Gainbridge is a self-directed platform that offers access to commission-free annuity products online.

When most people think about investing, they consider things like stocks and bonds or mutual funds and exchange-traded funds (ETFs). Annuities are another type of product you can add to your overall portfolio.

They are perhaps best known to provide a fixed income in retirement, but you can use them at any age.

We explore what Gainbridge has to offer, how it works, and whether or not an annuity is something you should consider.

Gainbridge Details | |

|---|---|

Product Name | SteadyPace™ |

APY | Up to 6.15% |

Monthly Fee | $0 |

Promotions | 30-day risk free trial period |

What Is Gainbridge?

Founded in 2019, Gainbridge is an annuity and life insurance agency. It sells annuities online and is available in every state except New York.

Gainbridge is part of the holding company Group1001, and offers annuities issued by Guggenheim Life and Annuity Company based in Indianapolis, Indiana.

Gainbridge offers multi-year guaranteed annuities (MYGA) and single premium immediate annuities (SPIA). MYGA’s earn a guaranteed interest over a specific period of time. This interest is deferred meaning you won’t pay taxes on it immediately.

Single premium annuities are lump sum offerings that have fixed monthly payouts, providing guaranteed income during retirement. SPIA’s are immediate annuities which means you pay interest as it occurs.

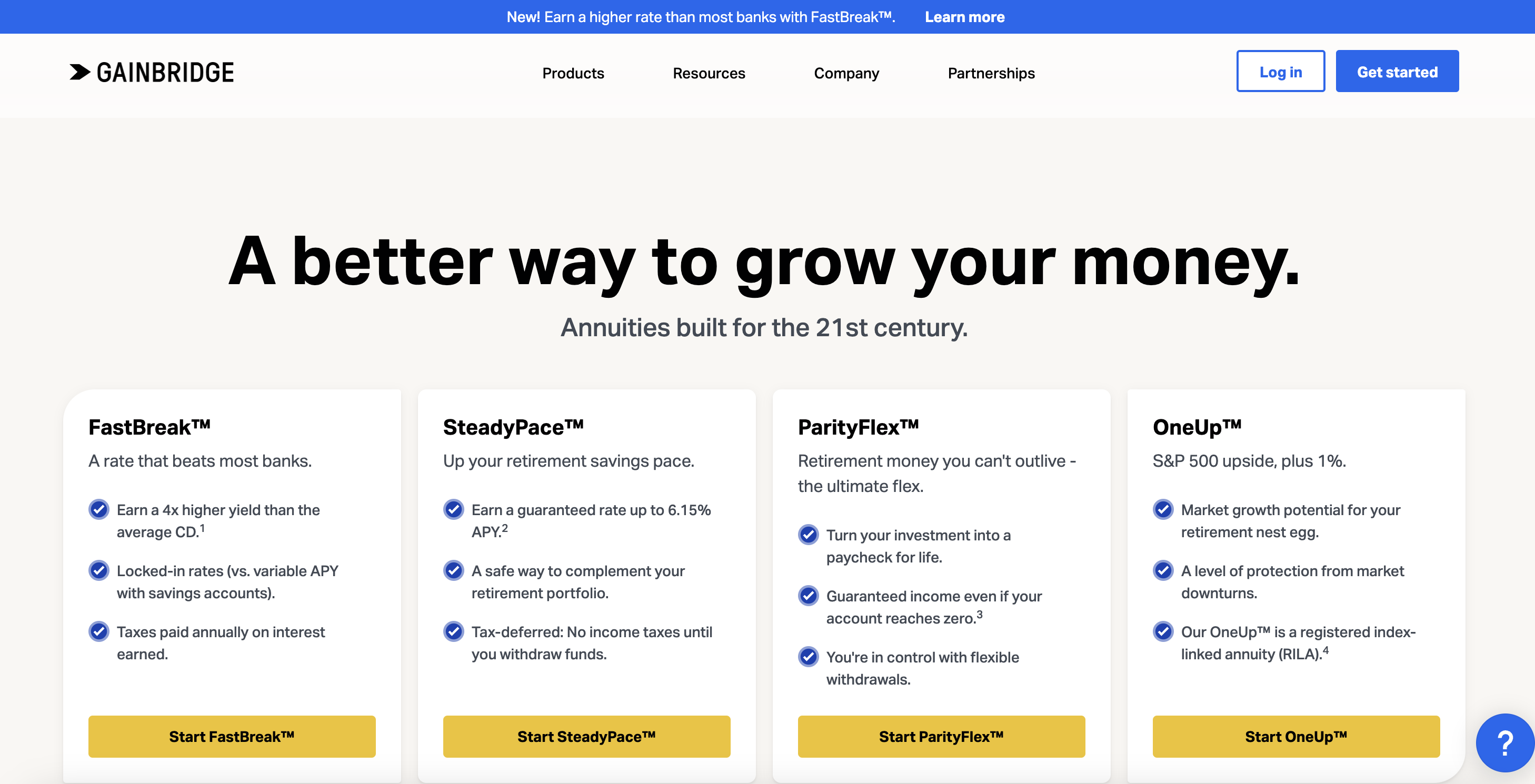

There are four annuity products that Gainbridge offers based on your personal needs and individual goals.

What Does It Offer?

Here's a closer look at the different annuity options provided by Gainbridge.

SteadyPace™

The Gainbridge SteadyPace annuity is a single-premium MYGA. You can invest a lump sum of money when you open an account. After that, you can’t add new funds to it.

SteadyPace earns guaranteed interest of up to 6.15% APY* over a term period. MYGA’s earn tax-deferred interest meaning you won’t pay taxes on the income generated until you withdraw it. Interest that accrues during the investment period is referred to as the guaranteed interest rate period. This means the amount of money you invest in an annuity is protected for this period of time.

Once the period ends you can start a new annuity, withdraw the funds as a lump sum from your account account, or take monthly payments over a five- to 10-year period. During the first year of your annuity’s contract, you can withdraw between $100 to 10% of your account’s value with no fees. (If you take out more than 10% you’ll be hit with hefty withdrawal fees).

FastBreak™

FastBreak is an annuity offered by Gainbridge that’s designed to be an alternative to traditional savings products offered by banks. It offers a yield of up to 6.15% APY* that is locked-in. Even if the Fed changes interest rates, you’ll keep earning interest at whatever rate your contract is for.

With FastBreak, taxes are paid annually on any interest you earn. Any growth in your annuity is yours to keep tax-free. Like SteadyPace, you can take out an annuity in terms ranging from three to 10 years.

You can withdraw up to 10% of your account’s value each year. In the first year, you can withdraw up to 10% of your initial deposit. For investors aged 59 ½ or older, there is no penalty for withdrawals.

ParityFlex™

ParityFlex is a fixed MYGA that’s designed to give you guaranteed income in retirement. Not only is your principal investment protected, but with this annuity, you’re guaranteed income for life (as long as you don’t make excessive withdrawals on your account). This annuity allows you to make flexible withdrawals as well.

OneUp™

OneUp is an index-linked annuity that provides returns based on the S&P 500 Total Return Index. It reinvests dividends and provides a 1% bonus. The goal of this annuity is to provide you with exposure to market growth without being exposed to too much risk.

*APYs listed are current as of June 22, 2024, and are subject to change at any time.

How Does Gainbridge Work?

Gainbridge is a direct-to-consumer annuity provider. Gainbridge is not a bank which means it is not FDIC-insured. When you purchase an annuity through Gainbridge, you’re entering into a contract with the insurance company. Unlike some annuity providers, Gainbridge does not charge commissions.

Annuities that earn interest come with tax benefits that can make them advantageous for someone looking to diversify their portfolio. That makes Gainbridge somewhat of a hybrid between a traditional savings account and a traditional online broker. It offers market exposure and a high APY on your savings but avoids exposure to too much risk.

Interest income is not taxed until you withdraw money from your Gainbridge account. For individuals who have maxed out their 401(k) and IRA contributions, annuities are an alternative investment vehicle that doesn’t follow IRS contribution limits.

Are There Any Fees?

Gainbridge has a 30-day trial period. You can open a contract to establish an account with Gianbridge and cancel it within 30 days for free.

There are penalties for early withdrawals made after your annuity contract’s first year. You can withdraw at least $100 and up to 10% of your account's value but if you go beyond that you’ll be assessed a withdrawal fee which can range between 1-3% of your account’s value. This is referred to as a surrender fee.

There are also market value adjustments (MVA). An MVA changes the payout of an annuity if the account is surrendered early and is applied on top of surrender fees beyond the amount you’re able to withdraw penalty-free. It’s calculated using the index rate of an annuity when you purchased it and current interest rates.

For SPIA’s there is a withdrawal fee – called a commutation fee – if you withdraw your account’s value before the end of the guaranteed period. You’ll be assessed a 4% fee.

Other than withdrawal penalties, Gainbridge does not charge any fees to establish an annuity. All you will be expected to pay is the initial premium for your contract.

How Does Gainbridge Compare?

Gainbridge is one of a growing number of insurance companies offering annuities online, direct-to-consumer. Here’s how Gainbridge compares to other annuity providers.

Blueprint Income

Blueprint Income is an online annuity marketplace. Unlike other annuity providers that work off of commissions, Blueprint is a fiduciary which means they have to offer you products and services with your best financial interests in mind.

Blueprint Income allows you to create personal pensions so you can have a guaranteed stream of income in retirement. At time of writing, Blueprint is offering a slightly higher APY than Gainbridge for its 5-year fixed annuity.

Canvas Annuity

Like Gainbridge, Canvas Annuity provides annuities online. Based in Arizona, Canvas is an insurance agency that offers fixed, multi-year guaranteed annuities guaranteed by Puritan Life Insurance Company of America.

Canvas Annuity offers two annuities: Future Fund and Flex Fund. The rate terms for these offerings are three, five, or seven years. The longer your money is invested in a Canvas Annuity, the higher your return will be.

Header |  | ||

|---|---|---|---|

Rating | Not Yet Rated | ||

Monthly Fees | $0 | $0 | $0 |

Types of Annuities | MYGA, SPIA, Index-Linked | MYGA, SPIA, Index-Linked | Fixed, MYGA |

5-Year MYGA APY | 6.15% | 6.50% | 6.35% |

Cell | Cell |

How Do I Use Gainbridge?

Gainbridge's platform is fairly straightforward to use. Simply head to the website and click on the “Get Started” button or select the annuity you’d like to purchase.

Once you do this you’ll be asked to provide information about how much you want to put up as an initial investment and how long you’d like to invest for. Before you commit to opening a contract, Gainbridge will provide you a projection of your expected earnings.

After you’ve selected an annuity, you’ll need to provide information about yourself and your designated beneficiary. (Gainbridge annuities pay out a death benefit that can be equivalent to the value of the contract, depending on the terms, when you die).

To fund your annuity you’ll need to transfer funds from an external bank account. If you have any issues during this process you can speak to a licensed agent by phone or via chat.

Remember that Gainbridge is offered in all states except New York.

Is It Safe And Secure?

Gainbridge’s annuities are issued through Guggenheim Life and Annuity Company. While Guggenheim is not accredited it does have an A+ rating from the Better Business Bureau.

While there haven’t been any significant complaints or data breaches, keep in mind that Gainbridge is not FDIC-insured since it's not a bank.

How Do I Contact Gainbridge?

To contact Gainbridge, you can speak with a licensed agent via the chat feature on the Gainbridge website. Alternatively, you can speak to an agent by phone at 1-866-252-9439 or by email at team@gainbridge.io.

Who Is Gainbridge For and Is It Worth It?

Gainbridge is for anyone looking for low-risk or fixed-income streams in retirement. An annuity provides regular cash flow which can help put you at ease if you’re afraid of outliving your retirement savings.

Gainbridge is also good for someone who wants to park their cash in a high-yield account. With rates as high as 6.15% APY, Gainbridge offers yields that are higher than the best certificates of deposit (CDs) on the market. If you don’t think you’ll need to touch your cash for a few years – regardless of when you plan on retiring – an annuity can be a tool you can use to capitalize on high interest rates.

Gainbridge Features

Monthly Fees | None |

Annuity Types | Multi-year Guaranteed Annuity (MYGA); Single Premium Immediate Annuity (SPIA) |

Interest | Up to 6.15% APY (as of June 22, 2024) |

Annuity Terms | 3-10 years |

Customer Service Number | 1-866-252-9439 |

Customer Service Email | team@gainbridge.io |

FDIC-Insured | No |

Promotions | 30-day trial period |

Gainbridge Review: An Online Annuity Platform

-

Pricing and Fees

-

Ease of Use

-

Products and Services

-

Customer Service

Overall

Summary

Gainbridge is an online investment platform that offers multi-year guaranteed annuities (MYGA) and single premium immediate annuities (SPIA). You can also purchase an annuity linked to the S&P 500 index.

Pros

- Offers 4 different annuity types

- Offers APYs that are preferable to CDs

- S&P 500-linked annuity available

Cons

- Annuities are not suitable for many investors

- Not available in New York State

Amanda Claypool is a writer, entrepreneur, and strategy consultant. She’s lived in the Middle East, Washington, DC, and a 2014 Subaru Outback but now calls Asheville home. Amanda writes about money, crypto, emerging tech, and the future of the economy on Medium.

Editor: Colin Graves