“Fact or cap” is another way of saying fact or fiction and is a phrase that is commonly used on TikTok. Speaking of TikTok, if you’re trying to build wealth by listening to what’s trending, you may feel confused by all the information out there. Especially when it comes to the sales pitch around the mythical "compound interest account".

Young investors on TikTok and other social media platforms are prime targets for high-cost, low-return “investments.” Perhaps you’re tempted to go all-in on meme stocks or some kind of secure compound interest account. Before you do, discover the truth behind them and what they entail.

Here are three caps of compound interest accounts and what they entail.

Cap #1: Secure Compound Interest Accounts Are The Best Way To Grow Your Money

Secure Compound Interest Accounts aren’t investment accounts at all. Secure Compound Interest Accounts are a form of whole life insurance or indexed universal life insurance.

You may have seen this topic discussed by TikTok star Curtis Ray, who sells indexed universal life insurance for Suncor Financial. The company’s trademarked Maximum Premium Indexing™ isn’t a secret sauce to help you get rich. It’s simply a variation of this type of life insurance policy.

The “investment” is an expensive form of life insurance that locks you into saving a small portion of the payment each month. Over time, you’ll slowly build up cash value inside a life insurance policy. The cash value earns some interest every year, but the expected return isn’t high enough to make you wealthy.

Consumer Reports runs an annual study comparing whole life insurance interest rates to T-bills and inflation. In general, inflation grows at a faster rate than the guaranteed cash value in a whole life insurance policy. That means you’re guaranteed to lose buying power over time.

Whole life insurance policies also offer a “potential cash value” that could grow slightly faster than inflation over the long run. However, the growth potential is no match for a well-balanced investment portfolio.

In general, the potential cash value grows at a rate of 3.5% whereas well-balanced portfolios can expect returns ranging from 7 to 10% over the long run.

And as for the "secure" part - many of these policies claim you can't lose money. What they actually say is that you can never earn below 0% return on the investment part. You still have to pay your life insurance premiums and any loans back. That means, if you actually earn 0% that year, you will pay more in fees than you earned.

Finally, when you die, the death benefit goes to your heirs, but any cash value you built up? Well, that goes right back to the insurance company.

Cap #2: Compound Interest Is Better Than Compound Growth

Some financial investments earn compound interest and others don't. In general, financial investments benefit from an effect known as compounding. Compounding is a phenomenon where your initial investment grows by a certain rate during the first period of investment.

During the next period, the growth applies to both the initial investment and the growth from the previous period. This results in an astounding exponential growth curve. Author Naved Abdali explains, “Compounding has a snowball effect. It is just a tiny ball of snow at the very start, but it can turn into an avalanche over time.”

The words compound interest and compound growth are often used interchangeably. However, compound interest is a type of growth that only applies to certain investments. Investments that earn interest such as CDs, I-Bonds, and high-yield savings accounts all earn interest at a set rate each year. The yield on these accounts (also known as the interest rate) compounds over time.

Note: CDs and savings accounts are also "secure" in that they can't lose value. They are insured by the FDIC up to the deposit limits.

Example Of Compound Interest: A Certificate of Deposit

Take a simplified example where you invest $1,000 in a two-year CD at 4%.

- During the first year, you will earn $40 (technically a tiny bit more because interest is paid monthly, but this is a simple example).

- The next year, you will earn $41.60 because the original $1,000 earned 4%.

- On top of that, the $40 of interest you earned during the first year earned 4% as well.

Types Of Investments That Don’t Earn Compound Interest (But Instead Grow)

Many investment classes like stocks, ETFs, real estate, and alternatives don’t benefit from compound interest. Instead, these investments grow in value through dividends, rental income, or growth in the underlying asset value.

If you continue to hold these investments (and especially when you re-invest the income earned from the investments), you will start to see compounding growth. Most of the time, stocks, ETFs, real estate, and alternatives are more volatile than interest-bearing investments. However, they also tend to have higher overall rates of return.

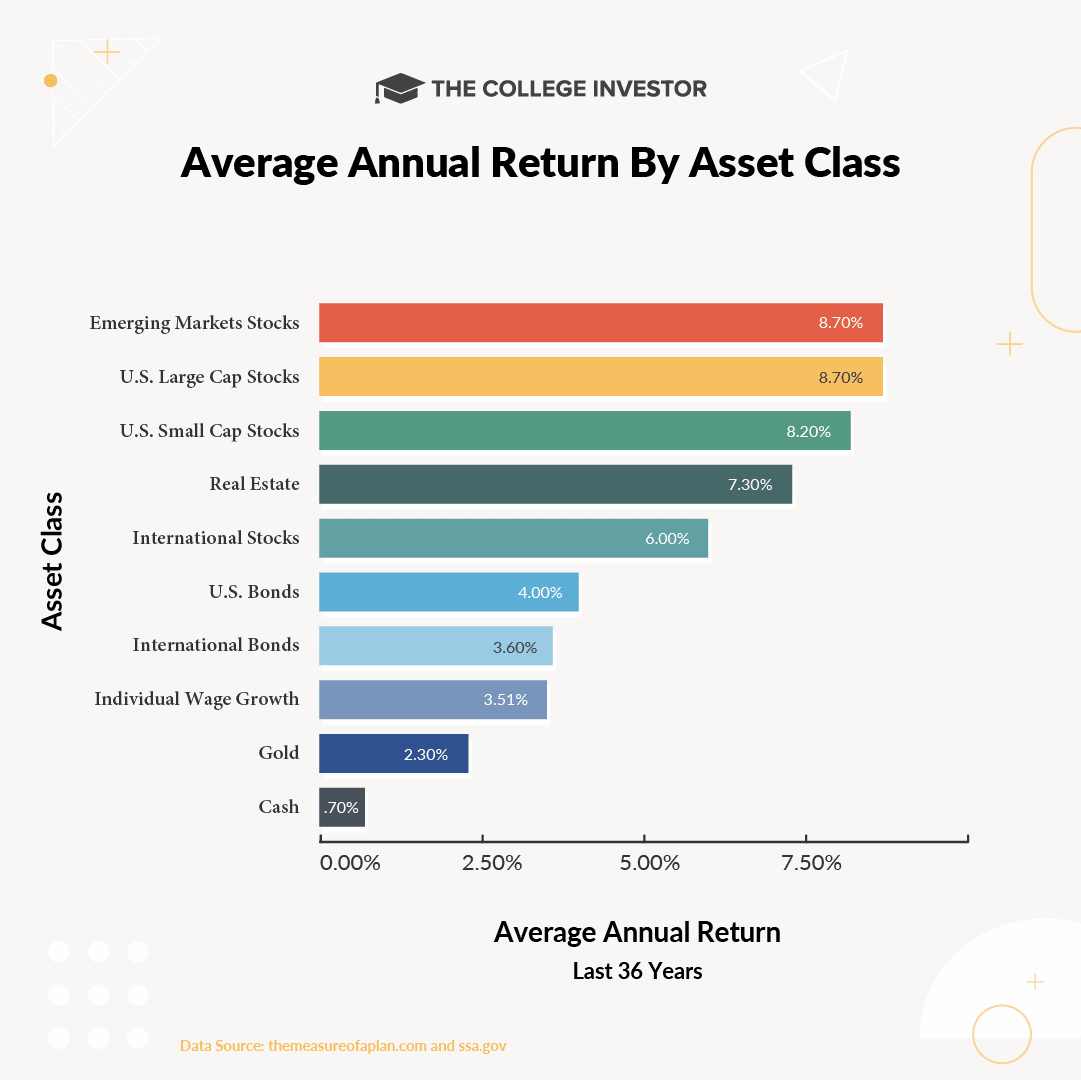

Here are the average rates of returns for various investments over the last 30 years:

Example Of Growth In Riskier Investments vs. Interest-Bearing Investments

If your riskier investments earn an average growth rate of 7.2% annually, your investment will double every 10 years on average. After 40 years, a $10,000 investment becomes $161,000.

By contrast, an interest-bearing investment tends to have a lower rate of return. If the cash value in your life insurance policy earns 3.5% per year, your $10,000 investment will be worth just under $40,000 after 40 years.

Interest-earning accounts are still an important part of your portfolio. We regularly recommend using CD ladders for short-term savings goals.

These conservative tools can help you earn returns as you save for a down payment, a wedding, or to fund a career gap. You may decide to use I-Bonds for your emergency fund. You certainly wouldn’t want an emergency fund locked up in real estate or subject to the whims of the stock market.

But for long-term investing, you need to focus more on compound growth rather than compound interest.

Cap #3: More Risk Is Alway Better

Investments that are advertised as no-risk rarely see high returns over time. But that doesn’t mean that more risk is always better.

You want the risks you take to be offset by the returns you earn.

A blend of low-risk investments (like bonds and CDs), high-risk investments (real estate, stocks, ETFs, etc.), and some exposure to ultra-high-risk investments (crypto, alternatives) may be suitable for most young investors with a long time to save.

Final Thoughts

Remember there’s no fast way to wealth. The best ways to invest and create more security for your future involve time and due diligence. Create a balanced portfolio with a mix of different types of accounts that can yield compound interest and steady growth.

And also remember - you don't have to pay a lot of money for these types of investments either!

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Claire Tak Reviewed by: Robert Farrington