When it comes to saving money, the right bank account can make a world of difference.

Savings accounts usually fall into two categories—ones that help you build your savings and ones that don’t.

Primis Bank offers savings options that fall firmly into the category of accounts that help you build your savings.

If you are looking for a place to tuck your funds, it’s worth taking a look at what Primis Bank has to offer.

Primis Bank Details | |

|---|---|

Product Name | Primis Bank Savings Account |

Min Deposit | $1 |

APY | 4.35% |

Account Type | Savings |

Promotions | None |

What Is Primis Bank?

Primis Bank is based out of Richmond, Virginia. However, it allows customers to open online accounts across the country.

According to the bank, it offers trailblazing tech and solutions for all. The bank’s mission is to “create significant value for customers and shareholders by cultivating an unmatched team, providing unrivaled solutions, building close relationships, and putting our customers first, always. Our vision is to be bigger, better, and more exceptional than our competition for our customers.”What Does It Offer?

Primis Bank offers a wide range of financial products, including checking accounts, mortgages, personal loans, lines of credit, credit cards, and more. However, in this review, we will focus on Primis Bank’s savings products.

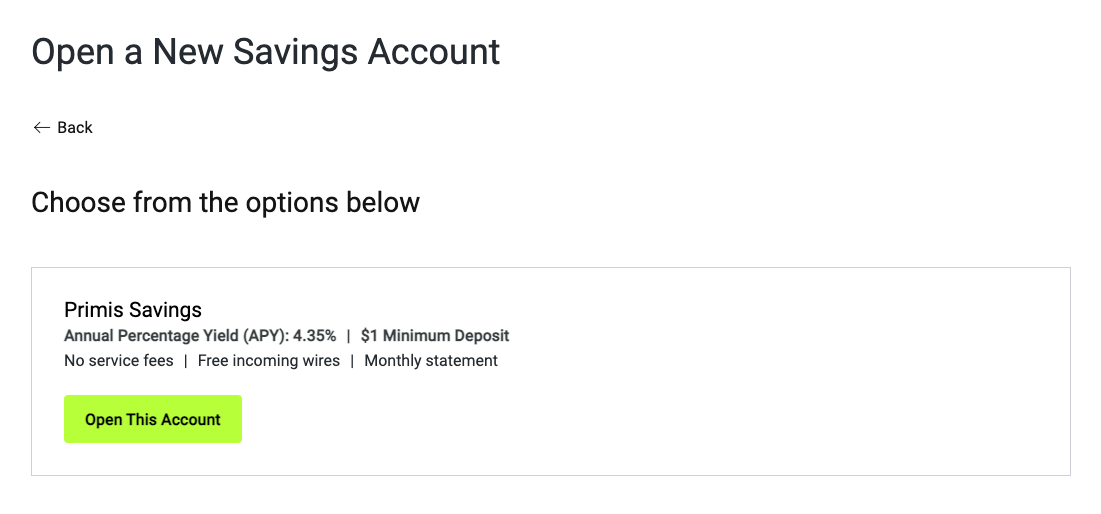

Savings Account

Primis bank offers a savings account designed to help you grow your funds. As of writing, the account is offering 4.35% APY on your savings. You can start saving with just $1 dollar.

The competitive APY is paired with relatively low fees. You won’t find monthly service fees or minimum balance requirements to maintain your account.

CDs

In contrast to the savings account option, the APYs tied to these CDs are relatively low. You will find CD options ranging from six to 72 months.

As of writing, here is the APY breakdown:

Minimum Deposit | APY | |

|---|---|---|

6-Month CD | $250 | 1% |

12-Month CD | $250 | 1.5% |

18-Month CD | $250 | 1.55% |

24-Month CD | $250 | 1.70% |

36-Month CD | $250 | 1.80% |

48-Month CD | $250 | 1.80% |

60-Month CD | $250 | 1.80% |

72-Month CD | $250 | 1.60% |

As you can see, the APYs offered by Primis Bank for CDs are relatively low.

For most savers, the high-yield savings account offered by Primis Bank might be a better fit. If you prefer to put your funds into a CD, then it’s worth exploring CDs offering higher APYs.IRAs

An Individual Retirement Account (IRA) offers a tax-advantaged way to save for retirement. If you are looking to start building your retirement savings, Primis offers access to both traditional and Roth IRAs.

As with all IRAs, there are contribution limits that you must stick to each year. Details about the investment options available through this IRA are limited.

Before signing up, you have the option to get in touch with a Primis Bank representative to learn more about Primis Bank’s IRA investment options.

Health Savings Account

A Health Savings Account (HSA) offers a way to save for future medical expenses. When used efficiently, an HSA can be a helpful retirement planning tool.

These accounts come with several tax advantages, including tax-free contributions, tax-free interest earnings, and tax-free withdrawals for qualified medical costs.

Through Primis Bank, you can open an HSA that’s not tied to a particular employer.

Are There Any Fees?

Primis Bank tends to offer relatively low fee structures with their accounts. For example, the savings account doesn’t come with any service fees, transaction limits, or incoming wire fees.

However, here are fees to watch out for:

- $5 fee for outgoing domestic wires

- $35 fee for international outgoing wires

- $5 reverse wire fee

Before signing up for any type of account, confirm you are comfortable with the bank fees.

How Do I Contact Primis Bank Savings?

If you need to get in touch with Primis Bank, you can head to one of the 35 branch locations in the Richmond area.

For customers not living near Richmond, you won’t find a local branch. But you can email the bank through customercarecenter@primisbank.com or call 833-477-4647.

Additionally, you can start an online chat. On a weekday afternoon, it took over an hour to get connected with a representative through the chat.

You can also bank online or through the highly-rated mobile app on iOS or Android.

How Does Primis Bank Savings Compare?

Primis Bank customers may find attractive APYs attached to high-yield savings accounts.

Although Primis Bank offers a relatively high APY for its savings account, it’s still possible to find higher APYs out there. For example, UFB Direct offers a high-yield savings account with a 5.02% APY while Discover offers 3.60%.

You’ll also find higher rates with CIT Bank, with a rate of 4.20% and Western Alliance Bank, which offers a high-yield savings account with a 4.20% APY.

Ultimately, you’ll need to compare the APYs when opening your account to find the best bang for your buck.

Header |  |  |  |

|---|---|---|---|

Rating | |||

APY | 4.83% | 3.90% | 4.35% |

Monthly Fees | $0 | $0 | $0 |

Min Deposit | $0 | $0 | $1 |

FDIC Insured | |||

Cell | Cell |

How Do I Open An Account?

You can open an account by selecting ‘open an account’ from the menu. From there, you can select which type of account you’d like to open. You’ll be directed to a digital application.

Be prepared to provide your name, address, date of birth, driver’s license, and more to get started. Also, you’ll need to provide funding account information to make your initial deposit.

Is It Safe And Secure?

Primis Bank offers FDIC-insured accounts which means the funds in savings accounts are secured for up to $250,000. Beyond FDIC insurance, Primis Bank offers bank-level security to protect your funds and personal information.

Is It Worth It?

The competitive APY attached to Primis Bank’s savings account is undeniably attractive. But the bank falls flat on its CD, IRA, and HSA offerings.

If you are looking for a place to stash your savings for optimal growth, Primis Bank might be the right fit.

For more of a comprehensive banking experience with high APYs across the board, then you might need to keep searching for a bank that suits your needs.Primis Bank Features

Account Offerings |

|

Fees For Savings Accounts | $0 |

Savings Rewards | 4.35% |

Other Fees to Watch Out For |

|

CD Rates |

|

CD Minimum Deposit | $250 |

Branches | 35 locations in the Richmond, VA area |

Customer Service Phone | 833-477-4647 |

Customer Service Email | customercarecenter@primisbank.com or Live Chat |

Web/Desktop Account Access | Yes |

Mobile App | |

Bill Pay | Yes |

FDIC Certificate | |

Promotions | None |

Primis Bank Savings Review

-

Interest Rates

-

Fees And Charges

-

Customer Service

-

Ease Of Use

-

Products And Services

Overall

Summary

Primis Bank offers savings options that help you build your savings. It’s worth taking a look at what Primis Bank has to offer.

Pros

- High-yield savings account with competitive APY

- Open an HYSA with just $1

- CD, IRA, and HSA options are available

Cons

- Limited network of in-person branches

- CD APYs are less competitive

Sarah Sharkey is a personal finance writer covering banking, insurance, credit cards, mortgages and student loans. She has written for numerous finance publications, including MagnifyMoney, Business Insider and ChooseFI. Her blog, Adventurous Adulting, helps young adults get a handle on their finances.

Editor: Clint Proctor Reviewed by: Claire Tak