When you head to college, you start to learn real world responsibilities, like doing your own laundry, making meals, and paying for bills. One major change you will face is managing your own financial decisions, and it may make sense to go with a financial institution that has the college experience in mind.

Firstcard, a student debit card, aims to help college students navigate their newfound financial responsibilities with ease. Firstcard promises a slew of benefits to make your financial life simple during college.

Let’s explore what Firstcard has to offer you. Then you can decide it is the right fit for your wallet.

Firstcard Details | |

|---|---|

Product Name | Firstcard debit card |

Min Initial Load | $0 |

Monthly Fee | $0 |

Savings Reward | N/A |

Promotions | None |

What Is Firstcard?

Firstcard is a fintech that provides access to a banking experience specifically designed for students in college. Kenji Niwa, a visiting scholar at Stanford, founded this startup in 2021. The company works with Regent Bank to provide the actual banking services.

College students are the top priority for Firstcard, and the company seems to be putting its money where its mouth is. Firstcard has included several college students within the team, presumably, this input helps Firstcard deliver what students really want.

What Does It Offer?

If you are a college student, Firstcard’s debit card might be worth a closer look. Here’s what Firstcard has to offer.

A Focus On College Student Needs

Firstcard is clearly putting an emphasis on creating a banking experience that’s easy for college students.

According to Firstcard, its mission is to “help every college student become more financially empowered so they can pursue their academic and professional goals without worrying about their finances. Our hope is to reshape the online banking experience for college students.”

As a college student, this focus is a big deal. While you might find a free checking account for students through many banks, most aren’t designed for the finances of a college student. This is why you’ll likely appreciate the focus on a campus lifestyle.

Attractive Rewards

Firstcard offers up to 15% cash back when you make purchases from select businesses. The network of businesses offering cash back includes many on-campus or near-campus establishments. However, cash back is also available through many national chains.

This cash back amount (15%) on purchases is a big win for your budget. Another nice perk is the ability to have your student discount applied whenever you use your Firstcard. You won’t have to shuffle around for a student discount, it’s applied automatically.

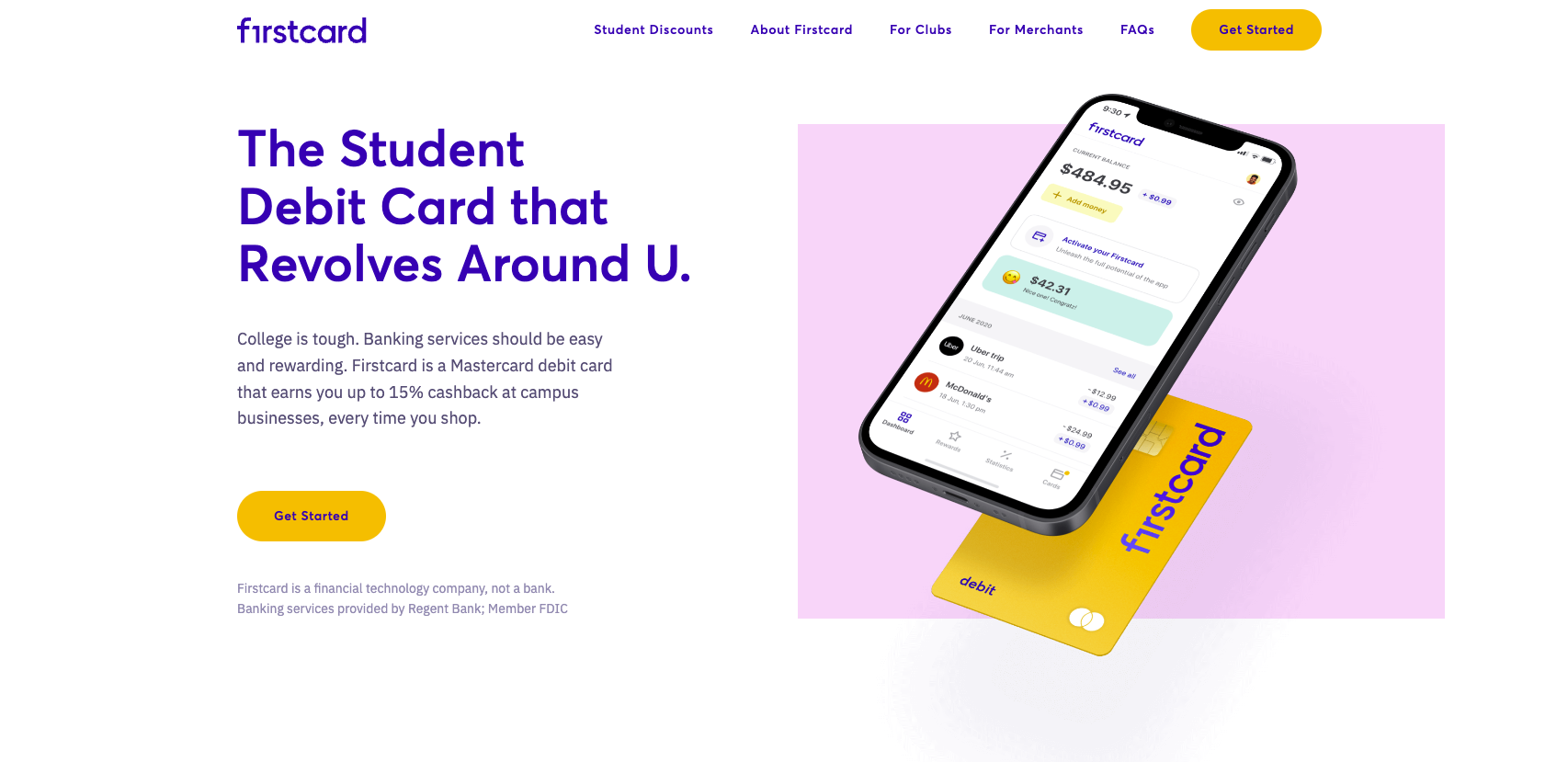

Straightforward Banking App

You can handle all of your banking needs directly through the Firstcard app. The comprehensive app gives you the ability to monitor your transactions, rewards, spending statistics, and more.

As you navigate your first banking experience, you’ll appreciate the simplicity of the app. You won’t have to dig around to manage your funds. Instead, the app makes it easy to handle your funds.

Are There Any Fees?

Overall, the general lack of fees is a nice perk of Firstcard.

Firstcard doesn’t have a lot of fees attached. You won’t find any annual fees, sign-up fees, overdraft fees, or minimum balance requirements through Firstcard.

However, you might face an inactivity fee if you don’t make any deposits or withdrawals for a period of 15 months.

How Do I Contact Firstcard?

If you want to get in touch with Firstcard, you can email support@firstcard.app. Although there is only one form of communication available, a relatively comprehensive FAQ section might help you find the answers you are looking for.

So far, the company has earned 4.1 out of 5 stars on Trustpilot. However, there are only five reviews of this relatively new company. The app reviews are less positive. Firstcard earned 2.6 out of 5 stars on the Google Play Store and 3.9 out of 5 stars on the Apple App Store. Both sites have fewer than 20 reviewers.

How Does Firscard Compare?

If you are looking for a debit card that offers rewards for your spending, Firstcard is an option worth considering. However, it’s not the only option for your college banking needs.

Current is a mobile banking app designed for younger users. Although Current isn’t specifically for college students, you’ll still find a convenient experience with minimal fees. Plus, Current gives you the chance of earning 4% APY on balances of up to $6,000 within a Savings Pod.

If you prefer to work with a big bank that offers convenient in-person locations, the Chase College Checking account might be a good fit.

You’ll avoid any monthly maintenance fees if you are between the ages of 17 to 24. Although the big bank can have some downsides, you’ll likely have an in-person branch to handle your banking needs.

Header |  |  |  |

|---|---|---|---|

Rating | |||

Maintenance Fees | $0 | $0 | $6 per month (waived with ACH deposit) |

Earns Cash Back | |||

Earns Interest | |||

Min Deposit | $0 | $0 | $0 |

ATM Network | Unclear from website | 40,000+ ATMs | 16,000+ ATMs |

Cell | Cell |

How Do I Open An Account?

The process of working with Firstcard starts by providing your email address. You’ll also need to create a password. After that, you’ll provide more personal information about yourself. Be prepared to provide your address and Social Security Number.

It should only take 10 minutes to complete the entire sign-up process.

Is It Safe And Secure?

When you make a deposit to Firstcard, it’s FDIC insured up to $250,000 through Regent Bank. Additionally, Firstcard uses industry-standard encryption measures to protect your information from falling into the wrong hands.

As you work with Firstcard, you’ll get notifications about your transactions. If you don’t recognize a transaction, you have the ability to lock the card at any time.

Is It Worth It?

Firstcard‘s debit card is an attractive option for college students. It’s always nice when a product is specifically designed with your needs in mind. Plus, the suite of cash back opportunities might be just what you need to stretch your dollars a little bit further.

Overall, Firstcard might be the right fit for some college students. But the lack of a savings account feature or any interest-earning opportunities might be a letdown for college students who want to put their funds to work.

Firstcard Features

Minimum Deposit | $0 |

Minimum Balance | $0 |

Cash Back Rewards | Yes |

Cash Back Amount | Up to 15% when you buy from select businesses |

Maintenance Fees | $0/mo Inactivity fee if you don’t make any deposits or withdrawals for a period of 15 months. |

Branches | None (online-only) |

ATM Availability | Unclear from website |

Customer Service Email | support@firstcard.app |

Trustpilot Rating | 4.1 out of 5 |

Mobile App Availability | |

Promotions | None |

Firstcard Review: A Debit Card Built For College Life

-

Fees and Charges

-

Customer Service

-

Ease of Use

-

Features and Services

-

Tools and Resources

Overall

Summary

Firstcard, a student debit card, aims to help college students with financial responsibilities while offering 15% cash back on purchases.

Pros

- Designed with college students in mind

- Easy to use mobile app

- Up to 15% cash back on purchases

Cons

- Limited customer feedback

- No savings account option

- No interest earning opportunities

Sarah Sharkey is a personal finance writer covering banking, insurance, credit cards, mortgages and student loans. She has written for numerous finance publications, including MagnifyMoney, Business Insider and ChooseFI. Her blog, Adventurous Adulting, helps young adults get a handle on their finances.

Editor: Claire Tak