What are the best college loan types?

This question is about student loans.

There are multiple college loan types, and many families wonder - which is best? The answer, like so much else in personal finance is, it mostly depends.

There are two main types of student loans: federal student loans and private student loans.

Federal student loans are offered by the government, and come in multiple variations.

Private student loans are offered by private lenders, including banks, credit unions, and state non-profits.

The best college loan type depends on your needs and situation. Some loans are not allowed for certain types of education. For example, some vocational and trade schools are not Title IV cerified, meaning you cannot get federal student loans.

Other loan types are specific to programs, such as Grad PLUS Loans, which are a type of federal loan only offered to graduate and professional students.

Types Of Federal Student Loans

There are four main types of Federal student loans, and some other nuances. The four main types are:

- Direct Subsidized Student Loans

- Direct Unsubsidized Student Loans

- PLUS Loans

- Direct Consolidation Loans

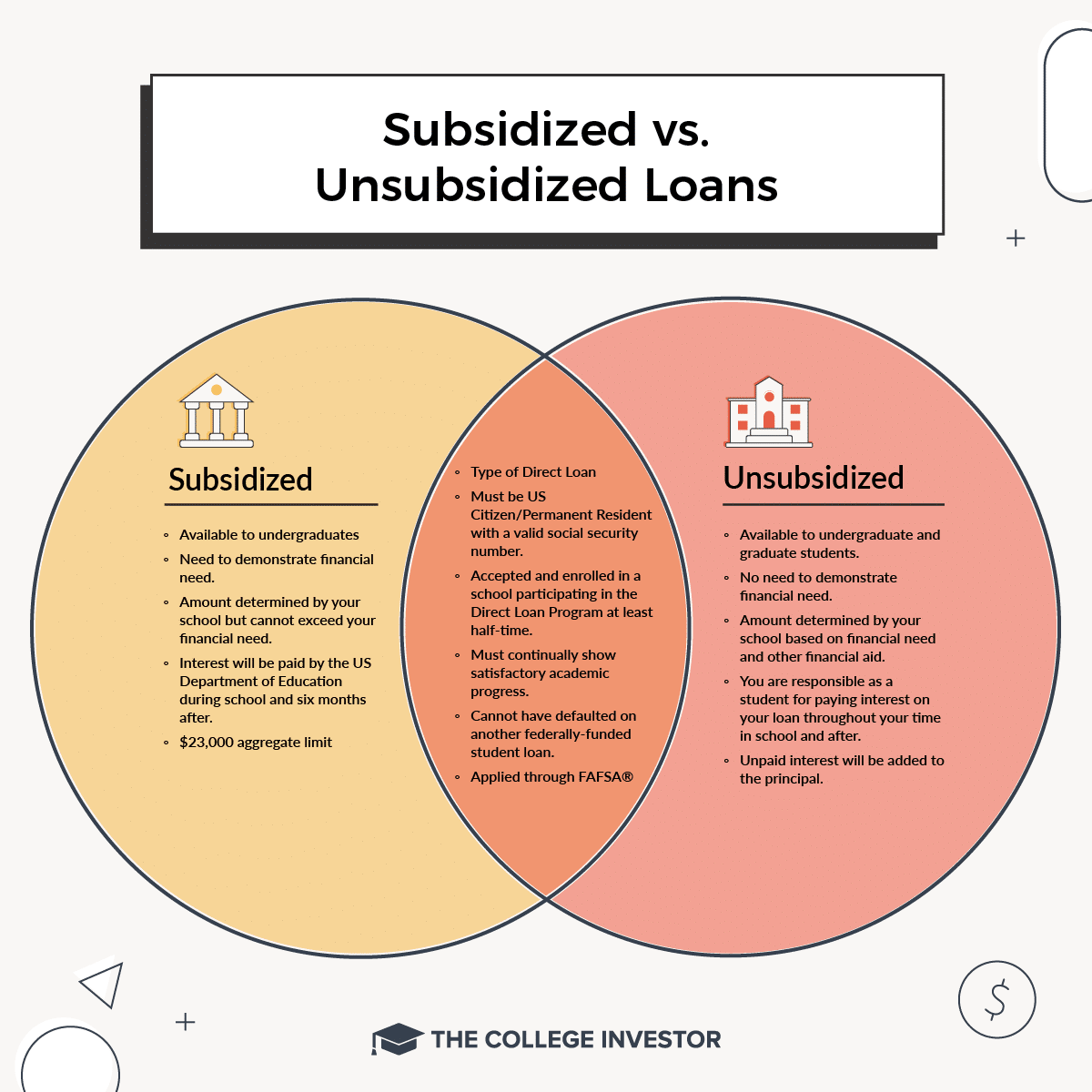

Within these main types of loans, there are a few variations. For example, Direct subsidized loans are only available to undergraduate students. Direct unsubsidized loans are available to both undergraduate and graduate students, but subject to loan limits.

Learn more about subsidized vs. unsubsidized student loans.

PLUS Loans come in two flavors: Parent PLUS Loans and Grad PLUS Loans. Parent PLUS Loans are loans made to parents to pay for their child's undergraduate degree. Grad PLUS Loans are for graduate and professional students.

Finally, there are Direct Consolidation Loans. These are loans you get when you consolidate your existing Federal Student Loans.

Types Of Private Student Loans

There aren't necessarily "types" of private loans, but the option you get will vary based on what type of lender is offering your private loan.

Private loans are offered by banks, credit unions, direct lenders, and state-based non-profits.

Banks and credit unions are pretty straightforward. For example, PenFed Credit Union is a popular credit union lender.

Direct lenders are companies like Earnest or SoFi.

State-based non-profits are more "unknown", but include brands like Brazos and RISLA. State-based non-profits sometimes offer discounts or better repayment terms to residents of their respective states (RISLA is Rhode Island, Brazos is Texas).

Private loans typically don't have any borrowing limits except the cost of attendance of the college. However, they do require a positive credit history and solid income - meaning most undergraduates will require a parent cosigner.

What Type Of College Loan Is Best?

Almost all financial experts will agree - undergraduate students should always borrow the Direct Loans first, up to the borrowing limit.

If you need more funds beyond that, it depends.

For undergraduates, the decision comes down to Parent Loans vs. Private Loans. Parent Loans offer some advantages, such as the potential for student loan forgiveness programs. But the downsides are that these are the parent's loan only, and the interest rates may be much higher for qualified borrowers.

Private loans can be good options for parents with good income and credit history. Especially given that non-profit lenders may have exceptionally low rates for in-state borrowers. The downside is that private loans don't offer any loan forgiveness, and the parent has to cosign. Some lenders may offer cosigner release, but it's not guaranteed.

For grad students, both Direct and Grad PLUS loans are great choices. Especially since both will include loan forgiveness if you qualify. It's rare for a student to need private loans for graduate school, though it is an option.

People Also Ask

What Are The Four Types Of Federal Student Loans?

The four main types of Federal student loans are Direct subsidized student loans, Direct unsubsidized student loans, PLUS Loans, and Direct consolidation loans.

What Type Of Loan Is Best For Students?

Federal Direct Subsidized and Unsubsidized Loans are typically the best for students.

What Type Of Loan Has The Best Terms?

All Federal student loans offer generous terms like income-driven repayment plans, hardship options, and loan forgiveness programs.

Related Articles

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Colin Graves