Piere is a new budgeting app that is trying to fill the gap left by Mint.

When Mint shut down, millions of active users needed a new budgeting app.

While many free apps have promised to deliver premium budgeting services, Piere may be the first free app that not only replaces Mint’s functionality, it surpasses it.

Here’s what you need to know about Piere, from key features to plans and pricing.

Piere Details | |

|---|---|

Product Name | Piere |

Services Offered | AI-Powered budgeting, account syncing, net worth tracking |

Monthly Fee | $0 - $9/monthly* |

Free Trial | 90 days |

Promotions | None |

*Paid plan coming in 2024.

What Is Piere?

Pierre is a budgeting and financial management app that uses AI to make creating and tracking your budget easier. It has both free and paid plans, but unlike many other budgeting apps, the free tier offers plenty of functionality, including multiple account connections, and transaction and budget management.

The app was started by Yuval Shuminer in 2022, and when Mint announced it was closing, it saw its popularity skyrocket.

Here's a look at the app's key features.

What Does It Offer?

Although Piere has an ambitious product roadmap, its primary features are an AI-driven budget, net worth tracker, and spending tracker. Here’s what you need to know about these features.

Two-Click Budget

Making a budget can be challenging, but Piere promises to make it simple by analyzing your financial history and recommending a budget based on your historical spending. Within two clicks, it provides a “tuned” monthly budget which you can use to track your income and expenses.

The two-click budget may work for some people since it uses 90 days of history to recommend your plan. But Piere’s budget has a major problem. It doesn’t require your budget to be balanced. My 90-day transaction window coincided with paying for summer child care and a major home upgrade.

We saved in advance for these expenses. However, the initial budget recommended by Piere showed a $4100 budget deficit every month. I was also shocked to see that Piere’s budget overlooked my mortgage payment.

However, manually adjusting the budget is simple, and tracking your expenses relative to your budget is truly painless.

Automated Categorization of Transactions

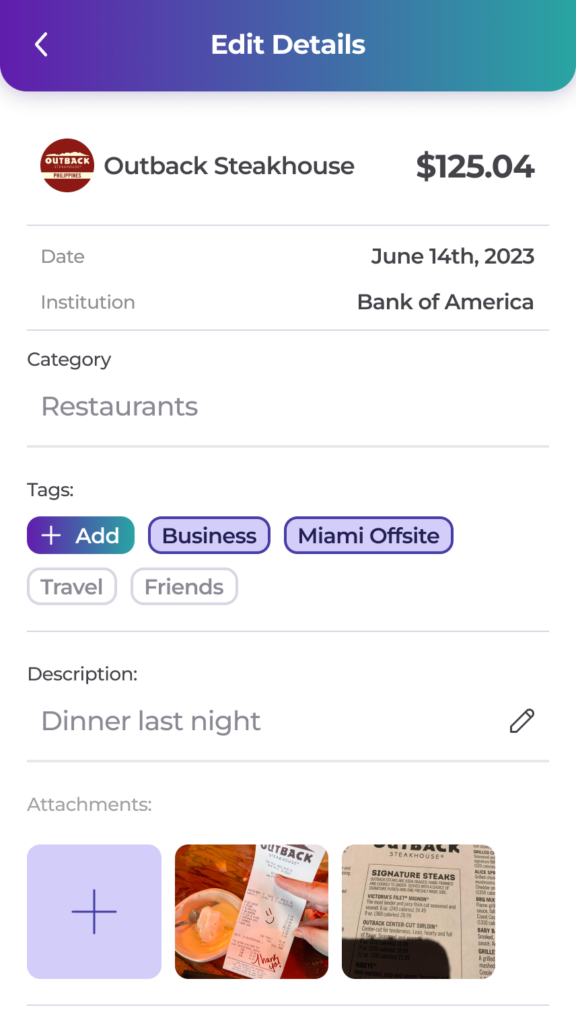

Piere automatically categorizes transactions based on the primary vendor. This is important because the budget it recommends is based on your transaction history. While I wasn’t impressed with the initial categorization of transactions (transfers were characterized as car payments, for example), I was impressed by how well Piere “learned” the new rules.

As soon as I identified savings transfers, charitable giving, and gym memberships, Pierre applied the rule to all related transactions.

Categorizing Venmo Transactions

As a heavy Venmo user, I appreciate that Piere “looks inside” your Venmo account, and treats those transactions as meaningful transactions. It even treats reimbursements as reductions in spending instead of as “other” income. I primarily use Venmo to pay for a handful of services, so I couldn’t test the reimbursement feature. However, plenty of Piere’s online reviews give accolades to this feature.

Shared Transaction, Smart Reimbursement, Pooling Money and More

Piere is doubling down on “shared” finances that don’t include a significant other. Pierre is positioning itself as a replacement for Venmo by allowing friends to share transactions and reconcile transactions within the app. It’s also created a financial Pool that’s perfect for a trip or an office PowerBall Pool.

Net Worth Tracking

Piere isn’t merely a spending tracker. It looks at your whole financial picture. Pierre allows you to connect to traditional brokerages like Fidelity, Charles Schwab, Betterment, Wealthfront, and Vanguard, and even some crypto exchanges such as Coinbase. These connections are used to track your net worth over time. It’s worth noting that historic net worth tracking will be a premium feature, and users will have to upgrade to Piere Plus to use this feature.

Are There Any Fees?

Piere currently offers a free plan, called Piere Purple. There is a Premium version, called Piere Plus+, as well as a desktop version of the app, in the works for 2024.

When Piere Plus+ is available, it will include AI-driven insights, advanced transaction rules (to count reimbursements against spending), historic net worth, and other features that haven’t yet been released. Piere Plus will cost $9.99 monthly or $79.99 billed yearly.

How Does Piere Compare?

Overall, Piere offers a robust, easy-to-use, easy-to-customize, and intelligent financial management platform. Piere’s free budgeting tool is better than most premium budgeting tools (although YNAB or Tiller may be better for those with complex budgeting needs).

Piere’s net worth tracking tool offers insights that rival the insights from Empower. Piere’s free option may truly be the best alternative to Mint.

Header |  | ||

|---|---|---|---|

Rating | |||

Pricing | Free (Paid plan coming 2024) |

| Free |

Net Worth Tracking | |||

Retirement Planning | |||

Free Trial | 90 days | 34 days | N/A |

Cell |

How Do I Open A Piere Account?

To get the app, visit the App Store and download Piere or you can use Piere from the Google Play Store. You’ll need an email address and password to get started. Once you’ve completed a profile, you can connect your accounts to Piere.

Piere uses a third-party service that only reads information from your accounts. Once that’s done, you can start looking at your budget and net worth, and categorize transactions. Right now, Piere doesn’t require users to enter a credit card to start an account. This may change when Piere starts charging for Piere Plus.

Is It Safe And Secure?

Piere uses a third-party service to encrypt information and keep it secure. The app also allows users to set up multi-factor authentication to ensure that information is kept safe and secure. Piere makes a big deal about being SOC 2 compliant. This simply means that it follows best practices for ensuring that banks and other financial institutions can connect to the app. Overall, Piere has excellent safeguards in place to minimize the risks associated with identity theft.

How Do I Contact Piere?

Piere’s headquarters is located at 910 17th St SE, Fort Lauderdale, Florida 33316. You can get in touch with the team by emailing contact@piere.com. If you download Piere, you can contact the development team by hitting the Gear Icon in the upper right corner and then using the “Contact The Team” section. The site doesn’t currently show any phone numbers, and it doesn’t currently have a chat option for users.

Is It Worth It?

Right now, Piere is an excellent app, and its product roadmap is promising. Personally, I’m eager to see how the AI-driven insights perform when they are released. The concept of “roll-over” budgeting is also very exciting. Because Piere is currently free, it is well worth downloading. The budgeting feature is excellent, and I’m impressed by the spending tracker.

When users have to pay for Piere’s premium features, the free version will still be worth using for most people. It’s an easy-to-use app that allows you to budget, spend, and track your finances easily.

Piere Features

Account Types | AI-powered budgeting and financial management app |

Key Features |

|

Pricing |

|

Net Worth Tracking | Yes |

Bank Account Syncing | Yes |

Free Trial | Yes; 90 days |

Customer Service Email | contact@piere.com |

Online Chat Capability | No |

Mobile App Availability | iOS and Android |

Web/Desktop Account Access | Coming in 2024 |

Promotions | None |

Piere Review: AI-Powered Budgeting

-

User Friendliness

-

Mobile App Functions

-

Customer Service

-

Security

Overall

Pros

- Categorizes all transactions, including Venmo transactions

- Easy-to-use budgeting features

- Ad-free

- Net worth tracking

Cons

- Unclear how often AI budgets can be updated

- Some of the initial transaction categorization is confusing

- You still have to mess around with the budget to get it working

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Colin Graves Reviewed by: Robert Farrington