As consumers, we’ve become accustomed to curated Netflix lists telling us this is what we should watch, to what we should consider for our next purchase on Amazon, but what about investing for our future? The power of recommendation engines is making its way to tailored offers for your investments.

Magnifi Personal is an AI-driven investment platform that offers customized recommendations based on your search behavior. While the recommendations aren’t as robust as Netflix or Amazon, the app harnesses a similar approach to make finding, analyzing, and buying stocks more tailored and specific to your preferences.

Here’s what you need to know about it.

Magnifi Details | |

|---|---|

Product Name | Magnifi |

Monthly Fee | $13.99 per month or $131.99 per year |

Managed Portfolios Cost | 0.23% annually |

Promotions | 7-Day free trial |

What Is Magnfi?

Founded in 2018, Magnifi Personal is a subsidiary business of TIFIN, a company dedicated to building engaging and personalized investment experiences using AI. Magnifi is the company’s offering for everyday retail investors who want to learn about trading and do it with smaller investment amounts.

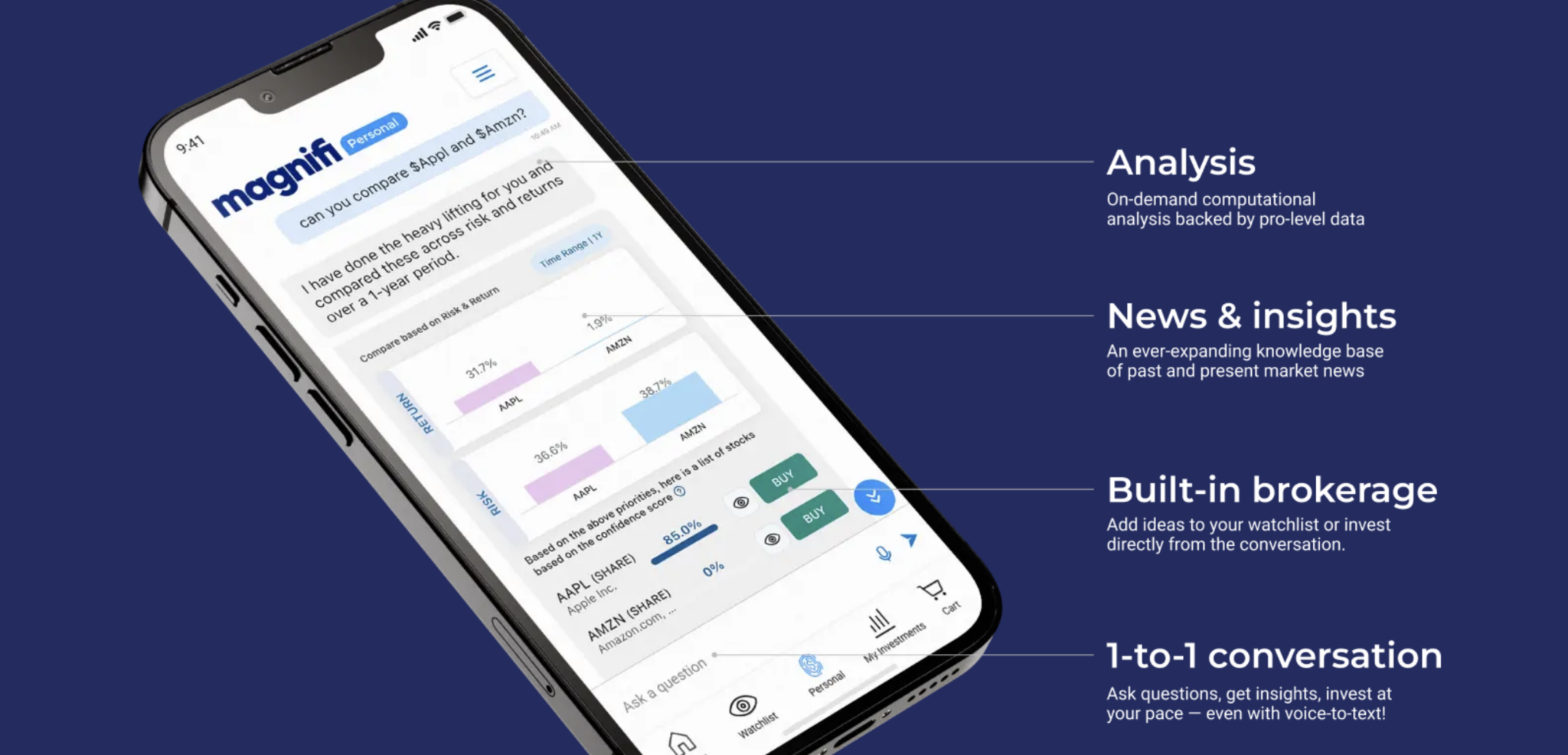

The app and web-based subscription service make it easy for users to research stocks (including volatility and return measures), manage investments, and keep securities on the watchlist.

What Does It Offer?

Magnifi is a trading app designed for beginner investors. It offers guardrails (such as no leverage), and presents risk and return information for users. Here’s what else it offers.

Commission-Free Investing

You have to pay a monthly fee of $13.99 or annual fee of $131.99 to use Magnfi, but once you’re in, you don’t pay any trading fees. You can buy stocks and ETFs through the app.

Robust Search Capabilities

One of Magnifi’s stand-out features is that it offers you the ability to search for investments around a theme. For example, when you type in phrases like “companies investing in green energy” or “healthcare innovation,” Magnifi serves up relevant stocks and ETFs.

Some of the ETFs are sponsored by fund managers, but those are disclosed through a “Sponsored” tag on the ETF. Magnifi also scores the relevance of the search result.

On top of the phrases you provide, Magnifi allows you to select from many pre-populated themes where the search results have been curated. You can try this feature without opening an account.

Checkout Style Buying Experience

Often, figuring out how to buy and sell stocks and ETFs is a challenge. Magnifi simplifies the process by offering a “checkout” interface. You put stocks or ETFs in your cart, review the cart, and adjust the amount you want to buy. When you’re ready, you click “buy.”

You can’t set up buy and sell orders to execute in the future, but most beginners don’t need that level of support. The buy and sell interface could be helpful if traditional brokerages have scared you away from investing in the past.

Watchlist

If you see an interesting stock or ETF, but you don’t want to buy just yet, you can put the security on your Watchlist. This allows you to keep tabs on the performance, so you can decide whether to buy it later on or to pass on the stock for another security on your watchlist.

Taxable Brokerage

Magnifi isn’t the platform for your retirement accounts or 529 plans. It only allows investors to invest through taxable brokerage accounts.

If you trade and incur gains, you will need to pay taxes on those gains the next year. If you have overall losses, you may be able to use the losses to offset gains in other accounts or to offset capital gains in future years.

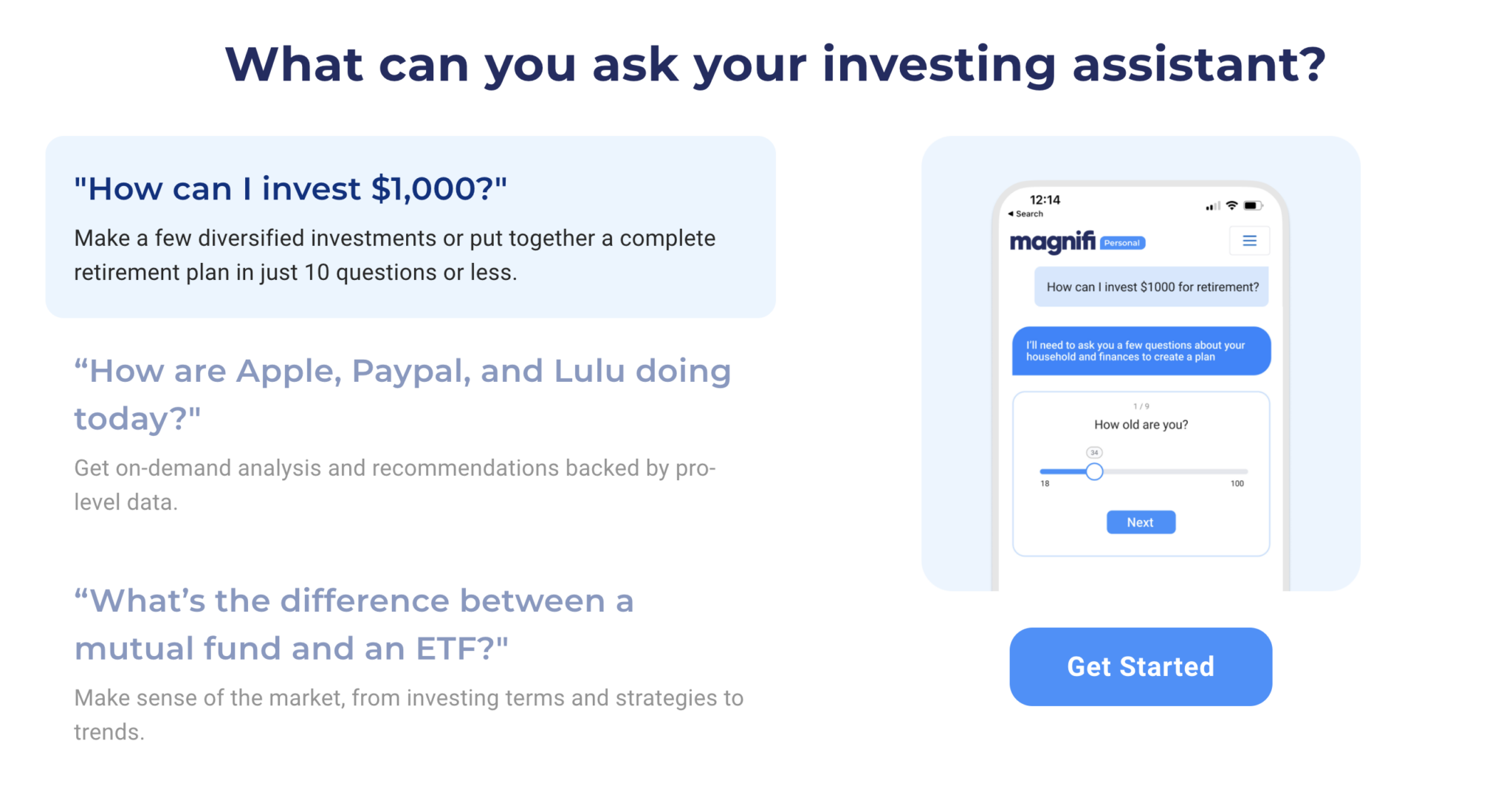

AI Assistant

Magnfi is bringing AI-power to your finances. You can ask it questions and have a one-on-one conversation about your investments. You can ask questions like "compare investments" and even use voice-to-text to help you make the conversation more natural.

Are There Any Fees?

Magnifi offers a 7-day free trial, but after that, you’ll need to pay $13.99 per month or $131.99 per year. If you use one of Magnifi’s Managed Portfolios, the cost is 0.23% annually.

How Does Magnifi Compare?

Magnifi is a trading app that seems like a more curated and education-focused version of Robinhood. While Robinhood has visualizations that entice you to spend time in the app, Magnifi has simple but useful graphs that show both risks and returns. It allows you to develop your portfolios, or use managed portfolios to invest on your behalf.

Magnfi has fewer account and trading options than M1 Finance or Fidelity, but it's extremely user-friendly to new investors. If you’re not a beginner investor and because Magnifi charges a fee, you may want to choose M1 or Ameritrade, which is one of our picks for top investor platforms.

If you’d like to see more options, here are the best free investing apps reviewed by The College Investor.

Header |  |  |  |

|---|---|---|---|

Rating | |||

Monthly Cost | $13.99 | $0 | $0 |

Min Investment | $0 | $100 | $0 |

Commissions | $0 | $0 | $0 |

Cell |

How Do I Open a Magnifi Account?

Download the Magnifi app from the App Store either on an iPhone or iPad touch device with iOS version 12.0 or later, or download it from the Google Play Store. You can also create an account on the website.

Provide your name, credit card Info, and billing address, and you can start your free trial. Billing begins after seven days.

To begin trading, you need to transfer funds to your Magnifi account via an electronic transfer.

How Do I Contact Magnifi?

Magnifi’s support email address is support@magnifi.com. This is the company’s primary support method.

Its headquarters location is 1 Pennsylvania Plaza, 39th Floor, New York, NY 10119.

Is It Safe And Secure?

As you start to use the app, it will “curate” suggestions for you based on your interactions in the app. The customizations make it more enticing to use, which can be a good or bad thing. Because Magnifi emphasizes risk analysis, it generally steers people away from the worst “gambling” type behaviors that can cause problems on other apps.

However, the customizations may also reinforce certain misunderstandings or biases that you have when selecting stocks. Buying stocks isn’t the same thing as purchasing a few things on Amazon. It’s important to be mindful of this type of engagement when it comes to your investments.

Magnifi uses common safety and security practices. Multi-factor authentication is required, and all data is encrypted and stored. Your investments on the platform could lose value, but you are generally protected against theft or hacks. All online platforms carry some risk of data breaches or data hacks, but Magnfi’s protections are robust enough to prevent most attacks.

Is It Worth It?

Overall, Magnifi’s value proposition seems aligned with its monthly and annual cost. However, there are many free trading apps that also offer great user experience and great investment options. M1 Finance offers similar guardrails while charging nothing.

Magnifi’s managed portfolios are also a cool concept, but it’s fairly easy to find ETFs that do the work of the managed portfolios.

In general, if you want someone else to select investments for you, a robo-advisor seems like a better option than Magnifi’s targeted portfolios.Magnifi Features

Tradable Assets |

|

Investments | Over 15,000 possible investments |

Standout Features | Search investments by category or personal interests |

Magnifi’s Managed Portfolios | 0.23% annually |

Monthly Fees |

|

Trading Fees | $0 |

Mobile Apps | |

Customer Service Email | support@magnifi.com |

Customer Inquiry Emails | hello@magnifi.com |

Company Address | 1 Pennsylvania Plaza, 39th Floor, New York, NY 10119 |

Promotions | 7-Day free trial |

Magnifi Personal Review: An AI-Driven Investment Platform

-

Commissions and Fees

-

Ease of Use

-

Investment Options

-

Customer Service

-

Tools and Resources

-

Specialty Services

Overall

Summary

Magnifi Personal is an AI-driven investment platform that offers customized recommendations based on your search behavior.

Pros

- Excellent user interface that allows you to understand risk and return.

- No commissions on trades.

Cons

- Must pay an annual or monthly fee to use the platform.

- Some sponsored ETFs or Funds could throw off the usability of the platform.

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Claire Tak