Google Play Store.

How Does Ava Compare?

Ava isn’t the only way to build credit, but it’s one of the more comprehensive platforms out there. On Ava’s website, you can apply for a personal loan through one of their partners and receive an instant decision without any gimmicks. However, it’s unclear what the APR is, and if there are any fees involved.

Here are a few other platforms that also offer extensive credit-building loan options. Credit Strong offers credit builder loans for individuals and businesses. A nice perk is that you can cancel these loans anytime if you run into a budget issue.

Another option is SeedFi, which offers credit-builders loans for a fee of $1 per month. If you have more immediate cash needs, you’ll find a Borrow & Grow plan that offers loans with some upfront cash component.

There’s also Self, that allows you to build credit and savings at the same time, doesn’t require credit history to open an account, and reports to all three of the major credit bureaus.

Header |  |  |  |

|---|---|---|---|

Rating | |||

APR | None | 15.65% to 15.97% | 5.85% to 14.89% |

Monthly Fee | $9 | $25 to $150 | $8.95 to $25 |

Secured Card | |||

Cell |

How Do I Open An Account?

The process for creating an account starts by downloading the mobile app on the Apple App Store or Google Play Store. After downloading the app, provide an email and password to get the ball rolling. Additionally, be prepared to provide personal details like your Social Security Number, name, and address.

Is It Safe And Secure?

Ava takes your security seriously. The platform uses 256-bit encryption to keep all of your personal information safe. As an additional security measure, Ava never saves your banking login information.

Is It Worth It?

If you are looking for a robust credit-building platform, Ava is a good option to consider. You’ll find several ways to build your credit. Plus, the technology built into the platform can help you lock in savings as you pay off debt and monitor your credit progress along the way.

Depending on your needs, the $9 monthly subscription fee may or may not be the best deal for your budget. For example, you might opt for a different credit-building app with a fee structure that better suits your budget.

Ava Features

Monthly Subscription Fee | $9 |

Credit Builder Card | Instant approval and no fees or interest. No credit check. |

Savings Builder | This is a type of credit builder loan, but without any interest charges. |

Reports to All 3 Credit Bureaus? | Yes |

Customer Service | Email only: support@meetava.com |

Trustpilot | 4.5 out of 5 stars |

Mobile App Availability | |

Web/Desktop Account Access | Yes |

Promotions | None |

Ava Review: Build And Monitor Your Credit

-

Pricing and Fees

-

Customer Service

-

Ease of Use

-

Features

Overall

Summary

Ava is a mobile platform to help you build credit and monitor your credit-building progress along the way. See what Ava has to offer.

Pros

- Build credit through multiple avenues

- No credit check required for Ava

- Credit monitoring included

- Easy to use credit-building tools

Cons

- $9 monthly fee

- Credit card usage is limited to specific streaming services

Sarah Sharkey is a personal finance writer covering banking, insurance, credit cards, mortgages and student loans. She has written for numerous finance publications, including MagnifyMoney, Business Insider and ChooseFI. Her blog, Adventurous Adulting, helps young adults get a handle on their finances.

Editor: Claire Tak Reviewed by: Chris Muller